# Bitcoin$bitcoin

222

NoorCryptoGirl

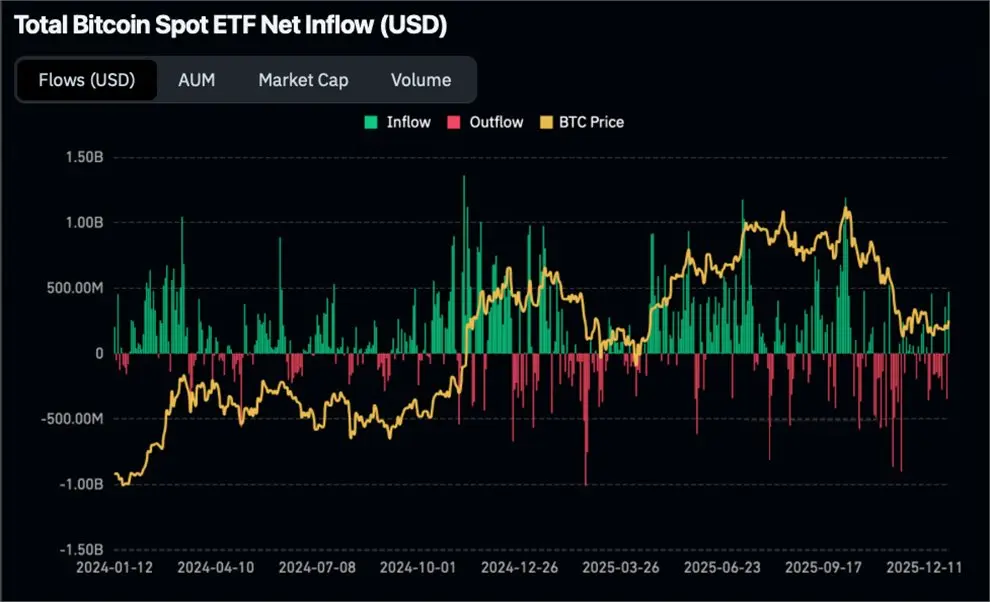

Spot Bitcoin ETFs have kicked off 2026 with strong momentum after heavy outflows at the end of 2025. On January 2, ETFs recorded $471M in net inflows, followed by an even bigger $697M on January 5 — the strongest day since the October correction. BlackRock’s IBIT led the surge, highlighting renewed institutional confidence.

With Bitcoin trading near $93K–$94K, these inflows signal improving sentiment, better liquidity, and growing mainstream adoption. While macro and regulatory risks remain, early 2026 data suggests institutions are positioning for long-term exposure.

Not financial advice. Do

With Bitcoin trading near $93K–$94K, these inflows signal improving sentiment, better liquidity, and growing mainstream adoption. While macro and regulatory risks remain, early 2026 data suggests institutions are positioning for long-term exposure.

Not financial advice. Do

BTC-0,62%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

17.04K Popularity

41.38K Popularity

11.4K Popularity

8.81K Popularity

98.38K Popularity

35.22K Popularity

4.4K Popularity

2.21K Popularity

98.55K Popularity

57.29K Popularity

128.67K Popularity

990.27K Popularity

237.37K Popularity

5.07K Popularity

286.97K Popularity

News

View MoreThe ONDO tokens worth $23.1 million were distributed to four wallets this morning. Historical behavior indicates they may flow to exchanges.

25 m

BSC Chain Meme Coin "Laozi" surged over 730 times intraday, with a current market cap of $5.86 million.

33 m

DeepSeek will release the next-generation AI model V4 in February, featuring powerful programming capabilities.

38 m

Ethereum OG Continues Large-Scale ETH Sell-Off

42 m

Bitdeer sold 137.9 BTC this week, reducing the total Bitcoin holdings to 1,990.9 BTC.

56 m

Pin