Ikhtisar Teknis Berachain

Pelajaran ini membahas spesifik teknis dari Berachain, termasuk Polaris EVM dan mesin konsensus CometBFT. Ini membahas bagaimana teknologi ini meningkatkan kinerja blockchain dan manfaat yang mereka berikan kepada pengembang.

Kompatibilitas EVM

Mesin Virtual Ethereum (EVM) berfungsi sebagai lingkungan runtime untuk kontrak pintar Ethereum, mendefinisikan aturan untuk menjalankan instruksi berdasarkan bahasa pemrograman aslinya seperti Solidity atau Vyper. Kompatibilitas EVM di blockchain lain berarti bahwa blockchain dapat menjalankan kontrak pintar dan DApps berbasis Ethereum tanpa memerlukan modifikasi yang signifikan.

Fitur Berkompatibilitas EVM Berachain

- Pengimplementasian Kontrak Pintar: Pengembang dapat menerapkan kontrak pintar Ethereum yang ada di Berachain tanpa perubahan besar. Kompatibilitas ini memudahkan migrasi aplikasi dari Ethereum ke Berachain, menjadikannya proses yang kurang intensif sumber daya.

- Perkakas dan Infrastruktur: Berachain mendukung alat dan infrastruktur pengembangan Ethereum umum, termasuk kerangka kerja dan pustaka populer seperti Truffle, Hardhat, dan Web3.js. Dukungan ini membantu dalam mempertahankan pengalaman pengembangan yang konsisten.

Bukti Likuiditas

Proof of Liquidity (PoL) adalah mekanisme konsensus inovatif yang digunakan oleh Berachain, membedakannya dari pendekatan yang lebih tradisional seperti Proof of Work (PoW) atau Proof of Stake (PoS). Mekanisme ini mengintegrasikan penyediaan likuiditas langsung ke dalam proses konsensus, menyelaraskan insentif keuangan validator dengan likuiditas dan stabilitas keseluruhan jaringan.

Bukti Likuiditas mengharuskan validator untuk tidak hanya berpartisipasi dalam validasi transaksi dan produksi blok tetapi juga untuk berkontribusi pada likuiditas jaringan. Peran ganda ini meningkatkan keamanan dan kelayakan ekonomi blockchain.

Peran Validator:Validator di bawah PoL harus mengunci sebagian token yang bertindak sebagai "stake" dalam proses konsensus. Namun, berbeda dengan PoS, token-token ini harus aktif digunakan untuk menyediakan likuiditas. Validator diberi imbalan berdasarkan aktivitas validasi transaksi mereka dan kontribusi mereka terhadap likuiditas jaringan.

Kolam Likuiditas: Token terkunci biasanya digunakan dalam aktivitas keuangan terdesentralisasi (DeFi) dalam jaringan, seperti kolam likuiditas. Hal ini memastikan bahwa blockchain tidak hanya mengamankan dirinya sendiri tetapi juga mendukung ekosistem perdagangan yang ramai dan operasi keuangan lainnya.

Manfaat dari Bukti Likuiditas

Dengan mensyaratkan validator untuk berkontribusi pada kolam likuiditas, PoL secara inheren menstabilkan ekosistem keuangan jaringan. Hal ini mencegah fluktuasi likuiditas yang besar dan memastikan bahwa blockchain tetap berfungsi bahkan dalam kondisi pasar yang volatile.

Penyelarasan Insentif

Validator didorong untuk menjaga stabilitas dan keamanan jaringan karena imbalan mereka terhubung langsung dengan kinerja mereka dalam memvalidasi transaksi dan mengelola likuiditas. Keselarasan insentif ini mengurangi kemungkinan perilaku jahat yang dapat merusak jaringan.

Efisiensi Ekonomi

PoL mendorong penggunaan modal yang efisien dalam ekosistem dengan memastikan bahwa aset yang dikunci oleh validator digunakan secara produktif, daripada hanya duduk diam seperti dalam beberapa sistem PoS. Penggunaan aktif aset ini mempromosikan lingkungan ekonomi yang lebih sehat dan tangguh.

Skalabilitas

Bukti Likuiditas memungkinkan operasi jaringan yang lebih dapat diskalakan, karena mendukung sejumlah besar transaksi dan interaksi tanpa mengorbankan kecepatan atau efisiensi. Hal ini terutama penting untuk blockchain yang bertujuan mendukung berbagai aplikasi DeFi.

Tantangan dan Pertimbangan

Persyaratan bagi validator untuk secara aktif mengelola likuiditas dapat menambahkan tingkat kompleksitas dan risiko pada operasi mereka. Validator harus cakap tidak hanya dalam operasi teknis tetapi juga strategi keuangan. Karena aset validator terikat dalam kolam likuiditas yang dipimpin pasar, kepemilikan mereka mungkin terkena volatilitas pasar, memengaruhi imbalan mereka dan potensial keamanan taruhan mereka.

