Gate Ventures Weekly Crypto Recap (December 22, 2025)

TLDR

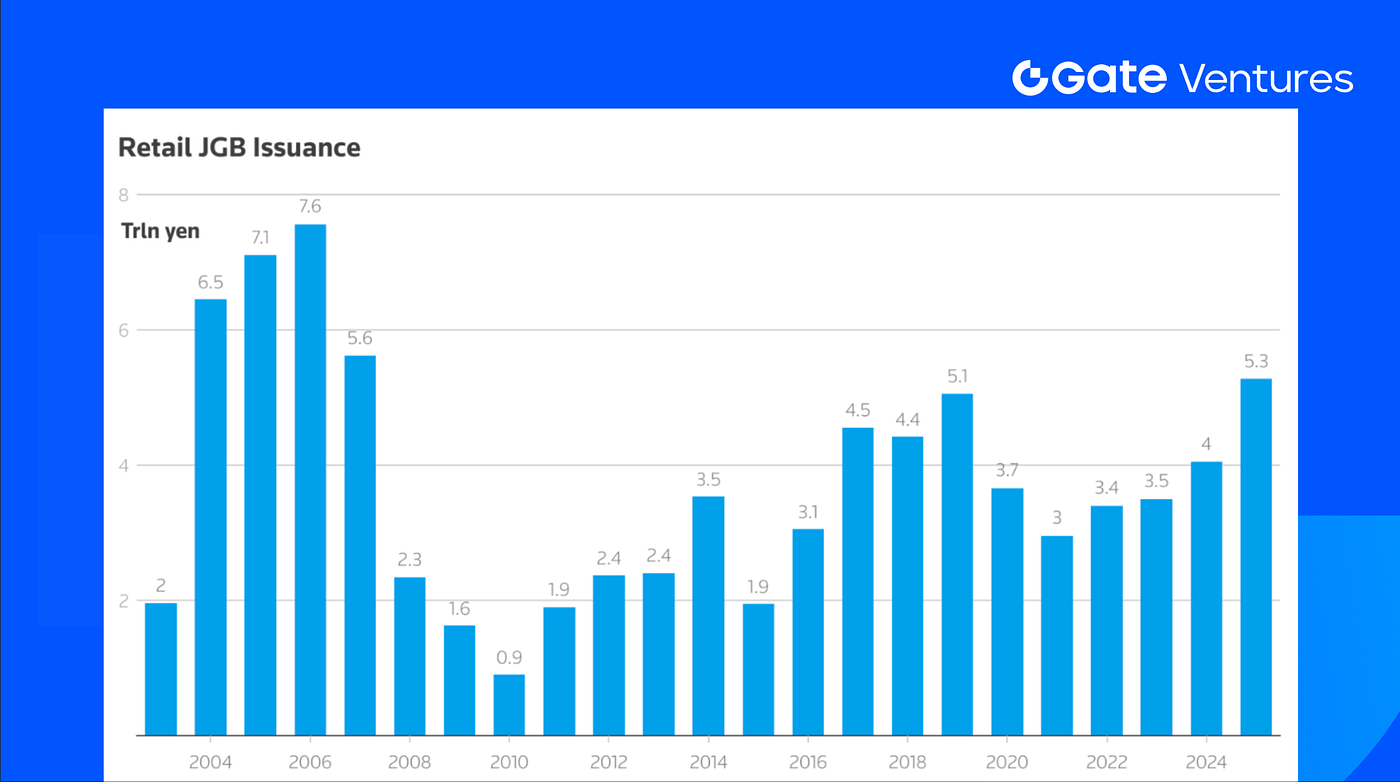

- Japan is increasingly mobilizing household savings as a stable source of demand for government bonds, with retail JGB issuance rising to over 5 trillion yen in 2024, the highest level in more than a decade.

- Upcoming US data, including delayed November non-farm payrolls and CPI, will be key for shaping expectations around the Fed’s 2026 policy path.

- The US dollar remains soft in the high 98s, reflecting a narrowing US rate advantage and expectations for further easing.

