2025 CWEB Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: CWEB's Market Position and Investment Value

Coinweb (CWEB) is a second-layer cross-chain computing platform designed to provide real interoperability for real-world blockchain applications. Since its inception in 2017, the project has emerged from stealth mode to establish itself as a unique player in the blockchain ecosystem through its innovative InChain architecture. As of December 2025, CWEB maintains a market capitalization of approximately $16.89 million with a circulating supply of 6.44 billion tokens, trading at around $0.002222 per token. This interoperability-focused asset is playing an increasingly critical role in bridging blockchain networks and enabling decentralized applications (dApps) to solve fundamental blockchain challenges.

This article will comprehensively analyze CWEB's price trends and market dynamics, combining historical performance data, market supply-demand mechanics, ecosystem development, and macroeconomic factors to provide investors with professional price analysis and actionable investment strategies for the coming years.

Coinweb (CWEB) Market Analysis Report

I. CWEB Price History Review and Current Market Status

CWEB Historical Price Movement Trajectory

- 2021: Project launch and initial growth phase, reaching an all-time high of $0.661693 on December 30, 2021.

- 2022-2025: Extended bear market period, with significant price depreciation from peak levels.

- December 2025: Price reached an all-time low of $0.0022147 on December 11, 2025, reflecting a cumulative decline of approximately 99.67% from the historical peak.

CWEB Current Market Status

As of December 21, 2025, CWEB is trading at $0.002222, representing a 24-hour decline of 3.05% and a 7-day decline of 6.78%. The token's market capitalization stands at $16.89 million, with a circulating supply of 6.44 billion tokens out of a total supply of 7.61 billion tokens (83.86% circulating). The 24-hour trading volume is $14,455.56, indicating relatively limited liquidity. The token maintains a market dominance of 0.00052%, reflecting its minor position within the broader cryptocurrency market. Current market sentiment reflects extreme fear conditions (VIX: 20).

View current CWEB market price on Gate.com

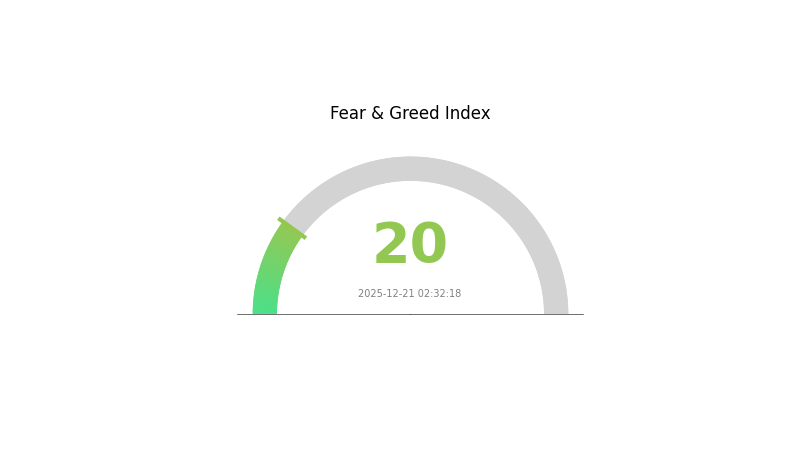

CWEB Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicator reflects significant market anxiety and bearish sentiment among investors. During periods of extreme fear, markets often present contrarian opportunities for long-term investors. However, caution remains essential as price volatility may continue. Monitor key support levels and market developments closely. Consider dollar-cost averaging strategies rather than making large lump-sum investments during such high-fear environments. Stay informed through reliable market analysis on Gate.com.