Token dan Tata Kelola

Berachain memperkenalkan ekosistem token yang canggih yang mendukung mekanisme Proof of Liquidity yang baru dan fungsi jaringan yang lebih luas. Ekosistem ini mencakup tiga token utama: BERA, BGT, dan Honey Stablecoin. Setiap token memainkan peran unik dalam tata kelola, stabilitas jaringan, dan insentif ekonomi.

Token BERA

BERA berfungsi sebagai token jaringan utama untuk Berachain, mirip dengan "gas" di Ethereum, digunakan untuk memfasilitasi transaksi di blockchain. Utilitas ini membuat BERA penting untuk melakukan operasi dalam jaringan Berachain, termasuk biaya transaksi dan dengan demikian memastikan aktivitas jaringan.

Token BGT

BGT (Bera Governance Token) unik dalam peran dan akuisisinya. Berbeda dengan token Proof of Stake tradisional, BGT khususnya merupakan token tata kelola yang digunakan dalam model Proof of Liquidity Berachain. Ini mengamankan jaringan melalui keterlibatan dalam penyediaan likuiditas daripada sekadar penempatan token. BGT tidak dapat ditransfer dan diperoleh dengan terlibat dalam ekosistem, terutama dengan mendepositokan likuiditas dalam BEX asli atau berpartisipasi dalam dApps yang diotorisasi lainnya.

BGT sangat penting untuk berpartisipasi dalam tata kelola, karena memungkinkan pemegangnya untuk memberikan suara pada proposal, termasuk yang menentukan distribusi emisi BGT di seluruh kolam LP. Selain itu, dapat dipercayakan kepada validator untuk mendapatkan berbagai reward jaringan. Menariknya, BGT dapat dibakar dalam perbandingan 1:1 untuk mendapatkan BERA, menekankan peran integralnya dalam menyeimbangkan tata kelola dan aktivitas ekonomi di dalam Berachain.

Mengelola BGT di Berachain

Mengelola Token Governance Bera (BGT) di Berachain melibatkan beberapa fungsi kritis yang memastikan penggunaan token yang efektif dalam tata kelola, insentif, dan keamanan jaringan. Berikut adalah aspek-aspek terperinci dalam mengelola BGT:

Emisi BGT

Emisi BGT adalah bagian mendasar dari struktur insentif dalam Berachain. Mereka dirancang untuk memberi penghargaan kepada pengguna yang berpartisipasi dalam ekosistem, terutama melalui penyediaan likuiditas dan aktivitas DeFi lainnya. Emisi didistribusikan ke berbagai kolam likuiditas dan aktivitas berdasarkan keputusan tata kelola. Ini termasuk memutuskan kolam likuiditas mana di Berachain Exchange (BEX) yang harus menerima BGT, sehingga mengarahkan sumber daya jaringan ke area yang meningkatkan likuiditas dan aktivitas secara keseluruhan.