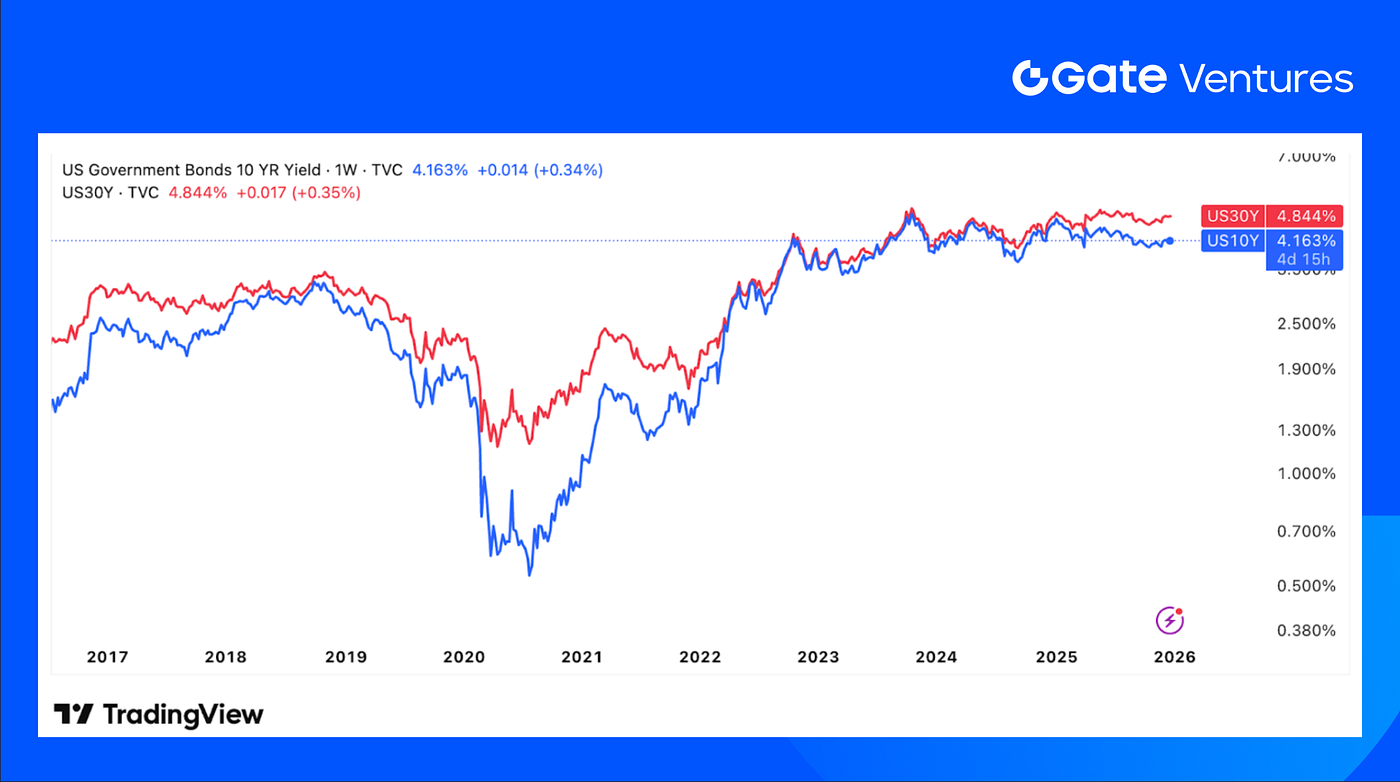

- Long-dated US Treasury yields remain elevated despite rate cuts, with the 10-year at 4.16% and the 30-year at 4.84%, driven by inflation uncertainty, term premium, and supply concern.

- Gold has reached fresh record highs above $4,400/oz, supported by easing expectations, a weaker dollar, geopolitical hedging, and sustained central bank demand.

