Post content & earn content mining yield

placeholder

deltapro

📊 Amid the correction, Bitcoin's True Market Mean indicator fell below the market price for the first time in two and a half years. The metric shows the average price at which investors purchased coins, excluding miners.

Analyst Keith Alan predicted a double bottom could be forming at around $74,000. This zone coincides with the April 2025 support line—the very levels Bitcoin fell to during the current sell-off.

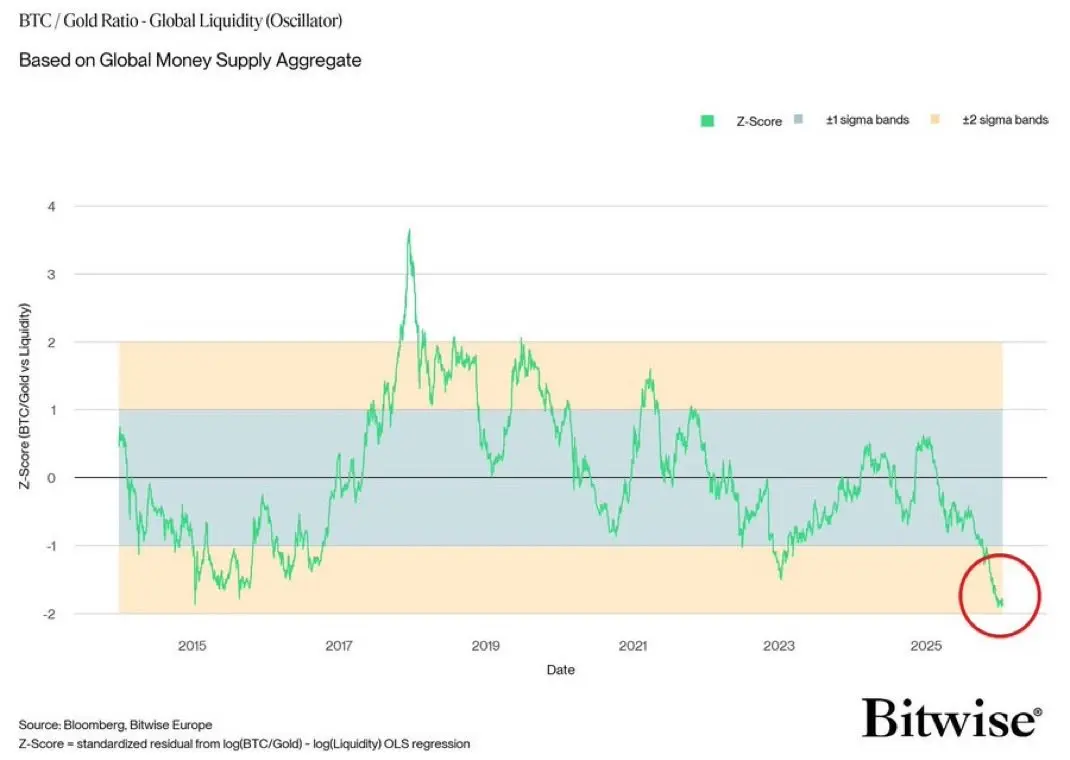

However, MN Trading founder Michael van de Poppe noted that the RSI on the weekly chart of the leading cryptocurrency against gold fell below 30.

"[...] this is a signal [of a trend r

Analyst Keith Alan predicted a double bottom could be forming at around $74,000. This zone coincides with the April 2025 support line—the very levels Bitcoin fell to during the current sell-off.

However, MN Trading founder Michael van de Poppe noted that the RSI on the weekly chart of the leading cryptocurrency against gold fell below 30.

"[...] this is a signal [of a trend r

- Reward

- 1

- 1

- Repost

- Share

deltapro :

:

Bitcoin Plunges Below $76,000: Hello, Bear Market Bitcoin's price fell to $75,555 on Bitstamp, marking a 40% drop from its all-time high on October 6, 2025. In the two days since January 29, the world's leading cryptocurrency has lost 15% of its value.

Dragon Fly Official insight: Market divergence — bullish or cautious? ⚡🐉

Recent crypto volatility has heightened the tug-of-war between bulls and bears. The structure of price action, on-chain flows, and macro liquidity signals are all pointing to a critical decision zone.

🔍 Market Analysis & Signals

BTC & ETH structure: BTC has held key accumulation zones, but short-term oscillators show overextension on lower timeframes, signaling potential pullbacks. ETH mirrors similar patterns, with smart money accumulation suggesting selective conviction.

On-chain metrics: Whale inflows and exchange ba

Recent crypto volatility has heightened the tug-of-war between bulls and bears. The structure of price action, on-chain flows, and macro liquidity signals are all pointing to a critical decision zone.

🔍 Market Analysis & Signals

BTC & ETH structure: BTC has held key accumulation zones, but short-term oscillators show overextension on lower timeframes, signaling potential pullbacks. ETH mirrors similar patterns, with smart money accumulation suggesting selective conviction.

On-chain metrics: Whale inflows and exchange ba

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

BTC Market Structure: Support, Resistance & Liquidity Zones (Educational Analysis)”

- Reward

- like

- Comment

- Repost

- Share

ma

ma

Created By@PleaseSaveMe

Subscription Progress

0.00%

MC:

$0

Create My Token

#USGovernmentShutdownRisk, written in a professional, premium tone suitable for crypto, finance, or macro-economic audiences:

USGovernmentShutdownRisk: Why Markets Are Watching Washington So Closely

The risk of a US government shutdown has once again moved to the forefront of global market discussions, raising concerns across equities, bonds, commodities, and the crypto space.

While government shutdowns are not new in American politics, the current environment of high interest rates, fragile economic growth, and geopolitical uncertainty makes this situation particularly sensitive. Investors a

USGovernmentShutdownRisk: Why Markets Are Watching Washington So Closely

The risk of a US government shutdown has once again moved to the forefront of global market discussions, raising concerns across equities, bonds, commodities, and the crypto space.

While government shutdowns are not new in American politics, the current environment of high interest rates, fragile economic growth, and geopolitical uncertainty makes this situation particularly sensitive. Investors a

BTC-5.25%

- Reward

- 1

- Comment

- Repost

- Share

【$LDO Signal】Empty position, decline accompanied by abnormal trading volume

$LDO Price drops by -8.75% with high trading volume, market logic indicates caution against main players offloading. Currently, there is no clear bottom structure on the chart, indicating an accelerated phase within a downtrend, and it is not advisable to catch falling knives on the left side.

🎯 Direction: Empty position

Wait for clear signs of a price bottom or accumulation before making an assessment. The current market sentiment is leaning towards panic, with no obvious buying absorption. Observe whether the subs

View Original$LDO Price drops by -8.75% with high trading volume, market logic indicates caution against main players offloading. Currently, there is no clear bottom structure on the chart, indicating an accelerated phase within a downtrend, and it is not advisable to catch falling knives on the left side.

🎯 Direction: Empty position

Wait for clear signs of a price bottom or accumulation before making an assessment. The current market sentiment is leaning towards panic, with no obvious buying absorption. Observe whether the subs

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

#SEConTokenizedSecurities This is a strong, well-structured macro + regulatory brief 👍

It reads like institutional research, not retail commentary. A few high-level takeaways and refinement notes (not criticism—polish):

What You Nailed 💯

Correct SEC framing: You’re spot on that tokenized ≠ exempt. Calling out “same securities laws, new rails” is exactly how regulators think.

Balanced tone: You avoid the common mistake of painting the SEC as anti-innovation. The emphasis on conditional relief and case-by-case exemptions reflects the 2025–26 shift accurately.

Market reaction insight: Different

It reads like institutional research, not retail commentary. A few high-level takeaways and refinement notes (not criticism—polish):

What You Nailed 💯

Correct SEC framing: You’re spot on that tokenized ≠ exempt. Calling out “same securities laws, new rails” is exactly how regulators think.

Balanced tone: You avoid the common mistake of painting the SEC as anti-innovation. The emphasis on conditional relief and case-by-case exemptions reflects the 2025–26 shift accurately.

Market reaction insight: Different

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

$ZORA just made a violent expansion after a long period of compression, and I’m focusing on the reaction, not the hype.

The reason I’m interested here is the structure before the move. Price spent a long time bleeding slowly, then flushed liquidity near 0.020 and immediately reversed with strong momentum. That tells me accumulation was already done below. The vertical push wasn’t random, it was a release of stored pressure.

After the spike into the 0.048 area, price pulled back instead of collapsing. That’s important. Strong moves that hold structure usually offer continuation or at least a cl

The reason I’m interested here is the structure before the move. Price spent a long time bleeding slowly, then flushed liquidity near 0.020 and immediately reversed with strong momentum. That tells me accumulation was already done below. The vertical push wasn’t random, it was a release of stored pressure.

After the spike into the 0.048 area, price pulled back instead of collapsing. That’s important. Strong moves that hold structure usually offer continuation or at least a cl

ZORA61.39%

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

Dragon Fly Official insight: Rates on hold — defensive or risk-on? 💹🐉

Markets are digesting “higher for longer” interest rate expectations, and positioning now is key. The interplay between BTC and altcoins is subtle but actionable.

🔍 Market Structure & Analysis

BTC as a macro hedge: With rates stable but high, BTC often behaves like a risk-adjusted safe haven. Large inflows tend to rotate into BTC first when equities or risk-on assets hesitate.

Altcoins and risk appetite: Alts historically lead during rotations from BTC dominance dips or when liquidity expands. Current data shows moderate

Markets are digesting “higher for longer” interest rate expectations, and positioning now is key. The interplay between BTC and altcoins is subtle but actionable.

🔍 Market Structure & Analysis

BTC as a macro hedge: With rates stable but high, BTC often behaves like a risk-adjusted safe haven. Large inflows tend to rotate into BTC first when equities or risk-on assets hesitate.

Altcoins and risk appetite: Alts historically lead during rotations from BTC dominance dips or when liquidity expands. Current data shows moderate

BTC-5.25%

- Reward

- 7

- 6

- Repost

- Share

DragonFlyOfficial :

:

Are you staying defensive in BTC, or exploring selective alts? Which projects do you think have real rotation potential under “higher for longer” rates?View More

GM CryptoWhalers

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketPullback #MarketVolatility ⚡

The crypto market is facing one of its toughest stress tests of early 2026.

Bitcoin has slipped below $80K, briefly touching the $75K–$78K zone — its weakest structure since mid-2025. Ethereum followed, sliding toward $2,400 as leveraged positions were aggressively flushed. Billions in liquidations erased over the weekend.

This isn’t just a random dip.

Macro pressure is building:

• Geopolitical instability

• Stronger U.S. dollar

• Fed uncertainty

• Risk-off capital rotation

Bitcoin is behaving like a high-beta tech asset — not digital gold — in this en

The crypto market is facing one of its toughest stress tests of early 2026.

Bitcoin has slipped below $80K, briefly touching the $75K–$78K zone — its weakest structure since mid-2025. Ethereum followed, sliding toward $2,400 as leveraged positions were aggressively flushed. Billions in liquidations erased over the weekend.

This isn’t just a random dip.

Macro pressure is building:

• Geopolitical instability

• Stronger U.S. dollar

• Fed uncertainty

• Risk-off capital rotation

Bitcoin is behaving like a high-beta tech asset — not digital gold — in this en

ETH-8.69%

- Reward

- 6

- 5

- Repost

- Share

LittleQueen :

:

good informationView More

【$SEI Signal】Short position, wait for downward momentum confirmation

$SEI After a volume-driven decline, the market enters a cooling-off phase. Price action indicates selling pressure dominates; observe whether a new supply zone forms.

🎯Direction: Short

Market logic: The price drops with significant trading volume, suggesting that market participants are either liquidating or the main players are offloading. Current price behavior leans bearish but lacks a clear bottoming or reversal pattern. A healthy approach is to wait for the price to form clear absorption or rejection signals at low leve

View Original$SEI After a volume-driven decline, the market enters a cooling-off phase. Price action indicates selling pressure dominates; observe whether a new supply zone forms.

🎯Direction: Short

Market logic: The price drops with significant trading volume, suggesting that market participants are either liquidating or the main players are offloading. Current price behavior leans bearish but lacks a clear bottoming or reversal pattern. A healthy approach is to wait for the price to form clear absorption or rejection signals at low leve

- Reward

- like

- Comment

- Repost

- Share

孔子

孔子

Created By@PiggyFromTheOcean

Listing Progress

100.00%

MC:

$49.93K

Create My Token

🔥CZ: Capital always flows into "safe haven" assets first before moving into Crypto

When global tensions escalate, according to CZ, the usual scenario unfolds as follows:

🖤Funds pour into Gold/Silver because they are considered “absolutely safe”

🖤Then the market realizes: safe havens also have volatility, not as stable as expected

This is the best time to “spread awareness” about Crypto, as the flow of money typically shifts from traditional assets to digital assets during times of uncertainty.

In times of crisis, investors tend to seek refuge in assets they perceive as secure, but they shou

View OriginalWhen global tensions escalate, according to CZ, the usual scenario unfolds as follows:

🖤Funds pour into Gold/Silver because they are considered “absolutely safe”

🖤Then the market realizes: safe havens also have volatility, not as stable as expected

This is the best time to “spread awareness” about Crypto, as the flow of money typically shifts from traditional assets to digital assets during times of uncertainty.

In times of crisis, investors tend to seek refuge in assets they perceive as secure, but they shou

- Reward

- 1

- 4

- Repost

- Share

PTDpro28 :

:

Bull Run 🐂View More

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Trade Like a Pro: Using Ichimoku Clouds to Spot Trend Reversals

- Reward

- like

- Comment

- Repost

- Share

Do we Still have Super Cycle?

- Reward

- like

- Comment

- Repost

- Share

Per system this is a very big zone here as we come into 2024 value You want to see a reclaim of the 24 VAH as steadfast as possibleThe longer we hang around here the higher the chance of hitting the 24 vwap at mid 65 k Big start to a new month #BTC

BTC-5.25%

- Reward

- like

- Comment

- Repost

- Share

$BTC #CryptoMarketPullback 🚨

The market just delivered a sharp reality check.

Bitcoin has officially broken the key $84,600 support and is now trading in the $77K–$78K range. That level was holding structure — and losing it triggered aggressive selling pressure.

BTC: ~$77,800 (-7%)

ETH: ~$2,370 (-13%)

Billions in liquidations flushed in 24 hours.

This isn’t random.

Macro tension, tech stock weakness, and renewed Fed uncertainty are pushing capital into “risk-off” mode. When liquidity tightens, crypto feels it first.

Now the real question:

Is this a market reset…

or a high-probability accu

The market just delivered a sharp reality check.

Bitcoin has officially broken the key $84,600 support and is now trading in the $77K–$78K range. That level was holding structure — and losing it triggered aggressive selling pressure.

BTC: ~$77,800 (-7%)

ETH: ~$2,370 (-13%)

Billions in liquidations flushed in 24 hours.

This isn’t random.

Macro tension, tech stock weakness, and renewed Fed uncertainty are pushing capital into “risk-off” mode. When liquidity tightens, crypto feels it first.

Now the real question:

Is this a market reset…

or a high-probability accu

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

Brothers, don't forget to activate this today as we discussed.

View Original

- Reward

- 7

- 14

- Repost

- Share

RideAMissileToBlowUpASnail :

:

怎么开View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More25.74K Popularity

62.7K Popularity

367.57K Popularity

45.75K Popularity

61.87K Popularity

Hot Gate Fun

View More- MC:$2.91KHolders:10.00%

- MC:$2.91KHolders:10.00%

- MC:$2.91KHolders:10.00%

- MC:$2.9KHolders:10.00%

- MC:$2.92KHolders:10.00%

News

View More“1011 Insider Whale” ranks first in the loss amount among Hyperliquid's top whales.

9 m

Cathie Wood: BTC, ETH, SOL, HYPE can be used as diversified investment options

15 m

Whale Deposits $3M USDC to Hyperliquid, Sets Buy Orders for HYPE

17 m

Ethereum's return rate for January 2026 is -17.52%, compared to Bitcoin's return rate of -10.17%.

18 m

Bitcoin has been surpassed by Tesla and has fallen to the 14th position in the global asset market capitalization ranking.

27 m

Pin