$300 Juta Terkumpul, Disetujui CFTC, Kalshi Berkompetisi untuk Dominasi Pasar Prediksi

Pasar prediksi kini berkembang pesat sebagai industri bernilai miliaran dolar di persimpangan kripto dan finansial. Pada 10 Oktober (UTC), Kalshi, platform pasar prediksi yang telah diregulasi di Amerika Serikat, meraih pendanaan lebih dari $300 juta dengan valuasi mencapai $5 miliar. Putaran ini dipimpin oleh Sequoia Capital dan a16z, sementara investor lama seperti Paradigm menambah investasi. Kalshi juga berencana membuka akses bagi pengguna dari lebih dari 140 negara untuk berpartisipasi dalam pasar prediksi di platformnya.

Pada bulan Juni, hanya empat bulan sebelumnya, Kalshi bernilai $2 miliar setelah putaran pendanaan sebesar $185 juta. Lonjakan valuasi ini menandakan keyakinan investor terhadap pertumbuhan pasar prediksi.

Tim Terkemuka & Jajaran VC

Kalshi didirikan oleh Tarek Mansour dan Luana Lopes Lara. Mansour adalah lulusan MIT dan trader kuantitatif berpengalaman, pernah menjabat eksekutif di Chicago Mercantile Exchange (CME) dengan keahlian di bidang penetapan harga derivatif dan manajemen risiko. Lara berasal dari sektor fintech Brasil dan memimpin strategi pasar berkembang di Morgan Stanley. Keduanya berfokus pada “kontrak peristiwa” yang sering diabaikan keuangan tradisional—yaitu bertaruh pada peristiwa masa depan.

Berbeda dengan Polymarket yang mengusung pendekatan blockchain-native, Kalshi membangun platform patuh regulasi sejak awal, mengantongi persetujuan dari Commodity Futures Trading Commission (CFTC) dan menjadi pasar prediksi pertama yang sepenuhnya diregulasi di AS. Alex Immerman, Mitra di a16z Growth Fund, menyebut langkah ini sebagai “proses yang menantang namun bertanggung jawab” yang membuat Kalshi menonjol di tengah dinamika regulasi.

Tim Kalshi menjadi kekuatan utama perusahaan. Selain para pendirinya, Kalshi merekrut veteran Wall Street dan talenta teknologi top. CTO Eli Levine, mantan Google Cloud, memimpin proyek infrastruktur data berskala besar demi menjaga latensi rendah dan throughput tinggi. Sarah Chen, Kepala Produk, bergabung dari Coinbase dan memimpin ekspansi ke pasar olahraga dan politik serta menghadirkan kontrak multi-peristiwa yang kompleks.

Pada Januari 2025, Donald Trump Jr. resmi bergabung di dewan penasihat Kalshi, memberikan wawasan politik dan memperkuat kinerja pasar pemilu platform—prediksi kemenangan presiden Kalshi mencapai akurasi 85% dalam pemilu AS 2024, melampaui survei tradisional. Tim Kalshi kini beranggotakan lebih dari 150 orang yang mencakup pemodelan kuantitatif, kepatuhan, dan pertumbuhan pengguna, dengan pengalaman industri rata-rata di atas 10 tahun. Sinergi antara Wall Street dan Silicon Valley ini memungkinkan Kalshi memimpin inovasi produk, memperluas kontrak dari satu peristiwa ke pasar olahraga, cuaca, dan data ekonomi, dengan pengguna aktif harian melampaui 100.000.

Pendanaan besar Kalshi menegaskan nilai strategis pasar prediksi. Sequoia Capital, ikon Silicon Valley yang berinvestasi di Airbnb dan Stripe, memimpin putaran ini, melihat keunggulan regulasi Kalshi sejak awal. a16z, dana crypto-native, dengan pendiri Marc Andreessen secara publik memuji Kalshi sebagai “revolusi keuangan berbasis peristiwa.” Paradigm, pemimpin putaran $185 juta di bulan Juni, meningkatkan kepemilikan pada putaran kali ini, dengan total investasi lebih dari $200 juta. Pendukung lain termasuk Coinbase Ventures dan Bond Capital yang dipimpin mantan partner a16z Mary Meeker dan fokus pada platform berbasis data. Total pendanaan Kalshi kini hampir $591 juta dari tiga putaran: seed round $15 juta pada 2021 (dipimpin SV Angel), Series A $50 juta pada 2023, dan Series D saat ini.

