# MarketCycles

2.13K

TheAboveOne

The Bear Market Is Not a Loss It’s a Test

When the market turns bearish, most people panic.

They:

• Sell at a loss

• Stop analyzing

• Or disappear until prices recover

But experienced traders see something different.

A bearish market is:

✔ A discount phase

✔ A capital preservation phase

✔ A preparation phase for the next cycle

Prices fall.

Sentiment drops.

Noise disappears.

And that creates opportunity for those who are patient.

This is the time to focus on: • Strong projects with real utility

• Liquidity management

• Building positions slowly

• Learning and improving strategy

Bear markets

When the market turns bearish, most people panic.

They:

• Sell at a loss

• Stop analyzing

• Or disappear until prices recover

But experienced traders see something different.

A bearish market is:

✔ A discount phase

✔ A capital preservation phase

✔ A preparation phase for the next cycle

Prices fall.

Sentiment drops.

Noise disappears.

And that creates opportunity for those who are patient.

This is the time to focus on: • Strong projects with real utility

• Liquidity management

• Building positions slowly

• Learning and improving strategy

Bear markets

BTC-1,97%

- Reward

- like

- Comment

- Repost

- Share

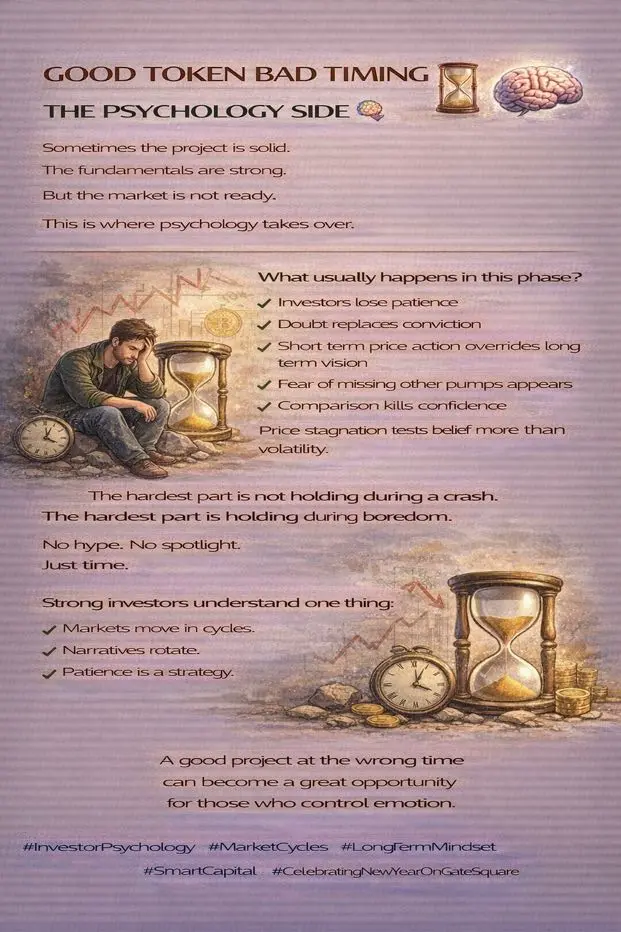

GOOD TOKEN BAD TIMING – THE PSYCHOLOGY SIDE 🧠

Sometimes the project is solid.

The fundamentals are strong.

But the market is not ready.

This is where psychology takes over.

⸻

What usually happens in this phase?

• Investors lose patience

• Doubt replaces conviction

• Short term price action overrides long term vision

• Fear of missing other pumps appears

• Comparison kills confidence

Price stagnation tests belief more than volatility.

⸻

The hardest part is not holding during a crash.

The hardest part is holding during boredom.

No hype.

No spotlight.

Just time.

⸻

Strong investors understand one

Sometimes the project is solid.

The fundamentals are strong.

But the market is not ready.

This is where psychology takes over.

⸻

What usually happens in this phase?

• Investors lose patience

• Doubt replaces conviction

• Short term price action overrides long term vision

• Fear of missing other pumps appears

• Comparison kills confidence

Price stagnation tests belief more than volatility.

⸻

The hardest part is not holding during a crash.

The hardest part is holding during boredom.

No hype.

No spotlight.

Just time.

⸻

Strong investors understand one

- Reward

- 4

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? – The Complete Crypto Dip Guide

Crypto dips spark the same question for every trader: “Is this the dip to buy, or should I wait?” The reality is, timing the market bottom is extremely difficult — even seasoned traders often miss it.

Here’s a structured approach to navigate dips strategically:

1️⃣ Market Cycles & Capital Rotation

BTC leads, absorbing institutional capital and setting market direction.

Large-cap altcoins (ETH, SOL, ADA) follow with amplified moves.

Mid/low-cap altcoins are highly speculative; expect rapid swings.

Current context: BTC $66,120 (24h vol ~$35B,

Crypto dips spark the same question for every trader: “Is this the dip to buy, or should I wait?” The reality is, timing the market bottom is extremely difficult — even seasoned traders often miss it.

Here’s a structured approach to navigate dips strategically:

1️⃣ Market Cycles & Capital Rotation

BTC leads, absorbing institutional capital and setting market direction.

Large-cap altcoins (ETH, SOL, ADA) follow with amplified moves.

Mid/low-cap altcoins are highly speculative; expect rapid swings.

Current context: BTC $66,120 (24h vol ~$35B,

- Reward

- 8

- 6

- Repost

- Share

ybaser :

:

LFG 🔥View More

5. Community / Light Engagement

Headline: Portfolio Check – February 2026 Edition 🤡

Body:

Market volatility is uncomfortable — but not unfamiliar.

Crypto has weathered multiple cycles, and disciplined participants understand that drawdowns are part of the process.

CTA:

Share a GIF that reflects your portfolio mood this week.

#CryptoCommunity #MarketCycles #HODL

$BTC $ETH $SOL

Headline: Portfolio Check – February 2026 Edition 🤡

Body:

Market volatility is uncomfortable — but not unfamiliar.

Crypto has weathered multiple cycles, and disciplined participants understand that drawdowns are part of the process.

CTA:

Share a GIF that reflects your portfolio mood this week.

#CryptoCommunity #MarketCycles #HODL

$BTC $ETH $SOL

- Reward

- like

- Comment

- Repost

- Share

🔥 LIVE NOW with GateLIVE Roundtable 2026 Episode 3! When gold and Bitcoin move together, it’s not a failure of safe havens — it’s a stress test of belief, liquidity, and timing.

In transition cycles, survival beats certainty — and patience becomes the real hedge. 💪🏻

https://www.gate.com/zh/live/video/9c721ed884eb43539d4ce6ff84301ba5?type=live

#Myrtleology #MarketCycles #Bitcoin #Gold #RiskAwareness

In transition cycles, survival beats certainty — and patience becomes the real hedge. 💪🏻

https://www.gate.com/zh/live/video/9c721ed884eb43539d4ce6ff84301ba5?type=live

#Myrtleology #MarketCycles #Bitcoin #Gold #RiskAwareness

BTC-1,97%

- Reward

- 2

- 4

- Repost

- Share

CryptoChampion :

:

Watching Closely 🔍️View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

42.47M Popularity

166.65K Popularity

148.37K Popularity

1.68M Popularity

531.84K Popularity

16.16K Popularity

15.53K Popularity

28.48K Popularity

10.45K Popularity

376.15K Popularity

50.93K Popularity

196.68K Popularity

21.5K Popularity

76.88K Popularity

15.33K Popularity

News

View MoreTraditional Finance Drop Alert: XTIUSD Falls Over 2%

9 m

U.S. Federal Funds Futures December Contract Falls by 3 Basis Points

10 m

U.S. stock index futures open lower, Nasdaq and Dow Jones drop over 1%

23 m

Traditional Finance Alert: AUDJPY rises over 0.5%

1 h

The US Dollar Index (DXY) rose above 98, with an intraday increase of 0.34%.

1 h

Pin