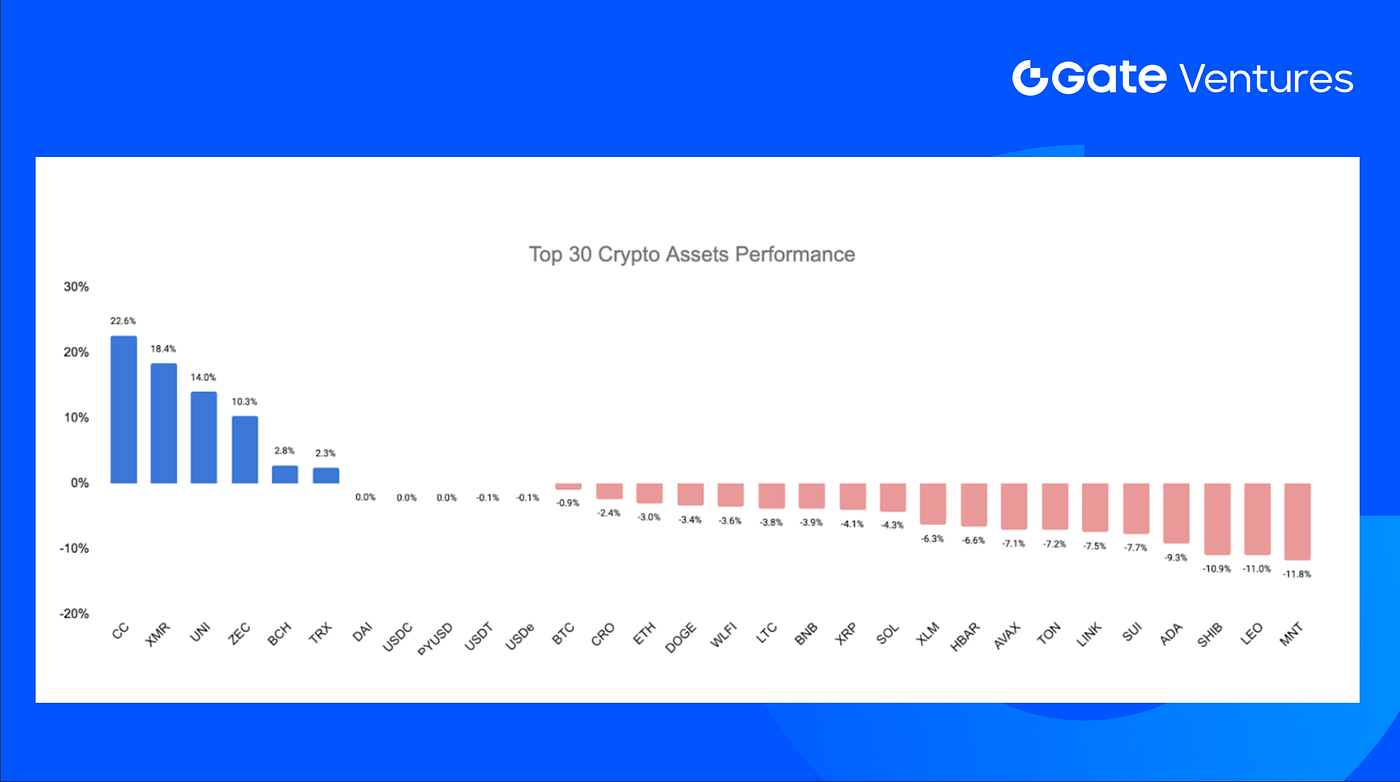

- Crypto markets remain under pressure: BTC +0.55% WoW, ETH −1.97% WoW; ETH/BTC fell 2.5% to 0.034, signaling continued ETH underperformance. ETF flows remain negative, with BTC ETFs seeing outflows of −$497.1M and ETH ETFs −$75.9M. Market sentiment remains weak, with the Fear & Greed Index at 25 (Extreme Fear).