Polymarket, pesaing Kalshi, didirikan tahun 2020 oleh Shayne Coplan dan beroperasi sebagai pasar prediksi blockchain-native di Polygon, memungkinkan pengguna bertaruh langsung dengan USDC. Pada 7 Oktober 2025 (UTC), Polymarket mengumumkan investasi hingga $2 miliar dari Intercontinental Exchange (ICE), induk dari Bursa Efek New York.

Kalshi vs. Polymarket

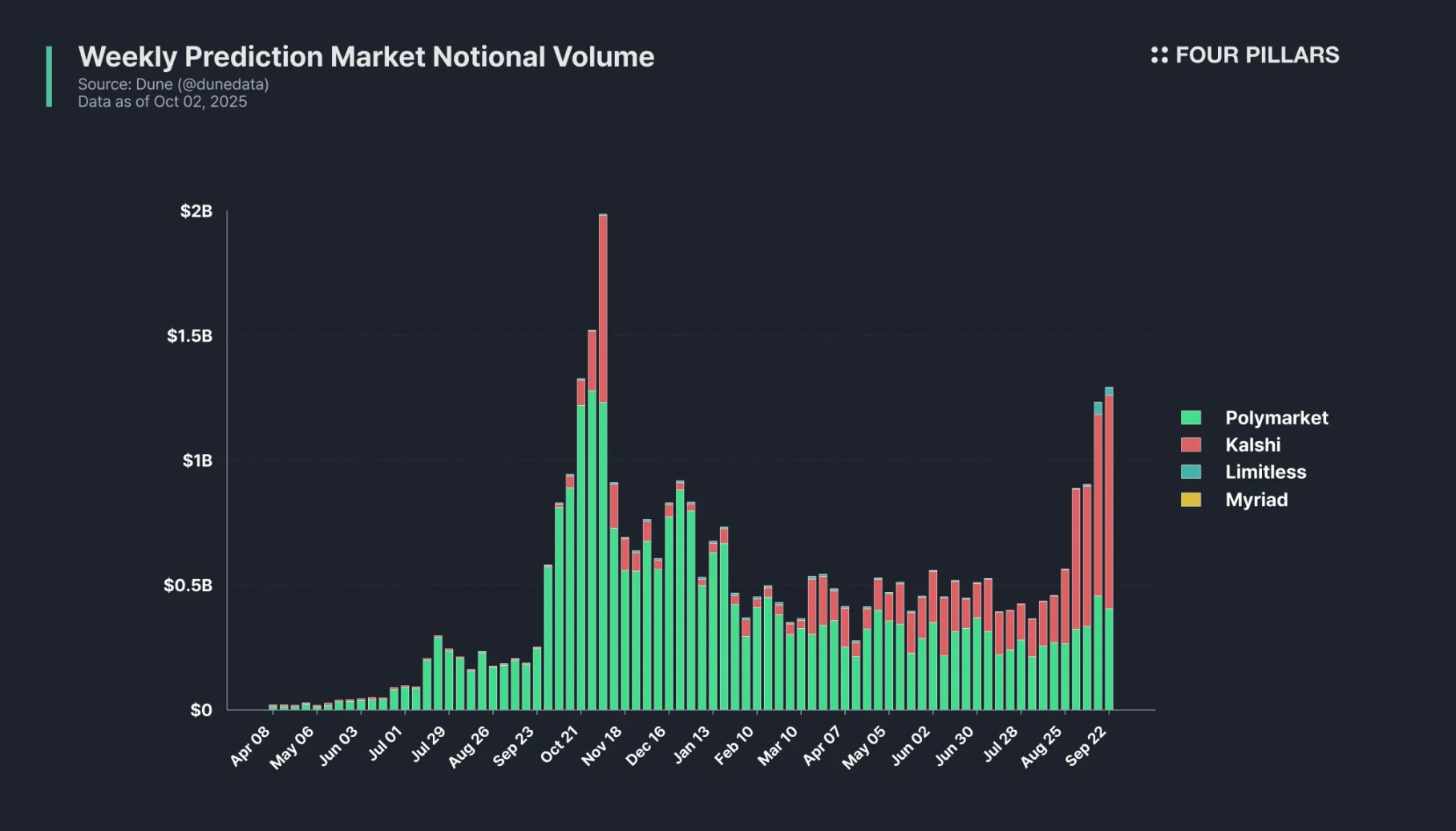

Keunggulan data Kalshi menjadi fondasi kesuksesan pendanaannya. Pool likuiditas platform ini menjaga rata-rata slippage di bawah 0,1%, jauh lebih rendah dari standar industri. Secara keuangan, Kalshi sudah profit dengan pendapatan di atas $200 juta pada semester pertama 2025, terutama dari biaya trading 0,5%–1%. Dune Analytics melaporkan volume pasar prediksi mingguan Kalshi melonjak, melampaui Polymarket.

Kalshi unggul atas Polymarket di beberapa aspek. Dari sisi kepatuhan: Kalshi adalah pasar kontrak (DCM) yang ditunjuk CFTC sehingga pengguna AS tidak perlu VPN. Polymarket kehilangan trafik AS usai larangan tahun 2022 dan kini mengandalkan pengguna internasional; baru-baru ini kembali ke pasar AS melalui akuisisi QCX LLC, namun tanggal peluncuran resmi masih menunggu.

Dari sisi pengalaman pengguna: Kalshi mendukung deposit USD dan proses verifikasi KYC efisien, melayani klien institusi. Polymarket mengandalkan dompet kripto, dengan biaya gas lebih tinggi dan volatilitas. Dari cakupan pasar: Kalshi memimpin pasar AS dengan kontrak olahraga dan ekonomi lebih luas, namun jangkauan internasionalnya terbatas. Polymarket fokus pada event politik dan kripto, namun penetrasi AS rendah karena batasan kepatuhan.

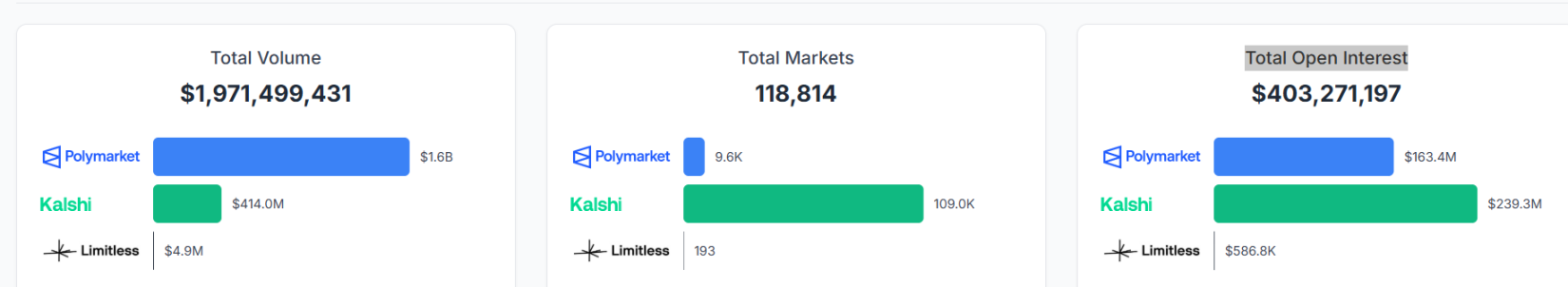

Data polymarketanalytics terbaru menunjukkan volume trading Kalshi hanya $400 juta, tertinggal dari Polymarket, tetapi unggul dalam jumlah pasar prediksi dan total open interest.

