Helix Labs 是一家致力於挖掘跨鏈質押資產最大價值的去中心化金融創新實驗室。其核心產品 EigenFi 提供安全的多鏈流動性金庫,支持發行“流動再質押代幣”(LRT),讓用戶不僅能持續獲得原鏈的質押收益,還能參與各種 DeFi 活動。借助 ICP 的 Chain Key 等前沿技術,Helix Labs 實現了無需信任的跨鏈交互,解決了流動性碎片化的問題,構建了一個統一、高效、資本利用率極高的跨鏈質押和去中心化金融基礎設施。

關於 Helix Labs

Helix Labs 是一家專注於挖掘多鏈質押資產經濟價值的去中心化金融創新實驗室。其核心產品 EigenFi 提供安全可靠的多鏈流動性金庫,讓用戶能通過再質押原生資產來參與以太坊上的主動驗證服務(AVS),從而最大化收益。EigenFi 支持順暢地發行“流動再質押代幣”(LRT),讓用戶在持續獲得原鏈質押激勵的同時,還能自由參與各種 DeFi 活動。Helix Labs 借助如 ICP Chain Key 等尖端技術,實現無需信任的跨鏈交互,爲未來 DeFi 構建了統一、高效且去中心化的流動性層。

盡管各大 L1 鏈通過質押機制保障了數十億美元的網路安全和共識,但當前質押生態面臨資金利用率低和流動性割裂的問題,嚴重削弱了質押資產的經濟效益。持幣者不得不在網路安全和資產流動性之間做出選擇:質押資產被鎖定在原鏈中,無法同時參與額外收益或 DeFi 應用。現有的流動質押方案雖然嘗試解決這一困境,但它們依賴於打包資產和中心化橋接,跨鏈能力有限,帶來了安全風險和流動性低效。此外,AVS 機制目前主要集中在以太坊,其他 L1 鏈的質押資產無法參與其中,從而導致安全模型的單一性。最終,質押者錯失了收益機會,AVS 缺乏多元化的安全保障,跨鏈資金流動效率也大打折扣。

盡管質押和再質押的應用逐漸增加,但依然存在一些效率瓶頸:多數 L1 質押模式的年化收益率(如 ADA 約 1.78%、ICP/BNB 約 7–12%)低於穩定幣借貸等 DeFi 方案,導致較高的機會成本;各鏈的質押結構差異較大,造成生態割裂,阻礙了鏈間流動性的自由轉移和資本的高效配置。雖然 EigenLayer 在以太坊再質押領域開創了先例,但對其他 L1 質押資產(如 stADA、stICP 等)的支持仍然有限,安全模型的多樣性和韌性亟待加強。

來源:Helix Lab

Helix Labs 背景

Helix Labs 成立於 2023 年,專注於通過再質押機制幫助非以太坊 Layer 1(L1)資產持有者最大化收益潛力。2024 年 9 月,Helix Labs 完成了 200 萬美元的前種子輪融資,公司的估值達到 4,000 萬美元。本輪融資由 Tribe Capital、EMURGO Ventures、Taureon Capital、LD Capital 和 Double Peak Group 聯合領投。此次投資的目標是通過允許 ADA 持有者在質押的同時繼續參與 DeFi,爲 Cardano 生態系統釋放約 120 億美元的流動性。目前,Helix Labs 已推出三款產品:

- Helix Vault:通過“流動再質押”幫助質押資產創造額外收益;