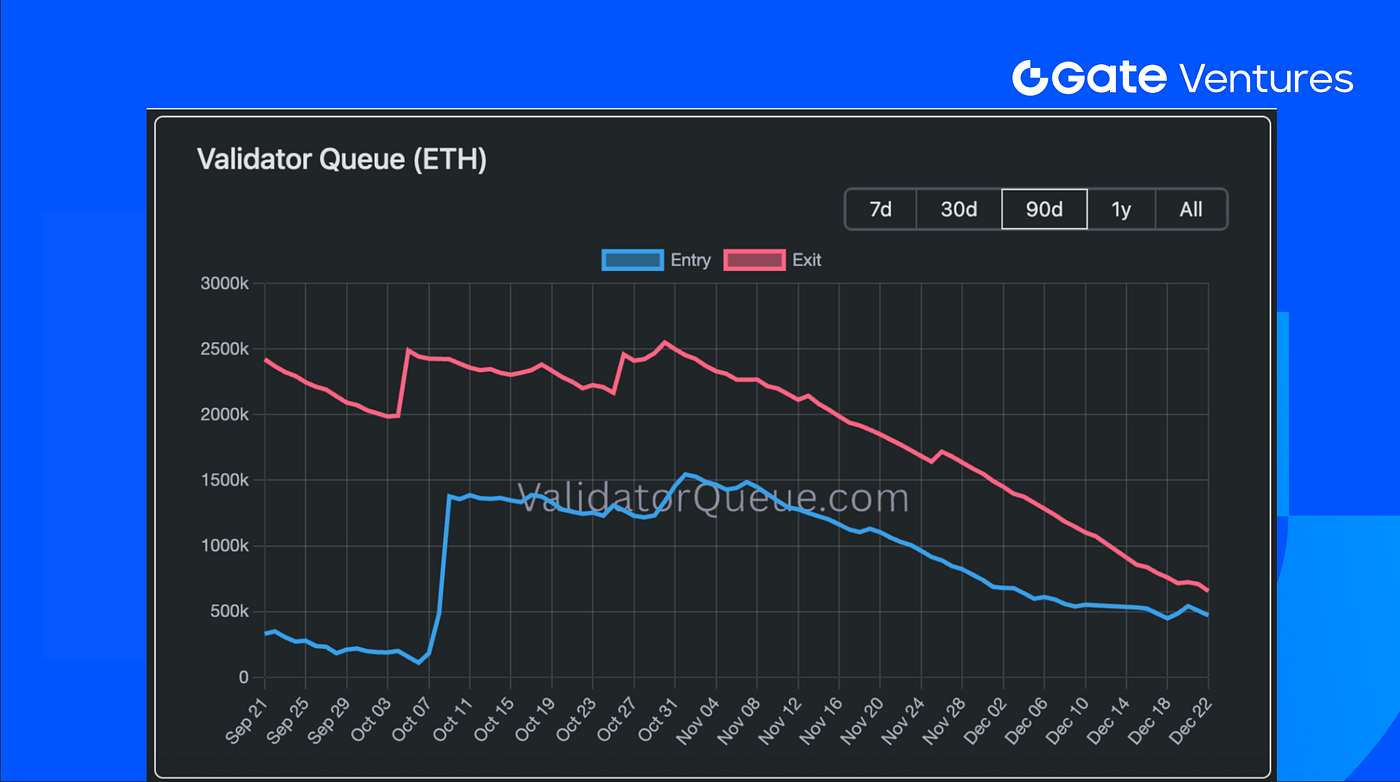

- ETH staking pressure is easing, as the validator exit–entry gap narrowed to approximately 180k ETH, indicating fewer large validators exiting. Market breadth remains weak: total crypto market cap −0.17%; excluding BTC and ETH −1.59%; excluding the top 10 −2.05%.

- Canton Network +22.6% on DTCC news to tokenize DTC-custodied U.S. Treasuries, reinforcing institutional credibility.

- UNI +18.4% on strong progress toward the UNIfication vote, enabling the fee switch, a 100M UNI burn, and improved token economics.

- Hegota unveiled as Ethereum’s next upgrade following Glamsterdam.

- MetaMask adds native Bitcoin support as multichain expansion accelerates.

- Securitize plans launch of fully compliant tokenized public stocks in 2026.

Macro Overview

Japan is increasingly looking to mobilize its large household savings base, estimated at roughly seven trillion dollars, as a more stable source of demand for government bonds. While households currently hold only a small share of outstanding Japanese government debt, recent issuance data indicate a meaningful shift in behavior. Retail JGB issuance has risen steadily from below one trillion yen in 2010 to around 5.3 trillion yen in 2024, marking the highest annual level in more than a decade. This rebound reflects the return of positive yields and suggests that higher interest rates are now transmitting more effectively into household portfolio allocation decisions. (1)

Retail JGB Issuance

This trend is occurring at a critical juncture, as traditional sources of demand, such as the central bank and commercial banks, become less willing or less able to absorb new issuance. With the Bank of Japan gradually normalizing policy and reducing its footprint in the bond market, expanding retail participation is increasingly viewed as necessary to preserve market stability and funding capacity. If the recent rise in retail issuance proves durable, the redirection of household savings from deposits into government bonds could help smooth Japan’s transition away from extraordinary monetary accommodation, reduce reliance on institutional balance sheets, and limit upward pressure on government bond yields over the medium term.

