2025 GAIPrice Prediction: Analyzing Market Trends and Future Valuation of GAI in the Evolving Digital Economy

Introduction: GAI's Market Position and Investment Value

GraphAI (GAI), as a pioneering project building the AI-native data layer for Web3, has made significant strides since its inception. As of 2025, GAI's market capitalization has reached $18,130,000, with a circulating supply of approximately 70,000,000 tokens, and a price hovering around $0.259. This asset, often referred to as the "blockchain-AI bridge," is playing an increasingly crucial role in transforming raw blockchain events into structured, queryable knowledge graphs.

This article will provide a comprehensive analysis of GAI's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. GAI Price History Review and Current Market Status

GAI Historical Price Evolution

- 2025: Initial launch, price fluctuated between $0.2 and $0.5078

GAI Current Market Situation

As of October 6, 2025, GAI is trading at $0.259, with a 24-hour trading volume of $129,444.58. The token has experienced a 7.96% increase in the last 24 hours. GAI's current market cap stands at $18,130,000, ranking it at 1151 in the overall cryptocurrency market.

The token's all-time high of $0.5078 and all-time low of $0.2 were both recorded on September 16, 2025, indicating a relatively short trading history. GAI has shown mixed performance across different timeframes, with a 0.47% increase in the past hour, a 7.96% gain in the last 24 hours, but a 0.65% decrease over the past week and a more significant 15.15% drop in the last 30 days.

The circulating supply of GAI is 70,000,000 tokens, which represents 70% of the total supply of 100,000,000 tokens. The fully diluted market cap is currently $25,900,000.

Click to view the current GAI market price

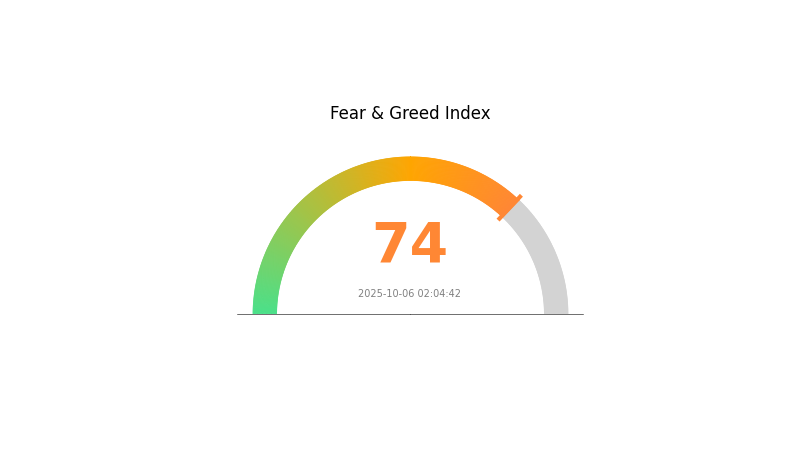

GAI Market Sentiment Indicator

2025-10-06 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The crypto market is buzzing with excitement as the Fear and Greed Index hits 74, signaling strong greed. This bullish sentiment often indicates a surge in buying pressure and potentially overvalued assets. While opportunities abound, investors should exercise caution and avoid FOMO-driven decisions. Remember, markets can be unpredictable, and what goes up must eventually come down. Consider diversifying your portfolio and setting clear profit-taking targets. Stay informed, manage risks wisely, and always do your own research before making investment choices in this volatile market.

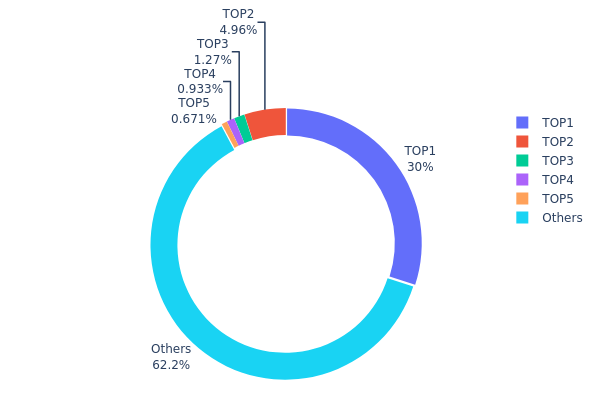

GAI Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of GAI tokens across different addresses. Notably, the top address holds a significant 29.99% of the total supply, indicating a high level of concentration. The second-largest holder possesses 4.95%, while the remaining top 5 addresses hold between 0.67% and 1.26% each. Collectively, the top 5 addresses control 37.8% of the total GAI supply, with the remaining 62.2% distributed among other addresses.

This distribution pattern suggests a moderate level of centralization, particularly due to the dominant position of the top address. Such concentration could potentially impact market dynamics, including price volatility and liquidity. The presence of a single entity holding nearly 30% of the supply may raise concerns about market manipulation risks. However, the fact that over 60% of tokens are held by smaller addresses indicates a degree of decentralization among the broader user base.

From a market structure perspective, this distribution reflects a balance between centralized control and wider participation. While the top holders have significant influence, the substantial portion held by smaller addresses suggests an active and diverse ecosystem. This structure may contribute to market stability but also warrants vigilance regarding potential large-scale token movements from major holders.

