The ETH Debate: Is it Cryptomoney?

The following is an excerpt from @ MessariCrypto‘s upcoming “The Crypto Theses 2026.” The full report will be available on December 18, 2025. Make sure to subscribe to Messari so you don’t miss it:

Of all the major assets in crypto, none has sparked more sustained debate than ETH. BTC’s role as the dominant cryptomoney is broadly uncontested, but ETH’s role is anything but settled. To some, ETH is the only credible non-sovereign monetary asset besides BTC; to others, it represents a business with declining revenues, tightening margins, and relentless competition from faster, cheaper L1s.

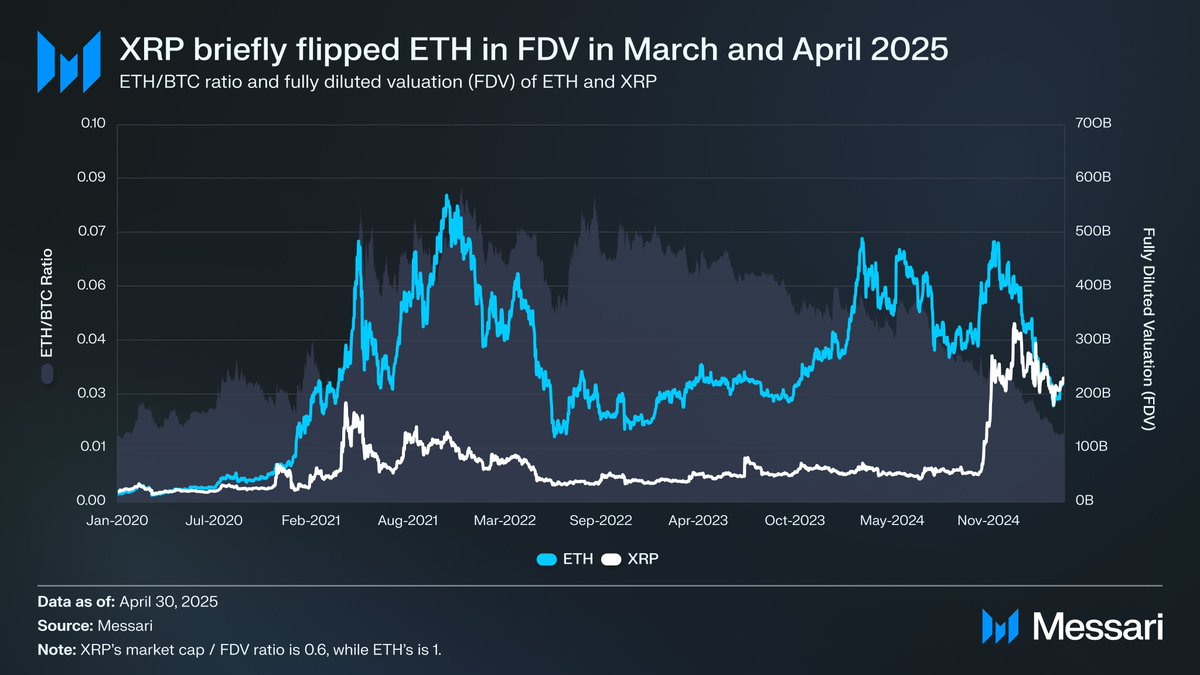

This debate seemingly reached its climax in the first half of this year. In March, XRP briefly surpassed ETH in fully diluted valuation (Notably, ETH is fully circulating, whereas only ~60% of XRP’s supply is circulating).

On March 16, ETH’s FDV stood at $227.65 billion, while XRP’s reached $239.23 billion, an outcome that virtually no one would have considered possible a year earlier. Then, on April 8, 2025, the ETH/BTC ratio fell below 0.02 for the first time since February 2020. In other words, the entirety of ETH’s outperformance against BTC from the last cycle had fully unwound. By that point, sentiment around ETH had deteriorated to its lowest level in years.

