Post content & earn content mining yield

placeholder

CoinPathSteadyWalker

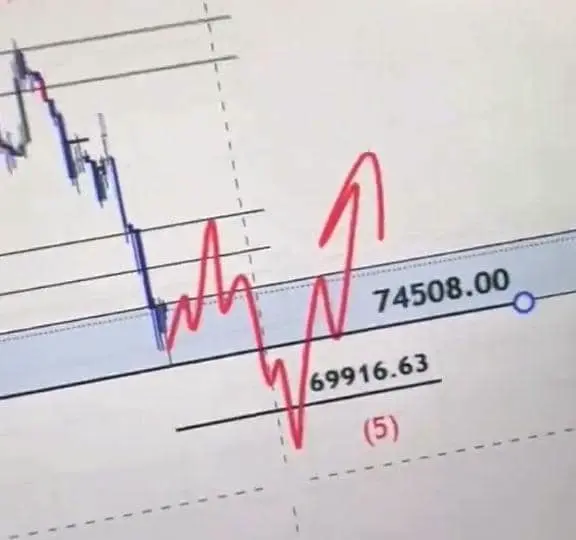

Yesterday, Bitcoin moved within a 6,000-point fluctuation range. Although there were multiple rebounds and corrections along the way, the overall trend remained clear.

Choosing the right direction is just the first step; only by holding firmly and maintaining your position can you withstand the volatility, ultimately realize profits, and exit smoothly.

$BTC $GT $ETH

#加密市场观察 #加密市场隔夜V型震荡 #BTC何时反弹?

View OriginalChoosing the right direction is just the first step; only by holding firmly and maintaining your position can you withstand the volatility, ultimately realize profits, and exit smoothly.

$BTC $GT $ETH

#加密市场观察 #加密市场隔夜V型震荡 #BTC何时反弹?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Bitcoin just slipped below $75,000 for the first time since April.

And the reason is clear on-chain 👇

• Whale wallets (10–10K $BTC) dumped 50,000+ BTC

• Small retail wallets (<0.01 BTC) are aggressively buying the dip

This is a classic bearish setup, according to Santiment.

When large holders distribute while retail rushes in, it usually signals smart money exiting into demand — not accumulation.

Price doesn’t fall because of fear alone.

It falls when liquidity is transferred from weak hands to strong exits.

Until whale behavior flips, downside pressure remains elevated.

And the reason is clear on-chain 👇

• Whale wallets (10–10K $BTC) dumped 50,000+ BTC

• Small retail wallets (<0.01 BTC) are aggressively buying the dip

This is a classic bearish setup, according to Santiment.

When large holders distribute while retail rushes in, it usually signals smart money exiting into demand — not accumulation.

Price doesn’t fall because of fear alone.

It falls when liquidity is transferred from weak hands to strong exits.

Until whale behavior flips, downside pressure remains elevated.

BTC-2,39%

- Reward

- 1

- 1

- Repost

- Share

CryptoAnalysisS :

:

2026 GOGOGO 👊馬币火

Malaysian Ringgit

Created By@TIANDAO

Listing Progress

100.00%

MC:

$10.75K

Create My Token

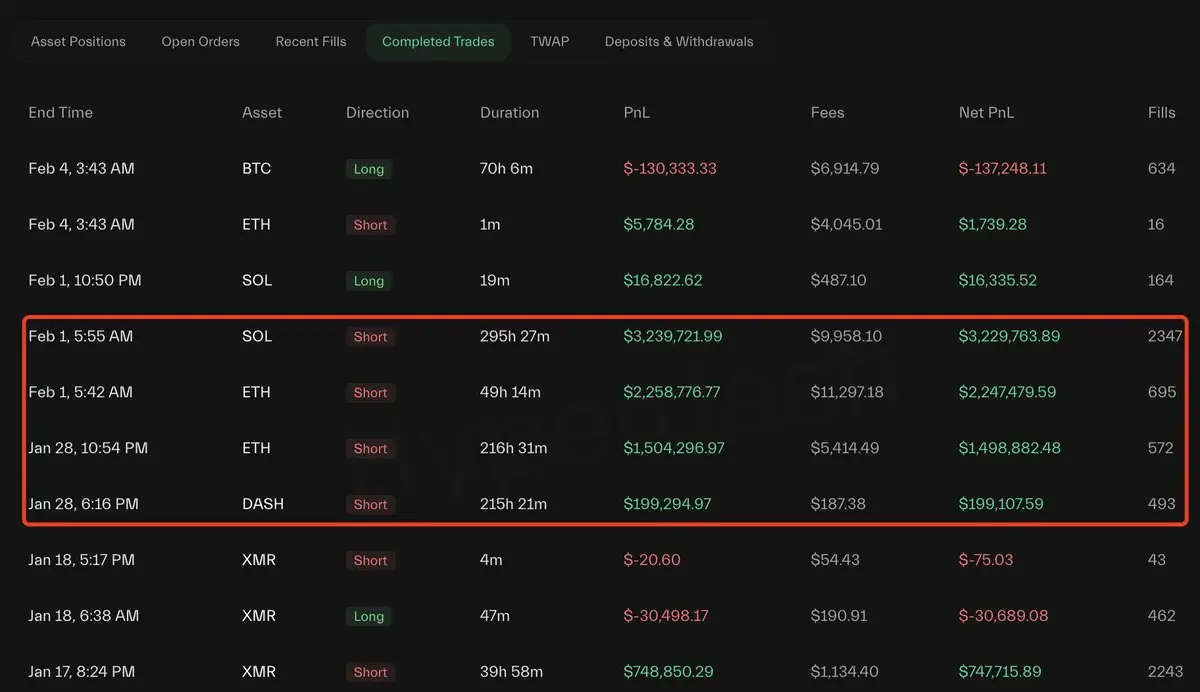

Whale Movements Alert: Smart Traders' New Bet <-> Smart Traders 0x152e recently made approximately $7.2 million through short selling. Currently, he has opened new 20x short positions, totaling 21,838 ETH ($49.3 million) and 227,635 SOL ($22 million). His total profit so far is $18.8 million. $ETH $SOL #Cryptocurrency #Blockchain #Coinbase #Aave

View Original

- Reward

- like

- Comment

- Repost

- Share

Gold price moves above $5,000; major institutions remain bullish on further upside

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

TheUnyieldingLeek :

:

Stop talking nonsense. It has always been about being cut from the beginning to the end.Gold hit a rebound today after one of the wildest corrections in decades. A historic $5 trillion wipeout, but the \'Why\' hasn\'t changed. No more panicking and overthinking on red days.I prefer to stay true to the plan. Securing physical assets while the paper markets reset. ⚓️

- Reward

- like

- Comment

- Repost

- Share

#OvernightV-ShapedMoveinCrypto 🔞🚨

JUST IN: Bitcoin falls under $73,000 $BTC 📉💥

$285,000,000 liquidated from the crypto market in the past 60 minutes. 📉‼️

JUST IN: Bitcoin falls to lowest price since President Trump's 2024 election victory.📉♦️

#VitalikSellsETH #BitMineAcquires20,000ETH

$ETH #WhenWillBTCRebound? 🚀🚀🚀

JUST IN: Bitcoin falls under $73,000 $BTC 📉💥

$285,000,000 liquidated from the crypto market in the past 60 minutes. 📉‼️

JUST IN: Bitcoin falls to lowest price since President Trump's 2024 election victory.📉♦️

#VitalikSellsETH #BitMineAcquires20,000ETH

$ETH #WhenWillBTCRebound? 🚀🚀🚀

- Reward

- 1

- 1

- Repost

- Share

BlockchainDisaster :

:

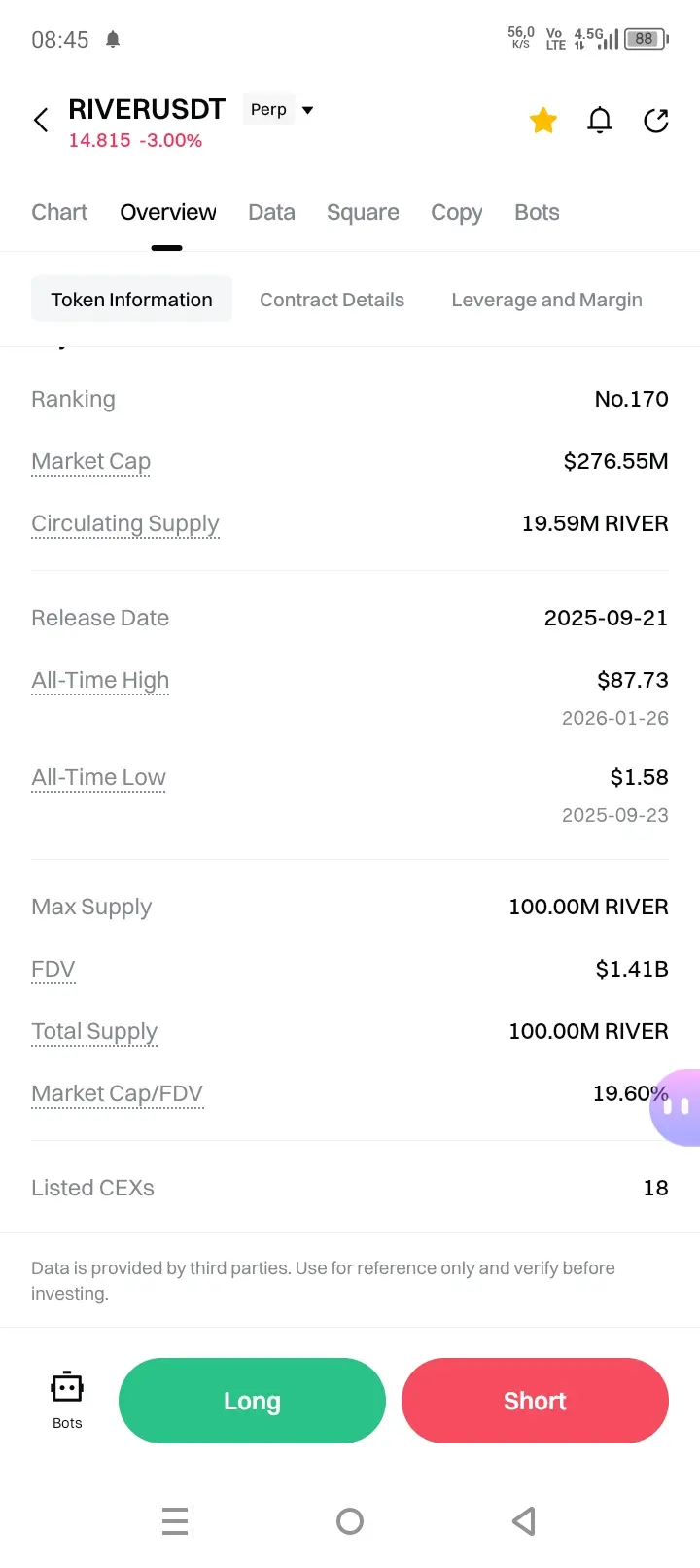

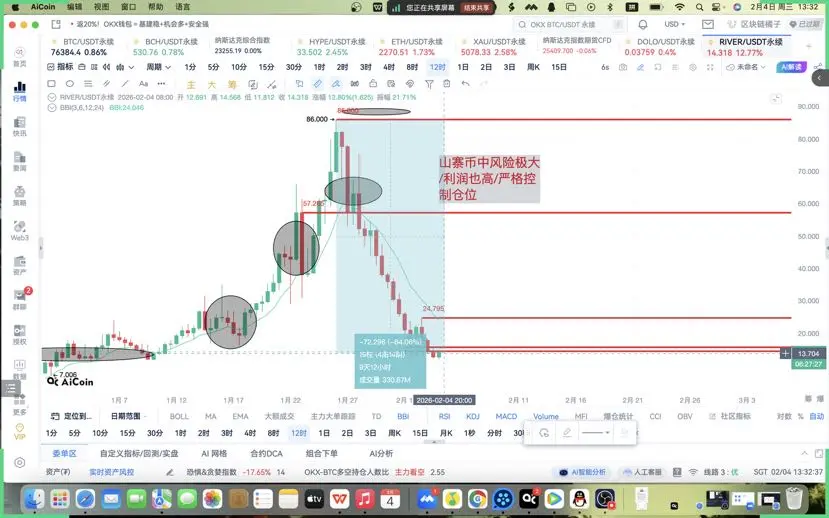

Hold you BTC RISK TO BE RICH 🚀🚀🚀$RIVER The landscape of copycat projects is brutal➕brutal

Make sure to manage risks properly

Spot Trading

◦ Building Position: 12.8-13.5 USDT for light positions, 10.5-11.0 USDT for adding positions, total position ≤30%.

◦ Take Profit: 15-16 USDT (reduce position), 18-20 USDT (partial take profit).

◦ Stop Loss: Effective break below 10.0 USDT to trigger stop loss, control drawdown.

• Futures

◦ Short-term: High sell at 12.8-15 USDT range, buy low, sell high, stop loss 1.0-1.5 USDT.

