The Selling Nobody Can Explain

Source: TradingView, CNBC, Bloomberg, Messari

The Bottom of the Risk Spectrum, I Guess

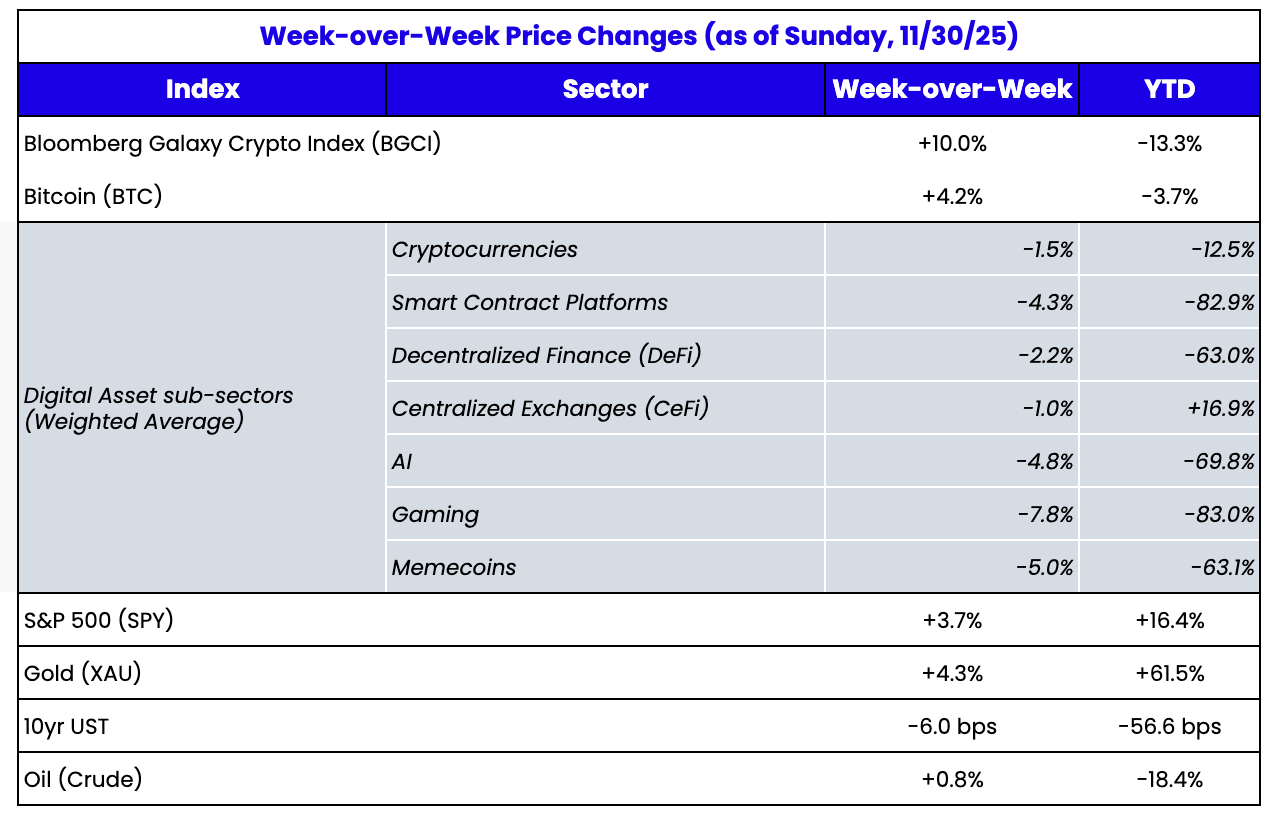

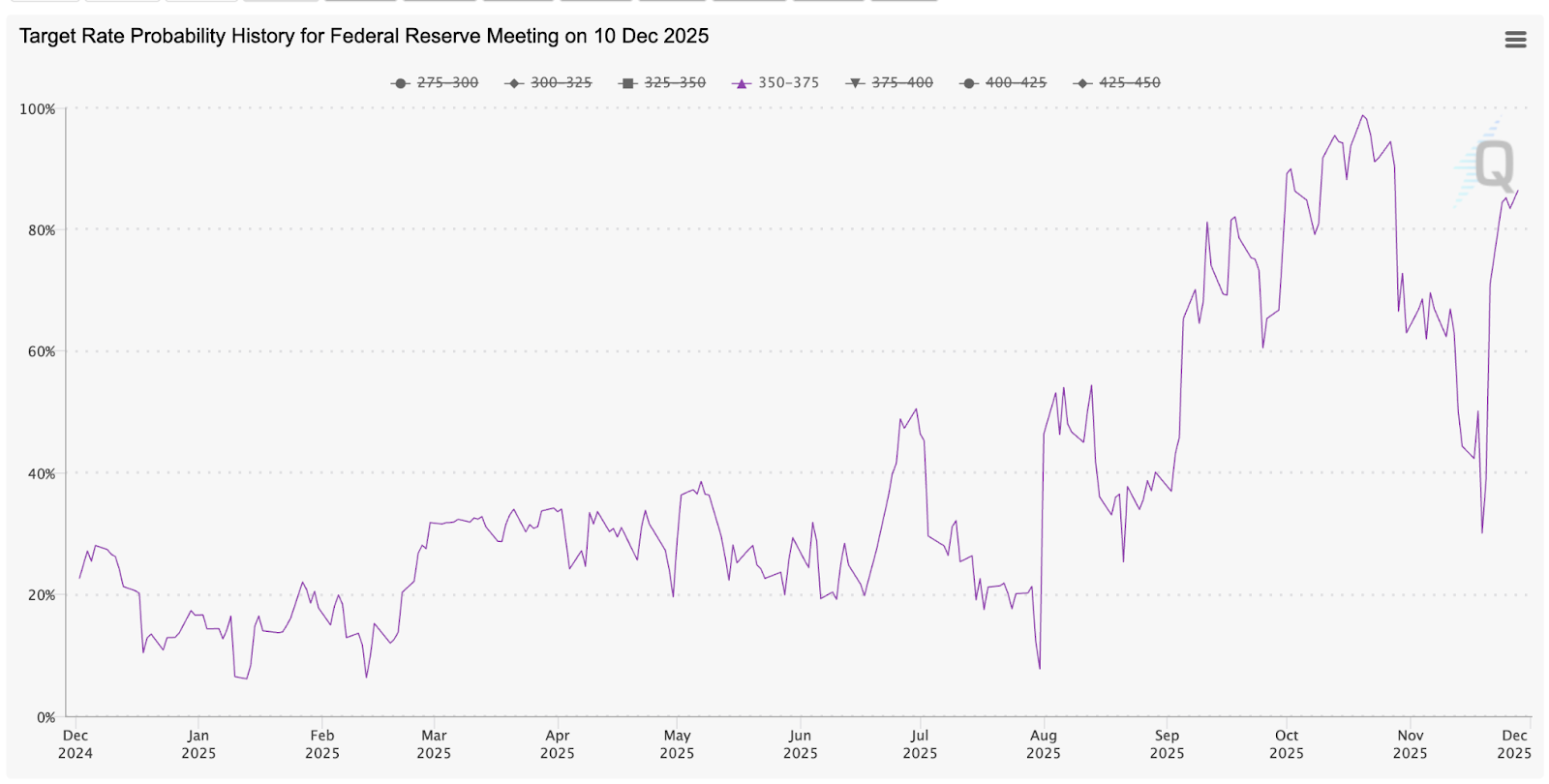

The digital assets market has been down for 7 of the past 8 weeks, but staged a brief rally during Thanksgiving week, only to plunge Sunday night again as Japanese markets opened (Nikkei down, JPY bond yields up). While the initial crypto slide happened after Binance and other exchanges broke on October 10th, three weeks before the FOMC meeting, most of the weakness in November was attributed (ex post) to the hawkish comments by Fed Chairman Powell. Expectations of a December rate cut plummeted throughout November, from almost a 100% chance of a rate cut, to as low as 30%. This sent equity and crypto markets lower throughout the month.

But a funny thing happened in the last week of November. Core PPI inflation fell to 2.6%, below expectations of 2.7%, and the little data we have on the labor market post-government shutdown indicate it is slowing, if not collapsing. Rate-cut expectations for December quickly climbed back to almost 90%, and equities staged a fierce rally to close November in positive territory. Further, President Trump has hinted at knowing who the next Fed Chairman will be, and prediction markets are basically fully pricing in Kevin Hassett, who is known for pushing faster rate cuts in alignment with the Trump admin, and is largely a macro bull.

Source: CME Fed Watch

So why are digital assets still selling off on every piece of bad news but failing to rally with good news?

I have no idea.

While we’ve seen similar periods like this in the past, where everything is lining up bullish except price (May/June 2021 and April 2025, for example), this feels different. There seems to be little interest in investing in most digital assets right now, but no one we speak to can really put a finger on why. And that is very different from years past. Most of the time, whether we are ahead of a big move lower or behind the curve, we can at least talk to other funds, exchanges, brokers, and industry leaders to figure out why this is happening. But thus far, this selloff seems to be happening without much rationale.

Recently, Bill Ackman commented that his Freddie Mac and Fannie Mae investments are suffering due to their correlation with crypto prices. And while that makes little sense fundamentally since these assets are quite different with completely different investment theses, it does make sense when you think about all of the ways TradFi, retail, and crypto investors are now converging. What was once a pretty isolated industry now overlaps with everything else. And while that is most definitely a good thing long-term (since it makes no sense to have a completely isolated sleeve of the financial industry), it is causing major problems in the short term, as investments in crypto seem to be the first to go in any diversified portfolio. Moreover, it helps explain why participants in the crypto industry don’t really understand where the selling is coming from – most likely, it’s not coming from within the industry at all. The crypto world is very transparent, often to a fault, whereas TradFi remains more of a black box. And that black box is dominating flows and activity right now.

A Few Possible Explanations for the Weakness

Aside from the obvious (lack of education and a lot of bad assets), there has to be a better explanation for why crypto is in such a downward spiral.

We’ve argued for a long time that assets have to have some combination of financial, utility and social value in order to have any value at all. And the biggest problem with most digital assets is that the majority of the value comes from social value, which is the hardest of the three to put a value on. In fact, in our piece earlier this year, when we did a sum-of-the-parts analysis of Layer 1 blockchain tokens (like ETH and SOL), we had to back into the social value component after deriving the much smaller financial and utility value components.

So with sentiment at the lows, you’d expect tokens that derive most of their value from social value to be plummeting right now (and most are - think Bitcoin, L1s, NFTs, and memecoins). Conversely, you’d expect those assets with a higher percentage of value from financial and utility sources to outperform – while some do (BNB), most do not (DeFi tokens, PUMP). So that’s a bit odd.

You’d also expect the cavalry to arrive to defend prices a little, but that isn’t happening much either. In fact, if anything, we’re seeing more investors pile into the weakness, expecting more weakness, even if there is no rationale beyond momentum and technical analysis. Our friends at Dragonfly, a prominent crypto VC, did come to the rescue of Layer-1 token valuations with a well thought out piece, which was at least indirectly influenced by our SOTP analysis on L1s. Dragonfly basically sides with the last 2 paragraphs of our piece, which state that the current valuations based on today’s revenues and utility value are irrelevant, because the entire world’s assets will one day be moving on blockchain rails. And while that doesn’t mean that any individual L1 token is cheap, collectively it makes the total value of all blockchains cheap, and betting on any one L1 token is essentially a probability function of its success. Essentially, you have to think much bigger about where this industry is headed rather than focusing on current usage. And he’s right about that. If prices keep falling, I’d expect to see more of these “in defense” pieces written.

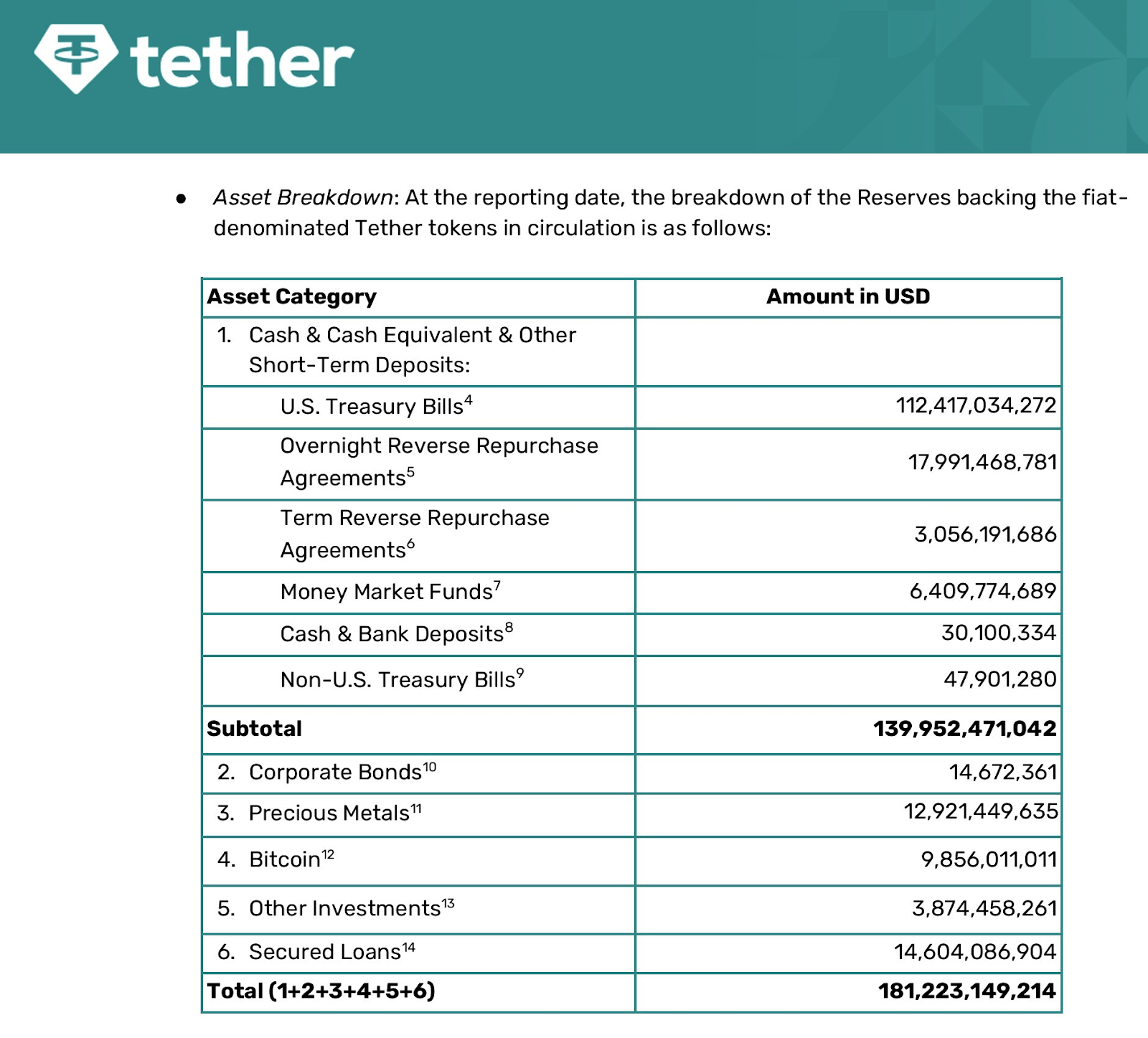

And of course, it wouldn’t be a crypto selloff without some hit pieces on Microstrategy (MSTR) and Tether. Even though we’ve debunked all the MSTR issues numerous times (they will never be forced sellers), these attacks keep coming. The Tether FUD is more timely. Somehow, we’ve gone from “Tether is raising $20 billion at a $500 billion valuation” to “Tether is insolvent” in a matter of just a few weeks.

S&P recently downgraded Tether to junk, and Tether’s latest attestation report (dated 9/30/25) shows that the USD stablecoin is 70% backed by cash and cash equivalents, and 30% backed by gold, bitcoin, corporate loans, plus an equity buffer.

Source: Tether

I guess this is freaking people out, even though it seems perfectly in line with what you’d expect from a private company with no regulations on asset mix. And of course, being almost fully collateralized with cash is certainly a lot better than how the entire fractionalized banking system works. But I won’t try to compare USDT to a bank, at least until the GENIUS ACT goes into effect.

However, I will say there is no scenario in which more than 70% of USDT is redeemed overnight, which is the only way they’d ever have a liquidity issue. So any questions about their liquidity are just silly. A solvency issue is different, though. If 30% of their holdings in BTC, Gold, and loans lose money, they’d have to dip into other assets the parent company holds that aren’t explicitly backing USDT. Given how profitable the parent company is, this also isn’t much of an issue, and I doubt any serious investors think it is an issue. But still, Tether CEO Paolo Ardoino still had to explain this. USDT has not depegged even a little, because, again, this is a non-issue, but it may be causing some market angst? I suppose the only question I have is why bother owning these other investments in the first place if you know the market just wants you to own cash & cash equivalents, and Tether can still make an obscene amount of money just clipping the coupons on government interest (3-4% annual interest on $180B of assets is north of $5B in profits per year).

So again, ex post, we can at least try to rationalize some of the moves lower in the market. But this persistent weakness certainly has us scratching our heads.

Disclaimer:

- This article is reprinted from [ar.ca]. All copyrights belong to the original author [Jeff Dorman, CFA]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market