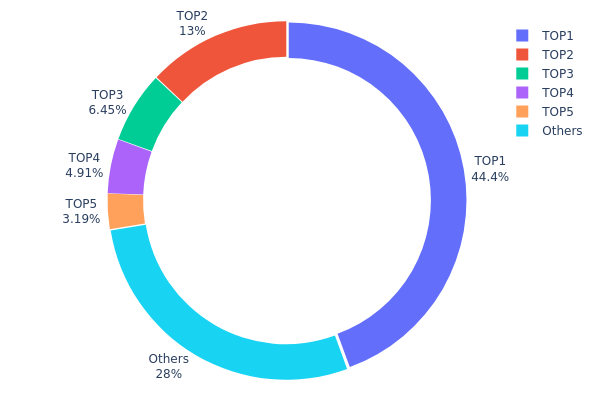

CWEB Holdings Distribution

Address holdings distribution refers to the allocation of CWEB tokens across different wallet addresses on the blockchain, serving as a key metric to assess token concentration risk and market decentralization. By analyzing the top holders and their proportional stakes, we can evaluate the governance structure, market stability, and vulnerability to potential manipulation within the CWEB ecosystem.

The current holdings data reveals a moderate concentration pattern in CWEB's distribution. The top address holds 44.42% of total supply, representing a significant single-entity stake that warrants attention. However, the top five addresses collectively control approximately 71.96% of circulating tokens, while the remaining 28.04% is distributed among other participants. This structure indicates notable centralization in the upper tiers, though the presence of distributed holdings among "Others" suggests some degree of decentralization at the broader level. The second-largest holder maintains 13.01%, followed by progressively smaller stakes, creating a tiered concentration model rather than extreme dominance by a single entity.

From a market structure perspective, this distribution pattern presents both risks and stabilizing factors. The substantial holdings by top addresses could theoretically influence price movements and market direction, though such influence would depend on the intent and trading patterns of these holders. However, the existence of multiple large stakeholders rather than a single dominant address reduces the risk of unilateral market manipulation. The 28% distribution among other addresses provides a natural check on concentration, suggesting ongoing community participation and engagement. Overall, CWEB exhibits a concentration level typical of projects in mid-stage development, where decentralization has progressed beyond purely centralized ownership but remains below the ideal distribution benchmarks of mature, fully decentralized networks.

Click to view current CWEB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x13fe...b12b1b | 3376243.43K | 44.42% |

| 2 | 0xd6fb...2f3ed7 | 989539.51K | 13.01% |

| 3 | 0x1660...4cfe36 | 490000.00K | 6.44% |

| 4 | 0x914b...01a6d8 | 373007.39K | 4.90% |

| 5 | 0x4209...4be2a1 | 242788.13K | 3.19% |

| - | Others | 2129055.56K | 28.04% |

II. Core Factors Affecting CWEB's Future Price

Macroeconomic Environment

-

China Policy Support: China's continuous policy support for green economy development is driving increased demand for raw materials related to green transition. As global manufacturing enters a recovery cycle, commodity metals are expected to enter an upward price cycle, which benefits companies in the Chinese internet and technology sectors represented in CWEB.

-

Geopolitical Factors: Macroeconomic drivers including geopolitical changes and shifts in capital costs will continue to reshape global investment opportunities and risks in 2026, potentially affecting international asset allocation and emerging market exposure like CWEB.

-

Market Sentiment: Recent market performance shows strong recovery in Chinese assets. The 2x leveraged China Internet Stock ETF (CWEB) experienced gains exceeding 5%, reflecting renewed investor confidence in Chinese technology and internet companies driven by supportive policy environment and economic recovery expectations.

Three, 2025-2030 CWEB Price Forecast

2025 Outlook

- Conservative Prediction: $0.00143 - $0.00223

- Neutral Prediction: $0.00223

- Bullish Prediction: $0.00325 (requires sustained market momentum and increased adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with steady fundamental development

- Price Range Prediction:

- 2026: $0.00162 - $0.00394 (23% upside potential)

- 2027: $0.00234 - $0.00421 (50% cumulative growth)

- 2028: $0.00223 - $0.00457 (69% cumulative growth)

- Key Catalysts: Enhanced tokenomics implementation, ecosystem expansion, institutional interest accumulation, and improved market liquidity on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00355 - $0.00547 by 2029 (87% growth from 2025 levels, assuming steady ecosystem development and moderate market conditions)

- Bullish Scenario: $0.00405 - $0.00636 by 2030 (116% growth, assuming accelerated adoption and positive macroeconomic conditions)

- Transformative Scenario: Potential for significant outperformance ($0.00636+) under conditions of breakthrough technological innovations, major partnership announcements, and broad-based cryptocurrency market expansion

- 2030-12-21: CWEB trading near $0.00482 average valuation (representing substantial long-term appreciation potential from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00325 | 0.00223 | 0.00143 | 0 |

| 2026 | 0.00394 | 0.00274 | 0.00162 | 23 |

| 2027 | 0.00421 | 0.00334 | 0.00234 | 50 |

| 2028 | 0.00457 | 0.00378 | 0.00223 | 69 |

| 2029 | 0.00547 | 0.00417 | 0.00355 | 87 |

| 2030 | 0.00636 | 0.00482 | 0.00405 | 116 |

Coinweb (CWEB) Professional Investment Strategy and Risk Management Report

IV. CWEB Professional Investment Strategy and Risk Management

CWEB Investment Methodology

(1) Long-term Holding Strategy

- Suitable For: Investors with high risk tolerance who believe in Coinweb's cross-chain interoperability vision and are willing to hold through market volatility

- Operational Recommendations:

- Accumulate CWEB during market downturns, particularly when prices approach the all-time low of $0.0022147

- Set quarterly portfolio reviews to assess Coinweb's progress on InChain architecture development and enterprise partnerships

- Dollar-cost averaging (DCA) approach to mitigate timing risk across multiple purchase intervals

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price points at $0.002222 (current price) and historical resistance at $0.003 and $0.005 levels

- Moving Averages: Track 20-day and 50-day moving averages to identify trend direction and potential reversal points

- Wave Trading Key Points:

- Capitalize on the 24-hour volatility range between $0.00220 and $0.002296 for short-term trading opportunities

- Watch for volume spikes on Gate.com, as current 24-hour volume of $14,455.56 may indicate institutional interest or market sentiment shifts

CWEB Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio

- Aggressive Investors: 3-5% of total crypto portfolio

- Professional Investors: 2-4% of total crypto portfolio with active rebalancing

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance CWEB holdings with established cryptocurrencies to reduce single-asset concentration risk

- Stop-Loss Orders: Implement stop-loss orders at 15-20% below entry price to limit downside exposure during adverse market movements

(3) Secure Storage Solutions

- Web3 Wallet: Gate.com's Web3 wallet solution offers integrated security for holding CWEB tokens with multi-signature protection

- Cold Storage: Transfer larger holdings to offline storage for enhanced security against exchange vulnerabilities

- Security Considerations: Enable two-factor authentication, maintain secure backup of recovery phrases, and never share private keys; be aware of smart contract risks associated with any staking or yield farming opportunities

V. CWEB Potential Risks and Challenges

CWEB Market Risk

- High Volatility: CWEB has experienced a -54.92% decline over the past year, indicating significant price swings that can result in substantial losses for investors

- Liquidity Risk: With an exchange listing count of only 1 and relatively low 24-hour trading volume of $14,455.56, CWEB faces liquidity constraints that may hinder rapid position entry or exit

- Market Capitalization Concentration: At a market cap of $16.89 million, CWEB remains a micro-cap asset highly susceptible to market sentiment shifts and speculative trading

CWEB Regulatory Risk

- Regulatory Uncertainty: Cross-chain protocols and interoperability solutions face evolving regulatory scrutiny globally, potentially affecting Coinweb's operational status

- Compliance Requirements: Jurisdictional changes in cryptocurrency regulation could impact token distribution, trading availability, and institutional adoption