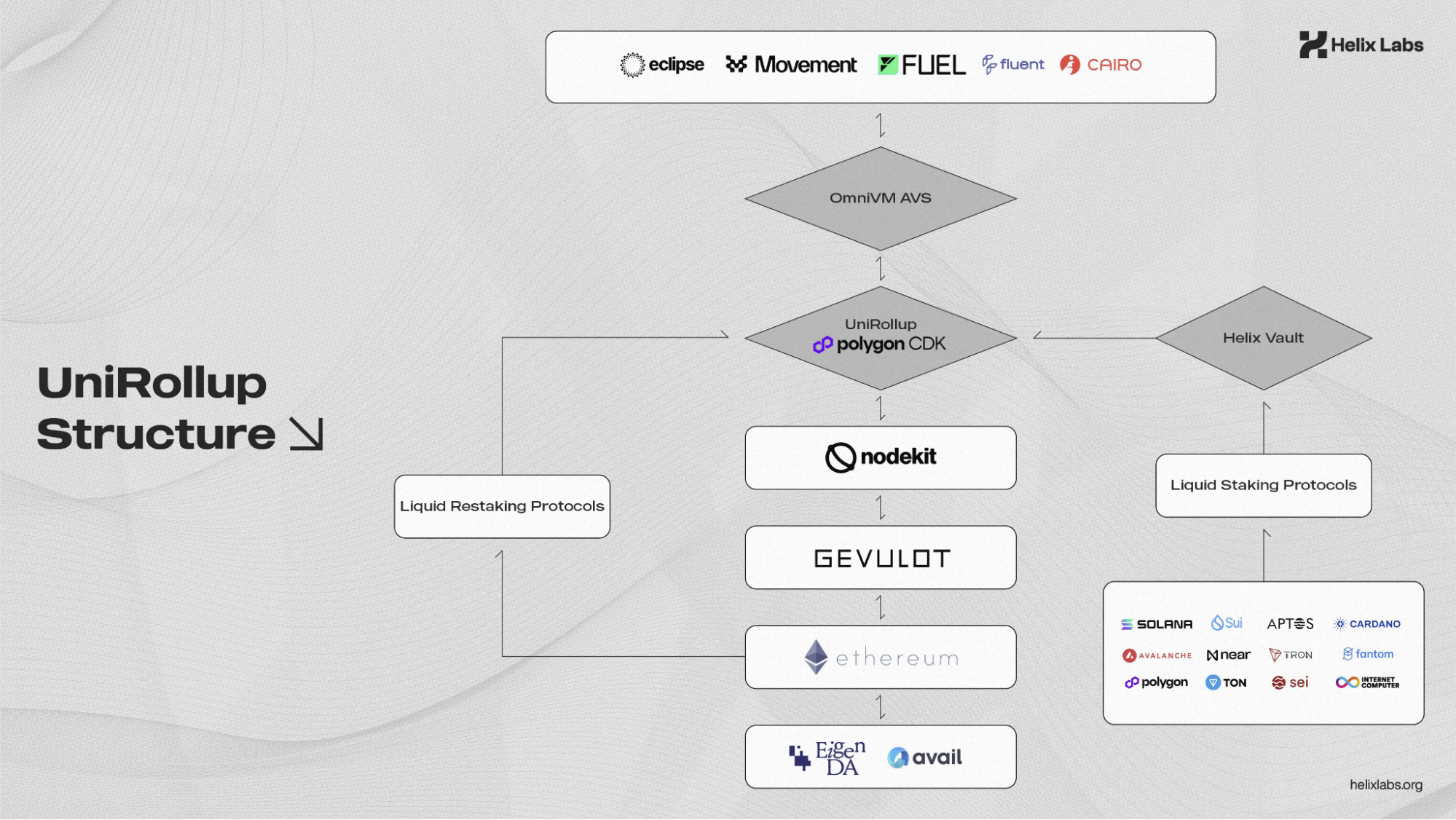

- UniRollup L2:基於 Move 的模塊化 Rollup,支持多種 DeFi 場景,並原生兼容再質押資產;

- OmniVM AVS:爲 L3 網路提供去中心化虛擬機層,用於“主動驗證服務”(AVS)的安全執行。

來源:Helix Lab

Helix EigenFi 協議

Helix 推出的 EigenFi 是一款跨鏈流動性金庫,旨在解決質押與再質押帶來的流動性和效率難題。EigenFi Vault 讓 L1 代幣持有者在保留原生質押收益的同時,通過參與 AVS 獲取額外獎勵。再質押生成的流動再質押代幣(LRT)具有流動性和跨鏈可互操作性,其用戶可在 DeFi 中靈活運用,同時仍然承諾保障網路安全。有了 Chain Fusion 技術,安全跨鏈質押無需中心化橋接或打包資產也能實現。EigenFi 整合了多項創新技術,提升用戶在再質押、DeFi 與 AVS 安全模型中的參與度,爲代幣持有者和網路驗證者創造新的經濟機會。

架構亮點

來源:Helix Lab Docs

作爲一家區塊鏈技術初創公司,Helix Labs 打造了 EigenFi 協議,以提升跨多鏈生態的流動性和收益潛力。Helix Labs 與 Avail 合作,基於其數據可用性技術構建模塊化網路,旨在幫助開發者搭建可擴展、合作夥伴驅動的區塊鏈,提升數據可用性和完整性,從而解決 Web3 領域的可擴展性難題。AvailDA 是Web3 基礎設施層,致力於實現增長和互操作的同事最小化信任,是新一代應用程序的核心層。AvailDA 採用分階段戰略,包括 Unification Layer、Nexus、Fusion Security。其中 Unification Layer 實現各執行層間的絲滑交互,以促進跨鏈組合性。借助 AvailDA,Helix Labs 正在推進新執行環境的“冷啓動”問題解決方案。NodeKit 項目致力於打造共享排序器的 Layer 1 解決方案,專注於提升多種 Rollup 解決方案的的穩健性、性能、可用性和互操作性。

核心產品

Helix Labs 是一種再質押資產流動性協議。它利用流動性抽象與 OmniVM 技術棧,爲非以太坊 Layer 1 資產持有者提升收益潛力,並爲未來的 MoveVM Rollup 提供支持。Helix Labs 通過拓展代幣用途、增強 EigenFi 容量以及提供“流動性即服務”,爲 DeFi 注入更多流動性。它正打造一種創新的協議,利用再質押最大化非 ETH L1 資產的收益潛力,同時通過流動性抽象與 OmniVM 技術棧,助力 MoveVM Rollup 生態的發展。Helix 的 EigenFi 協議包含三大核心產品:Helix Vault、Helix Unirollup 和 Helix OmniVM AVS。

Helix 金庫

Helix 金庫是一套多鏈流動質押系統,讓用戶在質押資產的同時,利用“流動質押代幣”(LST)維持流動性。類似於 Lido 對 ETH 的做法,Helix Vault 計劃將交易者在多條鏈上質押的資產代幣化,交易者質押原生代幣(如 ETH、SOL 等,具體取決於鏈上支持)後,不是直接鎖定,而是獲得對應的 LST 代幣,這些代幣能在 DeFi 中使用、交易並幫助賺取質押激勵。此外,Helix 還提供平台原生獎勵及更高 APY,進一步提升用戶收益。

Helix Unirollup

Helix Unirollup 是一個 L2(或 L3)Rollup,支持在模塊化區塊鏈基礎設施中實現橫向與縱向的流動性遷移,即在生態內上下堆棧和橫向轉移流動性。同時,Helix Unirollup 既能橫向也能縱向調配流動性。用戶還可借助模塊化區塊鏈架構,將執行層、數據可用性層和共識層(如 Celestia、Avail)解耦使用。它打通了各自爲政的區塊鏈與 Rollup,讓協議能夠隨時隨地調用流動性,而不會影響用戶體驗。

Helix OmniVM

Helix OmniVM AVS 是基於 EigenLayer 構建的“主動驗證服務”(AVS),爲 L2、L3 生態中的 altVM、並行 EVM 等虛擬機及 Rollup 提供持續的流動性支持。該服務會自動將再質押資產與流動性池資源定向分配至支持的虛擬機和 Rollup。它兼容 MoveVM、Cosmos SDK 鏈、Solana 風格的並行執行環境等多種技術。由於大多數 altVM 或新興 Layer 在流動性引導階段面臨挑戰,OmniVM AVS 提供了即插即用的解決方案,讓這些項目能夠專注於執行邏輯,同時直接接入 EigenFi 的流動性網路。

流動再質押

再質押是指將流動質押代幣(如 stETH)在其他網路或協議中再次質押。如此,用戶不僅能在原生質押收益之外獲取額外獎勵,還能進一步提升所參與網路的安全性。再質押通過將信任擴展到新協議,提高了靈活性、流動性和資本效率,讓用戶在保持對資產控制的同時,最大化收益並積極參與新興區塊鏈生態。

流動再質押平台(LSP) 是幫助用戶完成以上操作的協議。用戶將資產交由平台質押後,LSP 會在再質押協議中存入用戶資金,並返還給用戶一種代表性代幣——流動再質押代幣(LRT)。LSP 負責技術實現,包括部署節點軟件、選擇支持的網路服務等;而 LRT 則讓用戶能夠輕鬆進出再質押倉位,還能將 LRT 投入其他 DeFi 協議,放大槓杆。簡而言之,流動再質押正是借鑑了如 Lido 這樣的傳統流動質押平台的模式。

流動質押與再質押代幣

流動質押是指用戶將加密資產質押後會獲得等值的流動質押代幣(LST);而流動再質押是指通過 EigenLayer 等中間協議對再質押資產(已質押的 LST)進行代幣化的產物。市場上較爲常見的 LRT 包括:

- Swell 的 SWETH(以太坊)

- Renzo 的 EZETH(以太坊)

- Ether.fi 的 WeETH(以太坊)

- Puffer Finance 的 pufETH(以太坊)

LST 可以像其他加密貨幣一樣自由買賣,爲交易者提供傳統質押所不具備的流動性。流動質押代幣代表了已質押的資產,讓用戶既能持續享受質押激勵、爲網路安全貢獻力量,又能隨時使用或交易。在流動性與收益同等重要的快速變化市場中,這種“雙重優勢”尤爲關鍵。“流動再質押”則在流動質押基礎上更進一步,允許用戶將所持資產(或質押衍生品)在不同協議中反復質押,以獲取更高回報。換言之,用戶可將最初質押獲得的 LST 再次質押,從而賺取額外的獎勵或收益。

