# DecemberMarketOutlook

143.03K

As the market enters December, volatility persists. Do you anticipate a new breakout trend this month, or will we see continued range-bound consolidation? Share your unique insights!

EagleEye

#DecemberMarketOutlook

December Crypto Market Outlook: Will We Witness a Strong Breakout Trend or Continue Range-Bound Consolidation Amid Persistent Volatility?

As December unfolds, volatility remains a central theme in the crypto market, creating both opportunities and challenges for traders and investors alike. Price movements across major cryptocurrencies, including Bitcoin, Ethereum, and key altcoins, have been reactive to both technical patterns and macroeconomic factors. Historically, December is a pivotal month where the market either gains momentum heading into year-end or consolidat

December Crypto Market Outlook: Will We Witness a Strong Breakout Trend or Continue Range-Bound Consolidation Amid Persistent Volatility?

As December unfolds, volatility remains a central theme in the crypto market, creating both opportunities and challenges for traders and investors alike. Price movements across major cryptocurrencies, including Bitcoin, Ethereum, and key altcoins, have been reactive to both technical patterns and macroeconomic factors. Historically, December is a pivotal month where the market either gains momentum heading into year-end or consolidat

- Reward

- 13

- 10

- Repost

- Share

BabaJi :

:

HODL Tight 💪View More

#DecemberMarketOutlook

#BitcoinActivityPicksUp

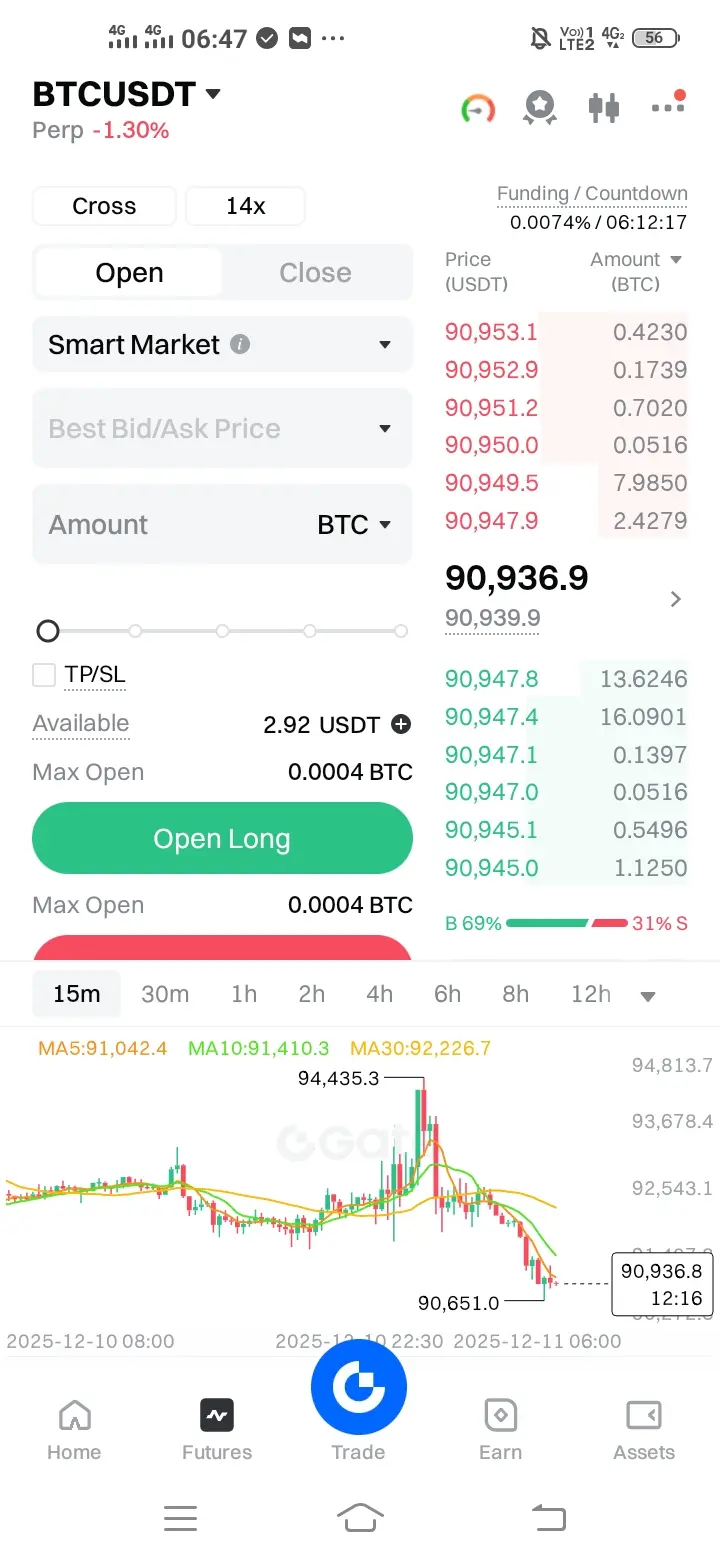

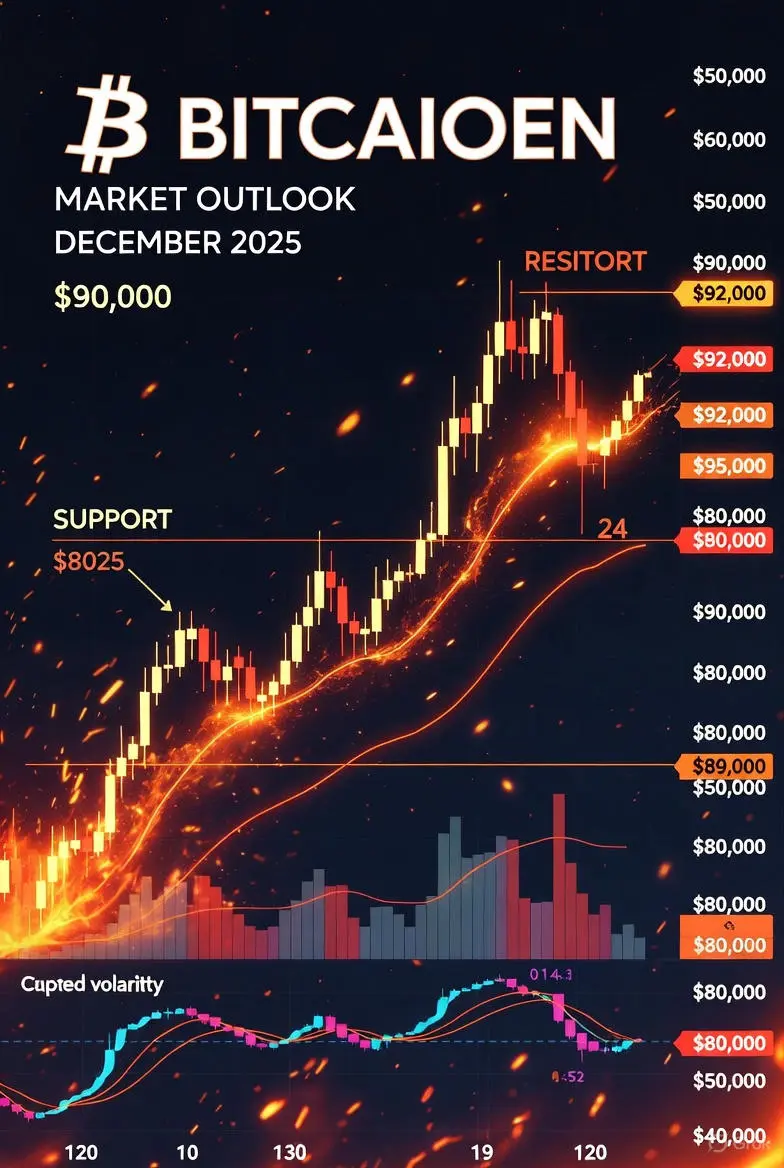

Bitcoin (BTC) — December 2025 Forecast

📊 Price Recap (Early December)

Dec 1: $90,372

Dec 6: $89,305

Dec 8: $90,163

Today: $90,824

💡 Market Pulse

Personally, I see Bitcoin showing resilience above $90K, and this gives me cautious optimism for the rest of December. The first week’s dip reminded me how volatile BTC can be, but the current momentum suggests buyers are stepping in stronger. I feel the market is in a delicate balance, testing key resistance and support levels, and December could be a decisive month for year-end positioning.

