Post content & earn content mining yield

placeholder

Vortex_King

#GateHKEventsKickOff

#GateHKEventsKickOff

The energy is building. The momentum is real. And Hong Kong is once again at the center of global crypto attention. #GateHKEventsKickOff marks the official launch of Gate’s major events in Hong Kong, signaling expansion, innovation, and stronger community engagement across Asia and beyond.

Organized by Gate.io, these Hong Kong events are not just meetups. They represent strategic positioning in one of the world’s most important financial hubs. Hong Kong has rapidly re-emerged as a leading center for digital assets, blockchain regulation, and instituti

#GateHKEventsKickOff

The energy is building. The momentum is real. And Hong Kong is once again at the center of global crypto attention. #GateHKEventsKickOff marks the official launch of Gate’s major events in Hong Kong, signaling expansion, innovation, and stronger community engagement across Asia and beyond.

Organized by Gate.io, these Hong Kong events are not just meetups. They represent strategic positioning in one of the world’s most important financial hubs. Hong Kong has rapidly re-emerged as a leading center for digital assets, blockchain regulation, and instituti

- Reward

- 3

- 8

- Repost

- Share

ShainingMoon :

:

LFG 🔥View More

The mistress's short position is still held, watching for a pullback. #Gate广场发帖领五万美金红包 #美国核心CPI创四年新低 #比特币下一步怎么走?

View Original

- Reward

- like

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLIWBLOKUW

- Reward

- 1

- 1

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊MLQS

MLQS

Created By@Yass3r

Subscription Progress

0.00%

MC:

$0

More Tokens

【$PIPPIN Signal】Long + 1H strong breakout, capital inflow confirmed

$PIPPIN After experiencing a brief consolidation, the 1H level broke through the previous high of 0.665 with increased volume in the last hour, creating a new intraday high of 0.6759. Currently, the price is consolidating strongly above the breakout level. The 4H level has closed bullish for several consecutive periods, with EMA20 and EMA50 forming a bullish alignment, indicating an upward trend. Open interest remains stable, and no capital outflow occurred during the price surge, showing that the main players are still in the

View Original$PIPPIN After experiencing a brief consolidation, the 1H level broke through the previous high of 0.665 with increased volume in the last hour, creating a new intraday high of 0.6759. Currently, the price is consolidating strongly above the breakout level. The 4H level has closed bullish for several consecutive periods, with EMA20 and EMA50 forming a bullish alignment, indicating an upward trend. Open interest remains stable, and no capital outflow occurred during the price surge, showing that the main players are still in the

