SEC Chair’s Tough Stance: No “Lenient Enforcement” for Cryptocurrencies Under Current Market Structure

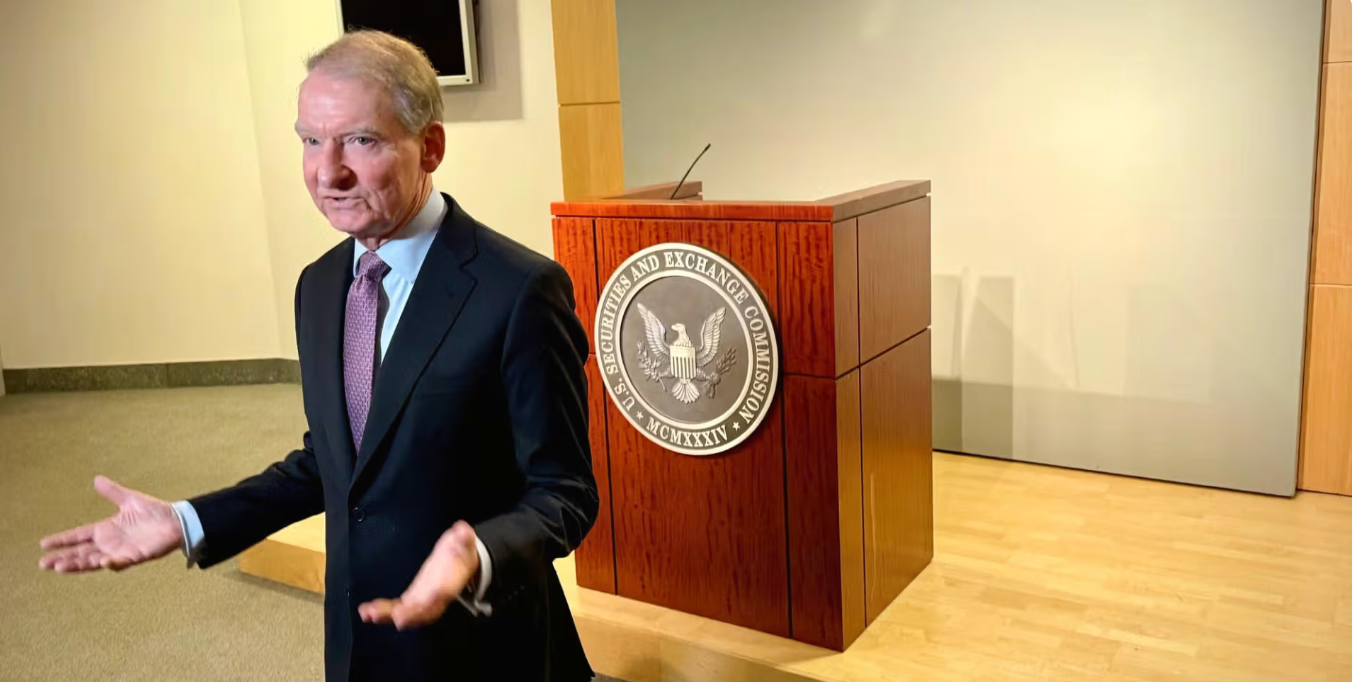

In recent years, the global cryptocurrency industry has experienced rapid expansion, but regulatory uncertainty has emerged as a significant barrier to progress. In the United States, the evolving position of the SEC—the central authority for capital markets oversight—continues to command close attention. According to the latest updates, SEC Chairman Paul S. Atkins made it clear in a public speech that, under the current market structure, he will not adopt a “light-touch enforcement” approach toward cryptocurrencies.

A Pivotal Moment for Crypto Regulation

The long-standing debate over whether crypto assets should be classified as “securities” or “non-securities” has created persistent ambiguity. Previously, unclear security determinations caused investors and project teams to face sharply higher compliance and regulatory costs. Chairman Atkins commented, “I believe that most tradable tokens today are not securities per se… but if they were initially investment contracts, that changes the equation.”

He went on to propose a token classification framework, outlining four categories: “digital commodities/network tokens,” “digital collectibles,” “digital utilities,” and “security tokens.” The U.S. is shifting its regulatory approach from treating all tokens as securities to differentiating among asset types. Still, he stressed that this does not signal more lenient or hands-off regulation.

Key Takeaways from the SEC Chairman’s Commitments

During his public remarks, Atkins highlighted three core points:

- Maintaining the regulatory framework, rejecting “light-touch enforcement” — Despite industry hopes for relaxed oversight, he stated: “This is not a commitment to a lenient approach toward cryptocurrencies.”

- Clarity in classification, prioritizing economic substance — He emphasized that “economic substance outweighs labels.” Even if a token is called an “NFT” or “non-security,” it must still satisfy the legal definition under securities law.

- Balancing compliance and innovation — He directed SEC staff to draft recommendations that would provide exemptions or special rules for startups, while protecting investors.

Overall, these statements convey a clear message: the regulatory path is becoming more transparent, but crypto assets will continue to face oversight. The SEC will ensure oversight is fair, regulated, and orderly.

Three Major Effects on the Crypto Market and Investors

Effect 1: Boosted Market Confidence

When regulators state unequivocally that there will be “no light-touch enforcement,” it stabilizes the market. Participants can trust that regulatory gaps or chaos will not suddenly undermine market confidence. This development is particularly beneficial for established projects.

Effect 2: Potential Rise in Compliance Costs for Projects

While the regulatory direction is clearer, the “no light-touch” approach requires project teams to continue prioritizing compliance, disclosure, and issuance structure. Regulators may subject projects lacking robust standards to stricter scrutiny.

Effect 3: A Clearer Path for Innovation

The token classification framework and exemption approach outlined by Atkins offer a possible “non-security” path for tokens with specific functions, decentralized networks, or defined utility. However, only projects that genuinely meet these criteria will avoid being classified as securities.

Innovation and Compliance: How Should the Industry Respond to Future Challenges?

Given the SEC’s stance against “light-touch enforcement” in the current market, the industry should focus on three priorities:

- Enhance disclosure and governance: Project teams should proactively upgrade their governance frameworks, disclosure practices, asset protection, and compliance procedures to demonstrate transparency and accountability to regulators.

- Clarify token functionality and structure: For tokens seeking “non-security” status, teams should define the token’s function, level of decentralization, and whether there is a profit expectation in the initial design.

- Monitor legislative developments and regulatory coordination: Atkins repeatedly expressed support for Congress to take action on crypto market structure. Project teams and investors should keep abreast of legislative progress and adjust strategies accordingly.

Conclusion

The SEC Chairman’s stance—that “under the current market structure, there will be no ‘light-touch enforcement’ measures for cryptocurrencies”—is not a crackdown, but rather the introduction of a clearer, more predictable regulatory framework. For the industry, this is a sign of maturity: regulation is coming, compliance is essential, and innovation must continue. Both investors and project teams should seize this opportunity to pursue compliance and sustainable growth. Regulatory clarity builds true market trust, and compliant innovation drives genuine industry advancement.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data