bullish rising channel

What Is a Bullish Ascending Channel?

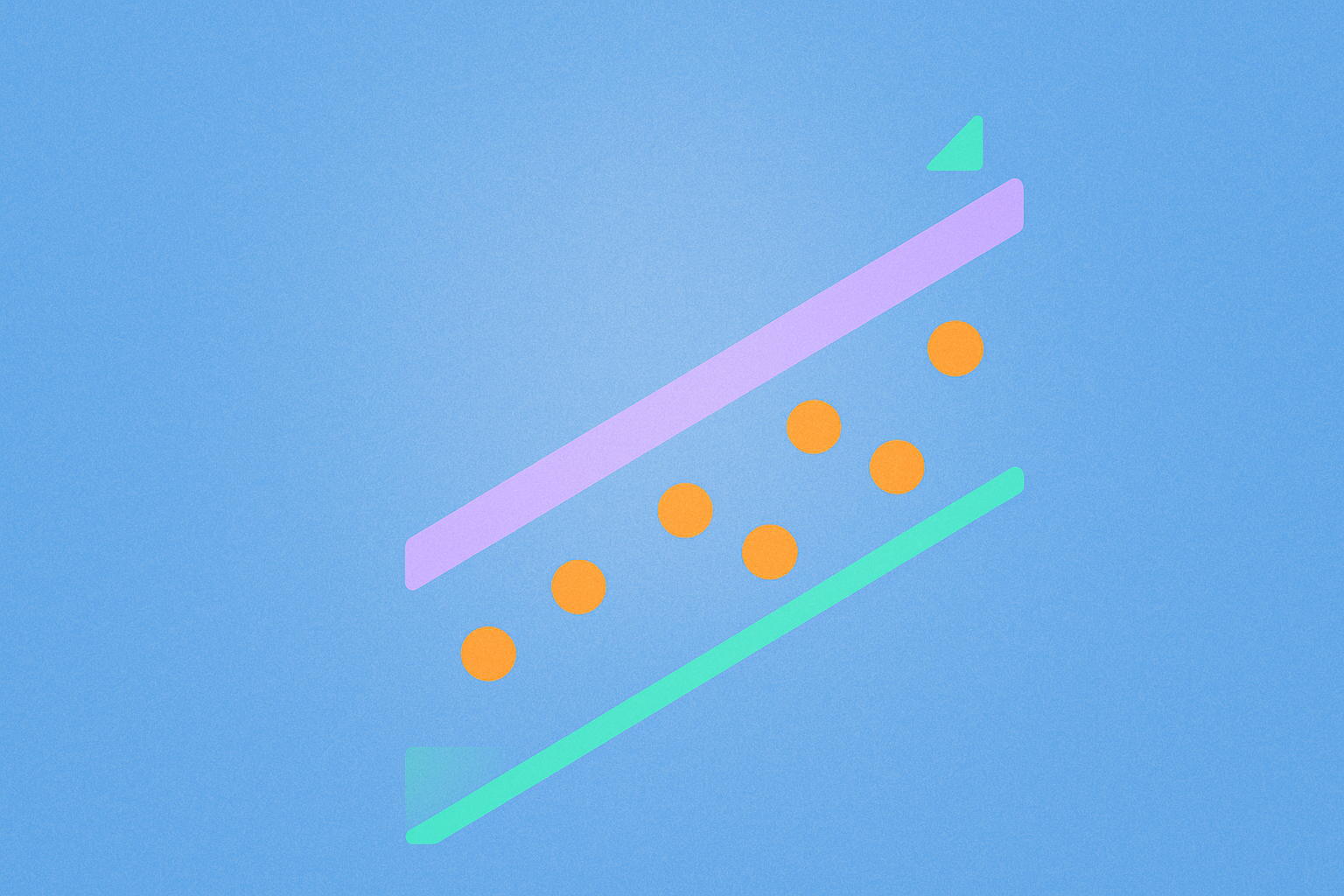

A bullish ascending channel is a price pattern where an asset’s price moves upward within two rising, nearly parallel boundaries.

This pattern is defined by two trendlines: a lower boundary (acting as “the floor”) and an upper boundary (acting as “the ceiling”). The lower boundary repeatedly supports price pullbacks and is often considered a support level; the upper boundary frequently restricts upward moves and serves as a resistance level. When both price highs and lows consistently rise and the price oscillates between these two lines, a bullish ascending channel is formed.

To confirm the validity of this pattern, three criteria are typically checked: at least two higher lows can be connected to form the lower boundary; at least two higher highs can be connected to form the upper boundary; and the two lines have similar slopes, running parallel or nearly parallel to each other.

Why Should You Understand Bullish Ascending Channels?

Recognizing bullish ascending channels helps you identify moderate uptrends and optimal buy/sell zones.

In crypto markets, prices rarely move straight up. Instead, they often “climb” within channels. Channels introduce a “range-based mindset”: prices near the lower boundary usually offer better value, while those near the upper boundary present less upside and higher risk of pullback.

For risk management, channels provide natural reference points. A breakdown below the lower boundary may signal a change in trend, suggesting it’s time to reduce positions or set stop-losses. Conversely, a breakout above the upper boundary with strong momentum can indicate increased bullish strength, offering an opportunity to add to positions or wait for a retest confirmation.

How to Draw a Bullish Ascending Channel

Enclose the main price action with two upward-sloping parallel trendlines.

- First, identify two or three successively higher lows. Connect them with a straight line to form the lower boundary—your potential support zone (where prices often bounce).

- Copy this line and shift it upward in parallel to connect two or three higher highs. This creates the upper boundary—your potential resistance zone (where upward moves tend to stall).

- Validate the channel: Price should touch both lines several times with clear reactions (bouncing near the lower boundary, pulling back from the upper). The distance and slope between the lines should remain fairly consistent.

- Choose a timeframe: Daily/4-hour charts suit swing trading; 1-hour/15-minute charts are for short-term trading. Smaller timeframes have more noise and more frequent false breakouts.

- Update dynamically: Adjust anchor points moderately as new highs or lows form to keep the channel relevant, but avoid frequent changes that reduce consistency.

If using charting tools, platforms like TradingView offer a “Parallel Channel” drawing tool; on Gate’s advanced charting, you can use trendline copy-and-shift methods.

Typical Behavior of Bullish Ascending Channels in Crypto

This pattern is common during uptrends in spot markets, derivatives, and highly liquid major cryptocurrencies.

In spot trading, leading coins or strong narrative tokens often form “stair-step” ascending channels during periods of positive expectations yet to trigger explosive moves. Prices find support near the lower boundary and rally toward the upper boundary on increasing volume, but may not always break out, resulting in an overall upward drift through repeated swings.

In derivatives trading, channels provide reference points for “buying dips” near the lower boundary and “scaling out” near resistance. Bulls often take small initial positions close to support, adding more on confirmation; leverage is managed carefully near resistance to avoid liquidation on pullbacks.

For algorithmic trading strategies, channels work well with grid bots. For example, on Gate’s spot grid feature, you can set your grid’s upper and lower limits to align with the channel’s boundaries and adjust grid density based on channel width. If a 4-hour channel is roughly 10% wide for a particular token, you might space your grids 0.8–1.2% apart to repeatedly capture price swings within that range.

On-chain assets (such as governance tokens) also show channel patterns when fundamentals are steadily improving but lack single catalyst events. A breakout with increased volume often follows positive news or capital inflows.

How to Trade Using Bullish Ascending Channels

Combine entry, stop-loss, take-profit, and position management with disciplined execution.

- Entry strategy: Watch for “confirmation signals” as price nears the lower boundary—such as a high-volume bullish candlestick or formation of a small-scale higher low above support. If confirmation is lacking, reduce position size or wait for another retest.

- Stop-loss placement: Set stops just below the lower boundary as a safety buffer—commonly 0.5–1.0 ATR (Average True Range) beneath support, or a fixed percentage such as -1.5% to -3%, adjusted for volatility.

- Taking profit and scaling out: Gradually reduce positions near the upper boundary; if price breaks out above resistance on strong volume, consider holding some position and adding more after a successful retest, aiming for an accelerated uptrend.

- Breakout strategy: Valid breakouts are indicated by closing prices above the upper boundary, surging volume, and subsequent successful retests. For false breakouts (where price quickly falls back into the channel), revert to range trading strategies.

- Position sizing & leverage: Within channels, trade swing moves using moderate leverage and staggered entries/exits for stability. For derivatives on Gate, combine “limit orders + stop orders” to avoid slippage and missed entries.

On Gate’s platform, you can implement this as follows:

- Step 1: Open your target pair’s 4-hour or daily chart and mark the boundaries using the Parallel Channel or trendline tool.

- Step 2: Set limit buy orders near the lower boundary along with stop orders just below support.

- Step 3: Place staggered sell orders near resistance; if price breaks out, keep part of your position and trail your stop up to the new confirmation level.