◦ Trend: Break through 15 USDT with increased volume to chase longs, target 18-20 USDT, stop loss 13.0 USDT.

◦ R

Make sure to manage risks properly

Spot Trading

◦ Building Position: 12.8-13.5 USDT for light positions, 10.5-11.0 USDT for adding positions, total position ≤30%.

◦ Take Profit: 15-16 USDT (reduce position), 18-20 USDT (partial take profit).

◦ Stop Loss: Effective break below 10.0 USDT to trigger stop loss, control drawdown.

• Futures

◦ Short-term: High sell at 12.8-15 USDT range, buy low, sell high, stop loss 1.0-1.5 USDT.

◦ Trend: Break through 15 USDT with increased volume to chase longs, target 18-20 USDT, stop loss 13.0 USDT.

◦ R

View Original

- Reward

- 1

- Comment

- Repost

- Share

Market rebounds after high volatility; Bitcoin holds around $73,000, signaling potential bottom formation

- Reward

- like

- Comment

- Repost

- Share

#加密市场隔夜V型震荡 Volatile Balance After the Crash! February 4 BTC Market Analysis

The market is seeking equilibrium amid extremely low price levels and chaotic macroeconomic conditions. Every sharp rise and fall resonates with macroeconomic trends, capital flows, and human emotions. After several days of intense selling, the cryptocurrency market is finally attempting to find some balance in this turbulent macro environment. As of the morning of February 4, Bitcoin is trading at $75,800, down 3.78% in 24 hours, with a daily low of $72,877 — the lowest since November 6, 2024! Over the past 24 hours,

The market is seeking equilibrium amid extremely low price levels and chaotic macroeconomic conditions. Every sharp rise and fall resonates with macroeconomic trends, capital flows, and human emotions. After several days of intense selling, the cryptocurrency market is finally attempting to find some balance in this turbulent macro environment. As of the morning of February 4, Bitcoin is trading at $75,800, down 3.78% in 24 hours, with a daily low of $72,877 — the lowest since November 6, 2024! Over the past 24 hours,

BTC-2,39%

- Reward

- 1

- 1

- Repost

- Share

playerYU :

:

Complete tasks, earn points, ambush the hundredfold coin 📈, let's all go for it【$BTC Signal】Empty Position + Observation of Divergence in Open Interest

$BTC Price decline accompanied by high open interest indicates market logic suggesting caution against long liquidation or main force distribution risks. The current market lacks clear absorption behavior, so blindly taking positions is not advisable.

🎯 Direction: Empty Position

Wait for clearer signals from price action. Divergence between price decline and open interest is a dangerous sign, indicating a large number of open positions that could trigger chain liquidations. Healthy reset should be accompanied by decrea

$BTC Price decline accompanied by high open interest indicates market logic suggesting caution against long liquidation or main force distribution risks. The current market lacks clear absorption behavior, so blindly taking positions is not advisable.

🎯 Direction: Empty Position

Wait for clearer signals from price action. Divergence between price decline and open interest is a dangerous sign, indicating a large number of open positions that could trigger chain liquidations. Healthy reset should be accompanied by decrea

BTC-2,39%

- Reward

- 1

- 1

- Repost

- Share

MagicianActor :

:

Don't you like him anymore? Haha, this video is really good. It's truly amazing, really fantastic. It's so nice, I really like it.金龙马

JLM

Created By@RichList

Listing Progress

0.00%

MC:

$2.8K

Create My Token

- Reward

- like

- Comment

- Repost

- Share

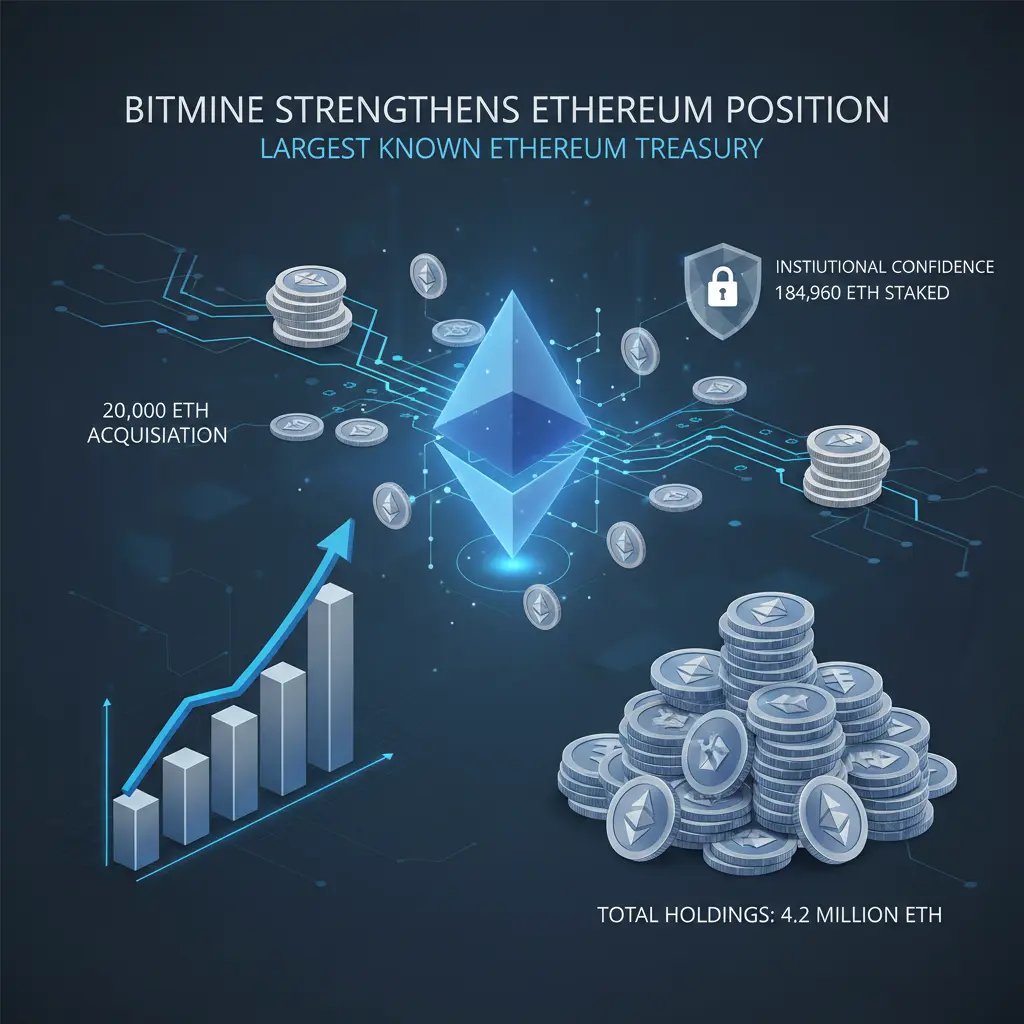

BitMine Strengthens Ethereum Position with Major Acquisition

BitMine has made a significant move in the crypto market, acquiring 20,000 ETH (worth ~$58.22M) on January 27th, 2026. This latest purchase brings their total Ethereum holdings to an impressive 4.2 million ETH, making BitMine the largest known Ethereum treasury.

In addition, BitMine staked 184,960 ETH (~$538M), supporting the Ethereum network and earning staking rewards. This move signals strong institutional confidence in Ethereum and highlights the growing trend of major players participating in Ethereum’s Proof-of-Stake network.

S

BitMine has made a significant move in the crypto market, acquiring 20,000 ETH (worth ~$58.22M) on January 27th, 2026. This latest purchase brings their total Ethereum holdings to an impressive 4.2 million ETH, making BitMine the largest known Ethereum treasury.

In addition, BitMine staked 184,960 ETH (~$538M), supporting the Ethereum network and earning staking rewards. This move signals strong institutional confidence in Ethereum and highlights the growing trend of major players participating in Ethereum’s Proof-of-Stake network.

S

ETH-1,94%

- Reward

- 2

- 2

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

#InstitutionalHoldingsDebate Institutional participation in crypto has reached a stage where it no longer asks for permission—it defines the environment. By February 2026, institutions are not just holders of Bitcoin and Ethereum; they are structural actors shaping liquidity conditions, volatility patterns, and long-term market behavior. The conversation has moved beyond “if institutions matter” to “how their behavior rewires the market itself.”

One of the most important shifts is the scale of custody concentration. With millions of BTC and tens of millions of ETH under institutional managemen

One of the most important shifts is the scale of custody concentration. With millions of BTC and tens of millions of ETH under institutional managemen

- Reward

- 3

- 4

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

Crypto was down again, are you ok? “There were tears that ran down my face, but I did not cry”

- Reward

- like

- Comment

- Repost

- Share

$RIVER 18-21 Resistance Upward Drive

1. Oversold Recovery: Indicator oversold + bullish divergence, high probability of rebound.

2. Ecosystem Expansion: Multi-chain deployment like X Layer, driving growth in TVL and satUSD circulation, boosting RIVER demand.