Click to view the current GAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb5d7...e0fe3b | 29990.57K | 29.99% |

| 2 | 0xf3d4...d58355 | 4957.42K | 4.95% |

| 3 | 0x36cc...75414f | 1269.00K | 1.26% |

| 4 | 0x4e3a...a31b60 | 933.31K | 0.93% |

| 5 | 0xb4b0...cb8812 | 671.43K | 0.67% |

| - | Others | 62178.28K | 62.2% |

II. Key Factors Affecting GAI's Future Price

Supply Mechanism

- Central Bank Gold Purchases: Central banks continue to increase gold reserves, directly boosting physical demand and sending positive signals to the market.

- Historical Pattern: Past increases in central bank gold holdings have generally supported gold prices.

- Current Impact: The ongoing trend of central bank gold accumulation is expected to provide sustained support for gold prices.

Institutional and Whale Dynamics

- Institutional Holdings: Gold ETF holdings have been rising, with the world's largest gold ETF reaching a 3-year high, reflecting increased inflows from European and American funds.

- National Policies: Various countries are implementing protectionist trade policies, particularly the U.S., which is affecting global trade dynamics and economic stability.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve is expected to cut interest rates, potentially starting in September 2025, which could weaken the U.S. dollar and support gold prices.

- Inflation Hedging Properties: Gold is viewed as a hedge against potential stagflation risks, with sticky inflation and slowing economic growth anticipated.

- Geopolitical Factors: Ongoing geopolitical tensions, including trade conflicts and regional disputes, are increasing gold's appeal as a safe-haven asset.

Technical Development and Ecosystem Building

- De-dollarization Trend: The global trend towards reducing reliance on the U.S. dollar is enhancing gold's role as a non-credit-based safe-haven asset and store of value.

III. GAI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.13621 - $0.20

- Neutral prediction: $0.20 - $0.30

- Optimistic prediction: $0.30 - $0.36751 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.27728 - $0.52459

- 2028: $0.27428 - $0.643

- Key catalysts: Technological advancements, wider industry integration, and favorable regulatory environment

2029-2030 Long-term Outlook

- Base scenario: $0.54632 - $0.60642 (assuming steady market growth and continued project development)

- Optimistic scenario: $0.60642 - $0.66651 (assuming accelerated adoption and positive market conditions)

- Transformative scenario: $0.66651 - $0.70 (assuming breakthrough innovations and mainstream acceptance)

- 2030-12-31: GAI $0.63674 (potential peak before year-end consolidation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.36751 | 0.257 | 0.13621 | 0 |

| 2026 | 0.43716 | 0.31226 | 0.18111 | 20 |

| 2027 | 0.52459 | 0.37471 | 0.27728 | 44 |

| 2028 | 0.643 | 0.44965 | 0.27428 | 73 |

| 2029 | 0.66651 | 0.54632 | 0.51901 | 110 |

| 2030 | 0.63674 | 0.60642 | 0.33959 | 134 |

IV. Professional Investment Strategies and Risk Management for GAI

GAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term believers in AI and blockchain integration

- Operation suggestions:

- Accumulate GAI tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Watch for breakouts above key resistance levels

- Use stop-loss orders to manage downside risk

GAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance GAI with other crypto assets

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Non-custodial wallet recommendation: Gate Web3 Wallet

- Hardware wallet option: Cold storage for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for GAI

GAI Market Risks

- Volatility: Crypto market fluctuations may impact GAI price

- Competition: Other AI-blockchain projects may emerge

- Adoption: Slow integration of AI in blockchain could affect demand

GAI Regulatory Risks

- Regulatory uncertainty: Evolving crypto regulations may impact GAI

- Cross-border restrictions: International regulations may limit usage

- AI governance: Future AI regulations could affect GraphAI's operations

GAI Technical Risks

- Smart contract vulnerabilities: Potential security issues in GAI token

- Scalability challenges: GraphEngine may face scaling difficulties

- AI integration complexity: Unforeseen issues in blockchain-AI fusion

VI. Conclusion and Action Recommendations

GAI Investment Value Assessment

GAI presents a unique value proposition in the intersection of AI and blockchain. Long-term potential is significant, but short-term volatility and adoption risks remain.

GAI Investment Recommendations

✅ Beginners: Consider small, long-term position with dollar-cost averaging

✅ Experienced investors: Implement balanced approach with active management

✅ Institutional investors: Explore strategic partnerships and larger positions

GAI Trading Participation Methods

- Spot trading: Buy and hold GAI tokens on Gate.com

- Staking: Participate in GAI staking programs when available

- DeFi integration: Utilize GAI in decentralized finance applications

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

Is Flock.io (FLOCK) a Good Investment? Analyzing the Potential and Risks of This Emerging Crypto Project

Is Sahara AI (SAHARA) a good investment?: Analyzing the potential and risks of this emerging AI cryptocurrency

Is Trusta.AI (TA) a Good Investment?: Analyzing Market Potential and Long-Term Growth Prospects for the AI Security Token

2025 VADERPrice Prediction: Analyzing Market Trends and Potential Growth Factors in the Cryptocurrency Landscape

2025 MASA Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 AI16Z Price Prediction: Navigating the Future of AI-Driven Cryptocurrencies in a Volatile Market

What Is BeatSwap and How It Turns Music Rights Into Tradable Blockchain Assets

LI.FI Raises $29M: What This Means for Cross-Chain Liquidity and Blockchain Interoperability

CFTC No-Action Letters Explained: What Relief for Polymarket, Gemini, PredictIt & LedgerX Means for Crypto Markets

Why Congress Is Pressuring the SEC to Allow Bitcoin in 401(k) Retirement Plans

Fed Divisions Deepen After Rate Cut, Silent Dissents Reveal Policy Fractures