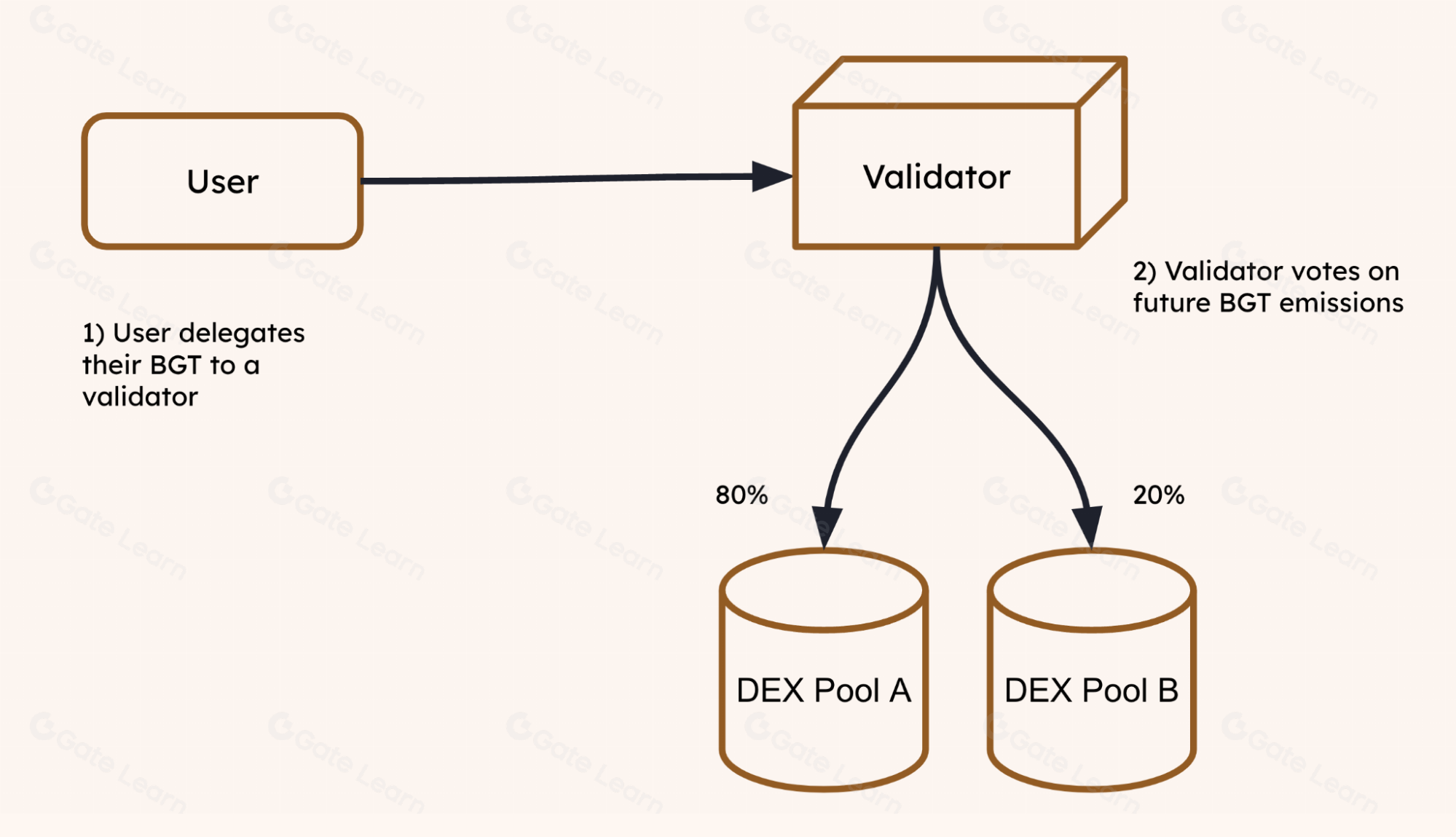

Delegasi BGT

Delegasi adalah mekanisme di mana pemegang BGT dapat mendukung validator dengan mendelegasikan token tata kelola mereka. Ini tidak hanya membantu mengamankan jaringan tetapi juga menyelaraskan kepentingan pemegang token dengan mereka yang memastikan integritas jaringan. Dengan mendelegasikan BGT ke validator, pemegang token dapat berpartisipasi secara tidak langsung dalam proses tata kelola, karena validator sering memiliki tanggung jawab untuk memberikan suara pada keputusan jaringan utama atas nama delegator mereka.

BGT Suap

Suap BGT adalah mekanisme baru dalam ekosistem Berachain yang digunakan untuk memengaruhi pengambilan keputusan, terutama untuk proposal yang memengaruhi distribusi emisi jaringan dan keputusan governance penting lainnya. Pemegang token dapat menggunakan BGT untuk “membujuk” atau memberikan insentif kepada pengguna lain untuk memberikan suara pada proposal tertentu. Strategi ini bertujuan untuk membentuk hasil governance dengan cara yang berpotensi menguntungkan kelompok-kelompok yang lebih besar dalam jaringan atau mendukung inisiatif strategis tertentu.

Stasiun BGT

Stasiun BGT berfungsi sebagai pusat utama untuk semua aktivitas terkait manajemen BGT. Ini adalah bagian integral dari infrastruktur Berachain di mana pengguna dapat terlibat dalam delegasi, mengelola kepemilikan mereka, dan berpartisipasi dalam tindakan tata kelola. Di Stasiun BGT, pengguna dapat mendeleGate.com BGT mereka ke validator dan melakukan redeleGate.com token mereka ke validator yang berbeda, mengoptimalkan pengaruh dan imbalan tata kelola mereka. Selain itu, mereka dapat berpartisipasi dalam pemungutan suara tata kelola, secara langsung memengaruhi bagaimana jaringan berkembang dan beroperasi.

Stablecoin Madu

Honey ($HONEY) adalah jawaban Berachain terhadap volatilitas yang umumnya terkait dengan cryptocurrency. Tertaut dengan nilai kira-kira 1 USDC, Honey menyediakan medium pertukaran yang stabil, penting untuk transaksi dan aktivitas keuangan di platform.

Di testnet, mendapatkan Honey melibatkan mendapatkan testnet BERA dari keran dan menukarnya dengan Honey di Berachain BEX, memperlihatkan integrasinya dengan ekosistem keuangan Berachain yang lebih luas.