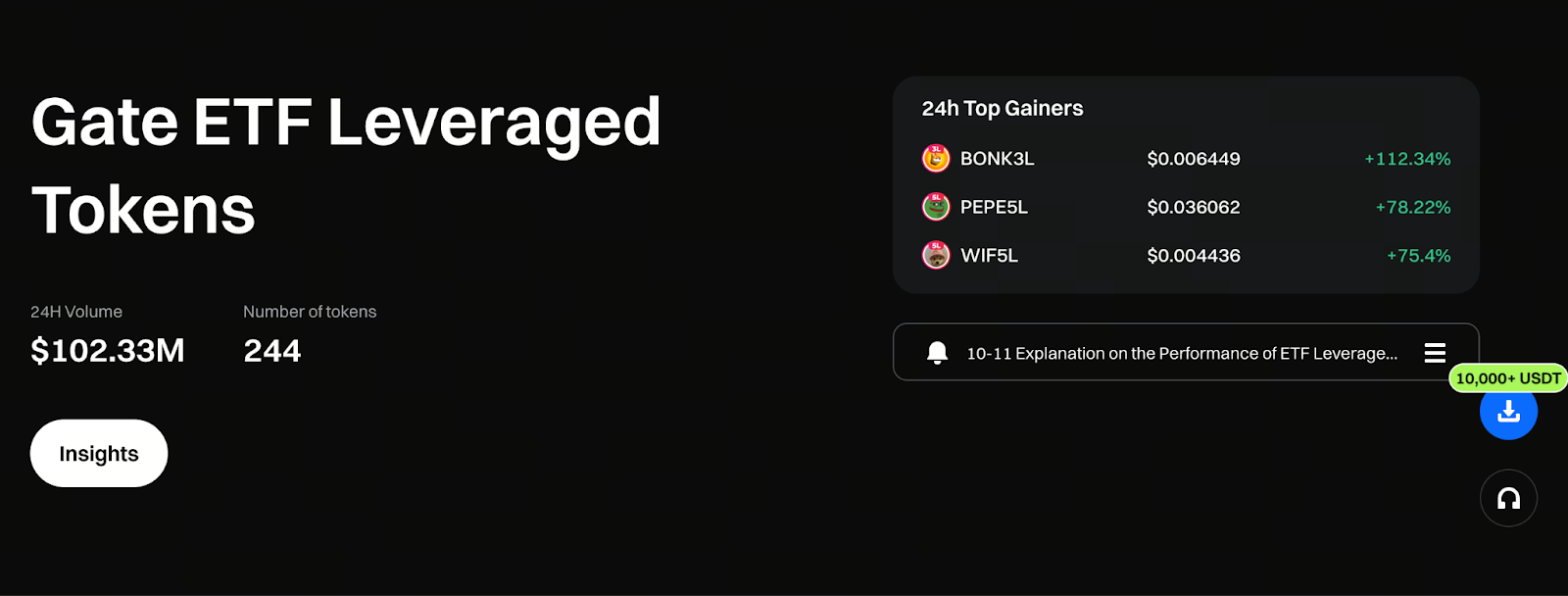

Practical Analysis of Gate ETF Leveraged Tokens: How to Improve Capital Efficiency in High-Volatility Markets

Image: https://www.gate.com/leveraged-etf

I. Why Is Capital Efficiency a Core Issue in Crypto Trading?

Volatility in the crypto market creates both risks and opportunities. Rapid price swings make capital efficiency a decisive factor in trading outcomes.

Spot trading typically ties returns directly to your capital outlay. Leverage tools, on the other hand, let you amplify price movements with the same capital. However, traditional contract trading requires advanced position management and risk controls, making it unsuitable for many traders.

Gate ETF leveraged tokens address this challenge by offering a more intuitive and lightweight way to access leveraged trading.

II. What Are Gate ETF Leveraged Tokens at Their Core?

Gate ETF leveraged tokens are trading instruments that encapsulate leverage strategies within a tokenized format. Each token provides a fixed market exposure in a specific direction and leverage multiple.

When you buy a token, you’re participating in a platform-managed contract strategy—no complex manual operations required. This strategy-as-token model dramatically reduces the execution costs of leveraged trading.

III. How Do Automated Mechanisms Impact Actual Returns?

Gate ETF leveraged tokens use automated rebalancing to maintain their target leverage. This feature is especially critical during trending markets.

When prices move in a single direction, rebalancing enables tokens to capture and amplify gains. In choppy, sideways markets, however, frequent rebalancing can erode net asset value.

As a result, ETF leveraged tokens are not universally suitable—they depend on market structure to be effective.

IV. Why Are ETF Leveraged Tokens Best for Traders with Strong Trend Recognition?

Returns from ETF leveraged tokens hinge on correct directional calls. When a trend is clear, these tokens can sharply boost returns in a short timeframe. If the call is wrong, losses are equally magnified.

These products are best suited for traders who:

- Can identify when a trend is forming

- Will take profits or cut losses before the trend reverses

- Do not rely on holding long-term and waiting for a reversal

For these traders, Gate ETF leveraged tokens serve as execution tools, not decision-making tools.

V. Combining Gate ETF Leveraged Tokens with Spot Positions

In practice, many traders use ETF leveraged tokens alongside spot holdings.

For instance, when expecting a short-term rally or correction, allocating a small portion to ETF leveraged tokens can boost position flexibility or provide a hedge.

The key is proportion control—not full leverage. ETF leveraged tokens work best as an enhancement module, not as the core of your entire position.

VI. The Hidden Costs of Holding ETF Leveraged Tokens Long-Term

Gate ETF leveraged tokens are not designed for long-term, passive holding.

Management fees are continuously deducted from net asset value. In sideways markets, frequent rebalancing can gradually reduce token value.

Even if the underlying asset price returns to its original level, the ETF leveraged token’s net asset value may not fully recover. Many beginners overlook this risk.

VII. How Can You Reduce the Risks of Using Gate ETF Leveraged Tokens?

Smart usage includes:

- Entering only after a trend is confirmed, not speculating in advance

- Avoiding positions when market direction is unclear

- Setting clear exit rules instead of holding indefinitely

- Treating them as short- or medium-term tools, not long-term investments

When used correctly, ETF leveraged token risks are manageable.

Conclusion

Gate ETF leveraged tokens are not a simple high-yield tool—they demand timing and discipline.

In the highly volatile crypto market, they offer a path to greater capital efficiency—but only if you understand the mechanics, respect the risks, and trade with the trend.

When you use them as tactical tools for trending markets, rather than as long-term holdings, ETF leveraged tokens can truly deliver value.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution