The Rise and Fall of Huiong in Phnom Penh: The “Alipay of Cambodia” Died Last Night

December 1, 2025, Phnom Penh.

The air along the Mekong River is still humid and hot, but for the hundreds of thousands of Chinese residents, this winter feels far colder than any before.

This day will be forever etched in the collective memory of Cambodia’s Chinese business community.

At dawn on Sihanouk Boulevard, the Huiwang headquarters—once hailed as the “city’s sleepless financial totem”—suddenly went silent overnight. The usual roar of armored cash trucks had vanished, replaced by a frigid “Withdrawal Suspension Notice” posted on the glass doors, and hundreds of anxious, frozen faces gathered outside.

History often repeats itself. This moment recalls the eve of the Gold Yuan collapse in 1948 Shanghai, or Beijing’s Financial Street during the 2018 P2P meltdown.

The collapse didn’t come out of nowhere. For 48 days and nights, rumors of the impending downfall of this so-called “Cambodian Alipay” had spread like wildfire through Phnom Penh’s underground money shops and Telegram groups. From joint US-UK sanctions on the Prince Group, to the seizure of $15 billion in crypto assets, to Huiwang’s USDH stablecoin plummeting on the black market, every signal pointed to one outcome: a liquidity crisis.

Huiwang’s shutdown wasn’t just a corporate death—it marked the end of a distorted business era.

Over the past six turbulent years, Huiwang was the vital artery of Cambodia’s underground economy. It linked Phnom Penh’s casinos, Sihanoukville’s industrial parks, and even overseas scam operations, creating an offshore financial island seemingly immune to the SWIFT system.

Its collapse locked up the fortunes and futures of tens of thousands of Chinese entrepreneurs and signaled the total failure of the “outlaw logic.”

The belief that technology alone could bypass rules, or that hiding in the jungle would keep you safe from regulators, finally crashed against the hard reality of geopolitics and compliance.

This was a long-overdue reckoning—a bloody rite of passage for the first generation of Chinese internet adventurers abroad.

Paradise Lost for the Tech Elite

Looking back at Huiwang’s ascent, it began not with malice, but with a relentless pursuit of efficiency.

In 2019, China’s internet traffic boom peaked, competition intensified, and “going global” became the new mission for elite tech talent. A cohort of mid-level engineers and product managers from major tech firms landed at Phnom Penh airport, bringing advanced code and visions of inclusive finance.

At the time, Cambodia’s financial system was stuck in the Jurassic era.

Banks were scarce, service was slow, and foreign exchange controls were strict. For the hundreds of thousands of Chinese involved in trade, dining, and construction, moving funds was a nightmare. They either risked carrying heavy cash or paid exorbitant underground remittance fees.

To Chinese internet professionals used to QR code payments, this backwardness wasn’t just a pain point—it was a gold mine of untapped opportunity.

Deploying mature Chinese mobile payment technology to disrupt Cambodia’s outdated financial system became the unspoken mission of these overseas elites.

And they succeeded spectacularly. At launch, Huiwang Pay won over the market with “brutal efficiency”: a fully Chinese interface, 24/7 customer support, and instant settlement—delivering an Alipay-like experience with pixel-perfect precision.

The real breakthrough was its ultra-low entry barrier. In a country where multiple layers of verification were the norm, Huiwang required no complex ID checks or tax documents—just a phone number, and funds flowed freely through Phnom Penh’s underground networks.

This approach drove massive commercial success. In just two years, Huiwang became woven into every aspect of Chinese life in Phnom Penh—from buying milk tea to paying contractors, it became the de facto “Chinese central bank” in Cambodia.

But the neutrality of technology is one of modern business’s greatest myths.

As these product managers, obsessed with “user experience,” raced through Phnom Penh’s lawless landscape, they quickly encountered temptations unimaginable back home—a tidal wave of illicit activity.

In the world of legitimate business, risk controls are the core barrier for payment companies. In Phnom Penh, the most profitable clients were gambling syndicates and telecom scam parks, whose biggest demand was “risk control exemption.”

For these giants, transaction fees didn’t matter—concealment and security did. They didn’t want a compliant e-wallet; they wanted an underground river to instantly launder hundreds of millions in dirty money.

This posed a classic ethical dilemma: when growth KPIs clash with compliance, which side should technology serve?

Huiwang chose growth.

They began “optimizing” money laundering with internet logic. To keep their top clients, they removed facial recognition and raised transfer limits. In their minds, this was still “serving users” and “solving pain points.” They rationalized it with “technology is innocent,” convincing themselves they were just building roads—what traveled on those roads, be it goods or dirty money, wasn’t their concern.

This warped “instrumental rationality” transformed Huiwang from a convenient payment tool into Southeast Asia’s largest money laundering hub.

They saw themselves as the Jack Ma of Phnom Penh, transforming business with technology—unaware that, in a lawless jungle, they were becoming the Du Yuesheng of the Mekong.

And that was only the beginning. After opening payment channels, these clever minds found an even darker, more lucrative path—applying the “e-commerce escrow” model to human trafficking.

Evil as an SKU

Every internet business textbook touts the “platform model” as the final stage of commercial evolution. Once Huiwang controlled payments, its ambitions naturally extended to transactions.

In Phnom Penh’s jungle of fraud and violence, the rarest resource wasn’t cash or people—it was trust.

This was a classic dark forest: smugglers took money but didn’t deliver people, parks received people but didn’t pay, money laundering brokers disappeared with funds. Double-crossing risks crippled black market efficiency.

To product managers, this wasn’t evil—it was the perfect “trust mechanism optimization.”

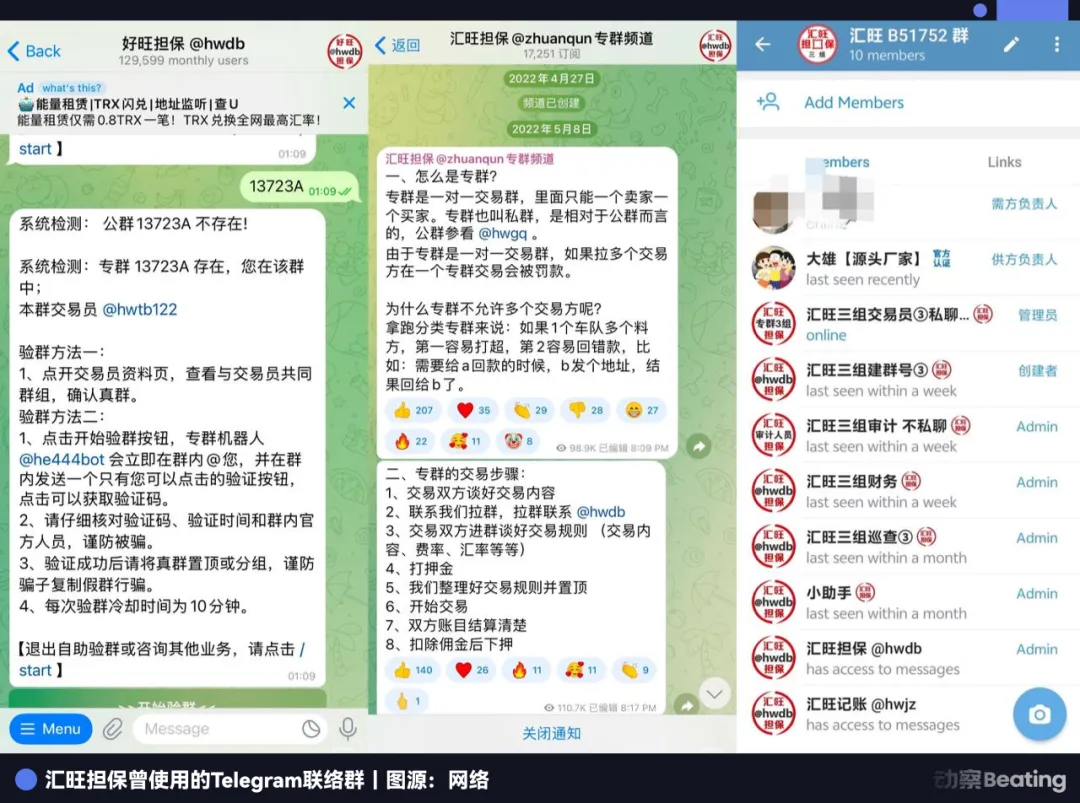

In 2021, Huiwang Escrow launched.

The product logic was a near-perfect clone of Taobao: buyers (scam parks) escrow funds with the platform, sellers (traffickers) deliver the “goods,” buyers confirm receipt, and the platform releases funds and takes a commission.

This system, used in Hangzhou to sell dresses, was used in Sihanoukville to buy and sell “front-end developers.”

In thousands of active Telegram groups, people were reduced to cold, standardized SKUs.

Each supply-demand post was packaged like a Double 11 product listing:

“Java expert, two years at a major tech firm, obedient, passport in hand, flat price $20,000.”

“Wanted: European/American promotion team, with resources, price negotiable, escrow available.”

For the tech staff maintaining these systems, it was just code and data. They didn’t see how “goods” were stuffed into vans or hear the screams under electric batons. Their only concern was backend order volume and rising GMV.

According to blockchain analytics firm Elliptic, since 2021, the platform has processed at least $24 billion in crypto transactions. This isn’t just a number—it’s the sum of countless lives reduced to chips.

Even more chilling was the relentless product iteration.

To meet the parks’ demand for tracking escapees, Huiwang Escrow even launched a “bounty” service.

In these secret groups, violence became a menu item: “Capture a runaway programmer, $50,000 USDT; provide a valid location, $10,000 USDT.”

This unchecked expansion inevitably attracted law enforcement. In February 2025, under FBI pressure, Telegram banned Huiwang Escrow’s main channel. This should have been a fatal blow, but the black market proved more resilient than anyone imagined.

Just a week later, hundreds of thousands of users seamlessly migrated to Potato Chat.

In the community, Telegram is “Paper Plane,” Potato Chat is “Potato.” Unlike the plane in the sky, the potato is buried deep underground—harder to track, harder to regulate.

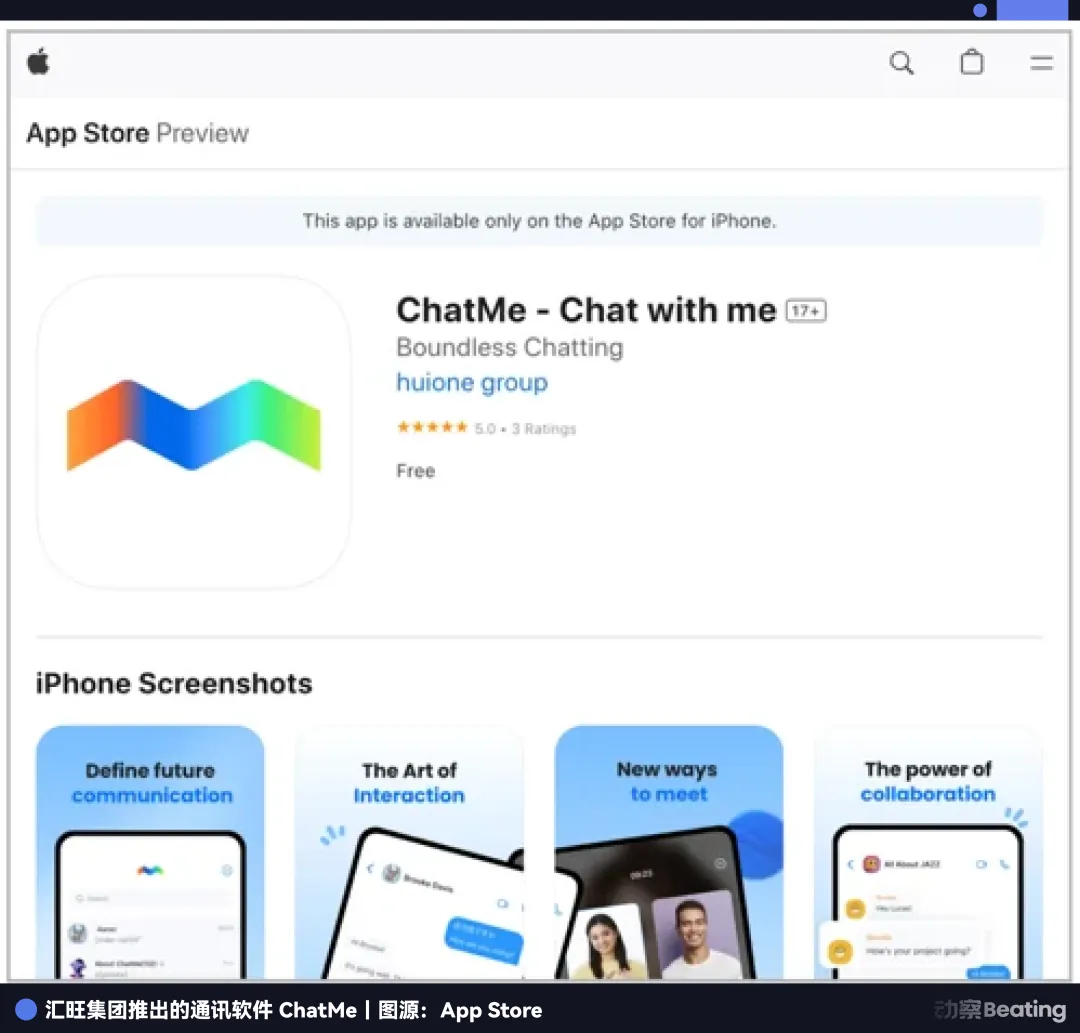

In this migration, Huiwang Group wasn’t just a participant—it was the mastermind. They invested in Potato, enabling a rebirth under a new name, and even developed their own app, ChatMe, aiming to build a self-sufficient digital dark kingdom.

This guerrilla “three burrows” strategy wasn’t just a mockery of regulation—it was pure arrogance.

They believed that fast code could outrun the law, and deeply buried servers could create a world beyond rules. But they forgot—even dark web servers need electricity.

While they scrambled to change digital identities, regulators were quietly tightening an iron net around their financial flows.

The Symbiosis Model

In finance, true power is not how many chips you hold, but who defines them.

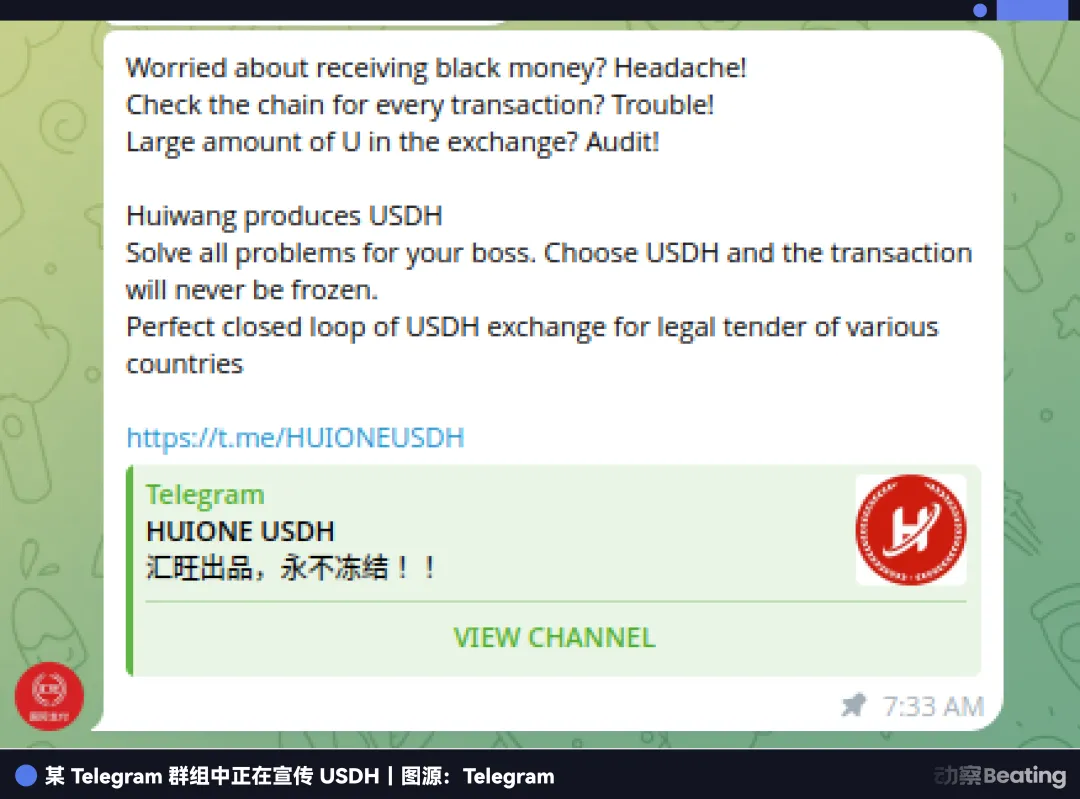

Huiwang’s operators realized that no matter how many times they changed their name, as long as they used USDT, Americans held their fate—Tether could freeze their assets at any time in cooperation with the FBI.

So, they set out to build their own Federal Reserve on the Mekong.

In September 2024, Huiwang launched its own stablecoin, USDH.

In official—and provocative—marketing, USDH’s core selling points were “unfreezable assets” and “beyond traditional regulation.” It was a rallying cry to the global black market: here, there’s no FBI, no anti-money laundering laws—only financial utopia.

To promote this private digital IOU, Huiwang rolled out an investment product in the parks that would make Wall Street blush: deposit USDH for an 18% annual yield, with a total return of 27% at maturity.

Ironically, scammers who had defrauded victims worldwide willingly deposited their ill-gotten gains back into Huiwang’s pool for the 18% yield.

In Phnom Penh’s underworld, the “pig-butchering” scam bosses didn’t realize that in Huiwang’s even larger “pig-butchering” scheme, they were the pigs.

Where did this “founder’s arrogance” come from?

Look at Huiwang Pay’s board: one name stands out—Hun To.

In Cambodia, that name carries weight. He is the nephew of former Prime Minister Hun Sen and the cousin of current Prime Minister Hun Manet. According to the US Treasury, he is not only a Huiwang board member, but also the vital link to Cambodia’s top leadership.

This is Southeast Asia’s most secretive “symbiosis model.”

Chinese teams provide technology—building payment systems with enterprise code, managing human trafficking with e-commerce logic, and using blockchain to evade regulation. Local elites provide privilege—granting banking licenses, allowing walled compounds, and turning a blind eye to cries for help within.

Technology delivers efficiency; power delivers security. With this top-level “umbrella,” they dared to post bounties in broad daylight and issue private currencies challenging the dollar. For them, the law was not a red line, but a commodity to be bought in bulk.

Such naked exchanges are often wrapped in the guise of charity.

In Cambodia’s Chinese-language newspapers, you’ll see Huiwang executives wearing sashes, receiving Red Cross certificates from dignitaries, donating to poor schools, their faces beaming with benevolence.

Meanwhile, in Huiwang Escrow groups, bloody money-laundering transactions flash across the screen.

Morning: a marketplace for crime. Afternoon: a charity banquet.

This extreme contradiction isn’t hypocrisy—it’s survival. Just as Du Yuesheng in old Shanghai built schools and kept the peace to become a “community leader,” on the Mekong, “charity” is a special tax paid to the powerful—a bleaching agent for one’s image and the lubricant for this massive symbiosis.

This carefully woven political-business network gave Huiwang years of security. They believed that as long as they managed Phnom Penh’s relationships, they could dance on the edge of legality.

