XRP Price Prediction: Federal Reserve Access Could Push XRP Toward $10 With Over 300% Upside Potential

U.S. Regulatory Shift

The United States is witnessing a rapid transformation in its digital asset regulatory landscape. Recently, the Federal Reserve has reportedly been researching ways for fintech and crypto companies to access its payment systems directly—a move that could revolutionize blockchain payment operations nationwide.

In this context, Ripple, the company behind XRP, has formally applied for a Federal Reserve master account, making it one of the first blockchain firms poised to connect directly with the traditional financial sector. If approved, Ripple would gain direct access to the FedNow system, enabling faster and lower-cost settlements, while expanding into digital asset custody and tokenized asset services.

Ripple’s Strategic Edge

If granted Federal Reserve approval, Ripple will strengthen its position in the stablecoin and cross-border payments markets. XRP is engineered as an efficient, low-cost settlement token for institutional transfers. With direct master account connectivity, Ripple can deliver real-time settlement, eliminating the need for intermediary banks.

Ripple already complies with the ISO 20022 financial messaging standard and is pursuing a U.S. banking license, underscoring its technological and regulatory leadership. These advantages lay the groundwork for institutional adoption. If Ripple successfully integrates with traditional payment infrastructure, XRP will serve as a critical bridge for global real-time settlement and liquidity—not just as a cryptocurrency.

Evernorth Debuts on NASDAQ

Evernorth, a company specializing in XRP treasury management, was recently listed on NASDAQ. Unlike private OTC acquisitions, Evernorth sources XRP directly from exchanges such as Coinbase, Uphold, and Kraken. Each purchase generates genuine market demand, potentially resulting in a supply squeeze as more institutions buy XRP from public exchanges instead of through private discounted deals.

DeepSeek AI Projection

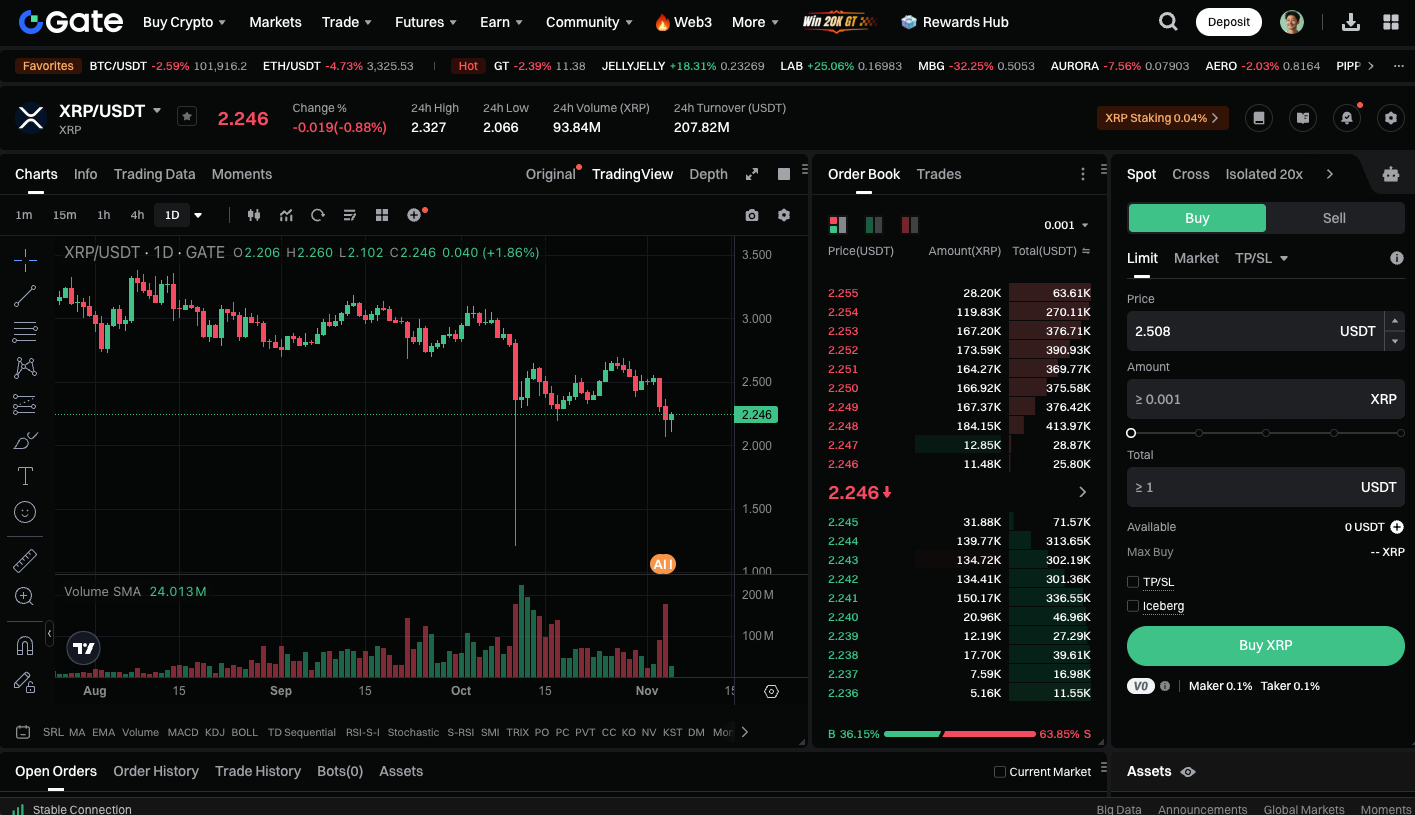

DeepSeek AI, a leading Chinese artificial intelligence model, projects that XRP could see significant growth within the next year, forecasting a price range of $5 to $10. With its current value at approximately $2.5, this suggests a potential gain of 300% to 400%. This bullish outlook—driven by relaxed U.S. regulation, Ripple’s financial integration, and new institutional demand from NASDAQ-listed firms—is fueling long-term optimism for XRP.

Trade XRP spot instantly: https://www.gate.com/trade/XRP_USDT

Conclusion

XRP is at a historic inflection point. If Ripple secures master account status with the Federal Reserve and price trends follow AI projections, XRP could reach the $10 milestone by the end of 2025. This would represent the convergence of technology and regulation. It could also signal the arrival of on-chain settlement for traditional finance. As confidence in the market improves, the long-term value of XRP is being reassessed by investors.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution