Post content & earn content mining yield

placeholder

交易做到无我

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVFMUGXFAQ

View Original

- Reward

- like

- Comment

- Repost

- Share

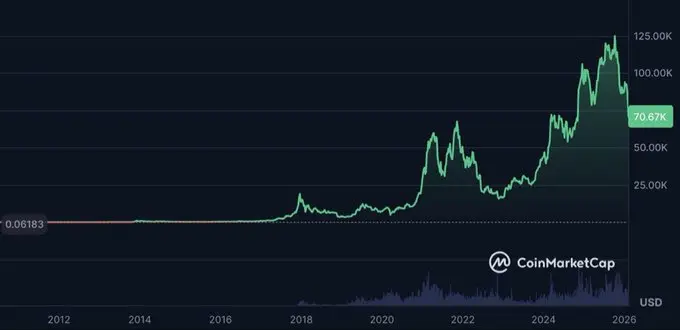

$126K: “Bitcoin is too expensive. I will wait for the price to go down”

$67K: “Bitcoin is dead. I will buy later”

EACH CYCLE 🤦♂️

$67K: “Bitcoin is dead. I will buy later”

EACH CYCLE 🤦♂️

BTC0,9%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

p小将

p小将

Created By@DreamJourney

Listing Progress

100.00%

MC:

$1.76K

More Tokens

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQVAV1GOAW

- Reward

- 2

- Comment

- Repost

- Share

#RussiaStudiesNationalStablecoin 🌍💰 #RussiaStudiesNationalStablecoin

In a world where digital finance is evolving rapidly, reports that Russia is studying the possibility of a national stablecoin signal a major strategic shift. This is not just about crypto — it’s about financial sovereignty, sanctions resistance, and modernization of the payment system.

A national stablecoin would likely be pegged to the ruble and backed or regulated by the Central Bank of Russia. The goal? Faster cross-border transactions, reduced reliance on traditional banking rails, and more control over digital settlem

In a world where digital finance is evolving rapidly, reports that Russia is studying the possibility of a national stablecoin signal a major strategic shift. This is not just about crypto — it’s about financial sovereignty, sanctions resistance, and modernization of the payment system.

A national stablecoin would likely be pegged to the ruble and backed or regulated by the Central Bank of Russia. The goal? Faster cross-border transactions, reduced reliance on traditional banking rails, and more control over digital settlem

- Reward

- 2

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVMVB1xe

View Original

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 3

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=UgMVUlpf

View Original

- Reward

- 2

- Comment

- Repost

- Share

Pov: You and your friends locked in, in your early 20s.

- Reward

- 2

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLREVFSJVQ

View Original

- Reward

- 2

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4039?ref_type=132

- Reward

- 2

- Comment

- Repost

- Share

GoodJob

GoodJob

Created By@TraderNo.56

Listing Progress

0.00%

MC:

$0.1

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLVDXAXBVA

View Original

- Reward

- 1

- Comment

- Repost

- Share

#CelebratingNewYearOnGateSquare ✨ #CelebratingNewYearOnGateSquare ✨

As the new year begins, I pause for a moment of reflection — not just on charts, trades, or market cycles, but on growth, resilience, and the journey itself. This year feels different. It feels intentional. It feels powerful. And celebrating it on Gate Square makes it even more meaningful.

The past year taught me that success in crypto is not built overnight. It is built in silence, in discipline, in patience, and in the courage to hold when others panic. Every dip carried a lesson. Every breakout carried a reminder. And every

As the new year begins, I pause for a moment of reflection — not just on charts, trades, or market cycles, but on growth, resilience, and the journey itself. This year feels different. It feels intentional. It feels powerful. And celebrating it on Gate Square makes it even more meaningful.

The past year taught me that success in crypto is not built overnight. It is built in silence, in discipline, in patience, and in the courage to hold when others panic. Every dip carried a lesson. Every breakout carried a reminder. And every

- Reward

- 2

- Comment

- Repost

- Share

Tucker had a routine security check.

What a drama queen 👑.

What a drama queen 👑.

- Reward

- 1

- Comment

- Repost

- Share

64GB of RAM ($19k MXN / ~$950 USD) are already worth more than an RTX 5070 ($13k MXN / ~$700 USD). 🤯

If this surprises you and you don't understand the real reason why it's happening... you're in trouble.

Have you already realized or are you still asleep? 🤔

View OriginalIf this surprises you and you don't understand the real reason why it's happening... you're in trouble.

Have you already realized or are you still asleep? 🤔

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 3

- Comment

- Repost

- Share

Gate Live 2026 Lunar New Year On-Chain Gala · Non-Stop Market Insights https://www.gate.com/campaigns/3937?ref=VQIRVFPZBA&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

Is It Too Late to Invest in Bitcoin? Is It a Bubble?

There’s a joke that goes like this:

A little boy asks his father—who invests in Bitcoin—for one Bitcoin as a birthday gift.

His father replies:

“What? You want $19,300? $17,000 isn’t a small number! What do you need $13,000 for?”

Pause.

“Alright… here’s $9,800. Proceed with caution.”

Funny—but also painfully accurate.

Bitcoin itself is not a bubble.

Speculation is.

And no—it’s not too late to invest. But how you do it matters more than when you do it.

Core Rules (Ignore These at Your Own Risk)

Don’t be avaricious. Greed is the fastest way to

There’s a joke that goes like this:

A little boy asks his father—who invests in Bitcoin—for one Bitcoin as a birthday gift.

His father replies:

“What? You want $19,300? $17,000 isn’t a small number! What do you need $13,000 for?”

Pause.

“Alright… here’s $9,800. Proceed with caution.”

Funny—but also painfully accurate.

Bitcoin itself is not a bubble.

Speculation is.

And no—it’s not too late to invest. But how you do it matters more than when you do it.

Core Rules (Ignore These at Your Own Risk)

Don’t be avaricious. Greed is the fastest way to

BTC0,9%

- Reward

- 2

- Comment

- Repost

- Share

While all attention in $TON is focused on new tokens and trading bots, many have somehow forgotten that the main returns in DeFi still lie in liquidity pools. And right now, they look much more interesting than they did a couple of months ago. For example:

— TRAIN/USDT — APR around 115%

— FRT/TON — APR ~73%

— PX/TON — APR ~28%

And these are no longer the astronomical percentages from early DeFi, which were based on empty volumes. Now, APR is formed by real trading activity: the more swaps pass through the pool, the higher the commissions that are distributed among liquidity providers.

At the

— TRAIN/USDT — APR around 115%

— FRT/TON — APR ~73%

— PX/TON — APR ~28%

And these are no longer the astronomical percentages from early DeFi, which were based on empty volumes. Now, APR is formed by real trading activity: the more swaps pass through the pool, the higher the commissions that are distributed among liquidity providers.

At the

TON-3,74%

- Reward

- 3

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More238.26K Popularity

866.68K Popularity

58.23K Popularity

95.95K Popularity

504.16K Popularity

Hot Gate Fun

View More- MC:$2.43KHolders:00.00%

- MC:$0.1Holders:10.00%

- MC:$2.43KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:00.00%

News

View MoreTraditional Finance Alert: XTIUSD rises over 2%

33 m

Punch surged 311.82% after launching Alpha, now priced at 0.032031594106268 USDT

43 m

Federal Reserve research paper states that prediction markets have significant analytical value

56 m

Eric Trump: Bitcoin will reach $1 million, saying "I've never been this bullish before"

58 m

On-chain analysis tool Parsec announces it will cease operations

1 h

Pin