# BitcoinWeakensVsGold

14.63K

Bitcoin’s gold ratio is down about 55% from its peak and has fallen below the 200-week MA. Is this a good dip-buying opportunity? Share your latest Bitcoin strategy.

Discovery

Market Evolution: Is Gold Strengthening Its Position?

The opening weeks of 2026 have introduced a new dynamic for global investors. While Bitcoin has seen a significant price correction after its peak in late 2025, currently consolidating between $85,000 and $95,000, Physical Gold (XAU) has maintained a steady upward trajectory, moving closer to the $5,000 milestone.

Understanding the Market Shift

Current market trends suggest that recent movements are driven by broader macroeconomic factors rather than just price volatility:

Global Sentiment Shift: Rising geopolitical uncertainties a

The opening weeks of 2026 have introduced a new dynamic for global investors. While Bitcoin has seen a significant price correction after its peak in late 2025, currently consolidating between $85,000 and $95,000, Physical Gold (XAU) has maintained a steady upward trajectory, moving closer to the $5,000 milestone.

Understanding the Market Shift

Current market trends suggest that recent movements are driven by broader macroeconomic factors rather than just price volatility:

Global Sentiment Shift: Rising geopolitical uncertainties a

BTC-3,18%

- Reward

- 50

- 52

- Repost

- Share

kader1 :

:

Buy To Earn 💎View More

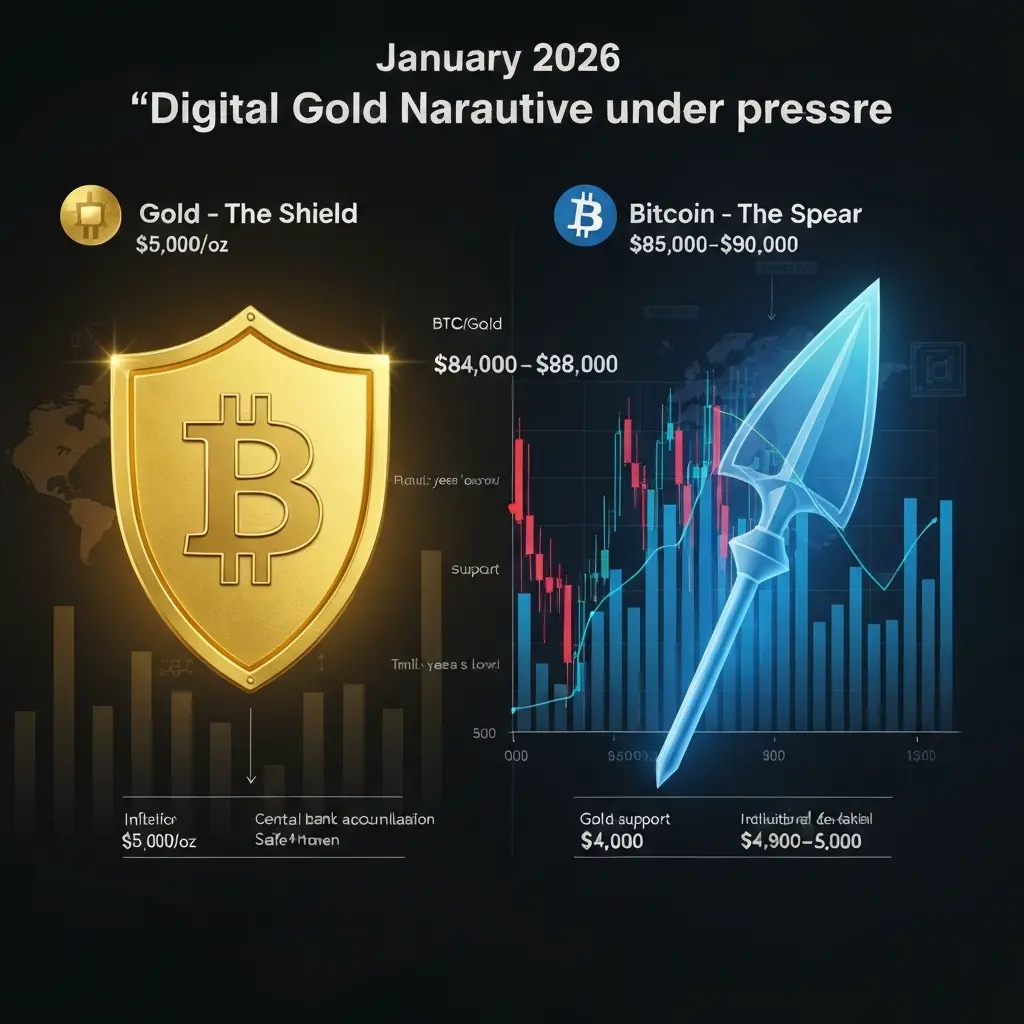

In January 2026, the long-standing "Digital Gold" narrative faces its most severe test yet. While Bitcoin continues to dominate the crypto space, it has notably underperformed its tangible predecessor, Gold. The BTC/Gold ratio has plunged to multi-year lows, highlighting a clear market preference for stability over speculative growth amid heightened global uncertainty.

1. Divergence in Price Action

Gold’s Historic Surge:

Gold has ascended toward the $5,000/oz milestone, driven by aggressive accumulation from central banks and a pronounced global flight to safety. Over a 12-month trailing perio

1. Divergence in Price Action

Gold’s Historic Surge:

Gold has ascended toward the $5,000/oz milestone, driven by aggressive accumulation from central banks and a pronounced global flight to safety. Over a 12-month trailing perio

BTC-3,18%

- Reward

- 31

- 23

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#BitcoinRelativeToGoldDeepWeakness

(#比特币相对黄金进入深度弱势)

The global financial market is witnessing a powerful shift in sentiment as Bitcoin shows deep relative weakness compared to gold. This trend is not just a short-term fluctuation—it reflects a deeper transformation in investor psychology, capital allocation strategies, and macroeconomic risk management. For the first time in a long while, gold is clearly outperforming Bitcoin as the preferred hedge asset during uncertainty.

Historically, Bitcoin has often been called “digital gold.” It was promoted as a decentralized store of value, a hedge ag

(#比特币相对黄金进入深度弱势)

The global financial market is witnessing a powerful shift in sentiment as Bitcoin shows deep relative weakness compared to gold. This trend is not just a short-term fluctuation—it reflects a deeper transformation in investor psychology, capital allocation strategies, and macroeconomic risk management. For the first time in a long while, gold is clearly outperforming Bitcoin as the preferred hedge asset during uncertainty.

Historically, Bitcoin has often been called “digital gold.” It was promoted as a decentralized store of value, a hedge ag

BTC-3,18%

- Reward

- 32

- 24

- Repost

- Share

Crypto24pro :

:

good information bro.View More

In January 2026, the long-standing "Digital Gold" narrative faces its most severe test yet. While Bitcoin continues to dominate the crypto space, it has notably underperformed its tangible predecessor, Gold. The BTC/Gold ratio has plunged to multi-year lows, highlighting a clear market preference for stability over speculative growth amid heightened global uncertainty.

1. Divergence in Price Action

Gold’s Historic Surge:

Gold has ascended toward the $5,000/oz milestone, driven by aggressive accumulation from central banks and a pronounced global flight to safety. Over a 12-month trailing perio

1. Divergence in Price Action

Gold’s Historic Surge:

Gold has ascended toward the $5,000/oz milestone, driven by aggressive accumulation from central banks and a pronounced global flight to safety. Over a 12-month trailing perio

BTC-3,18%

- Reward

- 19

- 16

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

In January 2026, the old narrative of "Digital Gold" faces its greatest test. While Bitcoin continues to dominate the crypto space, its performance is significantly below that of its tangible predecessor, Gold. The BTC/Gold ratio has fallen to its lowest level in years, highlighting the market's clear preference for stability over speculative growth amid increasing global uncertainty.

1. Divergence in Price Movements

Historic Gold Surge:

Gold has risen toward the $5,000/oz milestone, driven by aggressive central bank accumulation and a tangible global flight to safety. Over the past 12 months,

1. Divergence in Price Movements

Historic Gold Surge:

Gold has risen toward the $5,000/oz milestone, driven by aggressive central bank accumulation and a tangible global flight to safety. Over the past 12 months,

BTC-3,18%

- Reward

- 25

- 13

- Repost

- Share

GateUser-e640aaac :

:

wowwwView More

#比特币相对黄金进入深度弱势

Breaking below the 200-week moving average, Bitcoin to Gold ratio retraced 55%, is this a golden opportunity or a downtrend signal?

In the global macro financial landscape of early 2026, a highly significant long-term indicator has once again sounded the alarm: the Bitcoin to Gold ratio has retraced approximately 55% from its previous high and has officially fallen below the 200-week moving average, which is regarded as the long-term critical threshold.

In the technical analysis system of cryptocurrencies, the 200-week moving average is often called the last line of defense. Lo

View OriginalBreaking below the 200-week moving average, Bitcoin to Gold ratio retraced 55%, is this a golden opportunity or a downtrend signal?

In the global macro financial landscape of early 2026, a highly significant long-term indicator has once again sounded the alarm: the Bitcoin to Gold ratio has retraced approximately 55% from its previous high and has officially fallen below the 200-week moving average, which is regarded as the long-term critical threshold.

In the technical analysis system of cryptocurrencies, the 200-week moving average is often called the last line of defense. Lo

- Reward

- 6

- 7

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#BitcoinRelativeToGoldDeepWeakness

(#比特币相对黄金进入深度弱势)

The global financial market is witnessing a powerful shift in sentiment as Bitcoin shows deep relative weakness compared to gold. This trend is not just a short-term fluctuation—it reflects a deeper transformation in investor psychology, capital allocation strategies, and macroeconomic risk management. For the first time in a long while, gold is clearly outperforming Bitcoin as the preferred hedge asset during uncertainty.