- Reward

- like

- Comment

- Repost

- Share

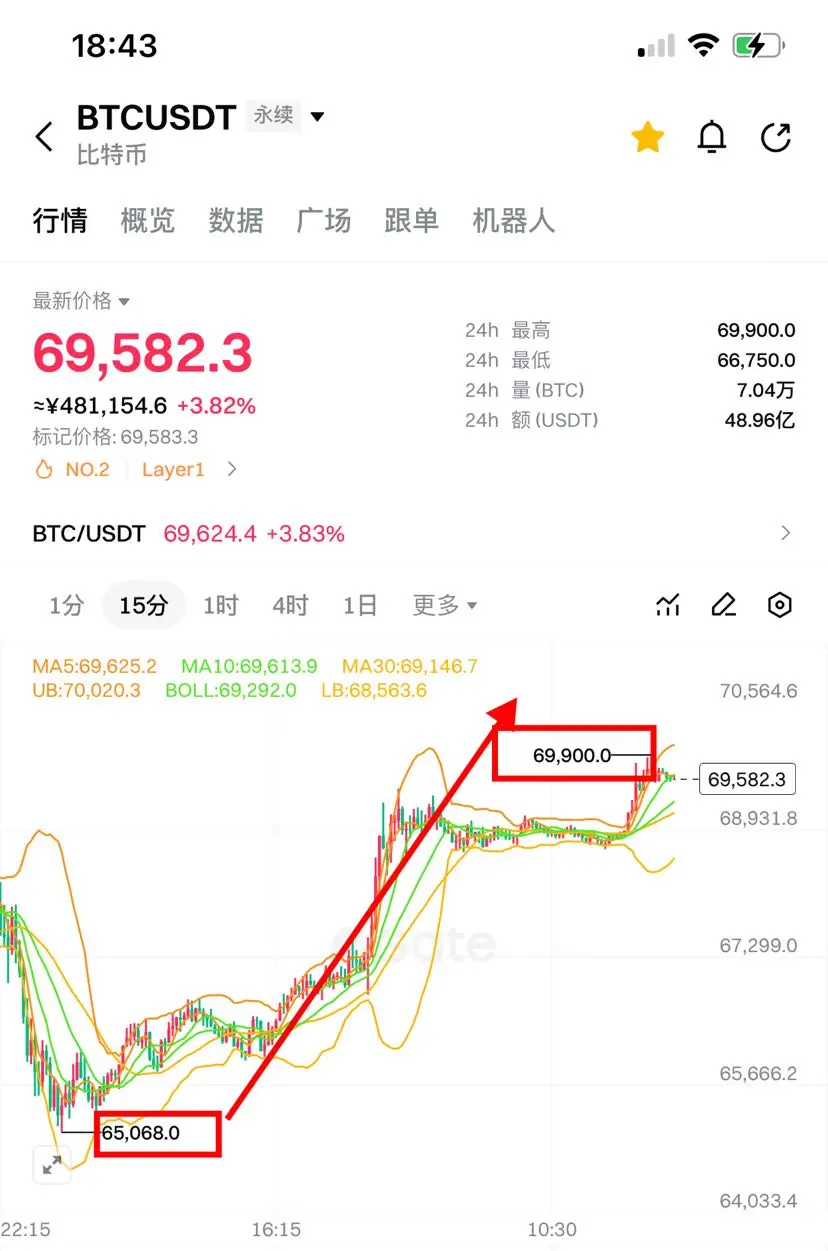

$BTC .D is only down ~6% from its recent high.

That’s not a collapse in dominance — it’s a pause.

Despite noise around alt breakouts, capital is still largely anchored in Bitcoin. A true altseason usually needs a deeper dominance reset, not just a minor pullback.

Until BTC.D breaks structure decisively, this looks like rotation — not regime change.

Stay sharp.

#BTC

That’s not a collapse in dominance — it’s a pause.

Despite noise around alt breakouts, capital is still largely anchored in Bitcoin. A true altseason usually needs a deeper dominance reset, not just a minor pullback.

Until BTC.D breaks structure decisively, this looks like rotation — not regime change.

Stay sharp.

#BTC

BTC4,77%

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊- Reward

- like

- Comment

- Repost

- Share

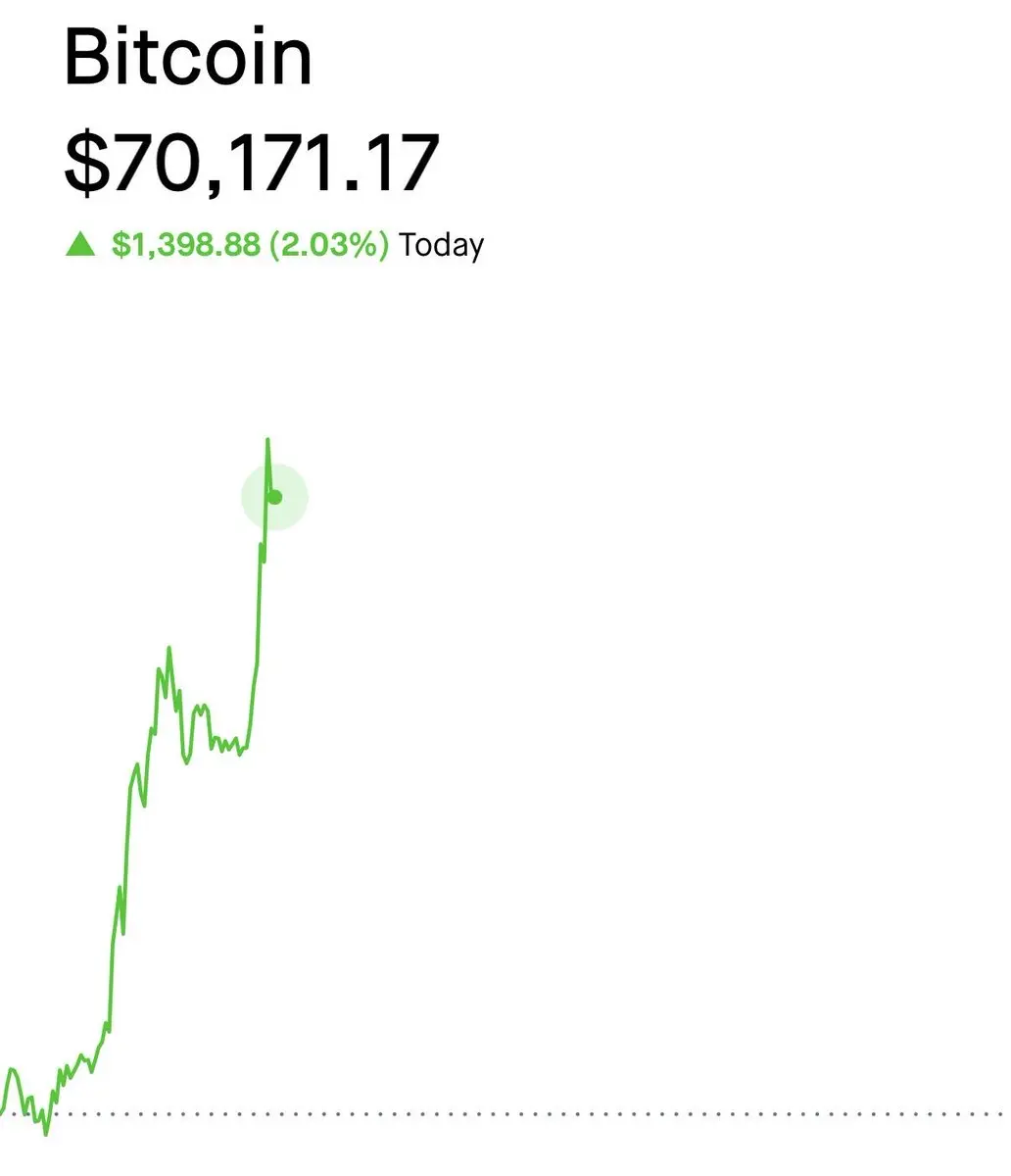

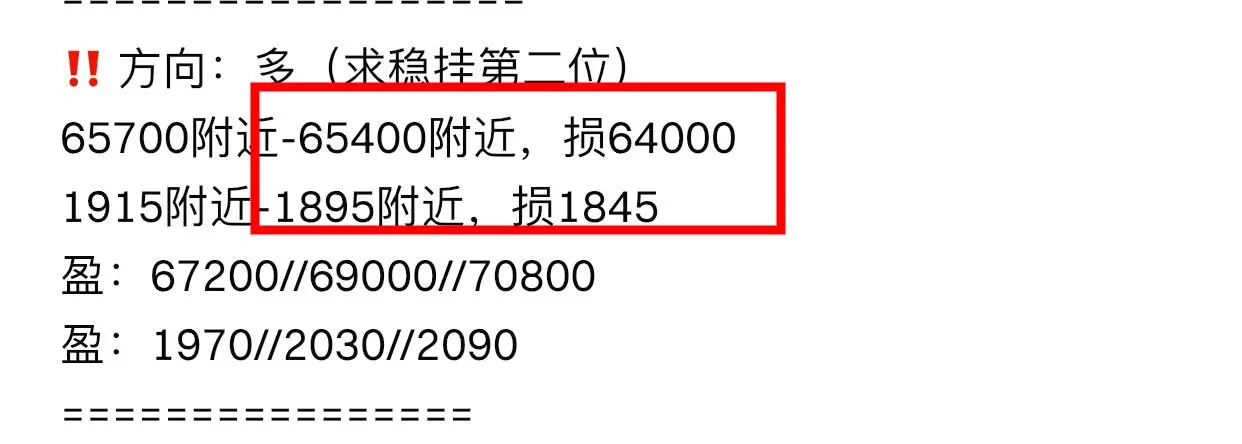

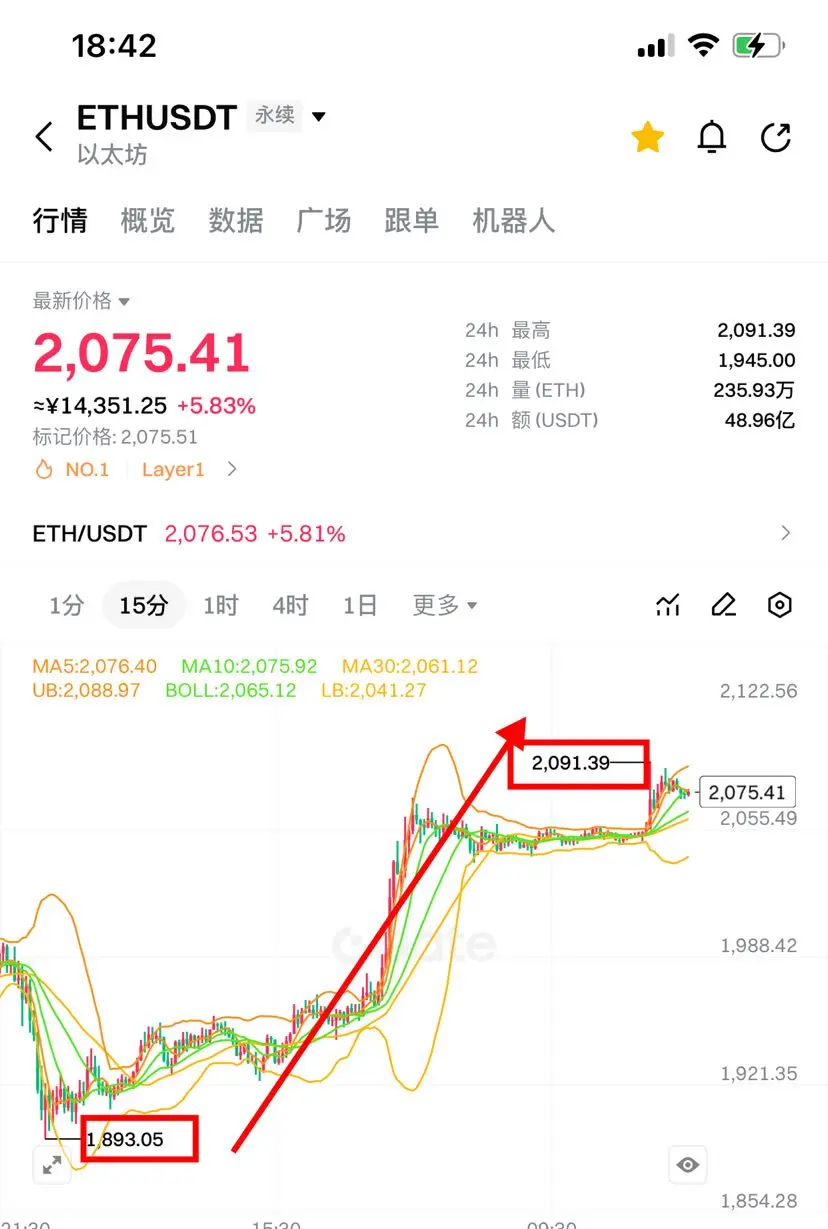

‼️Second order⬇️

‼️Direction: Long

Around 67,000 - 66,700, loss at 65,300

Around 1,990 - 1,970, loss at 1,920

Profit: 68,500 // 69,500 // 70,800

Profit: 2,055 // 2,110 // 2,180

#Gate广场发帖领五万美金红包

View Original‼️Direction: Long

Around 67,000 - 66,700, loss at 65,300

Around 1,990 - 1,970, loss at 1,920

Profit: 68,500 // 69,500 // 70,800

Profit: 2,055 // 2,110 // 2,180

#Gate广场发帖领五万美金红包

- Reward

- like

- Comment

- Repost

- Share

$ETHBTC MACRO PLAN

This is very close to a macro bottom, in my opinion.

Especially considering how weak and overextended $BTC.D looks.

There are two key zones that matter here:

1. The daily FVG sitting inside the 0.75 fib pocket — this inefficiency still needs to be filled.

2. The daily MSS and breaker zone above 0.031 — this level needs to be broken and flipped for bullish momentum to return.

The most likely path I see:

We bounce from here → reject at 0.031 → move lower to fill the daily FVG and sweep liquidity → and that move should provide the expansion needed to break and reclaim 0.031.

Th

This is very close to a macro bottom, in my opinion.

Especially considering how weak and overextended $BTC.D looks.

There are two key zones that matter here:

1. The daily FVG sitting inside the 0.75 fib pocket — this inefficiency still needs to be filled.

2. The daily MSS and breaker zone above 0.031 — this level needs to be broken and flipped for bullish momentum to return.

The most likely path I see:

We bounce from here → reject at 0.031 → move lower to fill the daily FVG and sweep liquidity → and that move should provide the expansion needed to break and reclaim 0.031.