Hence, this week’s incoming data includes a range of key releases that may shape market expectations for both the Federal Reserve’s future policy path and global growth momentum. In the United States, markets will continue to digest delayed November non-farm payrolls and unemployment figures, alongside updated CPI inflation readings, with both scheduled early in the week and potentially impacting expectations for 2026 interest-rate cuts. (2)

On the central-bank front, the Bank of Japan’s Summary of Opinions from its December monetary policy meeting is due late next week on December 29, offering insight into the BoJ’s view on inflation and policy direction after the recent rate hike. Other scheduled releases include updates on average contract interest rates on loans and T-bill purchase statistics by the BoJ, which will help markets assess liquidity conditions and domestic credit trends going into 2026. (3)

DXY

The U.S. Dollar Index (DXY) is hovering around the high-98s (≈98.6–98.7 in recent closes), consistent with the narrative that the market is leaning toward additional easing in 2026 and that the U.S. rate advantage is narrowing at the margin.

US 10-Year and 30-Year Bond Yields

The yield on the 10-year note finished at 4.16% on December 22, 2025, and the 30-year note ended at 4.84%. Longer yields remain elevated even after the policy cut, which is an expression of (i) inflation uncertainty, (ii) term premium/supply concerns, and (iii) cross-market rate repricing.

Gold

Gold broke $4,400/oz for the first time on Dec 22, with spot trading around $4,412 after hitting a new intraday record. Drivers cited include rate-cut expectations, a weaker dollar, geopolitical/trade tension hedging, and continued central-bank demand. (4)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC edged up 0.55% over the past week, while ETH underperformed with a 1.97% decline. The ETH/BTC ratio fell 2.5% to 0.034, reflecting continued relative weakness in ETH. (5)

On the flow side, BTC ETFs recorded a net outflow of $497.05M, while ETH ETFs saw net outflows of $75.89M. Market sentiment remains fragile, with the Fear & Greed Index still in the “Extreme Fear” zone at a reading of 25. (6)

ETH Validator Queue

Hence, the gap between ETH validator exits and entries has narrowed to around 180k ETH, indicating a smaller net change in staked ETH and fewer large validators opting to exit. (7)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

Total crypto market capitalization declined by 0.17%. Excluding BTC and ETH, market cap fell 1.59%, while the broader altcoin market excluding the top-10 experienced a sharper drop of 2.05%.

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Dec, 22nd 2025

Across the top 30 assets, the market still recorded an average decline of 1.89%, with Canton Network, XMR, UNI, and Zcash among the few tokens posting gains.

Canton Network outperformed sharply with a 22.6% rally, driven by DTCC’s announcement to tokenize DTC-custodied U.S. Treasuries on Canton. Backed by Digital Asset, an institutional blockchain infrastructure provider serving major banks and market infrastructures, the move validates Canton as institutional-grade infrastructure and is further reinforced by DTCC’s role in network governance. (8)

UNI followed with an 18.4% rally, driven by strong progress on the “UNIfication” governance vote, which is on track to pass with overwhelming support and activate the long-awaited protocol fee switch. The proposal includes a one-time burn of 100 million UNI from the treasury and introduces a protocol fee discount auctions system to increase liquidity provider returns. (9)

The Key Crypto Highlights

1. Hegota unveiled as Ethereum’s next upgrade following Glamsterdam

Ethereum core developers have named the network’s post-Glamsterdam upgrade “Hegota,” clarifying the structure of its 2026 development cycle under a twice-yearly release cadence. Still early-stage, Hegota has no headline EIP selected, with decisions expected in February as Glamsterdam’s scope is finalized. The upgrade is expected to absorb deferred items and advance longer-term roadmap goals such as statelessness and execution-layer efficiency, reinforcing Ethereum’s shift toward more predictable, incremental protocol upgrades rather than infrequent, sweeping hard forks. (1)