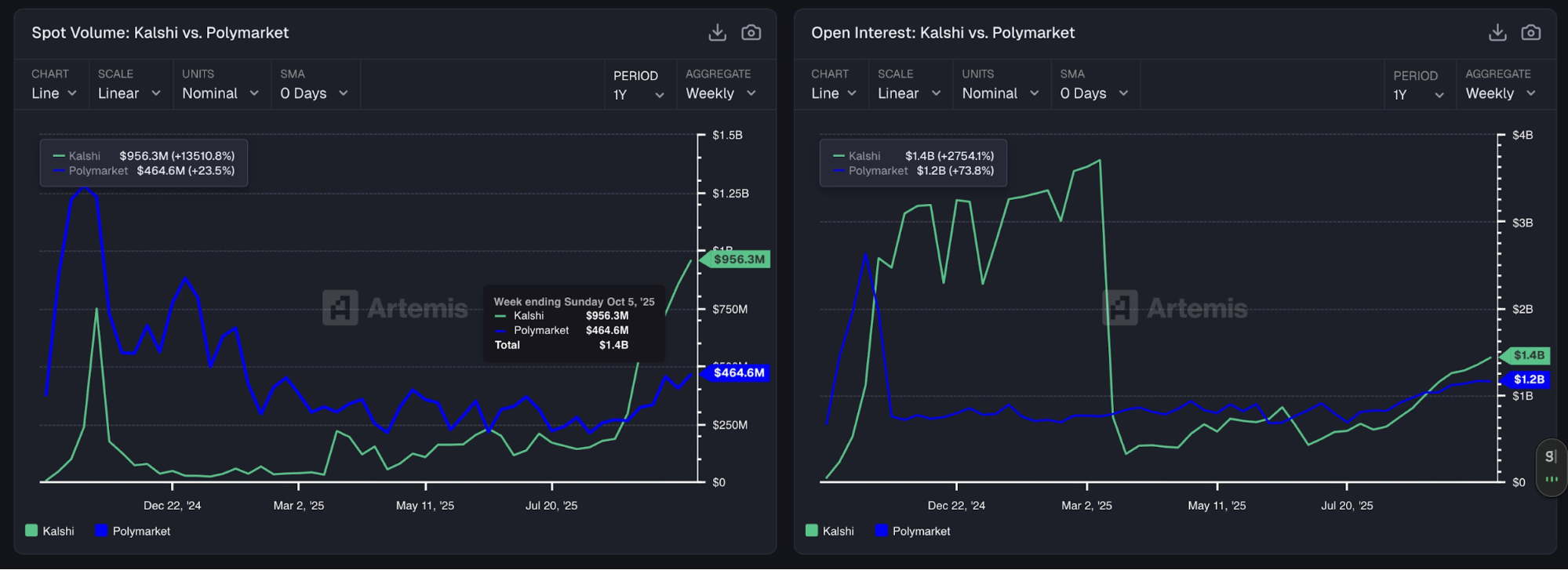

Menurut Artemis, volume transaksi pasar Kalshi melonjak 135 kali lipat dalam setahun menjadi $956,3 juta, sedangkan Polymarket hanya $464,6 juta.

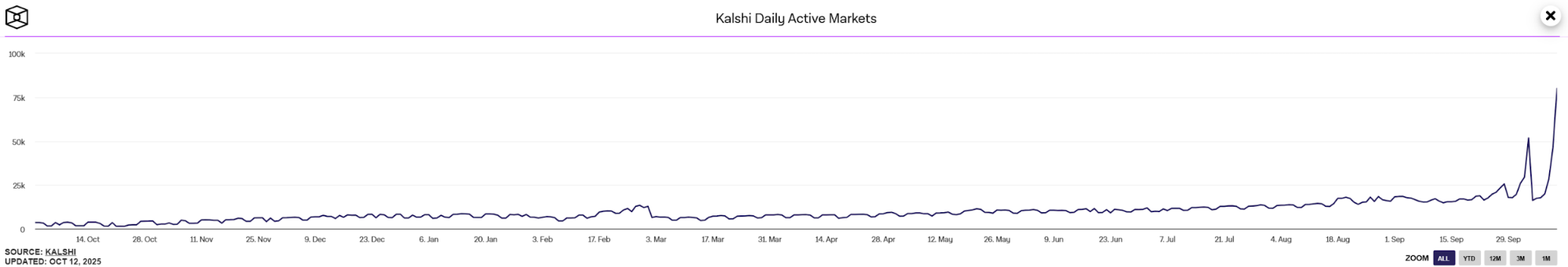

Data terbaru The Block menunjukkan pasar prediksi harian aktif Kalshi mencapai angka tertinggi, melewati 75.000.

Kalshi tercatat memuncaki chart aplikasi gratis Apple App Store pada 6 November 2024 (UTC), mengungguli Polymarket. Pada Oktober, Kepala Kripto Kalshi, John Wang, menyebut dalam wawancara The Block di konferensi Token2049 Singapura bahwa Kalshi akan diintegrasikan ke “setiap aplikasi dan exchange kripto utama” dalam 12 bulan ke depan.

Pendiri Polymarket mengisyaratkan peluncuran token POLY. Spekulasi pun muncul apakah Kalshi juga akan menerbitkan token sendiri. Meski rumor pasar tentang tokenisasi beredar, saluran resmi dan pengumuman pendanaan belum menyebutkan token Kalshi.

Disclaimer:

- Artikel ini diterbitkan ulang dari [Foresight News]. Hak cipta milik penulis asli [1912212.eth, Foresight News]. Untuk pertanyaan mengenai publikasi ulang, silakan hubungi tim Gate Learn yang akan menindaklanjuti sesuai prosedur berlaku.

- Disclaimer: Seluruh pendapat dan pandangan yang diungkapkan di sini sepenuhnya milik penulis dan bukan merupakan nasihat investasi.

- Versi bahasa lain dari artikel ini diterjemahkan oleh tim Gate Learn dan tidak boleh disalin, didistribusikan, atau direproduksi tanpa atribusi yang tepat kepada Gate.

Artikel Terkait

Apa itu Tronscan dan Bagaimana Anda Dapat Menggunakannya pada Tahun 2025?

Apa itu USDC?

Apa itu Hyperliquid (HYPE)?

Apa Itu Narasi Kripto? Narasi Teratas untuk 2025 (DIPERBARUI)

Apa itu Stablecoin?