Recent Trends & Data on Bullish Ascending Channels

In the past year, traders increasingly reference channel patterns during sideways uptrends, placing greater emphasis on parameterized risk management.

- Timeframes & data sources: As of January 2026, analyses primarily reference full-year 2025 or recent half-year reviews (H2 2025), using public charting platforms (like TradingView charts/scripts) and exchange-exported OHLC data. Due to differences in scripts and annotation methods, readers are encouraged to verify patterns using consistent rules.

- Volatility & channel width: Historical samples show that during moderate volatility phases, daily channel widths typically range from 8%–15%; in high-volatility phases, widths expand to 15%–25%. For your chosen tokens, calculate average distance between channel boundaries for custom parameters.

- Post-breakout performance: Backtests using public pattern-recognition scripts indicate that after an upward breakout from a channel, 50%–60% of cases see positive returns within the next 10–20 candles; this win rate falls to 45%–50% in choppy markets or when false breakouts are common. Use “Q4 2025” lookbacks with consistent parameters for verification on your own assets.

- Risk management parameter trends: In H2 2025, more trading education resources recommend ATR-based stop-losses (e.g., 0.7–1.2×ATR) over fixed percentages—especially for highly volatile coins—to reduce forced stop-outs.

How to analyze your asset’s data:

- Choose your time window: e.g., “past year (2025-01 to 2025-12)” or “past six months (2025-07 to 2025-12).”

- Annotate channels: Use consistent rules to draw each valid ascending channel; record average channel width and number of touches.

- Record events: Track returns and maximum drawdowns for 10/20 candles after valid breakouts to build your own win rate vs. drawdown table.

Common Mistakes With Bullish Ascending Channels

Confusing ascending channels with rising wedges, chasing breakouts at resistance, or ignoring false breakouts are high-frequency errors.

Ascending channels have roughly parallel boundaries; rising wedges feature converging lines with decreasing volume and waning momentum—breakout failures are more common in wedges. Mislabeling patterns leads to wrong expectations.

Chasing entries at the upper boundary yields poor risk/reward. It’s smarter to look for value near support or after confirmation on retests—with stop-losses to control risk.

Ignoring false breakout risk leads to buying tops. If a breakout on high volume quickly reverses back into the channel, acknowledge it as invalid and reduce exposure accordingly. Use ATR-based stops, staged position management, and conditional orders to combat noise.

Finally, remember that channels aren’t “crystal balls.” They visualize current market rhythm but should be used alongside fundamentals, liquidity conditions, and risk management tools for stable win rates and returns.

Related Terms

- Bullish Ascending Channel: A price pattern where price fluctuates between two parallel rising trendlines—indicating strong upward market momentum.

- Trendline: A straight line connecting price highs or lows—used to identify and confirm market direction.

- Support Level: A psychological threshold where falling prices often bounce back up.

- Resistance Level: A psychological threshold where rising prices often face pullbacks.

- Breakout: When price crosses a key support or resistance level—often signaling the start of a new trend.

FAQ

What’s the difference between the upper and lower boundaries in a bullish ascending channel?

The upper boundary acts as resistance during rallies; the lower boundary acts as support during pullbacks. Both lines extend upward in parallel. When prices oscillate within the channel, touching resistance often prompts corrections while touching support often triggers rebounds. Knowing this distinction helps you set more precise stop-loss and take-profit levels.

What does it mean when price breaks out of a bullish ascending channel?

A breakout above the upper boundary usually signals continued bullish momentum—potentially starting a stronger uptrend; breaking below support suggests possible trend reversal and warrants caution. However, beware of false breakouts—always wait for confirmation and check whether volume supports the move before acting.

How can beginners quickly identify bullish ascending channels?

Find two recent swing lows and connect them with a straight line as support; then draw a parallel line from the first low through its corresponding high as resistance. If subsequent price action oscillates between these lines, you have a bullish ascending channel. Gate’s charting tools provide trendline drawing features to help visualize this easily.

Are bullish ascending channels always reliable?

No. The validity of any channel depends on market conditions and liquidity changes—the longer it lasts with repeated tests, the more reliable it becomes. But all technical patterns can fail due to unexpected events—never rely on just one pattern; combine it with other indicators like volume and support/resistance levels for better judgment.

How should risk management be set within bullish ascending channels?

A common approach is placing stop-loss orders just below support (lower boundary) to protect capital, while setting take-profit targets near resistance (upper boundary) to lock in gains. It’s advisable to keep initial position sizes within 2–5% of your account so that even if your trade thesis fails, losses remain manageable.

References & Further Reading

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?