Which Cryptocurrency Is Often Called Digital Gold?

The Concept of Digital Gold

Digital gold is a metaphor referring to cryptocurrencies that serve functions similar to gold:

- Scarcity: The supply is capped and cannot be expanded at will.

- Store of Value: Retains value over time and is resistant to inflation-driven depreciation.

- Market Acceptance: Broadly recognized by investors, offering stable liquidity and high levels of trust.

In the crypto market, assets that embody these traits are known as digital gold.

Which Cryptocurrency Is Considered Digital Gold?

Bitcoin is unequivocally the most widely regarded digital gold asset in the cryptocurrency market. Since its launch in 2009, its distinctive features have made Bitcoin the preeminent store of value in the digital asset space.

Why Is Bitcoin Called Digital Gold?

- Limited Supply

Bitcoin’s maximum supply is fixed at 21 million coins, ensuring it cannot be inflated. This inherent scarcity strengthens its ability to preserve value and fosters market consensus, much like gold. - Decentralization and Security

Bitcoin operates on a decentralized blockchain network, preventing any single entity from controlling or tampering with the issuance of new coins. Transactions are secured by the Proof-of-Work (PoW) consensus mechanism, ensuring reliability and immutability akin to gold. - Divisibility and Liquidity

Bitcoin is divisible down to 0.00000001 BTC (1 Satoshi), lowering barriers to entry and making transactions and payments easier. Even small investors can access this market for storing value. - Global Recognition

As the first decentralized cryptocurrency, exchanges, investment funds, and institutional investors widely accept Bitcoin. This broad recognition mirrors gold’s standing as a global safe-haven asset. - Inflation Resistance

Bitcoin’s fixed supply and scheduled halving events (block rewards halve every four years) give it anti-inflation features. In periods of fiat currency depreciation or economic instability, Bitcoin is frequently viewed as a means of safeguarding assets.

Bitcoin Investment and Applications

- Investment Vehicle

Bitcoin is often used for long-term investment and asset allocation, particularly during economic uncertainty or times of high inflation when investors seek safe-haven assets. - Payment Method

Despite volatility, a growing number of merchants accept Bitcoin as payment, with its use expanding in certain types of transactions. - Financial Derivatives

Bitcoin has inspired the development of futures, options, ETFs, and other financial derivatives, enabling greater liquidity and diverse investment strategies.

Challenges of Digital Gold

- Significant Price Volatility: Prices may swing dramatically in the short term, so investors should exercise caution.

- Regulatory Uncertainty: Legal frameworks for Bitcoin vary widely by country, impacting its usage and trading.

- Cybersecurity Risks: Poor wallet management or exchange security breaches can result in asset loss.

- Adoption and Education: Many investors remain unfamiliar with cryptocurrency concepts, highlighting the need for further education and broader adoption.

Despite these challenges, Bitcoin’s scarcity and decentralized nature solidify its position as the leading store of value in the digital asset world.

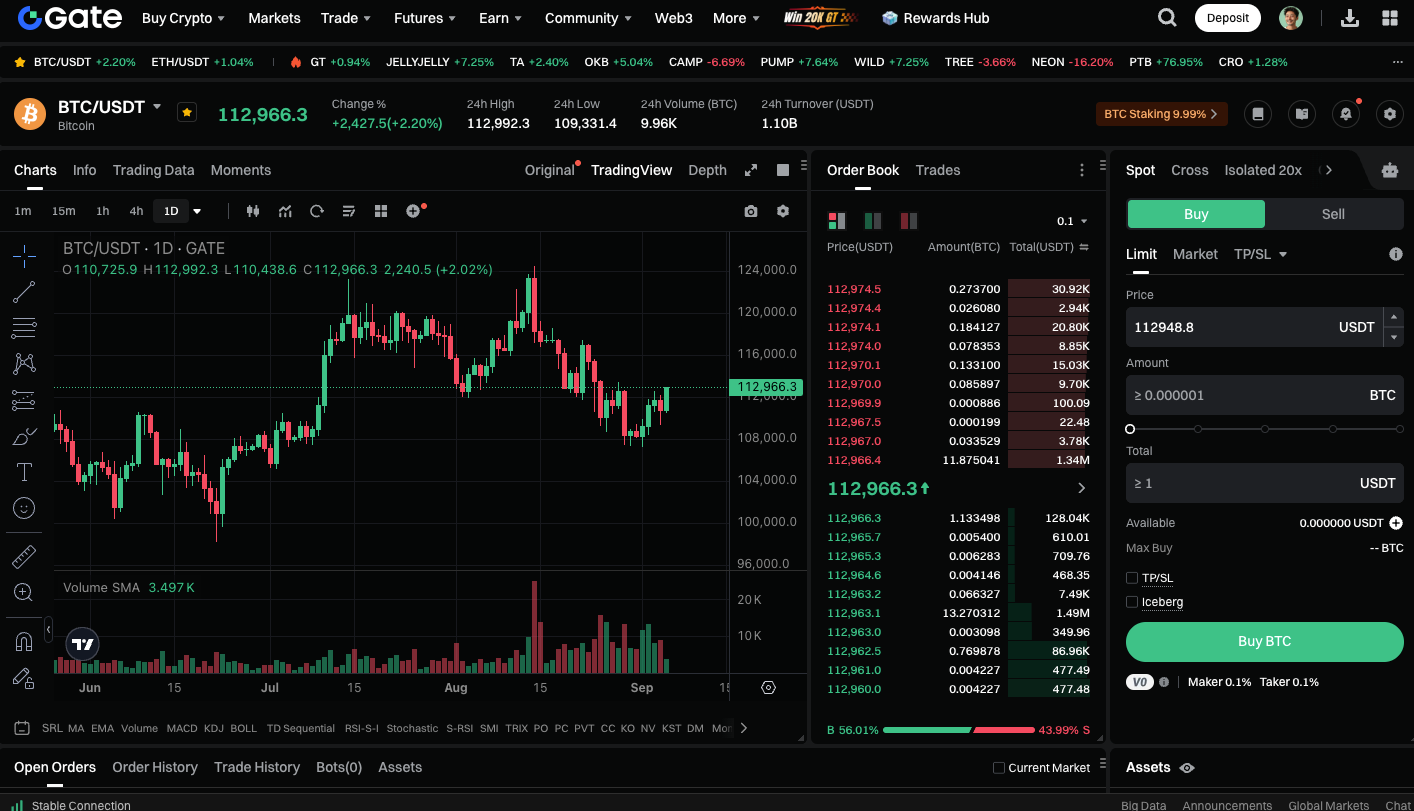

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Summary

Bitcoin’s status as digital gold is well-founded. Through its scarcity, decentralization, security, liquidity, global acceptance, and inflation-resistant properties, Bitcoin delivers value storage akin to gold. Its digital nature also supports enhanced ease of transferring assets and sophisticated investment strategies. For investors navigating Web3 or the broader crypto market, understanding Bitcoin’s role as digital gold provides deeper insight into the digital asset ecosystem and future investment opportunities.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution