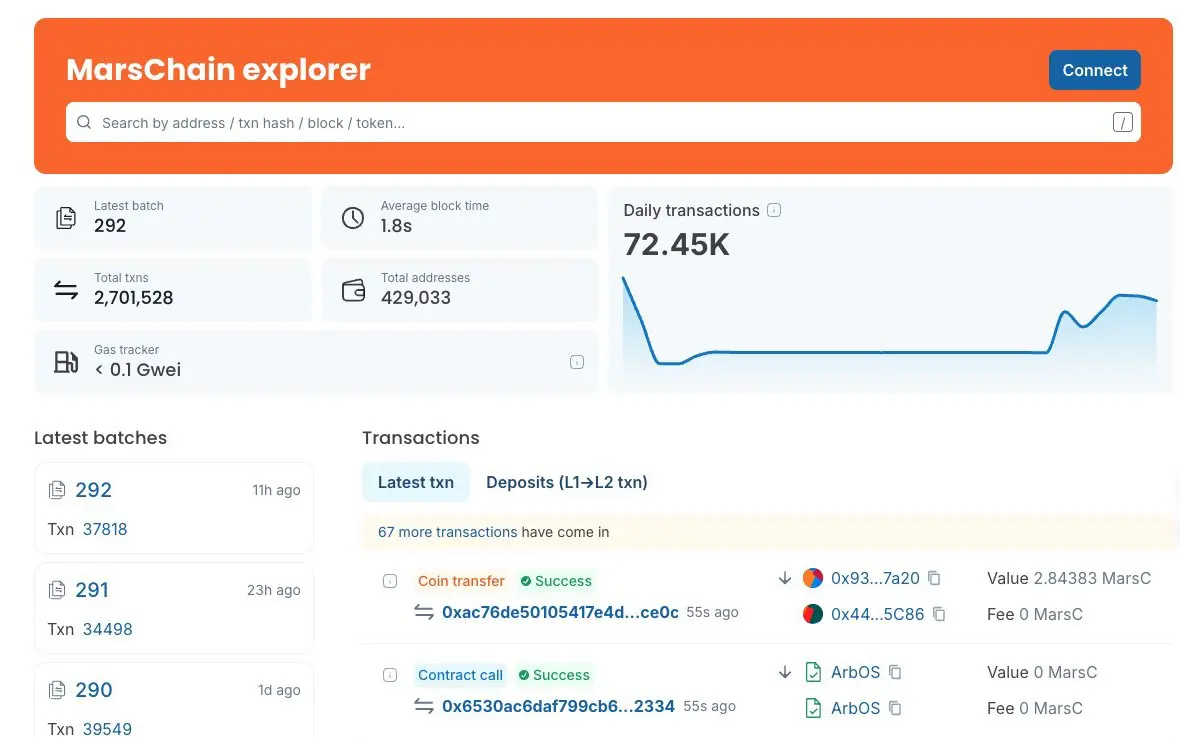

Major Announcement! We've discovered an ultra hardcore Layer1 new star—— NERO Chain( $NERO ), which will be available for free participation in the split at GT on July 28 at 15:00 UT! Total prize pool of 5,000,000 NERO!

In simple terms, NERO is a modular Layer 1 designed specifically for applications. Its compatibility with EVM means that developers can quickly migrate projects without having to learn a new language. What impressed me the most is its native support for ERC-4337 account abstraction, combined with a flexible Paymaster system, allowing for various Gas operations: paying Gas with

View OriginalIn simple terms, NERO is a modular Layer 1 designed specifically for applications. Its compatibility with EVM means that developers can quickly migrate projects without having to learn a new language. What impressed me the most is its native support for ERC-4337 account abstraction, combined with a flexible Paymaster system, allowing for various Gas operations: paying Gas with