Historically, Bitcoin has often been called “digital gold.” It was promoted as a decentralized store of value, a hedge ag

(#比特币相对黄金进入深度弱势)

The global financial market is witnessing a powerful shift in sentiment as Bitcoin shows deep relative weakness compared to gold. This trend is not just a short-term fluctuation—it reflects a deeper transformation in investor psychology, capital allocation strategies, and macroeconomic risk management. For the first time in a long while, gold is clearly outperforming Bitcoin as the preferred hedge asset during uncertainty.

Historically, Bitcoin has often been called “digital gold.” It was promoted as a decentralized store of value, a hedge ag

BTC-3,18%

- Reward

- 12

- 13

- Repost

- Share

NiluQueen :

:

2026 GOGOGO 👊View More

#比特币相对黄金进入深度弱势 🔥

Global financial markets are quietly delivering a clear message: the hierarchy of safe-haven assets is shifting, and traditional defenses are reclaiming their historical role. Recent price action across multiple asset classes confirms a growing divergence between Bitcoin and Gold, signaling a decisive change in investor behavior. As uncertainty deepens across geopolitical, monetary, and economic fronts, capital is flowing not toward speculative innovation, but toward stability and preservation.

Gold’s ascent is not accidental. It reflects a deliberate reallocation by institut

Global financial markets are quietly delivering a clear message: the hierarchy of safe-haven assets is shifting, and traditional defenses are reclaiming their historical role. Recent price action across multiple asset classes confirms a growing divergence between Bitcoin and Gold, signaling a decisive change in investor behavior. As uncertainty deepens across geopolitical, monetary, and economic fronts, capital is flowing not toward speculative innovation, but toward stability and preservation.

Gold’s ascent is not accidental. It reflects a deliberate reallocation by institut

BTC-3,18%

- Reward

- 8

- 8

- Repost

- Share

Saffvls :

:

Precious metals are on fire! #GoldAndSilverHitRecordHighs reflects global economic uncertainty prompting investors to shift to safe assets. On the other hand, easing tensions after #TrumpWithdrawsEUTariffThreat provides a positive sentiment for the equity markets. How does your portfolio strategy navigate this volatility? Is it time to buy or to take profits?View More

#比特币相对黄金进入深度弱势

Price Action Confirms the Shift in Safe-Haven Preference

Recent market price action clearly shows a growing divergence between Bitcoin and Gold, strengthening the argument that traditional safe havens are reclaiming dominance. While Bitcoin struggles to regain momentum, Gold continues to attract capital as global uncertainty intensifies.

Gold prices have surged to historic levels, recently trading around the $4,900–$5,000 per ounce zone, supported by strong central-bank buying, geopolitical tensions, and long-term inflation concerns. This steady upward move reflects confidence

Price Action Confirms the Shift in Safe-Haven Preference

Recent market price action clearly shows a growing divergence between Bitcoin and Gold, strengthening the argument that traditional safe havens are reclaiming dominance. While Bitcoin struggles to regain momentum, Gold continues to attract capital as global uncertainty intensifies.

Gold prices have surged to historic levels, recently trading around the $4,900–$5,000 per ounce zone, supported by strong central-bank buying, geopolitical tensions, and long-term inflation concerns. This steady upward move reflects confidence

BTC-3,18%

- Reward

- 12

- 13

- Repost

- Share

Cuce4ka :

:

Where is this money button already?)))View More

#黄金白银再创新高 #比特币相对黄金进入深度弱势 Bitcoin's short-term upside is limited, and the risk of consolidation is increasing. Outlook for 2026: macro risks and forecasts, market signals of caution

As Bitcoin's price continues to hover around $90,000 without breaking the psychological barrier of $100,000, its trend sharply contrasts with traditional safe-haven assets like gold and silver, which recently hit all-time highs. This divergence is not accidental but a significant signal of Bitcoin's evolving role within the global macro system.

Looking ahead to 2026, Bitcoin's prospects will be increasingly driven b

As Bitcoin's price continues to hover around $90,000 without breaking the psychological barrier of $100,000, its trend sharply contrasts with traditional safe-haven assets like gold and silver, which recently hit all-time highs. This divergence is not accidental but a significant signal of Bitcoin's evolving role within the global macro system.

Looking ahead to 2026, Bitcoin's prospects will be increasingly driven b

BTC-3,18%

- Reward

- 10

- 12

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

74.95K Popularity

48.27K Popularity

39.64K Popularity

14.63K Popularity

30.44K Popularity

22.45K Popularity

18.01K Popularity

88.56K Popularity

58.18K Popularity

28.21K Popularity

17.73K Popularity

6.54K Popularity

264.75K Popularity

27.33K Popularity

167.54K Popularity

News

View MorePin