South Korea Crypto Market Report: A Reset and the Next Growth Cycle

1. Introduction: Market Paradigm Shift Underway

Key Signals

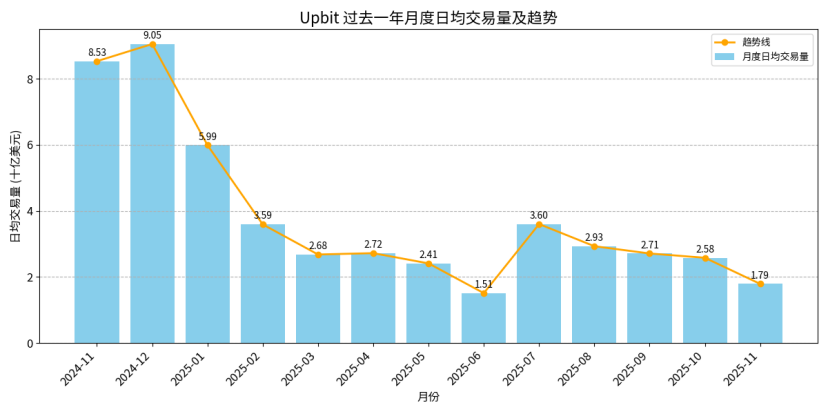

- South Korea’s digital asset market is undergoing one of its most significant structural resets to date. Upbit’s average daily trading volume plunged from $9 billion in December 2024 to $1.78 billion in November 2025—an 80% decline. Notably, this occurred as the total number of new token listings on Korean exchanges surged 141% year-over-year in 2025. At the same time, retail capital rotated aggressively into a booming stock market. The KOSPI Index soared roughly 70%, led by the AI chip sector with Samsung Electronics and SK hynix at the forefront.

- The “Kimchi Premium”—long a defining feature of the Korean market and historically hovering around 10%—has now narrowed to just 1.75%. This isn’t a capital flight, but a normalization as speculative froth is squeezed out of the market.

- The Kimchi Premium refers to the price differential where crypto assets like Bitcoin trade at a premium on Korean exchanges (such as Upbit and Bithumb) compared to global platforms (like Binance and Coinbase).

- The central question: Has Korea’s crypto era ended, or is this a systemic reset ahead of the next structural wave?

2. Behind the Freeze: Unpacking the Slowdown in Korea’s Crypto Market

This is not a short-lived correction, but a structural realignment fueled by regulatory delays, capital controls, and investor fatigue.

2.1 Regulatory Delays and Uncertainty

- Korea’s Stablecoin Act—expected to serve as a cornerstone for the nation’s digital asset future—has been stalled for seven months due to debates over whether banks or non-bank entities should serve as issuers. There are currently six different proposals under review, with the Financial Services Commission (FSC) targeting a unified bill by the end of 2025.

- This regulatory vacuum has slowed institutional innovation and made Web2 enterprises exploring tokenization and settlement layer advancements more cautious. The overall environment has clearly shifted toward risk aversion.

2.2 Capital Outflows and the Liquidity Trap

- Korea’s strict foreign exchange controls have blocked overseas market makers and institutions from injecting liquidity, resulting in persistent one-way capital outflows.

- Foreign Exchange Transactions Act (FETA): Non-residents cannot freely hold or flexibly use KRW. Nearly all major foreign exchange and capital flows require mandatory reporting or prior approval, severely limiting overseas institutions’ ability to operate in Korea.

- Financial Supervisory Service (FSS) “Foreign Exchange Business Processing Guidelines”: Local banks face strict intraday position limits and are generally prohibited from providing KRW liquidity to non-resident institutions, making it nearly impossible for overseas market makers to establish KRW positions or provide genuine bilateral liquidity.

- While some forecasts see Korea’s digital asset market revenue reaching $635 million by 2030, short-term liquidity constraints remain acute.

- Notably, Korea’s market is highly leveraged. Should a new catalyst emerge—such as regulatory clarity or a fresh global Bitcoin rally—the market could rebound with remarkable speed.

2.3 Constructive Correction, Not a Collapse

- Rather than signaling a downturn, the market’s cooling should be seen as a return to normalcy. Korea’s market cycle is aligning with global trends—shifting from speculation-driven, rough expansion toward a phase more focused on real utility. Market participants are gradually shifting from short-term trading toward infrastructure, custody, compliance, and real-world applications. While this transition is challenging, it is necessary for sustainable future growth.

3. Crypto Giants Make Their Move in Seoul

- Despite a clear drop in local retail participation, global crypto giants are doubling down on the Korean market. This counter-cyclical expansion underscores external players’ confidence in Korea’s tech-savvy population and the long-term promise of its institutional market.

3.1 Key Developments

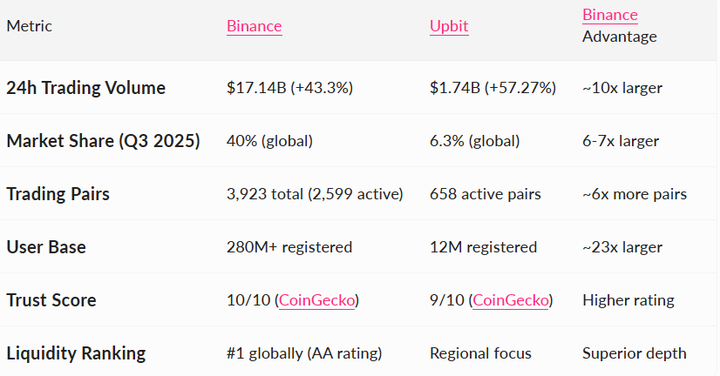

- In October 2025, Binance staged a major return to Korea by acquiring Gopax, ending a four-year absence. This was enabled in part by Korea’s easing of foreign ownership restrictions, sending a clear signal of openness to global crypto firms.

- This acquisition paves the way for fiercer competition, smoother liquidity channels, and more sophisticated product offerings. Local users will benefit from significantly upgraded products and services.

- Core Performance Indicator Matrix

Source: Surf AI, 2025

3.2 Why Now?

Three strategic factors explain this timing:

- High crypto literacy and rapid tech adoption

- Korea remains one of the world’s fastest markets for adopting and deploying new technologies, including AI and digital assets.

- Stablecoin integration potential

- Local banks, fintechs, and internet giants like Kakao and Naver are piloting stablecoins, potentially connecting the domestic financial system and the blockchain ecosystem.

- Rising institutional demand

- Korean institutional investors are increasingly interested in custody, asset tokenization, and compliant digital asset allocation, laying the groundwork for sustained long-term capital inflows.

4. Outlook

- The current downturn is not the end, but a structural reset moving Korea’s market beyond pure speculation toward utility-driven, institutionally aligned growth. Stablecoin legislation, institutional custody infrastructure, and a potential Bitcoin ETF are likely to be the next phase’s key growth pillars. Korea is entering a new era powered by real product value, user education, and regulatory innovation.

4.1 Market Forecast

- Korea’s crypto market is expected to grow at a modest 2.94% CAGR, but the real turning point could come with the anticipated approval of a Bitcoin ETF in 2026—a topic already under active discussion among Korean policymakers.

- Once approved, this could bring:

- Official participation from Korean pension and asset management institutions

- Large-scale entry of overseas market makers

- Higher-quality price discovery and tighter bid-ask spreads

This could reestablish Korea as a regional capital inflow hub.

4.2 Korea’s Web2 and Web3 Convergence

- Korean conglomerates are deepening practical blockchain adoption:

- Banks, fintechs, and major tech firms are piloting stablecoins and exploring digital KRW payment and settlement rails.

- Upbit and Bithumb have launched or expanded institutional custody, enabling both local institutions and overseas capital to re-enter the market compliantly.

- This marks a shift from speculation-driven activity to infrastructure and real-world utility at the core.

4.3 Global Benchmarking

- Korea’s regulatory approach is increasingly mirroring Japan’s: strict yet relatively predictable. If Korea achieves similar clarity on stablecoins, asset tokenization, and digital asset ETFs, it could emerge as one of Asia’s most balanced crypto hubs, attracting both institutional builders and global liquidity.

4.4 From a Web3 Marketing Lens: Why Korea Prioritizes Real Product Usability

- In Korea’s next cycle, a critical but often overlooked driver will be the rising demand for real product usability.

- Korea stands out as a market where exchanges and users actively test, validate, and deeply understand a project before embracing it—a trend becoming even clearer as the market shifts toward utility-driven growth.

- For example:

- Upbit’s quiz campaigns: Education as essential market infrastructure

- Upbit frequently hosts quiz-based educational events for new listings, requiring users to answer questions on:

- Technical architecture

- Tokenomics

- Use cases and real-world functionality

- Roadmap and risk profile

- This fundamentally differs from the airdrop farming model common elsewhere. The message: Korean exchanges emphasize verification, understanding, and user education, and require project teams to clearly and thoroughly articulate their value.

- Upbit X Surf’s hands-on product campaign

- In 2025, Upbit and Surf partnered on a campaign encouraging users to directly engage with project products, experience features, and generate meaningful results.

- This marks a clear shift:

- Korean exchanges are increasingly valuing validation based on actual user experience over surface-level exposure marketing.

- In Korea, a product’s usability and quality is the strongest marketing tool.

- Narrative without execution cannot survive long here.

4.5 Investor Playbook

To position effectively during this reset, investors should:

- Track key catalysts such as FSC bill consolidation, Bitcoin ETF developments, and imminent stablecoin legislation.

- Prioritize projects with durable utility over hype-driven tokens.

- Focus on Q4 macro indicators, as Korean retail investors historically re-enter the market en masse during risk-on cycles.

- Diversify to avoid concentrated bets tied to regulatory or political timelines.

Investors should also focus on international ecosystems establishing a local presence early in Korea. A key trend shaping Korea’s next cycle is the rapid formation of partnerships between global public chains and major Korean enterprises—signaling Korea’s evolution from a transaction-driven market to a hub for co-development and deep infrastructure integration.

Case 1: Sui x t’order

- Local partner: t’order (Korea’s leading table-ordering and POS network)

- Integration: Supports KRW-pegged stablecoin payments, QR code and facial recognition, zero merchant fees, real-time settlement

Case 2: Solana x Shinhan Securities

- Local partner: Shinhan Securities (one of Korea’s top brokerages)

- Collaboration: Strategic MOU to jointly support Web3 entrepreneurs, developers, and the Solana ecosystem in Korea, led by Superteam Korea

Case 3: Arbitrum x Lotte Group

- Local partner: Lotte Group (one of Korea’s largest conglomerates)

- Integration: Arbitrum provides major developer grants to Caliverse (Lotte’s metaverse platform) for blockchain integration

5. Korea’s Crypto Winter Is a Reset, Not a Retreat—And a Strategic Window for Builders

Despite the current contraction, Korea remains one of the world’s most dynamic crypto markets. Stablecoins are enabling major Web2 enterprises to explore on-chain settlement and infrastructure tokenization. Leading exchanges continue to expand custody and institutional services. The potential approval of a Bitcoin ETF has significantly increased the likelihood of overseas liquidity returning to Korea.

Korea’s crypto ecosystem isn’t ending—it’s maturing at an accelerated pace.

This reset marks Korea’s shift from a hype-driven retail playground to a digital asset economy with structural design, institutional support, and institutional participation at its core.

Disclaimer:

- This article is reprinted from [TechFlow], copyright belongs to the original author [JE labs]. For reprint concerns, please contact the Gate Learn team, who will address them promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Without mention of Gate, translated articles may not be copied, distributed, or plagiarized.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?