📈 What

#BitcoinActivityPicksUp

Bitcoin (BTC) — December 2025 Forecast

📊 Price Recap (Early December)

Dec 1: $90,372

Dec 6: $89,305

Dec 8: $90,163

Today: $90,824

💡 Market Pulse

Personally, I see Bitcoin showing resilience above $90K, and this gives me cautious optimism for the rest of December. The first week’s dip reminded me how volatile BTC can be, but the current momentum suggests buyers are stepping in stronger. I feel the market is in a delicate balance, testing key resistance and support levels, and December could be a decisive month for year-end positioning.

📈 What

BTC-5,1%

- Reward

- 24

- 12

- Repost

- Share

BabaJi :

:

1000x Vibes 🤑View More

#DecemberMarketOutlook

1. Macro Environment & Risk Factors (Global Markets)

Fed Policy & Rates:

• The U.S. Federal Reserve is a central focus this month; markets are pricing in potential rate cuts or shifts in guidance — which are key catalysts for risk assets including stocks and crypto.

• Consumer spending and labor data (e.g., non‑farm payrolls) will influence rate expectations and risk flows. Historically, softer data increases the odds of easing, which could lift stocks and risk assets into year‑end.

Market Breadth:

• Small‑cap stocks are showing relative strength (a “January‑effect‑like

1. Macro Environment & Risk Factors (Global Markets)

Fed Policy & Rates:

• The U.S. Federal Reserve is a central focus this month; markets are pricing in potential rate cuts or shifts in guidance — which are key catalysts for risk assets including stocks and crypto.

• Consumer spending and labor data (e.g., non‑farm payrolls) will influence rate expectations and risk flows. Historically, softer data increases the odds of easing, which could lift stocks and risk assets into year‑end.

Market Breadth:

• Small‑cap stocks are showing relative strength (a “January‑effect‑like

- Reward

- 12

- 7

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍View More

#DecemberMarketOutlook

📊 Crypto Market Overview — 15 December 2025

The cryptocurrency market is showing mixed and cautious movement as traders head into the final weeks of the year. Major assets are consolidating, with volatility remaining moderate while investors closely monitor macroeconomic and regulatory developments.

🔹 Bitcoin $BTC

Bitcoin continues to trade within a tight range, reflecting market indecision. Buyers are defending key support zones, while sellers remain active near recent highs. BTC dominance is stable, suggesting capital is not aggressively rotating into altcoins yet

📊 Crypto Market Overview — 15 December 2025

The cryptocurrency market is showing mixed and cautious movement as traders head into the final weeks of the year. Major assets are consolidating, with volatility remaining moderate while investors closely monitor macroeconomic and regulatory developments.

🔹 Bitcoin $BTC

Bitcoin continues to trade within a tight range, reflecting market indecision. Buyers are defending key support zones, while sellers remain active near recent highs. BTC dominance is stable, suggesting capital is not aggressively rotating into altcoins yet

- Reward

- like

- Comment

- Repost

- Share

Digital Financial Market Overview (24 Hours), as of the morning of December 15, 2025:

The cryptocurrency market experienced a slight correction but is rapidly recovering. Bitcoin (BTC) traded between $87,000 and $90,000 over the past 24 hours, a 2.32% decrease from the previous 24 hours. However, as of this morning, December 15, 2025, the price of BTC is showing signs of renewed growth and is currently trading above $89,000.

Ethereum (ETH) maintains its momentum and is trading steadily above $3,100.

Overall, the market is showing positive signs of recovery this morning, indicating potential fo

The cryptocurrency market experienced a slight correction but is rapidly recovering. Bitcoin (BTC) traded between $87,000 and $90,000 over the past 24 hours, a 2.32% decrease from the previous 24 hours. However, as of this morning, December 15, 2025, the price of BTC is showing signs of renewed growth and is currently trading above $89,000.

Ethereum (ETH) maintains its momentum and is trading steadily above $3,100.

Overall, the market is showing positive signs of recovery this morning, indicating potential fo

- Reward

- like

- Comment

- Repost

- Share

In 2025, the renewed escalation of the US-China trade war, coupled with ongoing Israeli-Iranian tensions in the Middle East and the Russia-Ukraine conflict, brought global geopolitical risks to a peak. These developments led to high volatility in Bitcoin (BTC) and cryptocurrency markets. For example, in October, Trump's new tariffs on China caused BTC to fall from $126,000 to $107,000. Similarly, the Middle East attacks in June caused BTC to experience short-term drops of 4-8%. While geopolitical risks are pushing investors to avoid risky assets, BTC is partly fulfilling a safe-haven role as "

BTC-5,1%

- Reward

- 42

- 18

- Repost

- Share

CryptoSelf :

:

HODL Tight 💪View More

#DecemberMarketOutlook

Bitcoin, Geopolitics, and Volatility: Risk or Strategic Opportunity?