2. MetaMask adds native Bitcoin support as multichain expansion accelerates

MetaMask has rolled out native Bitcoin support, allowing users to buy, swap, send, and receive BTC directly within the wallet after nearly a year of anticipation. The integration removes reliance on wrapped Bitcoin and positions MetaMask as a more comprehensive multichain interface alongside Ethereum, Solana, Sei, and Monad. By incentivizing BTC swaps with reward points and signaling additional network integrations in 2026, MetaMask continues shifting from an Ethereum-first wallet toward a broader consumer gateway for cross-chain asset management. (2)

3. Securitize plans launch of fully compliant tokenized public stocks in 2026

Securitize announced plans to launch natively tokenized public stocks in early 2026, positioning the product as a compliant, on-chain trading system that conveys real equity ownership rather than synthetic exposure. The tokens will represent regulated shares recorded directly on issuers’ cap tables and trade fully on-chain through a DeFi-style interface, including outside traditional market hours. By combining its role as a registered transfer agent with blockchain issuance, Securitize aims to bring programmability and 24/7 liquidity to public equities while maintaining KYC, AML, and investor protections. (3)

Key Ventures Deals

1. ETHGas raises $12M Seed round to build Ethereum’s blockspace market

ETHGas raised a $12M Seed round led by Polychain Capital with Stake Capital, Amber Group and other investors to develop a standardized, tradeable blockspace market on Ethereum. The platform introduces pre-confirmations and blockspace commitments to reduce gas volatility and enable predictable execution. As applications demand real-time performance and budgetable UX, the investment reflects belief that blockspace will emerge as a core financial primitive underpinning the next generation of gasless, institutional-grade Ethereum applications. (4)

2. Tether leads $8M Strategic round in Speed’s Lightning-native payment rails

Speed raised an $8M Strategic Round led by Tether with Ego Death Capital to expand its Lightning-native payments infrastructure supporting BTC and USDT settlement. Processing over $1.5B in annual volume, Speed targets instant, low-fee global payments for consumers and merchants. As stablecoins and Lightning converge for real-world commerce, the investment reflects growing demand for Bitcoin-aligned rails that deliver scalable, compliant, and price-stable digital payments. (5)

3. Harbor raises $4.2M Seed round to build a high-performance native-asset DEX

Harbor raised a $4.2M Seed round led by Susquehanna Crypto and Triton Capital with other investors backing its native-asset, high-performance DEX for wallets and apps. Designed to adapt as chains proliferate and assets move on-chain, Harbor focuses on fast connectivity across evolving networks. As market structure fragments and interoperability becomes critical, the investment reflects demand for flexible infrastructure that can serve as connective liquidity rails for a multi-chain financial system.(6)

Ventures Market Metrics

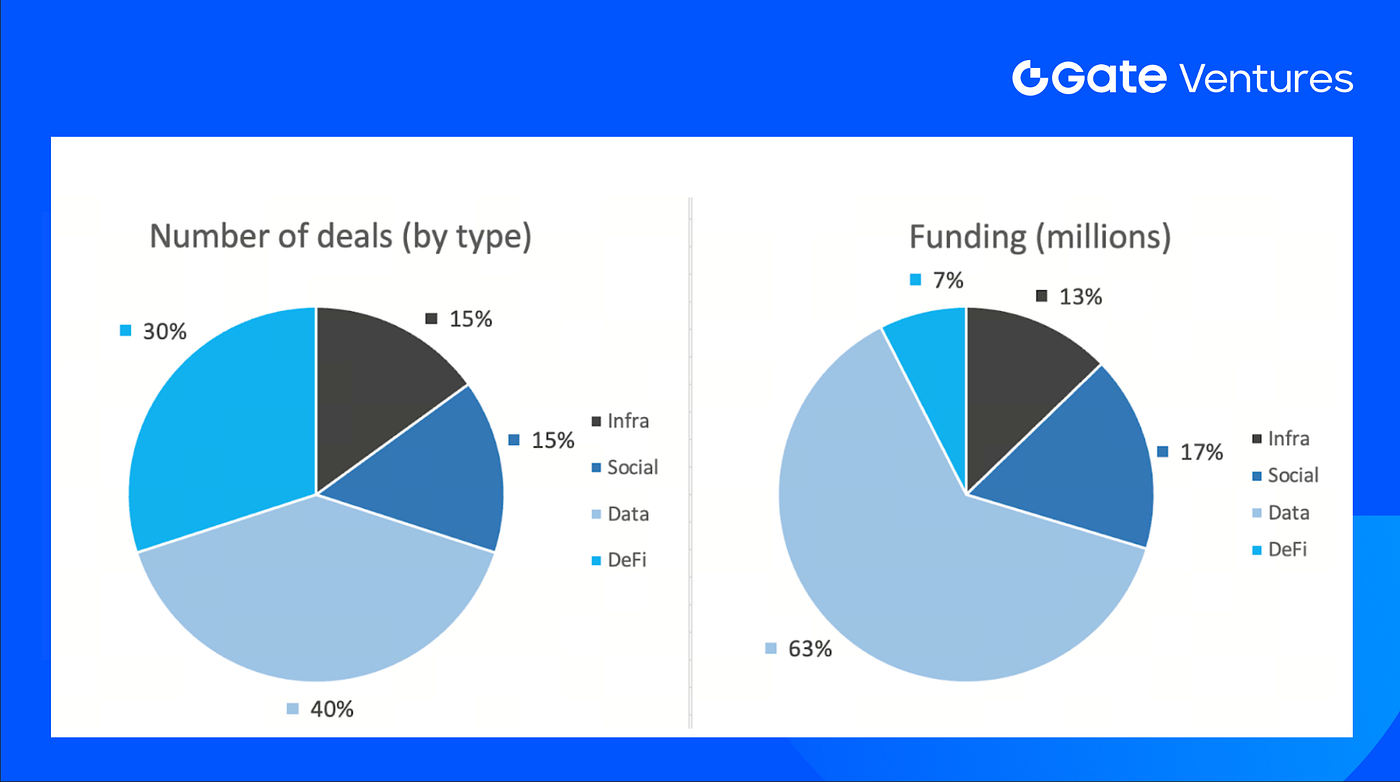

The previous week, 20 deals were closed, with Data accounting for 8, or 40% of the total. Meanwhile, Infra had 3 (15%), Social had 3 (15%) and DeFi had 6 (30%).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 22th Dec 2025

The total amount of disclosed funding raised in the previous week was $329M; 4/20 deals in the last week didn’t announce the raised amount. The top funding came from Data sector with $207M. Most funded deals: RedDotPay $107M, Fuse $70M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 22th Dec 2025

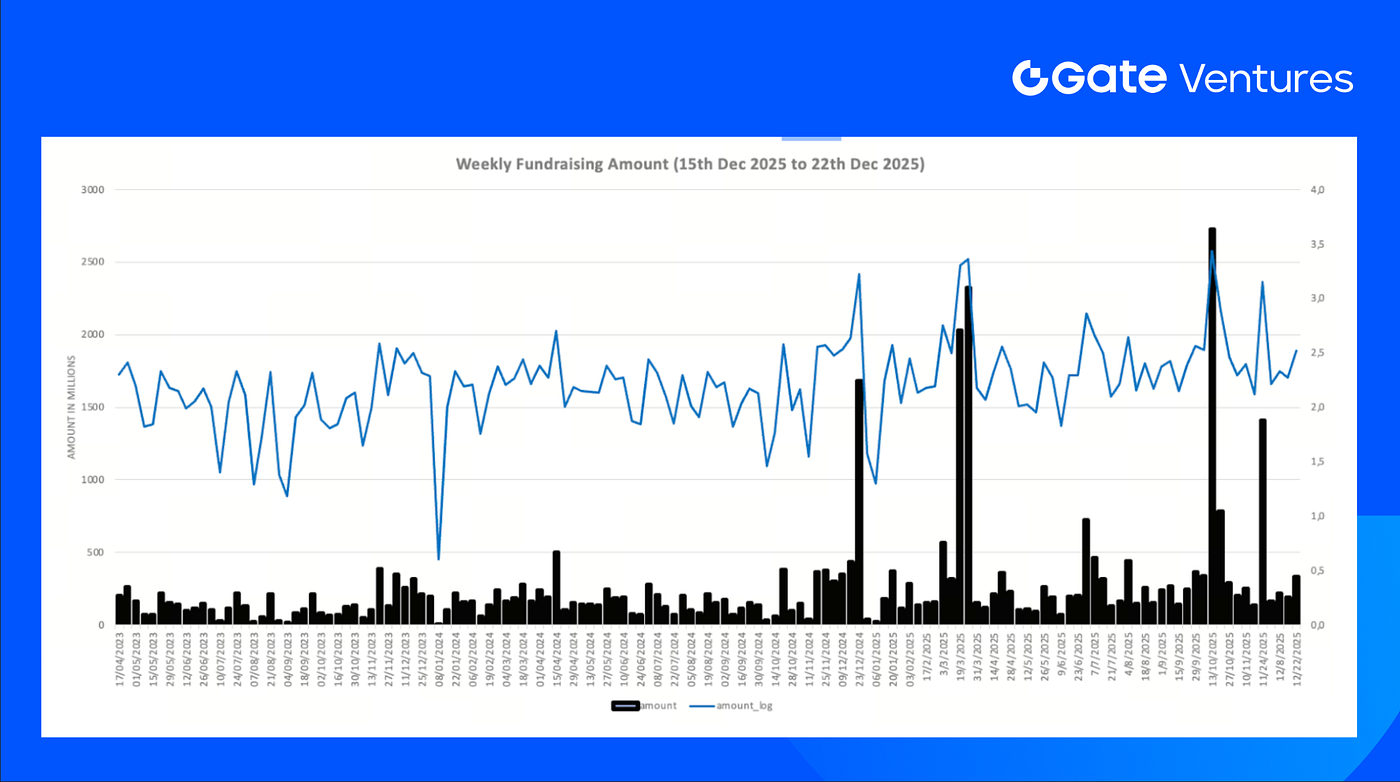

Total weekly fundraising rose to $329M for the 3rd week of Dec-2025, an increase of 75% compared to the week prior. Weekly fundraising in the previous week was down -410% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- Japan eyes $7 trillion household savings pile for fresh bond demand, https://www.reuters.com/business/finance/japan-eyes-7-trillion-household-savings-pile-fresh-bond-demand-2025-12-22/

- Explainer: Delayed US employment, CPI reports are due this week, with many gaps, https://www.reuters.com/markets/us/delayed-us-employment-cpi-reports-are-due-this-week-with-many-gaps-2025-12-15/

- Bank of Japan release schedule, https://www.boj.or.jp/en/about/calendar/index.htm

- Gold jumps over 2% to all-time peak; silver follows with record gain, https://www.reuters.com/world/india/gold-hits-record-high-fed-rate-cut-bets-silver-scales-fresh-peak-2025-12-22/

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- ETH Validator Queue, https://www.validatorqueue.com/

- Canton Network x DTCC Partnership, https://www.dtcc.com/news/2025/december/17/dtcc-and-digital-asset-partner-to-tokenize-dtc-custodied-us-treasury-securities

- UNIfication Goverance Vote, https://coinmarketcap.com/community/articles/69489225cecd084459513cd8/

- Hegota unveiled as Ethereum’s next upgrade following Glamsterdam, https://www.theblock.co/post/383275/ethereum-developers-name-post-glamsterdam-upgrade-hegota-as-2026-roadmap-takes-shape

- MetaMask adds native Bitcoin support as multichain expansion accelerates,https://metamask.io/news/bitcoin-on-metamask-btc-wallet?utm_source=twitter&utm_medium=social&utm_campaign=cmp-761302056-afbf08

- Securitize plans launch of fully compliant tokenized public stocks in 2026,https://cointelegraph.com/news/stocks-reach-web3-as-securitize-announces-real-regulated-shares-stocks-for-on-chain-trading

- ETHGas raises $12M Seed round to build Ethereum’s blockspace market, https://www.ethgas.com/blog/ethgas-raises-12m-to-accelerate-ethereums-realtime-gasless-future

- Tether leads $8M Strategic round in Speed’s Lightning-native payment rails, https://tether.io/news/tether-leads-8m-strategic-investment-in-speed-to-advance-lightning-native-stablecoin-powered-payments/

- Harbor raises $4.2M Seed round to build a high-performance native-asset DEX, https://x.com/ovedm606/status/2001028474644177160?s=20

Related Articles

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (November 3 , 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)