- Enterprise Partnership Restrictions: Regulatory changes may influence Coinweb's ability to execute partnerships with traditional enterprises

CWEB Technology Risk

- InChain Architecture Adoption: The success of Coinweb depends on widespread adoption of its InChain architecture; limited real-world implementation could undermine the project's value proposition

- Cross-Chain Interoperability Challenges: Technical vulnerabilities in cross-chain mechanisms could pose security risks to users and damage investor confidence

- Development Execution Risk: Despite being under construction since 2017 and recently emerging from stealth mode, any delays in feature rollout or technical issues could negatively impact market sentiment

VI. Conclusion and Action Recommendations

CWEB Investment Value Assessment

Coinweb presents a high-risk, speculative investment opportunity centered on the promise of cross-chain interoperability through its InChain architecture. With a current market cap of $16.89 million and 83.86% of maximum supply in circulation, CWEB operates at the intersection of innovation and uncertainty. The project's long development timeline and recent emergence from stealth mode suggest early-stage positioning. However, the significant 54.92% year-over-year decline and current price proximity to all-time lows reflect market skepticism regarding commercial viability and enterprise adoption prospects. Investment in CWEB should be viewed as exposure to emerging cross-chain technology rather than a stable store of value.

CWEB Investment Recommendations

✅ Beginners: Limit exposure to 0.5-1% of crypto portfolio; focus on understanding InChain architecture fundamentals before committing capital; use Gate.com's educational resources to learn about cross-chain technology risks

✅ Experienced Investors: Consider 2-3% allocation with active monitoring of enterprise partnership announcements and technical development milestones; employ technical analysis tools on Gate.com to time entries during oversold conditions

✅ Institutional Investors: Conduct comprehensive due diligence on Coinweb's development team and technical roadmap; engage with project leadership regarding commercialization timelines; consider participation primarily through liquid trading positions rather than illiquid holdings

CWEB Trading Participation Methods

- Spot Trading on Gate.com: Purchase CWEB directly using USDT or other stablecoins available on the platform; ideal for long-term accumulators

- Dollar-Cost Averaging: Execute recurring purchases of fixed CWEB amounts at regular intervals through Gate.com to smooth entry price and reduce timing risk

- Market Limit Orders: Set buy orders at support levels to automatically accumulate CWEB when price declines to predetermined targets, minimizing emotional decision-making

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Cweb a good long-term investment?

CWEB shows limited long-term growth potential, with projections suggesting minimal price appreciation through 2028. Current valuations already reflect expected levels, making it a modest investment opportunity requiring careful consideration of market dynamics.

How volatile is Cweb stock?

CWEB exhibits a volatility of 61.36%, indicating moderate to high price fluctuations. This level of volatility reflects its sensitivity to market movements and trader sentiment changes.

What is the price prediction for CWEB in the next 12 months?

CWEB is forecasted to trade between $0.001636 and $0.002342 over the next 12 months, based on current market trends and technical analysis.

What factors influence CWEB price movements?

CWEB price movements are influenced by market sentiment, trading volume, technological developments, and user adoption rates. Network upgrades and broader crypto market trends also impact pricing significantly.

How does CWEB compare to other similar cryptocurrencies in terms of growth potential?

CWEB offers distinct growth potential through its specialized use case and emerging ecosystem. Compared to general-purpose cryptocurrencies, CWEB targets specific market segments with focused utility. Its growth trajectory depends on adoption rates and strategic partnerships, positioning it competitively within its niche category.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

2025 XEM Price Prediction: Expert Analysis and Market Outlook for NEM's Native Token

2025 PSG Price Prediction: Expert Analysis and Market Outlook for Paris Saint-Germain's Stock Performance

Buying ALON Tokens: A Beginner's Guide

Is Sweat Economy (SWEAT) a good investment?: A Comprehensive Analysis of Tokenomics, Market Potential, and Risk Factors

Is NuriTopia (NBLU) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Potential, and Risk Factors for 2024