#PartialGovernmentShutdownEnds Market Impact & Strategic Implications (Feb 2026)

The recent partial government shutdown in the United States has officially concluded, restoring full federal operations and removing a key source of short-term macro uncertainty. While the direct economic damage was limited, the psychological and structural impacts on global financial markets were significant. Its resolution has already begun improving investor confidence and shaping capital flows, particularly in risk-sensitive sectors such as equities and cryptocurrencies.

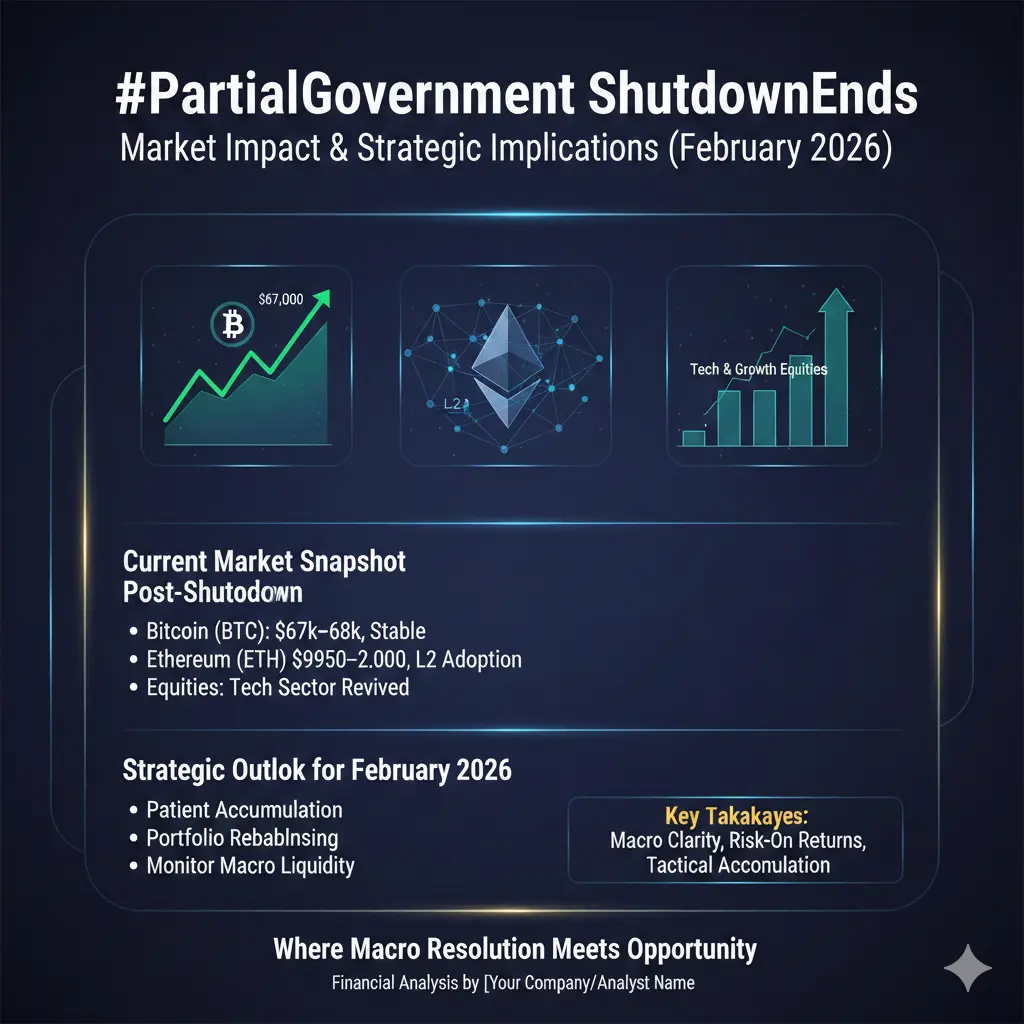

📊 Current Market Snapshot

Following the shutdown, major asset classes have shown early signs of stabilization. Bitcoin is trading around $67,000–$68,000, reflecting moderate strength after recent volatility. Ethereum has stabilized near $1,950–$2,000, holding critical technical support zones. Equity markets, especially in the technology sector, are seeing renewed interest, while gold and other safe-haven assets have retraced slightly as risk-off sentiment fades. The removal of this macro overhang allows sidelined capital to gradually reenter risk markets.

💧 Restored Confidence and Liquidity

The resumption of full government operations has improved both market transparency and liquidity conditions. During the shutdown, uncertainty around fiscal spending, economic data releases, and regulatory processes weighed heavily on sentiment. With normal operations resumed, institutional and retail participants now operate in a more predictable environment, encouraging incremental positioning and smoother capital deployment.

📈 Return of Risk-On Sentiment

The elimination of this highly visible short-term risk has led to a resurgence of risk-on behavior. Historically, markets respond positively when major political or fiscal disruptions are resolved. Bitcoin, select altcoins, and growth-oriented equities now face more favorable conditions for attracting inflows. While a sustained rally is not guaranteed, stabilization probabilities have improved, creating tactical opportunities for traders and investors.

⚖️ Macro Stability and Policy Visibility

Although the shutdown’s direct economic impact was modest, its symbolic importance was substantial. Full government functionality reduces the risk of disruptions to fiscal programs, regulatory approvals, and key economic reporting. This enhanced policy visibility allows both traders and institutional investors to plan with greater confidence, lowering the likelihood of sudden shocks driven by governance uncertainty.