In 2025, global geopolitical risk has reached one of its highest levels in decades. The renewed escalation of the US–China trade war, persistent Israeli–Iranian tensions in the Middle East, and the prolonged Russia–Ukraine conflict have collectively reshaped global capital flows. These macro pressures have injected extreme volatility into traditional markets and cryptocurrencies have been no exception.

Bitcoin (BTC), as the leading digital asset, has become a real-time barometer of geopolitical stress

Bitcoin, Geopolitics, and Volatility: Risk or Strategic Opportunity?

In 2025, global geopolitical risk has reached one of its highest levels in decades. The renewed escalation of the US–China trade war, persistent Israeli–Iranian tensions in the Middle East, and the prolonged Russia–Ukraine conflict have collectively reshaped global capital flows. These macro pressures have injected extreme volatility into traditional markets and cryptocurrencies have been no exception.

Bitcoin (BTC), as the leading digital asset, has become a real-time barometer of geopolitical stress

BTC-5,1%

- Reward

- 12

- 9

- Repost

- Share

ybaser :

:

HODL Tight 💪View More

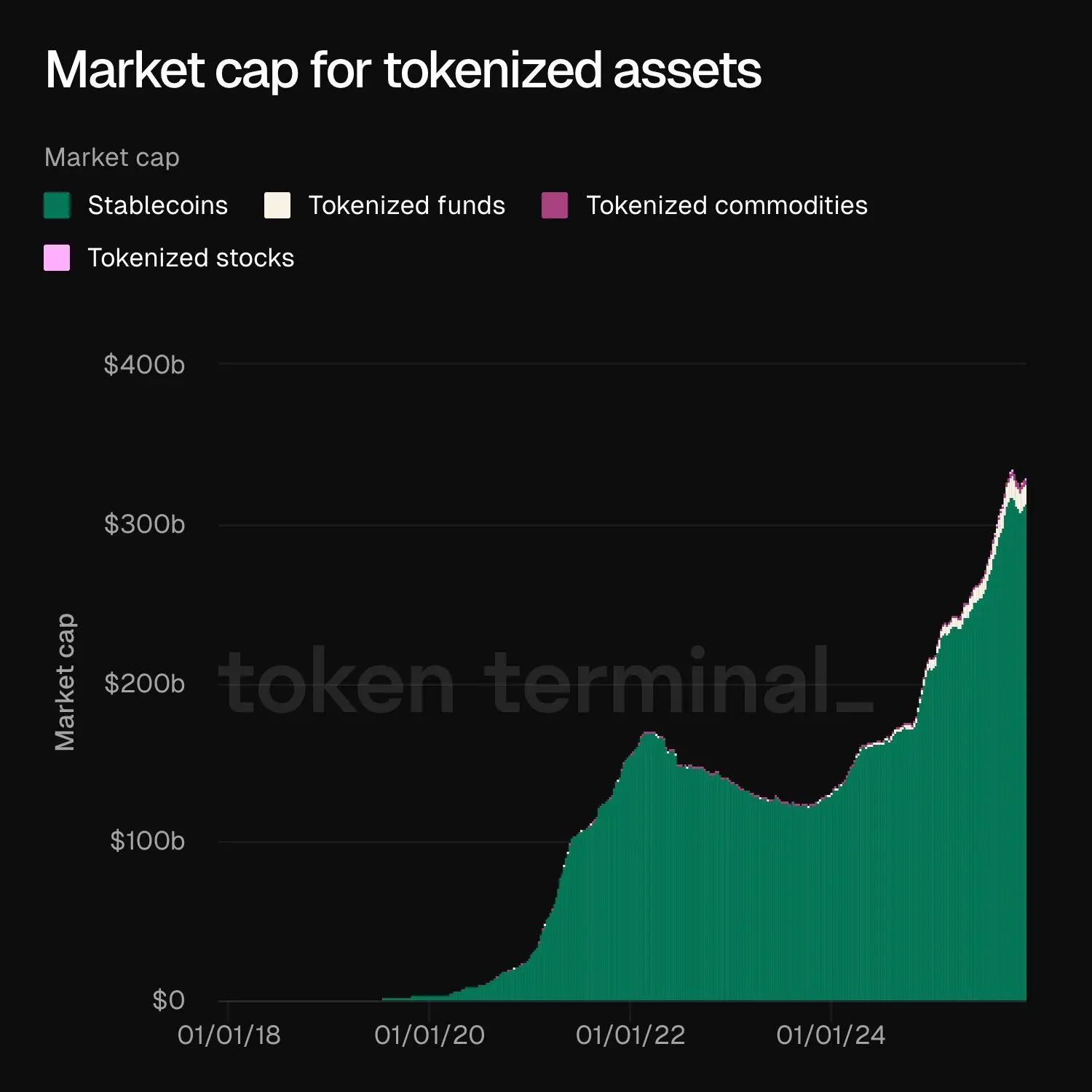

Tokenized assets hit an all-time high of $330B market cap, spanning stablecoins, tokenized funds, commodities, and stocks, per Token Terminal.

#DecemberMarketOutlook

#DecemberMarketOutlook

- Reward

- like

- Comment

- Repost

- Share

Crypto yearly returns

Bitcoin: -9.99%

Ethereum: -20%

Solana: -41%

BNB: +24%

SUI: -66%

AVAX: -74%

ADA: -62%

TON: -74%

LINK: -52%

XRP: -15%

This is not the bull run we expected#GateNovTransparencyReportReleased #BitcoinActivityPicksUp #DecemberMarketOutlook #CryptoMarketWatch

Bitcoin: -9.99%

Ethereum: -20%

Solana: -41%

BNB: +24%

SUI: -66%

AVAX: -74%

ADA: -62%

TON: -74%

LINK: -52%

XRP: -15%

This is not the bull run we expected#GateNovTransparencyReportReleased #BitcoinActivityPicksUp #DecemberMarketOutlook #CryptoMarketWatch

- Reward

- 2

- 1

- Repost

- Share

User_any :

:

Bull Run 🐂$SOL USDT PERP UPDATE 🔥🚀

$SOL is trading near $130.2 after rejection from $133.5 and now price is compressing hard. On the 15m chart, price is sitting right around the moving averages, showing pressure building before a move.

Strong support is holding at $129.2, buyers stepped in clean here. As long as this level holds, a bounce scenario stays valid. Immediate resistance is at $131.0 – $132.5, and if momentum flips, a quick push toward $133+ is on the table.

Volatility is loading, market is quiet but tense, and this structure usually ends with a fast expansion.

Risk smart, stay sharp ⚡

Let’s

$SOL is trading near $130.2 after rejection from $133.5 and now price is compressing hard. On the 15m chart, price is sitting right around the moving averages, showing pressure building before a move.

Strong support is holding at $129.2, buyers stepped in clean here. As long as this level holds, a bounce scenario stays valid. Immediate resistance is at $131.0 – $132.5, and if momentum flips, a quick push toward $133+ is on the table.

Volatility is loading, market is quiet but tense, and this structure usually ends with a fast expansion.

Risk smart, stay sharp ⚡

Let’s

SOL-8,64%

- Reward

- 3

- 4

- Repost

- Share

Ryakpanda :

:

Just go for it💪View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

28.66K Popularity

64.44K Popularity

368.61K Popularity

46.69K Popularity

62.43K Popularity

19.28K Popularity

26.41K Popularity

20.01K Popularity

92.78K Popularity

38.15K Popularity

33.09K Popularity

29.07K Popularity

17.53K Popularity

24.01K Popularity

197K Popularity

News

View MoreData: The Hyperliquid platform's whale addresses currently hold a total position of 3.772 billion USD. The ratio of long to short positions is 0.89.

3 m

Data: Tokens such as HYPE, BERA, XDC will experience large unlocks next week, with HYPE unlocking worth approximately $305 million.

7 m

Tokyo and Hong Kong jointly report massive cash robbery cases, with 2 virtual currency exchange shop employees already detained

23 m

Bhutan Sovereign Wealth Fund transferred approximately 100 BTC to QCP Capital before the market downturn

25 m

SoSoValue's high-performance Layer 1 order book SoDEX is officially fully open, with 150 million $SOSO incentives to rebuild on-chain transactions.

28 m

Pin