Stimulating Into a Bubble

Did you see that the Fed’s announcement that it will stop QT and begin QE? While it is described as a technical maneuver, any way you cut it it’s an easing move that is one of my indicators to pay attention to in order to track the progression of the Big Debt Cycle dynamic that was described in my last book. As chairman Powell said “…at a certain point, you’ll want reserves to start gradually growing to keep up with the size of the banking system and the size of the economy. So we’ll be adding reserves at a certain point…” How much they will be adding will be important to watch. Since one of the Fed’s jobs is to contain “the size of the banking system” during bubbles we will want to watch this along with watching its rate of easing via interest rate cuts into the emerging bubble. More specifically, if the balance sheet starts expanding significantly, while interest rates are being cut, while the fiscal deficits are large, we will view that as a classic monetary and fiscal interaction of the Fed and the Treasury to monetize government debt. If that happens while private credit and capital market credit creation is still strong, stocks are making highs, credit spreads are near their lows, unemployment is near its lows, inflation is above target, and AI stocks are in a bubble (which they are based on my bubble indicator), it will look to me like the Fed is stimulating into a bubble. Since the administration and many others believe that restraints should be radically reduced so there can be a big capitalist go for growth approach to monetary and fiscal policy, and since there is a pending big deficit/debt/bond supply and demand issue, I should be excused for wondering if this is more than the technical issue that it is being made out to be. While I understand the Fed being highly attentive to funding-markets risk which means being inclined to prioritize market-stability over fighting inflation aggressively, especially in this political environment, at the same time, whether this becomes a full and classic stimulative QE (with big net purchases) remains to be seen.

At this time it should not escape our attention that when the supply of U.S. Treasury bonds is larger than the demand for them and the central bank is “printing money” and buying bonds and the Treasury is shortening the maturities of the debt being sold to compensate for the demand shortfall in long-term bonds, these are classic Big Debt Cycle late cycle dynamics. While I comprehensively explained the mechanics of how this all works in my book “How Countries Go Broke: the Big Cycle” I want to both note the approaching of this classic milestone in this Big Debt Cycle and briefly review its mechanics.

What I aspire to do is to teach by sharing my thinking about market mechanics and showing what is happening like teaching how to fish by sharing my thinking and pointing out what’s happening while leaving the rest to you because that’s more valuable for you and keeps me from being your investment advisor which is better for me. Here is how I see the mechanics working.

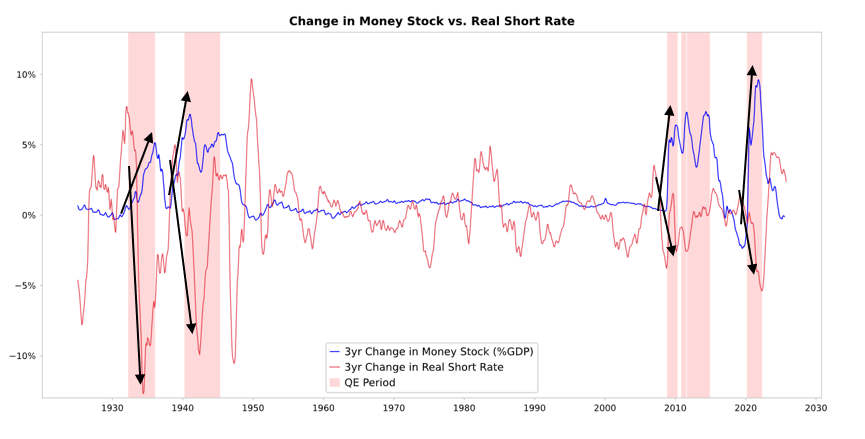

When the Fed and/or other central banks buy bonds, it creates liquidity and pushes real interest rates down as you see in the chart below. What happens next depends on where the liquidity goes.

- If it stays in financial assets, it bids up financial asset prices and lowers real yields so multiples expand, risk spreads compress, and gold rises so there is “financial asset inflation.” That benefits holders of financial assets relative to non-holders so it widens the wealth gap.

- It typically passes to some degree into goods, services, and labor markets raising inflation. In this case, with automation replacing labor, the extent to which this will happen would seem to be less than typical. If it stimulates inflation enough that can lead nominal interest rates to rise to more than offset the decline in real interest which then hurts bonds and stocks in nominal terms as well as in real terms.

The Mechanics: QE Transmits Through Relative Prices

As explained more comprehensively in my book “How Countries Go Broke: The Big Cycle” than I can explain here, all financial flows and market movements are driven by relative appeals rather than absolute appeals. Said simply, everyone has a certain amount of money and credit which central banks influence through their actions, and everyone makes their choices about what to do with it based on the relative appeals of their choices. For example, they can borrow or lend depending on the cost of money relative to the returns they can get for their money, and what they put their money into primarily depends on the relative expected total returns of the alternatives, with the expected total return equaling the yield of the asset plus its price change. For example, the yield on gold is 0% and the yield on a 10-year Treasury bond is now about 4%, so you’d prefer to own the bond if you expect the price appreciation of gold to be less than 4% per year and you’d prefer to own gold if it’s expected to be more than 4%. When thinking about how gold will perform and how bonds will perform relative to that 4% hurdle, one of course should think about what the inflation rate will be because these investments need to pay enough to compensate for inflation that will lower our buying power. All things being equal, the higher the inflation rate, the more gold will go up because most of inflation is due to the value and buying power of other currencies going down due to their increased supply, while there isn’t much increased supply of gold. That’s why I think about the supply of money and credit, which is why I am thinking about what the Fed and other central banks are doing. More specifically, over long periods of time, gold’s value has tracked inflation, and since the higher the level of inflation the less appealing the 4pct bond yield (e.g. a 5pct inflation rate would make gold more appealing supporting gold prices and would make bonds less appealing because it would lead one to have a -1pct real return), the more money and credit central banks are making, the higher I expect the inflation rate to be, and the less I like bonds relative to gold. All else being equal, the Fed’s increased QE should be expected to lower real interest rates and increase liquidity by compressing risk premia, pushing real yields down and pushing P/E multiples up, and especially boosting valuations of long-duration assets (such as tech, AI, growth) and inflation hedge assets such as gold and inflation indexed bonds. Tangible asset companies like miners, infrastructure, real assets would likely outperform over pure long-duration tech once inflation risk re-awakens.

With a lag it should be expected to raise inflation from what it otherwise would have been. If real yields fall because of QE but inflation expectations rise, nominal multiples can still expand, but real returns erode.

It would be reasonable to expect that, similar to late 1999 or 2010-2011, there would be a strong liquidity melt-up that will eventually become too risky and will have to be restrained. During that melt-up and just before the tightening that is enough to rein in inflation that will pop the bubble is classically the ideal time to sell.

This Time is Different Because the Fed Will be Easing into a Bubble.

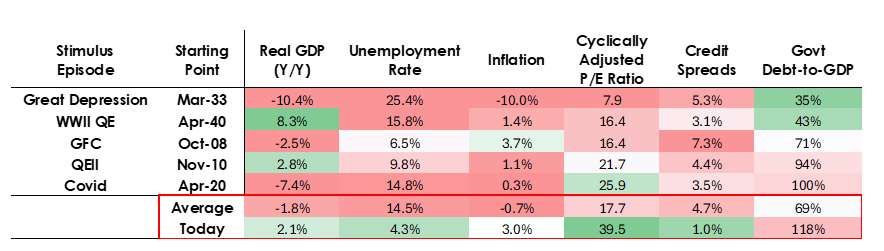

While I would expect the mechanics to work as I described, the conditions in which this QE would take place are very different from those that existed when they took place before because this time the easing will be into a bubble rather than into a bust. More specifically, in the past QE was deployed when:

- Asset valuations were falling and inexpensive or not overvalued.

- The economy was contracting or very weak.

- Inflation was low or falling.

- Debt and liquidity problems were large and credit spreads were wide.

So, QE was a “stimulus into a depression.”

Today, the opposite is true:

- Asset valuations are at highs and rising. For example, the S&P 500 earnings yield is 4.4% while the 10-year Treasury bond nominal yield is 4% and real yields are about 1.8%, so equity risk premiums are low at about 0.3%.

- The economy is relatively strong (real growth has averaged 2% over the last year, and the unemployment rate is only 4.3%).

- Inflation is above target at a relatively moderate rate (a bit over 3%) while inefficiencies due to deglobalization and tariff costs are exerting upward pressures on prices.

- Credit and liquidity is abundant and credit spreads are near record lows.

So, QE today is “stimulus into a bubble.”

So, QE now would not be a “stimulus into a depression” but rather a “stimulus into a bubble.”

Let’s look at how the mechanics typically affect stocks, bonds, and gold.

Because the fiscal side of government policy is now highly stimulative (due to huge existing debt outstanding and huge deficits financed with huge Treasury issuance especially in relatively short maturities) QE would effectively monetize government debt rather than simply re-liquify the private system. That’s what makes what is happening different in ways that seem to make it more dangerous and more inflationary. This looks like a bold and dangerous big bet on growth, especially AI growth, financed through very liberal looseness in fiscal policies, monetary policies, and regulatory policies that we will have to monitor closely to navigate well.

Disclaimer:

- This article is reprinted from [RayDalio]. All copyrights belong to the original author [RayDalio]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

NFTs and Memecoins in Last vs Current Bull Markets