🔗 Strengthening Link Between Crypto and Macro Cycles

Crypto markets continue to demonstrate increasing sensitivity to broader macroeconomic trends. Risk-on and risk-off dynamics in equities and bonds regularly influence digital asset performance. Improved sentiment in traditional markets often coincides with Bitcoin and Ethereum stabilization, particularly during periods when macro stress diminishes. The shutdown’s resolution reinforces this correlation, supporting a normalization narrative across asset classes.

💡 Trading Perspective — Gate User Insights

For active traders, events like government shutdowns highlight the importance of macro awareness and market context. Even developments unrelated to blockchain fundamentals can shift capital allocation and influence crypto prices. Maintaining disciplined position sizing, predefined risk limits, and structured trade planning is essential during such periods. Traders who focus on technical structure rather than reacting emotionally to headlines typically achieve more consistent results.

📌 Strategic Outlook Going Forward

The end of the shutdown represents a transition from uncertainty to greater macro stability. This environment favors patient accumulation, selective exposure, and structured risk-taking rather than aggressive speculation. While volatility remains, the increased clarity supports medium-term positioning across both traditional and digital markets, allowing participants to take advantage of emerging opportunities with more confidence.

🔍 Key Takeaways

The conclusion of the partial shutdown removes a major macro overhang and restores confidence across financial markets. Renewed risk appetite is likely to benefit both crypto and equities, particularly if broader economic conditions remain supportive. Traders should monitor key technical levels on Bitcoin and Ethereum, remain patient, and continue prioritizing disciplined risk management.

💬 Final Note

As uncertainty fades, strategic clarity becomes the dominant factor in capital allocation. Market participants who approach the environment methodically—balancing risk, evaluating macro signals, and managing exposure—are positioned to benefit from stabilization and potential upside moves in both crypto and traditional financial markets.

The recent partial government shutdown in the United States has officially concluded, restoring full federal operations and removing a key source of short-term macro uncertainty. While the direct economic damage was limited, the psychological and structural impacts on global financial markets were significant. Its resolution has already begun improving investor confidence and shaping capital flows, particularly in risk-sensitive sectors such as equities and cryptocurrencies.

📊 Current Market Snapshot

Following the shutdown, major asset classes have shown early signs of stabilization. Bitcoin is trading around $67,000–$68,000, reflecting moderate strength after recent volatility. Ethereum has stabilized near $1,950–$2,000, holding critical technical support zones. Equity markets, especially in the technology sector, are seeing renewed interest, while gold and other safe-haven assets have retraced slightly as risk-off sentiment fades. The removal of this macro overhang allows sidelined capital to gradually reenter risk markets.

💧 Restored Confidence and Liquidity

The resumption of full government operations has improved both market transparency and liquidity conditions. During the shutdown, uncertainty around fiscal spending, economic data releases, and regulatory processes weighed heavily on sentiment. With normal operations resumed, institutional and retail participants now operate in a more predictable environment, encouraging incremental positioning and smoother capital deployment.

📈 Return of Risk-On Sentiment

The elimination of this highly visible short-term risk has led to a resurgence of risk-on behavior. Historically, markets respond positively when major political or fiscal disruptions are resolved. Bitcoin, select altcoins, and growth-oriented equities now face more favorable conditions for attracting inflows. While a sustained rally is not guaranteed, stabilization probabilities have improved, creating tactical opportunities for traders and investors.

⚖️ Macro Stability and Policy Visibility

Although the shutdown’s direct economic impact was modest, its symbolic importance was substantial. Full government functionality reduces the risk of disruptions to fiscal programs, regulatory approvals, and key economic reporting. This enhanced policy visibility allows both traders and institutional investors to plan with greater confidence, lowering the likelihood of sudden shocks driven by governance uncertainty.

🔗 Strengthening Link Between Crypto and Macro Cycles

Crypto markets continue to demonstrate increasing sensitivity to broader macroeconomic trends. Risk-on and risk-off dynamics in equities and bonds regularly influence digital asset performance. Improved sentiment in traditional markets often coincides with Bitcoin and Ethereum stabilization, particularly during periods when macro stress diminishes. The shutdown’s resolution reinforces this correlation, supporting a normalization narrative across asset classes.

💡 Trading Perspective — Gate User Insights

For active traders, events like government shutdowns highlight the importance of macro awareness and market context. Even developments unrelated to blockchain fundamentals can shift capital allocation and influence crypto prices. Maintaining disciplined position sizing, predefined risk limits, and structured trade planning is essential during such periods. Traders who focus on technical structure rather than reacting emotionally to headlines typically achieve more consistent results.

📌 Strategic Outlook Going Forward

The end of the shutdown represents a transition from uncertainty to greater macro stability. This environment favors patient accumulation, selective exposure, and structured risk-taking rather than aggressive speculation. While volatility remains, the increased clarity supports medium-term positioning across both traditional and digital markets, allowing participants to take advantage of emerging opportunities with more confidence.

🔍 Key Takeaways

The conclusion of the partial shutdown removes a major macro overhang and restores confidence across financial markets. Renewed risk appetite is likely to benefit both crypto and equities, particularly if broader economic conditions remain supportive. Traders should monitor key technical levels on Bitcoin and Ethereum, remain patient, and continue prioritizing disciplined risk management.

💬 Final Note

As uncertainty fades, strategic clarity becomes the dominant factor in capital allocation. Market participants who approach the environment methodically—balancing risk, evaluating macro signals, and managing exposure—are positioned to benefit from stabilization and potential upside moves in both crypto and traditional financial markets.