Th

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVDBU1BBCA

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Ethereum Foundation launches Chinese website to support institutional participation

- Reward

- like

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$13.26K

More Tokens

Standard Chartered expects Bitcoin could rebound before year-end

- Reward

- 2

- 1

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊Bullshit, you motherfucker

I'm TM2500's Ethereum at cost

You bunch of bad assholes only went up a few points and you're already bragging

Can I get my break-even point back?

That wave at 1700 almost wiped me out and made me poor again

That night I couldn't sleep, kept worrying and fearing

#eth

I'm TM2500's Ethereum at cost

You bunch of bad assholes only went up a few points and you're already bragging

Can I get my break-even point back?

That wave at 1700 almost wiped me out and made me poor again

That night I couldn't sleep, kept worrying and fearing

#eth

ETH6,43%

- Reward

- 2

- 3

- Repost

- Share

CenterBack :

:

Laughing to death, hahaha, wiped out and returned to poverty, hahahaView More

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: A whale has opened a massive Ethereum long position worth $94.3 Million, which is currently in over $3M+ profit.

With an entry price of $2,029 and high leverage, this trade could be a major signal of a big upcoming bounce.

With an entry price of $2,029 and high leverage, this trade could be a major signal of a big upcoming bounce.

ETH6,43%

- Reward

- like

- 1

- Repost

- Share

EarningMillionsAnnuallyThrough :

:

It should be time to withdraw.Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQRFUWHACQ

View Original

- Reward

- like

- Comment

- Repost

- Share

#ApollotoBuy90MMORPHOin4Years

Apollo’s Strategic Entry Into On-Chain Credit Markets

The #ApollotoBuy90MMORPHOin4Years reflects a major strategic shift in how traditional financial institutions are approaching decentralized finance. Apollo Global Management, one of the world’s largest alternative asset managers, has outlined plans to acquire up to $90 million worth of MORPHO tokens over a four-year period, signaling long-term conviction rather than short-term speculation. This move positions Apollo as a patient institutional participant in the evolving on-chain credit economy.

Rather than chas

Apollo’s Strategic Entry Into On-Chain Credit Markets

The #ApollotoBuy90MMORPHOin4Years reflects a major strategic shift in how traditional financial institutions are approaching decentralized finance. Apollo Global Management, one of the world’s largest alternative asset managers, has outlined plans to acquire up to $90 million worth of MORPHO tokens over a four-year period, signaling long-term conviction rather than short-term speculation. This move positions Apollo as a patient institutional participant in the evolving on-chain credit economy.

Rather than chas

- Reward

- 1

- 1

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊#GrayscaleEyesAVESpotETFConversion

#GrayscaleEyesAVESpotETFConversion

highlights an important development in the crypto investment space. It refers to Grayscale Investments considering the conversion of its AAVE investment product into a spot ETF structure. This is not just a routine product adjustment. It represents a potential structural shift for decentralized finance exposure in traditional markets.

Below is a detailed point by point breakdown.

Who is Grayscale Investments

Grayscale Investments is one of the largest and most recognized digital asset managers globally. The firm manages bil

#GrayscaleEyesAVESpotETFConversion

highlights an important development in the crypto investment space. It refers to Grayscale Investments considering the conversion of its AAVE investment product into a spot ETF structure. This is not just a routine product adjustment. It represents a potential structural shift for decentralized finance exposure in traditional markets.

Below is a detailed point by point breakdown.

Who is Grayscale Investments

Grayscale Investments is one of the largest and most recognized digital asset managers globally. The firm manages bil

- Reward

- 3

- 9

- Repost

- Share

ShainingMoon :

:

To The Moon 🌕View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More72.98K Popularity

4.05K Popularity

3.64K Popularity

50.8K Popularity

2.06K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.63KHolders:20.76%

- MC:$2.49KHolders:10.00%

- MC:$2.51KHolders:20.00%

News

View MoreThis week, the US Solana spot ETF experienced a total net inflow of $12.6 million.

6 m

Bankr: From now on, developers are only allowed to deploy tokens themselves through the X platform.

7 m

GT 24H Up 5.02%, current price 7.3 USDT

34 m

"Maji" increased their ETH long position, now with a floating profit of $150,000

35 m

SPACE increased by 54.05% after launching Alpha, current price is 0.009490201060445165 USDT

40 m

Pin