傳統質押要求交易者將資產鎖定在鏈上,在預定時間內無法動用。流動質押則通過發行代表質押資產的代幣,爲交易者提供了流動性,這些代幣可自由買賣或用於其他用途。例如,交易者質押 ETH 可獲得質押 ETH(stETH),隨後便可將 stETH 在市場上交易或投入其他 DeFi 協議中使用。質押不僅能賺取獎勵,還能讓用戶在自由交易與使用質押資產之間靈活切換;而再質押則在此基礎上實現收益複利。再質押讓用戶將 LST 重新質押以獲取額外回報,流動質押讓用戶在保持流動性的同時獲得質押收益。這兩種模式各有側重,用戶可根據自身需求選擇不同方式來獲取收益。流動質押讓交易者在享受質押獎勵的同時,還能參與其他創收活動。這種雙重收益顯著提升了用戶的總體回報。然而,用戶可將手中的 LST 投入流動性池、借貸平台或其他 DeFi 協議,進一步增值。再質押則能讓交易者在初始質押收益的基礎上,獲得額外的獎勵,發揮複利效應。

EigenLayer 生態

什麼是 EigenLayer?

EigenLayer 首創了“再質押”這一加密經濟安全新範式。它利用以太坊現有的質押者和節點運營商,通過協作化的創新方式實現再質押。EigenLayer 促進了發明者、以太坊質押者和節點運營商之間的高效協作,即便是彼此互不信任的合作夥伴,也可高效協作。EigenLayer 讓以太坊的“去中心化信任”模塊得以真正落地。該模塊不再要求各協議自行組建驗證者集羣,從而激發了更開放的創新,讓開發者能直接無縫調用以太坊的算力和資金池資源。EigenLayer 的運營商則運行 AVS 軟件,擔任 AVS 節點,負責驗證各種 AVS 服務,進一步提升了網路的安全性和正確性。

生態系統

EigenLayer 生態由四大支柱組成:

- 主動驗證服務(AVS):AVS 是利用以太坊安全性的去中心化服務,支持側鏈、數據層等各種網路。EigenLayer 利用以太坊的共享資源,爲中間件服務、區塊構建和交易排序提供安全保障。

- ETH 質押者:以太坊質押者非常重要,他們通過質押 $ETH 爲 EigenLayer 生態內的多個網路提供安全支持。這相當於將現有資產槓杆化用於多協議。雖然這能帶來更高收益,但若未滿足所支持服務的條件,也面臨被罰沒的風險。

- 節點運營商:節點運營商爲去中心化應用(DApp)、預言機和跨鏈橋等關鍵功能提供算力資源。他們可自主選擇參與的 AVS 服務,並按協議推薦執行,從而獲得相應獎勵或遭受懲罰。

- EigenLayer 協議:該協議的核心由一系列以太坊智能合約構成,保障質押者、節點運營商和服務模塊之間的無信任協作。用戶可取回資產、將資產分配給節點運營商,或直接調用鏈上服務模塊。每個服務模塊都設有明確的獎勵與罰沒規則,確保生態系統各方的順暢互動。

EigenFi 金庫

以太坊金庫

要使用以太坊金庫,交易者需要一個支持 Web3 的錢包,如 MetaMask,用於存儲資金並與 EigenFi 去中心化應用(dApp)交互。此外,錢包中必須有足夠的 ETH 用於支付交易費用,如充值、提現,以及與智能合約交互等產生的交易費用。由於 Gas 費會根據網路活動波動,建議保持一些額外的本地代幣以備不時之需。

如何使用 EigenFi 金庫

- 啓動 EigenFi dApp:訪問 EigenFi 以太坊金庫網站,啓動去中心化應用(dApp)。雖然交易者無需連接錢包即可使用部分功能,但完整訪問需要連接錢包。

連接錢包:要使用 EigenFi 的主要服務(充值、賺取、提現),交易者需要通過連接錢包進行身分驗證。

- 點擊“連接錢包”按鈕

- 選擇錢包提供商(如 MetaMask、Rainbow 等)

- 在錢包中籤名以驗證通信

存入資金:錢包連接後,交易者將可使用以下重要服務:

- 充值

- 賺取

- 提現

探索其他鏈:EigenFi 金庫現在支持以太坊、Movement、BNB Chain、Cardano 和 Bitlayer。以下測試網資金可用於充值:

- stETH

- stBTC

- tADA

- stBNB

Movement 金庫

在使用 Movement 金庫之前,交易者必須確保他們擁有一個支持 Web3 的錢包,如 Petra,用於存儲資金並與 EigenFi 去中心化應用(dApp)交互。錢包中還必須有足夠的 MOVE 代幣用於支付交易費用,如充值、提現和智能合約交互等產生的交易費用。

如何配置 Movement 錢包

Petra 錢包用戶:

- 安裝 Petra 錢包

- 訪問網路

- 添加自定義網路

- 添加以下組合:

- 名稱:Movement Bardock Testnet

- 節點 URL: https://testnet.bardock.movementnetwork.xyz/v1

- 水龍頭 URL: https://faucet.testnet.bardock.movementnetwork.xyz

- 索引 URL: https://indexer.testnet.movementnetwork.xyz

Nightly 錢包用戶:

- 安裝 Nightly 錢包

- 點擊自定義網路

- 添加 Movement 的 Bardock Testnet RPC URL:復制並粘貼此 RPC URL,然後保存。

https://testnet.bardock.movementnetwork.xyz/v1

如何使用 Movement 金庫

- 啓動 Movement 金庫 dApp:交易者需訪問 EigenFi Movement 金庫網站並啓動去中心化應用(dApp)。雖然交易者無需連接錢包即可使用部分功能,但要完全訪問則需要連接錢包。

連接錢包:要使用 EigenFi 的主要服務(充值、賺取、提現),交易者需要通過連接錢包進行身分驗證。

- 點擊“連接錢包”按鈕。

- 選擇錢包提供商(Petra、Nightly 等)。

- 在錢包中籤名以驗證通信。

存入資金:錢包連接後,交易者將能使用以下重要服務:

- 充值

- 賺取

- 提現

探索其他鏈:EigenFi 金庫現在支持以太坊、Movement、BNB Chain、Cardano 和 Bitlayer。以下測試網資金可用於充值:

- stETH

- stBTC

- tADA

- stBNB

Cardano 金庫

要使用 Cardano 金庫,交易者首先需要擁有 Cardano 錢包。這個支持 Web3 的錢包(類似於 Nami)非常重要,將用於存儲資金並與 Cardano dApp 交互。錢包中必須有足夠的 ADA,用於充值、提現,以及與智能合約交互等產生的交易費用。要使用 Cardano 金庫,交易者需訪問官方的 EigenFi Cardano 金庫網站,並使用去中心化程序(dApp)。雖然交易者可在未連接錢包的情況下探索其功能,但完全訪問需要連接錢包。

BNB 鏈金庫

要使用 BNB 鏈金庫,交易者需確保擁有足夠的資金並與 EigenFi dApp 交互,他們需要一個支持 Web3 的錢包,如 MetaMask。錢包中必須有足夠的 BNB,用於支付交易費用,如充值、提現,以及與智能合約交互等產生的交易費用。要使用 BNB 金庫,交易者需要訪問官方的 EigenFi BNB 金庫網站並使用去中心化程序(dApp)。雖然交易者可在未連接錢包的情況下探索其功能,但完全訪問需要連接錢包。

Bitlayer 金庫

要使用 Bitlayer 金庫,交易者必須確保擁有足夠的資金並與 EigenFi dApp 交互,他們需要一個支持 Web3 的錢包,如 MetaMask。錢包中必須有足夠的 ETH,用於支付交易費用,如充值、提現,以及與智能合約交互等產生的交易費用。要使用 Bitlayer 金庫,交易者需訪問官方的 EigenFi Bitlayer 金庫網站並使用去中心化程序(dApp)。雖然交易者可在未連接錢包的情況下探索其功能,但完全訪問需要連接錢包。

結語

Helix Labs 在 EigenLayer 生態中引入了先進的集成方案和堅實的安全保障,開拓了流動質押的新可能。通過發行流動質押代幣(LST),它推動了 DeFi 領域的創新,催生了多樣化的金融產品和服務。LST 讓交易者在保留資產流動性的同時穩定獲取質押收益。Helix 的金庫系統則徹底釋放了質押資產的潛力:它解決了流動性碎片化難題,最大化了質押資金的利用效率,並提升了去中心化網路的安全性,爲跨鏈質押和 DeFi 的可持續發展奠定了堅實基礎。

相關文章

Sui:使用者如何利用其速度、安全性和可擴充性?

Arweave:用AO電腦捕捉市場機會

即將到來的AO代幣:可能是鏈上AI代理的終極解決方案

Solv協定:集中式去中心化金融趨勢下的資產管理新範式

什麼是漿果?您需要瞭解的有關BERRY的所有資訊