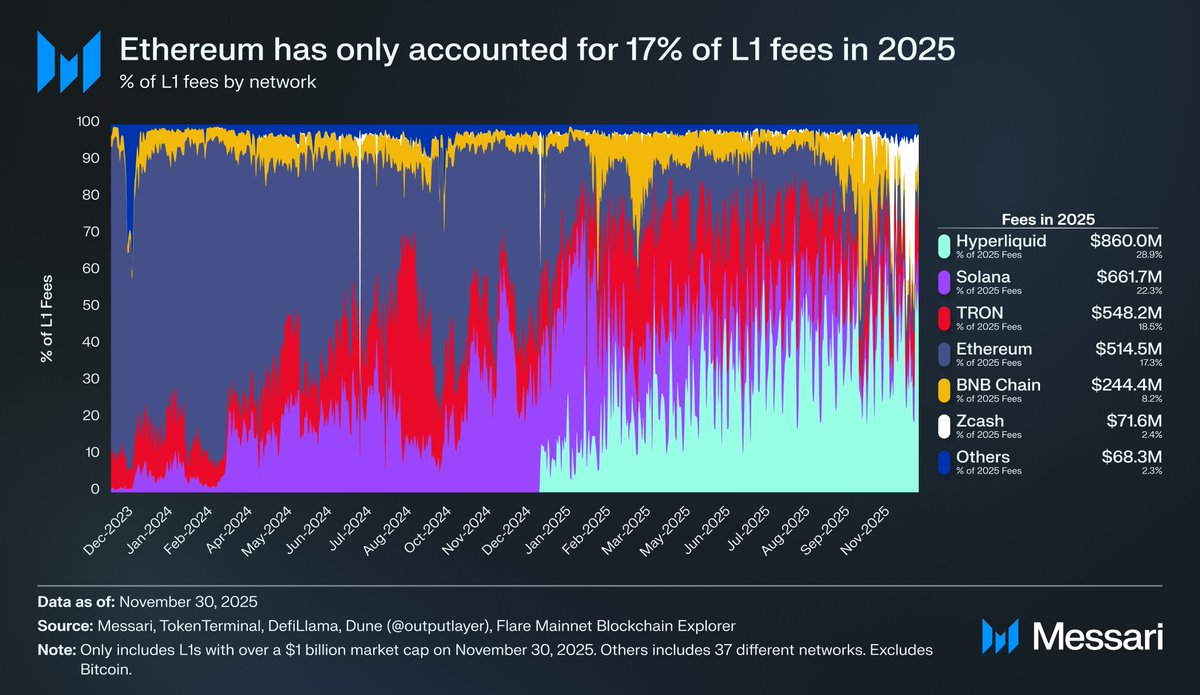

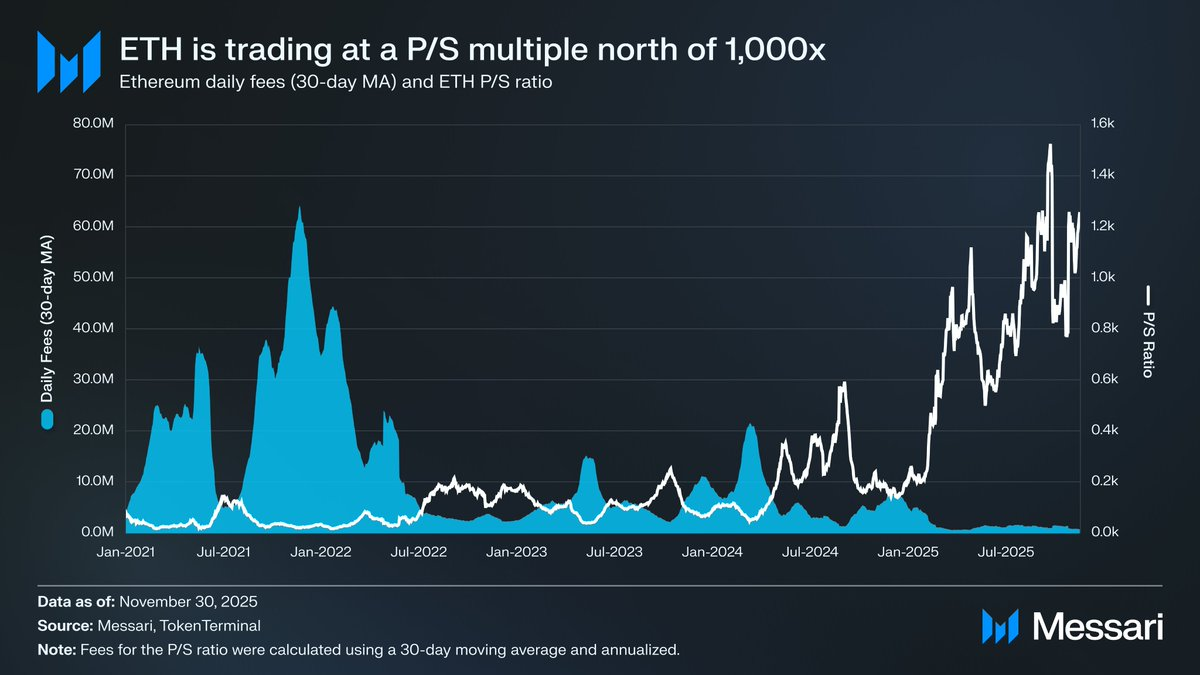

To make matters worse, price action was only part of the story. Ethereum’s share of L1 fees has declined steadily as rival ecosystems strengthened. Solana reestablished itself in 2024, Hyperliquid broke out in 2025, and together they pushed Ethereum’s fee share down to 17%, fourth among L1s and a dramatic fall from the top spot it held just a year earlier. Fees aren’t everything, but they are a clear signal of where economic activity is migrating, and the competitive landscape Ethereum faces today is the fiercest in its history.

Yet history shows that crypto’s most significant reversals often begin when sentiment is at its bleakest. By the time ETH was being written off as a failed asset, most of its perceived “failures” had already been priced in.

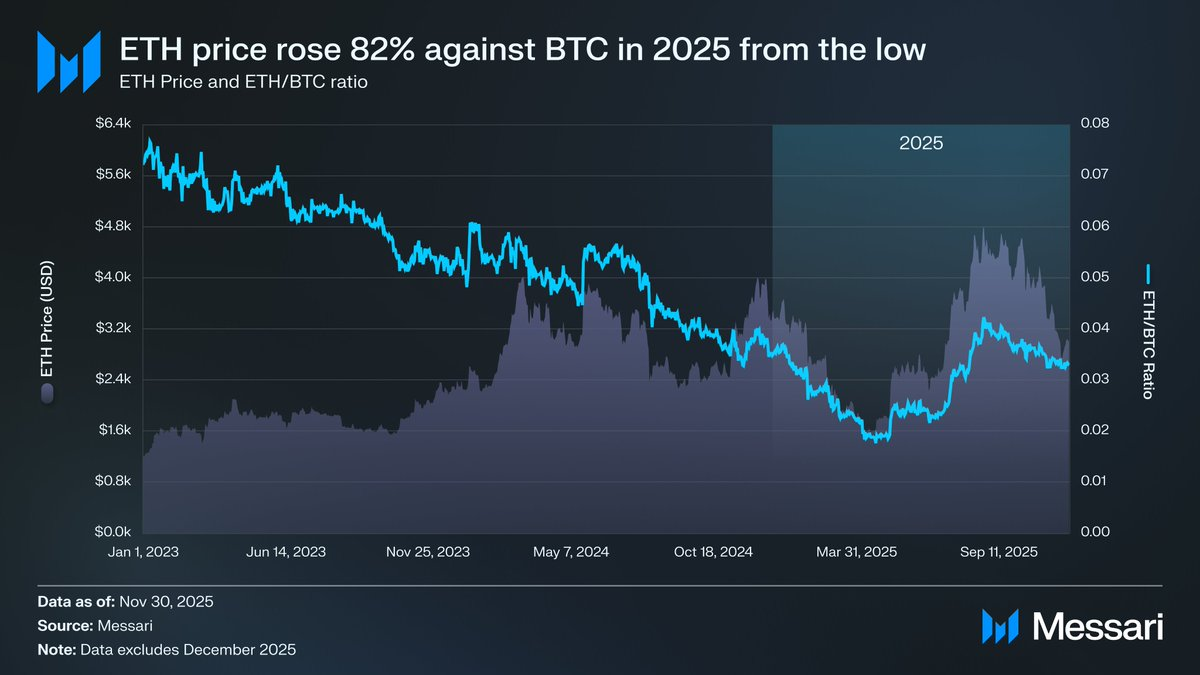

In May 2025, the first real signs emerged that the market had become too confident in the bear case. Both ETH/BTC and ETH’s USD price began to reverse sharply during this period. The ETH/BTC ratio climbed from a low of 0.017 in April to 0.042 in August, a 139% move, while ETH itself rose 191% over the same stretch, from $1,646 to $4,793. That momentum ultimately culminated in a new all-time high on August 24, when ETH reached $4,946.

Following this repricing, it became clear that ETH’s broader trajectory had shifted toward renewed strength. Leadership changes at the Ethereum Foundation and the arrival of ETH-focused Digital Asset Treasuries brought a degree of conviction that had been absent for much of the prior year.

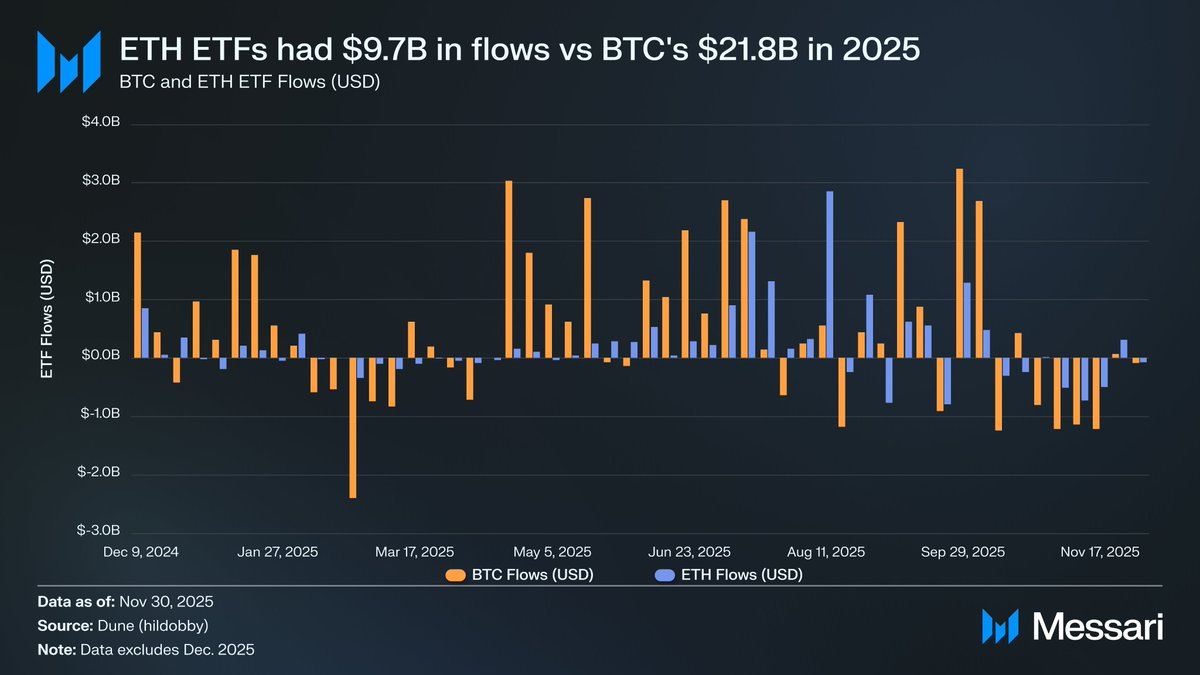

Prior to this rally, the contrast between BTC and ETH was nowhere more visible than in their respective ETF markets. When spot ETH ETFs launched in July 2024, flows were anemic. Over their first six months, they pulled in just $2.41 billion, an underwhelming figure when set against BTC’s record-breaking ETF performance.

However, concerns over ETF flows completely reversed alongside ETH’s revival. Over the year, spot ETH ETFs pulled in $9.72 billion, compared to $21.78 billion for BTC. Given that BTC’s market cap is nearly five times larger, the difference in flows, being only 2.2x, was far narrower than many expected. Put differently, once adjusted for market cap, ETH saw more ETF demand than BTC, a sharp reversal from the narrative that institutions had no real appetite for ETH. And, in some instances, ETH outpaced BTC outright. From May 26 to August 25, ETH ETFs pulled in $10.20 billion, more than BTC’s $9.79 billion over the same period, marking the first time institutional demand clearly tilted toward ETH.

When viewed by ETF issuers, BlackRock extended its dominance in the ETF market, finishing 2025 with 3.7 million ETH, representing 60% of the total spot ETH ETF market share. That figure was up from 1.1 million ETH at the end of 2024, a 241% increase, outpacing all other issuers in yearly growth. Overall, spot ETH ETFs ended the year with 6.2 million ETH, or about 5% of the total ETH supply.

Underneath ETH’s sharp recovery, the most important development was the rise of ETH-focused Digital Asset Treasuries. DATs created a steady, repetitive source of demand that ETH had never seen before, anchoring the asset in a way that narratives or speculative flows could not. If ETH’s price action marked the visible turning point, DAT accumulation was the deeper structural shift that made it possible.

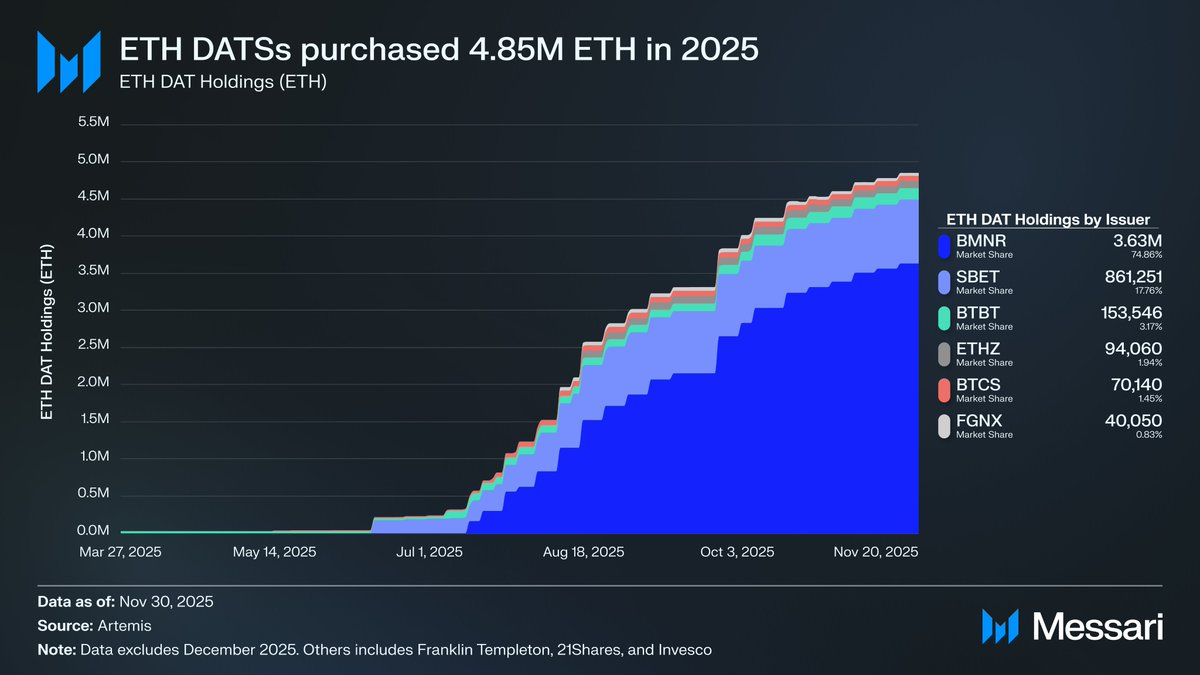

The DATs had a significant impact on the price of ETH, accumulating a total of 4.8 million ETH, 4% of the total ETH supply, over the course of 2025. The most prolific of the ETH DATs was Tom Lee’s Bitmine (BMNR), a former Bitcoin mining company that began converting its treasury and capital to ETH in July 2025. Between July and November, Bitmine purchased 3.63 million ETH, making it the clear leader in the DAT market share with 75% of all DAT holdings.

As powerful as ETH’s reversal was, the rally eventually cooled. By November 30, ETH had pulled back from its August highs to $2,991, significantly below even last cycle’s prior all-time high of $4,878. ETH is in a far stronger position than it was in April, but the recovery has not erased the structural concerns that sparked the bear case in the first place. If anything, the ETH debate has returned stronger than ever.

On one side, ETH is displaying many of the same markers BTC exhibited during its own ascent to monetary status. ETF inflows are no longer anemic. Digital Asset Treasuries have emerged as a persistent source of demand. And, perhaps most importantly, an increasingly visible share of the market is treating ETH as something categorically different from other L1 tokens, an asset that a subset of the market now treats as part of the same monetary framework as BTC.

However, the counterpoints that dragged ETH down earlier this year have yet to be alleviated. Ethereum’s core fundamentals have not fully recovered. Its share of L1 fees continues to face pressure from credible competitors, such as Solana and Hyperliquid. Activity on the base layer remains far below prior-cycle peaks. And despite ETH’s sharp rebound, BTC still sits comfortably above its previous all-time highs while ETH remains below them. Even during ETH’s strongest months, a significant portion of holders used the rally as exit liquidity rather than as confirmation of a long-term monetary thesis.

The fundamental question at the center of this debate is not whether Ethereum is valuable, but rather how ETH, the asset, accrues value from Ethereum.

Last cycle, a common assumption was that ETH would directly accrue value from the success of Ethereum. This is a key part of the “Ultrasound Money” argument: Ethereum would be so useful that it would burn vast quantities of ETH, giving the asset a clear and mechanically enforced source of value.

Now, we think we can say with considerable confidence that this will not be the case. Ethereum’s fees have plummeted with no recovery in sight, and its largest sources of growth, RWAs and institutions, primarily use USD as the base monetary asset, not ETH.

The value of ETH will now depend on how ETH indirectly accrues value from Ethereum’s success. But indirect accrual is far less certain. It rests on the hope that as Ethereum becomes more systemically important, more users and capital will choose to treat ETH as cryptomoney and a store of value.

But unlike direct, mechanical value accrual, there is no guarantee this happens. It relies entirely on social preference and collective belief, which isn’t inherently a flaw (This is, after all, how BTC accrues value). But, it does mean that ETH’s appreciation is no longer tied to Ethereum’s economic activity in a deterministic way.

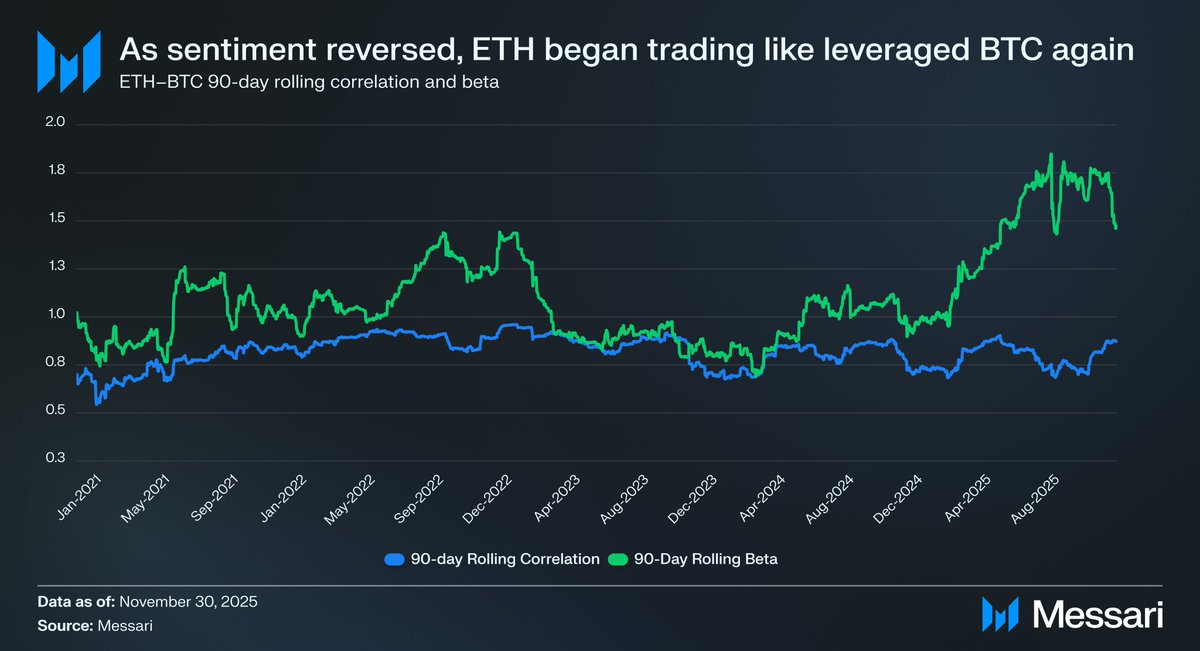

All of this brings the ETH debate back to its core tension. ETH may, in fact, be accruing a monetary premium, but that premium has remained downstream from BTC’s. The market is once again treating ETH as a levered expression of BTC’s monetary thesis, not as an independent monetary asset. ETH’s 90-day rolling correlation with BTC has hovered between 0.7 and 0.9 throughout 2025, while its rolling beta surged to multi-year highs, at times exceeding 1.8. ETH is now moving more aggressively than BTC, but has remained dependent on BTC.

This is a subtle, but extremely important distinction. ETH’s monetary relevance today exists because BTC’s monetary narrative remains intact. As long as the market believes in BTC as a non-sovereign store of value, there will be a marginal cohort of market participants willing to extend that belief to ETH. And if BTC continues to strengthen in 2026, ETH has a simple path to make up even more ground.

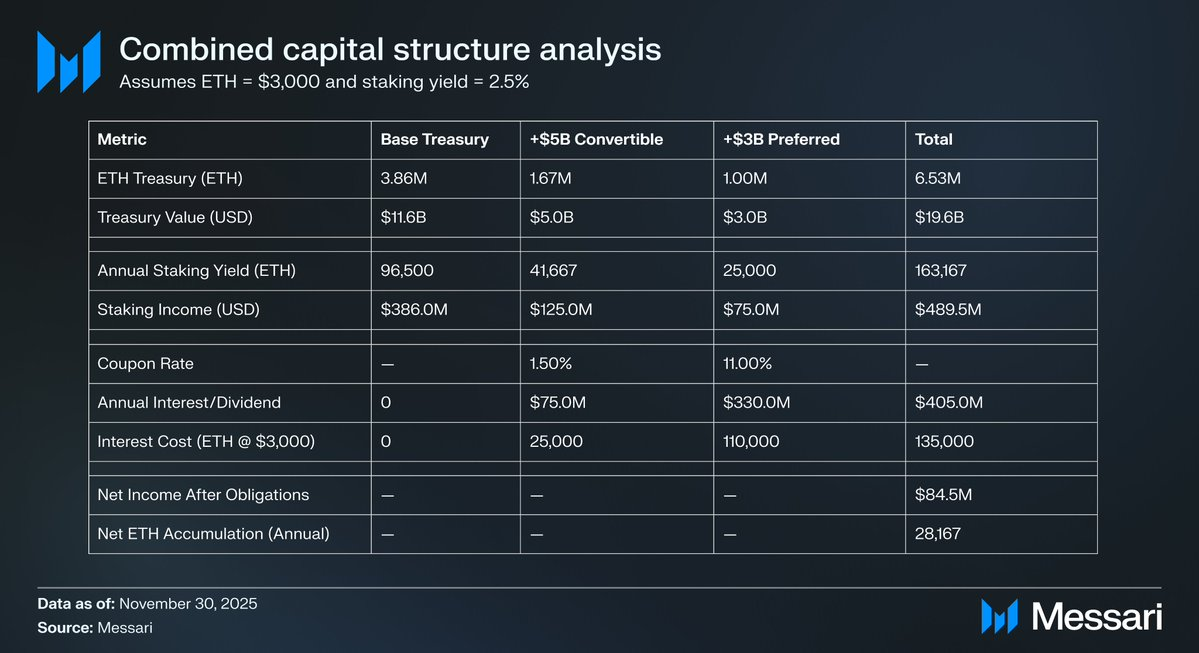

Ethereum DATs are still early in their life cycle and, to date, have primarily facilitated ETH accumulation through common equity issuance. In a renewed crypto bull market, however, these entities could explore additional capital formation strategies similar to those Strategy has used to expand its BTC exposure, including convertible notes and preferred stock.

For example, a DAT such as BitMine could raise a mix of low-coupon convertible debt and higher-yield preferred capital, deploy the proceeds directly into ETH purchases, and stake that ETH to generate recurring yield. Under reasonable assumptions, staking income could partially offset fixed interest and dividend obligations, allowing the treasury to continue accumulating ETH while increasing balance sheet leverage during favorable market conditions. This potential “second life” of the Ethereum DATs could serve as an additional force sustaining ETH’s higher beta to BTC in 2026, assuming a broader BTC bull market resumes.

Ultimately, the market continues to price ETH’s monetary premium as contingent on BTC’s. ETH is not yet an autonomous monetary asset with an independent macro foundation; rather, it is a growing secondary beneficiary of BTC’s monetary consensus. Its recent resurgence reflects a marginal cohort of believers willing to treat ETH more like BTC and less like a typical L1 token. Still, even amidst relative strength, the market’s belief in ETH is inseparable from the continued strength of BTC’s own narrative.

In short, ETH’s monetary story is no longer broken, but neither is it settled. Under the existing market structure and in light of ETH’s heightened beta relative to BTC, ETH can appreciate meaningfully if BTC’s thesis continues to play out, and structural demand from DATs and corporate treasuries gives it real upside in that scenario. But, ultimately, ETH’s monetary trajectory still depends on BTC for the foreseeable future. Until ETH exhibits lower correlation and beta to BTC, something it has never done on a longer time frame, ETH’s premium will fluctuate in the shadow of BTC.

Disclaimer:

- This article is reprinted from [AvgJoesCrypto]. All copyrights belong to the original author [AvgJoesCrypto]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

What Is Ethereum 2.0? Understanding The Merge

Reflections on Ethereum Governance Following the 3074 Saga

Our Across Thesis

What is Neiro? All You Need to Know About NEIROETH in 2025

An Introduction to ERC-20 Tokens