3. DeFi Revival: Benefiting from cross-chain stablecoin sector, RIVER as a leading project is expected to see valuation recovery.

4. Unlocking and Selling Pressure Absorption: Early circulation is limited, release pace is controllable, and selling pressure weakens after absorption.

Downside Risks

1. Market Drag: Mainstream coins weaken,

1. Oversold Recovery: Indicator oversold + bullish divergence, high probability of rebound.

2. Ecosystem Expansion: Multi-chain deployment like X Layer, driving growth in TVL and satUSD circulation, boosting RIVER demand.

3. DeFi Revival: Benefiting from cross-chain stablecoin sector, RIVER as a leading project is expected to see valuation recovery.

4. Unlocking and Selling Pressure Absorption: Early circulation is limited, release pace is controllable, and selling pressure weakens after absorption.

Downside Risks

1. Market Drag: Mainstream coins weaken,

View Original

- Reward

- like

- Comment

- Repost

- Share

#GoldAndSilverRebound Gold and silver aren’t just metals — they’re macro hedges and long-term safe havens.

After recent pullbacks:

🔹 Gold: Holding key support, positioning for renewed institutional inflows

🔹 Silver: Highly sensitive to industrial demand and global liquidity cycles

Why This Rebound Matters

1️⃣ Macro Context

• Geopolitical tensions and inflation uncertainty continue to support demand

• Central bank policy shifts are creating windows for strategic accumulation

2️⃣ Market Implications

• Investors rotate from high-risk assets into defensive hedges

• ETFs and tokenized metals are

After recent pullbacks:

🔹 Gold: Holding key support, positioning for renewed institutional inflows

🔹 Silver: Highly sensitive to industrial demand and global liquidity cycles

Why This Rebound Matters

1️⃣ Macro Context

• Geopolitical tensions and inflation uncertainty continue to support demand

• Central bank policy shifts are creating windows for strategic accumulation

2️⃣ Market Implications

• Investors rotate from high-risk assets into defensive hedges

• ETFs and tokenized metals are

- Reward

- like

- Comment

- Repost

- Share

$GT is looking interesting because a clear liquidity sweep already happened and price is now shifting from aggressive selling into short-term stabilization.

Market read

I’m seeing heavy sell pressure that pushed price into the lower range and cleared weak hands fast. The sharp drop toward the 7.70 area triggered immediate buying, and price didn’t stay down for long. That tells me sellers are getting exhausted and buyers are starting to step in with confidence.

Structure insight

I’m treating this as a rebound setup after liquidity was taken below the range. Price is now holding above the swee

Market read

I’m seeing heavy sell pressure that pushed price into the lower range and cleared weak hands fast. The sharp drop toward the 7.70 area triggered immediate buying, and price didn’t stay down for long. That tells me sellers are getting exhausted and buyers are starting to step in with confidence.

Structure insight

I’m treating this as a rebound setup after liquidity was taken below the range. Price is now holding above the swee

GT-1,94%

- Reward

- 1

- Comment

- Repost

- Share

Not everything needs to be visibleEspecially finance on-chainMost privacy leaks don’t start with exploitsThey start with ledgers that sit still and show everything by defaultMiden, built by @0xMiden keeps financial state moving instead of exposedNo permanent public balances, no fixed transaction trails and disclosure exists only when it’s needed.Good privacy is quiet.

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More6.03K Popularity

4.23K Popularity

3.31K Popularity

1.62K Popularity

2.44K Popularity

Hot Gate Fun

View More- MC:$2.77KHolders:00.00%

- MC:$2.82KHolders:20.12%

- MC:$2.79KHolders:10.00%

- MC:$3.33KHolders:33.33%

- MC:$2.78KHolders:10.00%

News

View MoreData: 184.03 BTC transferred out from the Royal Government of Bhutan, worth approximately $14.08 million

6 m

Spot silver surges 5% intraday, currently at $89.48 per ounce

6 m

South Korea's first violation case of the "Virtual Asset User Protection Act" verdict, with the main offender sentenced to 3 years for manipulating the coin price

8 m

Preview: The US January ADP employment figures will be released tonight at 21:15

8 m

OSL Group will hold a series of themed events called "No Ramp" during Consensus Hong Kong 2026.

15 m

Pin