Until October 2025, when a butterfly flapped its wings across the ocean.

The sanctions storm from Washington not only blew away their supposed “umbrella,” but shattered the fragile foundation of this “shadow central bank.”

When Outlaw Ingenuity Meets the Financial Iron Curtain

In China’s county-level economy, there are two ways to solve problems: pull strings, or change your name.

When the crisis first emerged, Huiwang’s leaders tried their old tricks. Even after losing their banking license in March 2025, they optimistically rebranded as “H-Pay” and announced plans to “expand to Japan and Canada” to create a smokescreen.

In their minds, as long as the panda statue stood in Phnom Penh and the Hun Sen family held shares, it was just another problem money could solve.

This time, however, their opponent wasn’t a local cop on the take—it was the full force of the US government.

On October 14, 2025, a black swan event struck. The US Department of Justice seized $15 billion in crypto assets from Prince Group’s Chen Zhi.

The number stunned Southeast Asia. Cambodia’s 2024 GDP was only about $46 billion. This wasn’t just asset seizure—it drained a third of the country’s underground economy overnight.

For Huiwang, Prince Group was its biggest client and main liquidity source. When the source dried up, the entire system collapsed.

Even more devastating was the “dimensionality reduction” of the crackdown.

For years, the black market believed USDT was “decentralized” and immune to legal control. In reality, USDT is highly centralized. While the FBI can’t directly command Tether, as a company eager to access mainstream finance, Tether must comply with OFAC sanctions.

When US regulators issue an order, there’s no need for SWAT raids or lengthy lawsuits—Tether simply freezes the relevant addresses. Hundreds of millions on-chain become “dead money” instantly.

This was a kind of warfare they never understood. These clever operators had always found loopholes—this time, their opponent tore down the wall itself.

In the aftermath, it’s always the little guys who suffer first.

At the bottom of Huiwang’s ecosystem were exchangers. In Phnom Penh, they were cash couriers on motorcycles; in China, “running score” gangs in rented apartments. They earned a meager 0.3% spread but bore the system’s highest risks.

In the past, they were Huiwang’s most sensitive nerve endings; now, they were the first to fall in the anti-fraud crackdown.

In Telegram’s “Frozen Friends” groups, thousands of desperate pleas appeared daily: all their bank cards frozen, blacklisted for fraud, unable to travel, and facing arrest if they returned to China.

Once-lucrative cash fleets became dangerous cages. They held unsellable USDH, their domestic accounts frozen, trapped abroad.

A Generation’s Funeral

When Huiwang’s glass doors were plastered with the notice, it wasn’t just a company that fell—it was an era.

This was the requiem for China’s “outlaw internet abroad” era, a footnote to a history of wild ambition and fantasy.

In that unique window, some overseas entrepreneurs entered Southeast Asia’s jungle with a “giant baby” mentality. They wanted the profits and freedom of lawlessness, as well as the rules and safety of civilization; they believed in connections and technology, but never respected the law.

They thought technology was a neutral tool, not realizing that in the wrong hands, it becomes a weapon for evil. They thought globalization meant escaping one cage for the wild, not realizing it meant moving from one set of rules to another, even stricter, set.

Huiwang’s rise and fall is a modern parable of the “banality of evil.”

At first, they just wanted to create a useful payment tool to solve currency exchange issues. Later, for growth, they became accomplices to the gray market. Later still, for profit, they became architects and participants in evil.

The moment you decide to impose order on evil, you can never turn back.

Years from now, when a new generation of entrepreneurs sits in Phnom Penh’s modern offices, sipping Starbucks and discussing ESG and compliance, perhaps no one will remember how many evil bytes once flowed through the city’s underground cables.

Nor will anyone remember how many self-styled “Du Yueshengs” were buried in the Mekong night.

Statement:

- This article is republished from [Beating], with copyright belonging to the original author [Sleepy.txt]. If you have any concerns about this republication, please contact the Gate Learn team, and we will address it promptly according to our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article without mentioning Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?