November 2025: What It Takes to HODL

Key Takeaways:

- Bitcoin investors have enjoyed high returns but have also stomached many challenging drawdowns. The ~30% drawdown since early October is in line with the historical average and the ninth meaningful pullback during the latest bull market.[1]

- Grayscale Research does not believe Bitcoin is on the cusp of a deep and prolonged cyclical drawdown, and we expect prices to potentially make new highs next year. Tactically, some indicators point to a short-term bottom while others are still mixed. Into year-end, positive catalysts may include another rate cut from the Fed and bipartisan progress on crypto legislation.

- Beyond the majors, privacy-related crypto assets continued to stand out. Meanwhile, the first exchange-traded products (ETPs) for XRP and Dogecoin began trading.

Investing in Bitcoin has historically delivered favorable returns, including annual gains of 35%-75% over the last 3-5 years.[2] However, it has also involved many significant drawdowns: Bitcoin’s price typically declines by at least 10% three times per year.[3] Like every other asset, its potential investment returns can be thought of as compensation for its risk. Bitcoin investors have been rewarded for HODL-ing over the long term, but they have needed to stomach sometimes challenging drawdowns along the way.

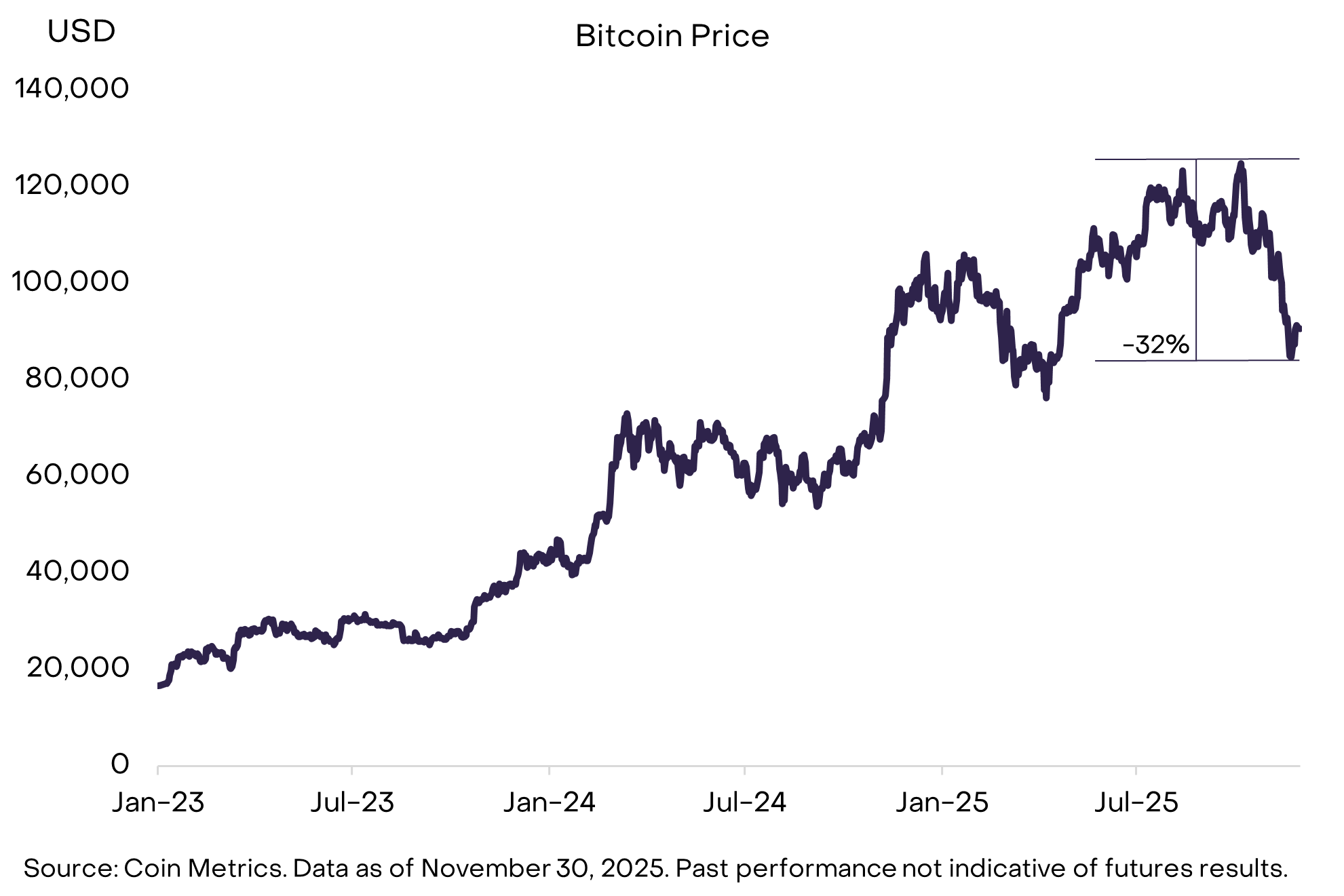

The Bitcoin drawdown that began in early October continued through most of November. From peak to trough, its price declined 32% (Exhibit 1). This makes the latest pullback, so far, close to the historical average. Bitcoin’s price has declined at least 10% about 50 times since 2010; these episodes had an average peak-to-trough price decline of 30%. Since Bitcoin’s price bottomed in November 2022, it has declined at least 10% nine times. It has been a bumpy ride, but not atypical for a Bitcoin bull market.

Exhibit 1: Latest pullback consistent with historical average

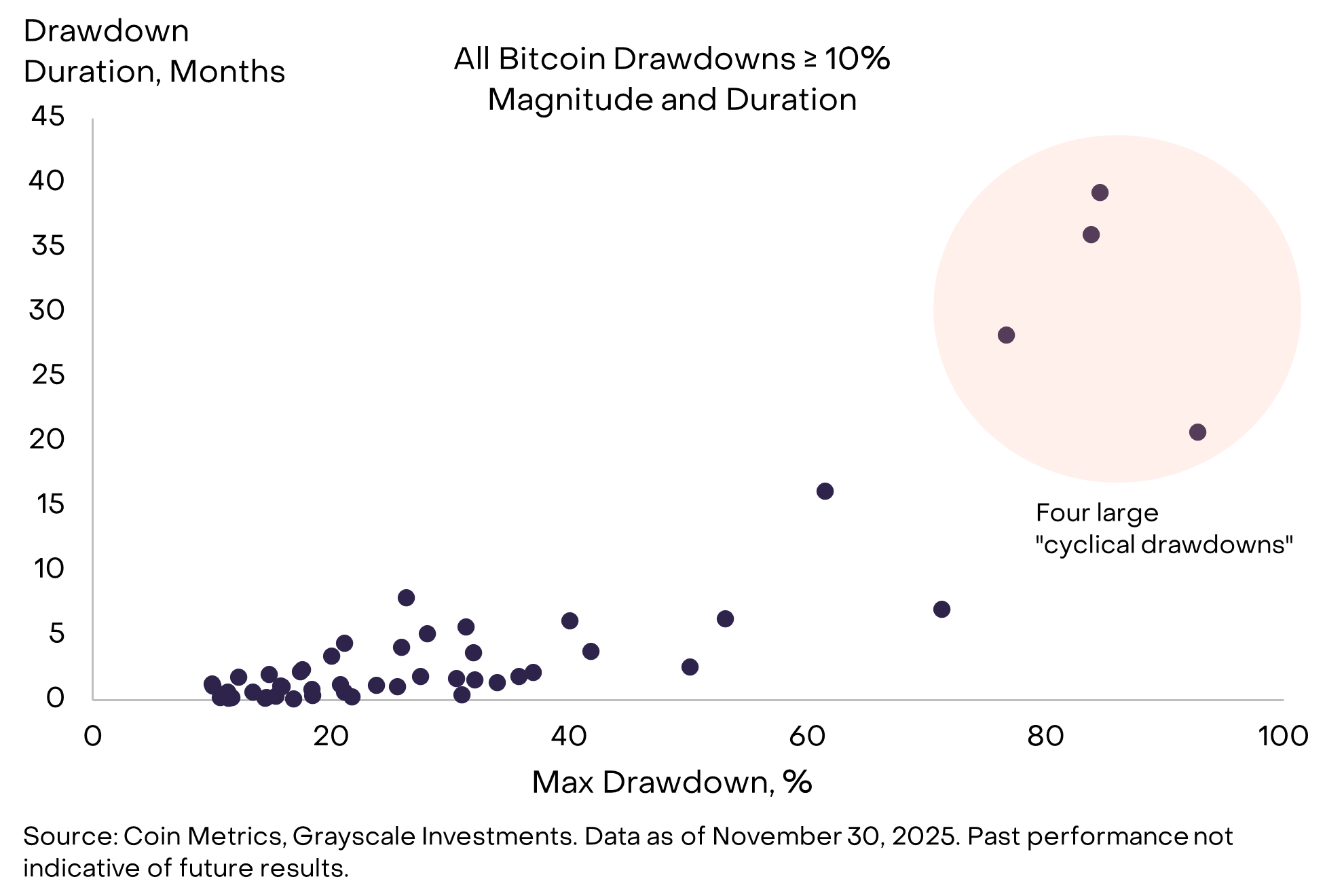

Bitcoin drawdowns can be measured by their magnitude and duration, and reviewing the data suggests there are largely two types (Exhibit 2). “Cyclical drawdowns” involve deep and prolonged price declines lasting 2-3 years. Historically these have occurred about once every four years. In contrast, “bull market drawdowns” have average price declines of 25% and last 2-3 months. These occur 3-5 times per year during bull markets.

Exhibit 2: Bitcoin has experienced four large cyclical drawdowns

Fading the Four-Year Cycle

Bitcoin supply follows a four-year halving schedule, and large cyclical drawdowns in price have historically occurred once every four years. As a result, there is an impression among many market participants that Bitcoin’s price will also follow a “four-year cycle.” After three years of appreciation, this thesis means price is scheduled to fall over the next year.

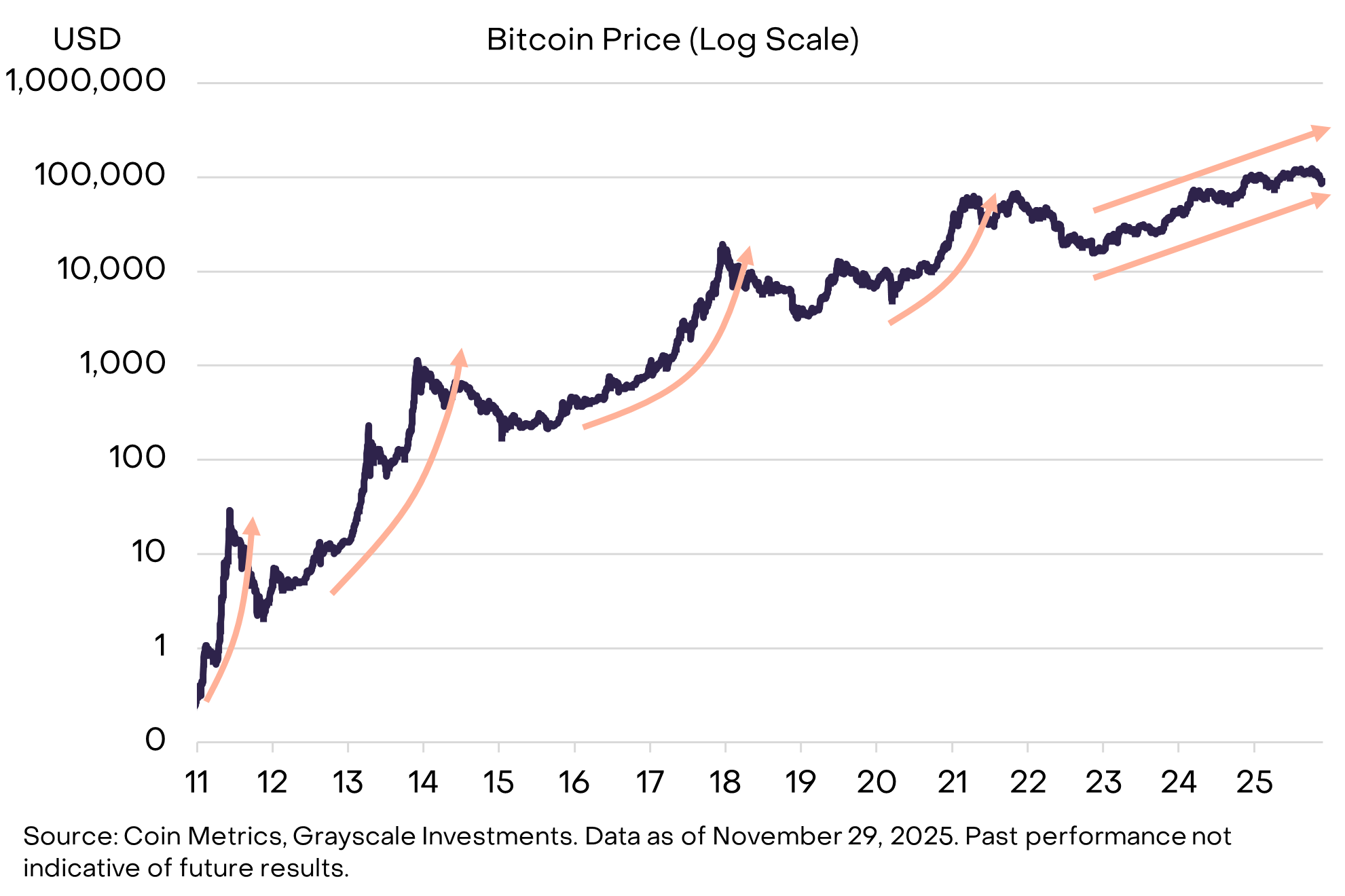

Although the outlook is uncertain, we believe the four-year cycle thesis will prove to be incorrect, and that Bitcoin’s price will potentially make new highs next year. First, unlike in past cycles, there was no parabolic price increase during this bull market that might suggest overshooting (Exhibit 3). Second, Bitcoin’s market structure has changed, with new capital largely coming through ETPs and digital asset treasuries (DATs) rather than retail exchanges. Third, as we discuss further below, the broad macro market backdrop still appears favorable for the crypto asset class.

Exhibit 3: No parabolic price increase this cycle

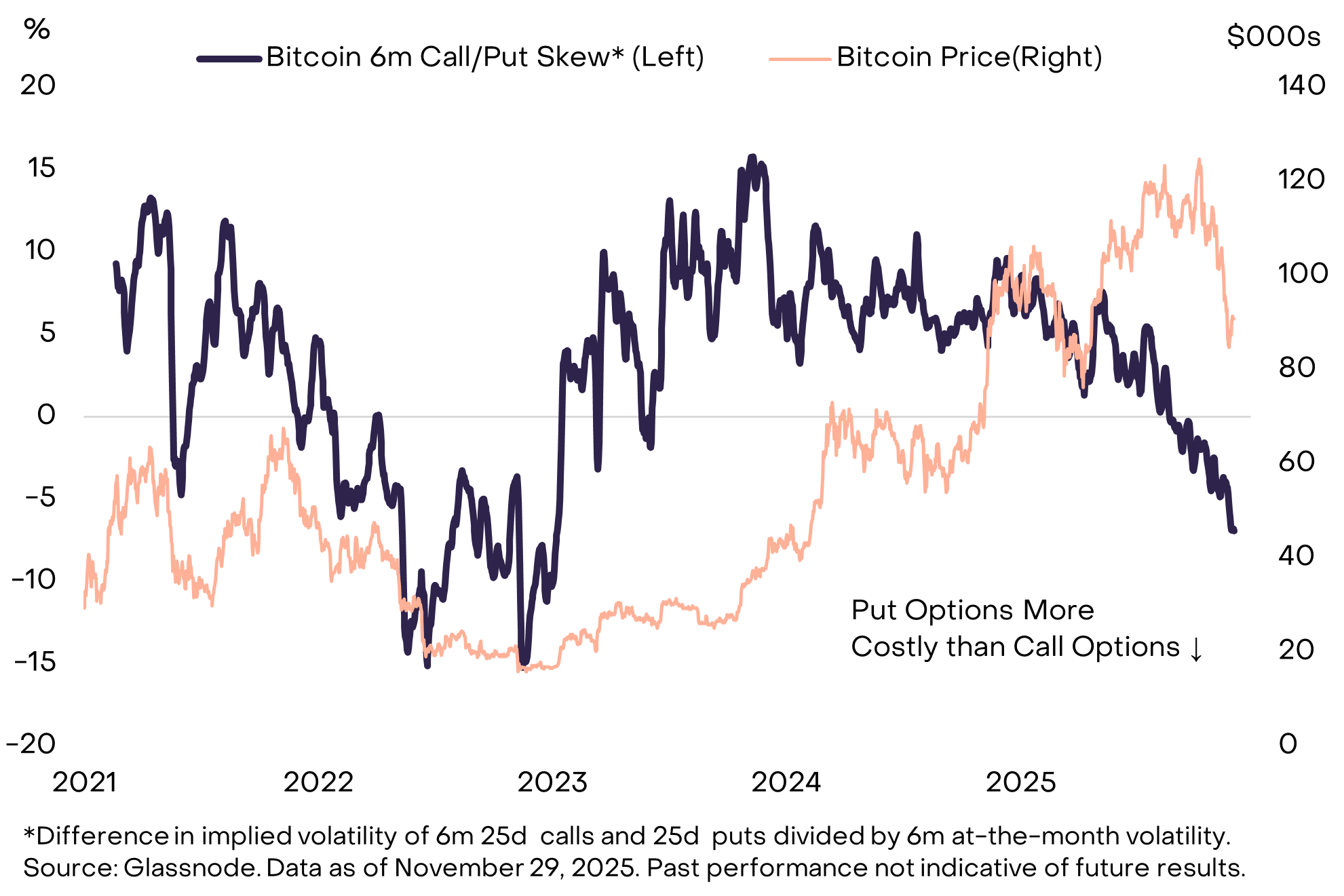

There are already some signs that Bitcoin and other crypto assets may have bottomed. For example, Bitcoin put option skew[4] is very high, especially for 3- and 6-month tenors, suggesting that investors have already extensively hedged downside exposure (Exhibit 4). The largest DATs are also all trading at discounts to the value of the crypto on their balance sheets (i.e., their “mNAVs” are below 1.0), which may also indicate light speculative positioning (often a precursor to recovery).

Exhibit 4: Elevated put skew suggests hedging of downside risk

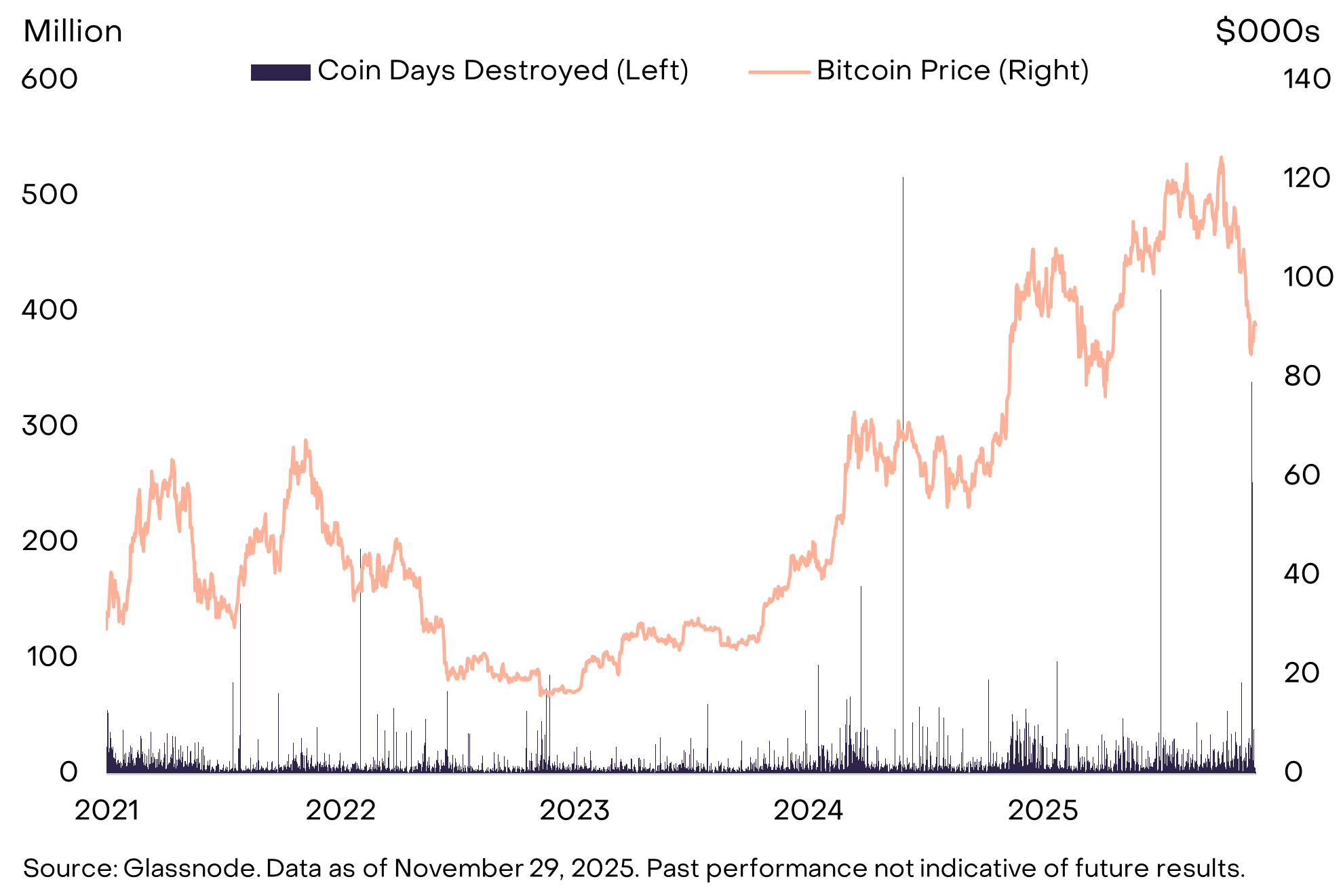

At the same time, a variety of fund flow indicators point to still-tepid demand: futures open interest declined further in November, ETP flows were negative until late in the month, and there may have been more Bitcoin “OG” selling. For the latter, on-chain data showed another spike in Coin Days Destroyed (CDD) in late November (Exhibit 5). Coin Days Destroyed is calculated as the number of coins transacted multiplied by the number of days since they were last transacted — CDD therefore increases when many old coins move at the same time. Similar to the spike in CDD in July[5], the increase in late November could indicate Bitcoin selling by a large longtime holder. For the short-term outlook, investors can be more confident that Bitcoin has bottomed once these fund flow indicators — futures open interest, ETP net inflows, and OG selling — turn around.

Exhibit 5: More old Bitcoin moved on chain

Privacy Stands Apart

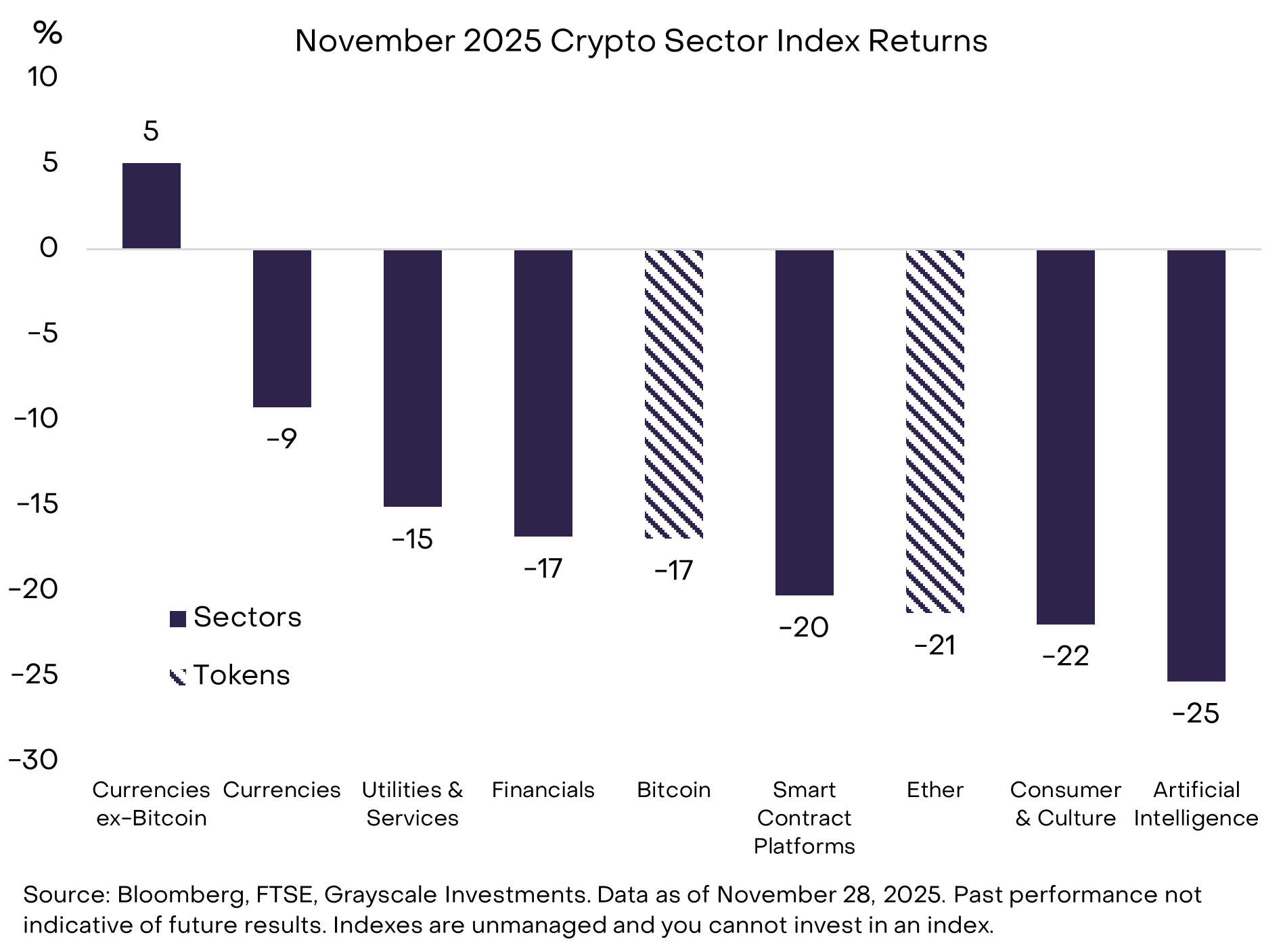

Bitcoin’s price decline during November was in the middle of the range among investable crypto assets, based on our Crypto Sectors family of indexes. The best-performing market segment was the Currencies Crypto Sector (Exhibit 6). Excluding Bitcoin, this market segment was higher during the month. The gains were tied to several privacy-focused cryptocurrencies: Zcash (+8%), Monero (+30%), and Decred (+40%).[6] There was also extensive focus on privacy in the Ethereum ecosystem: Vitalik Buterin unveiled a privacy framework at the Devcon conference, and Aztec, a privacy-focused Ethereum Layer 2, launched its Ignition Chain.[7] As discussed in our last monthly report, Grayscale Research believes that blockchain technology cannot reach its full potential without privacy elements.

Exhibit 6: Non-Bitcoin currency assets outperformed in November

The worst-performing market segment was the Artificial Intelligence (AI) Crypto Sector, which slid 25%. Despite price weakness during the month, there have been notable positive fundamental developments.

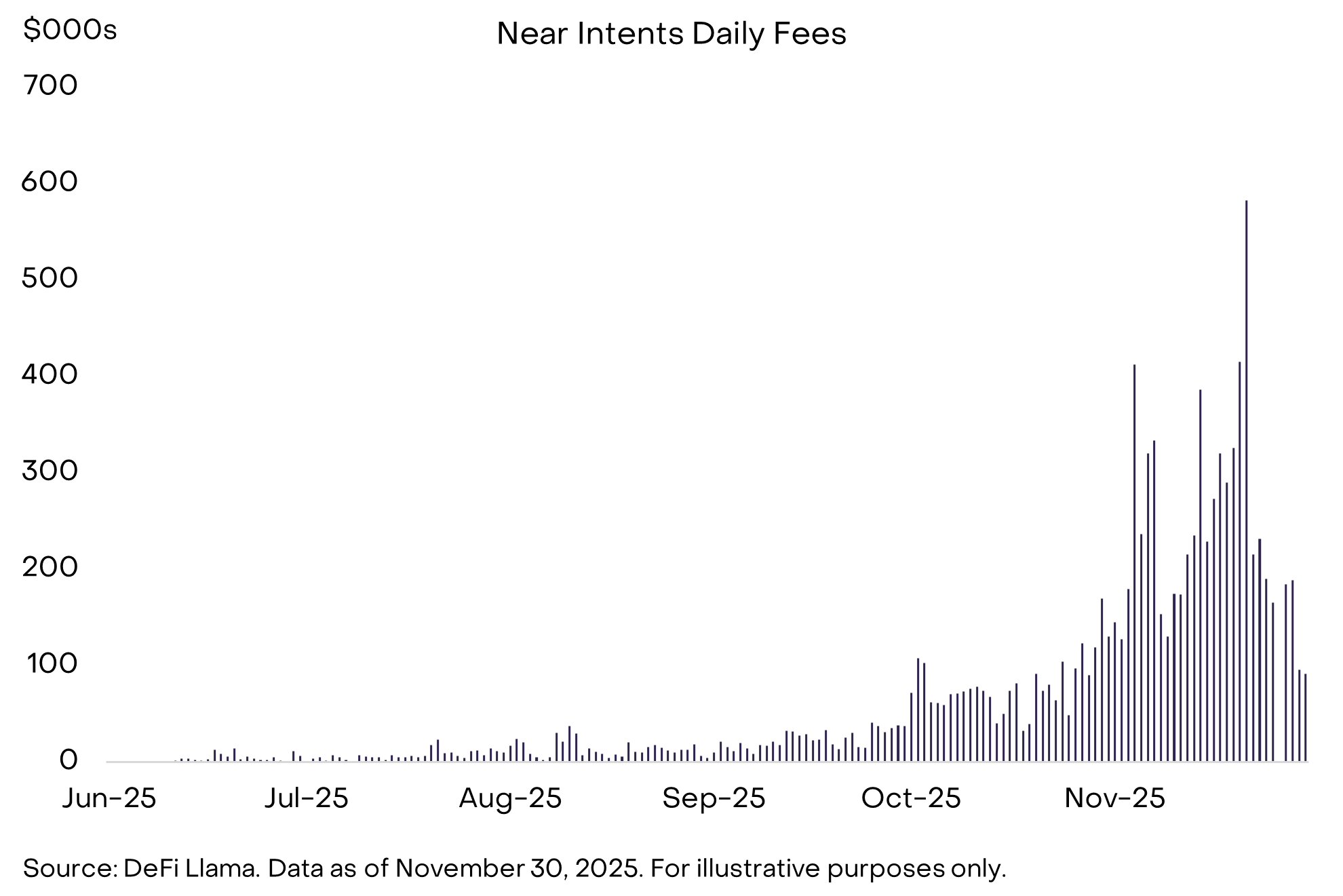

In particular, Near, the second-largest asset in the AI Crypto Sector by market cap, has seen rising adoption for its Near Intents product (Exhibit 7). Near Intents abstract away cross-chain complexity by connecting a user’s desired outcome to a network of solvers that compete to execute the optimal fulfillment path across chains. This feature is already boosting Zcash’s utility by allowing users to privately spend ZEC while recipients receive assets like Ether or USDC on other chains. It’s early, but we believe this integration could play a meaningful role in extending privacy-preserving payments across crypto.

Exhibit 7: Near finding product/market fit with Intents

Separately, developer attention has turned to x402, which is a new open payment protocol developed by Coinbase that enables AI agent-driven stablecoin payments directly over the internet. By eliminating account creation, human approval steps, and hosted payment processor fees, this payments standard enables frictionless, autonomous microtransactions executed by AI agents while using blockchains as the settlement layer. Recently, adoption of x402 has accelerated, rising from under 50,000 transactions per day in mid-October to more than 2 million per day by late November.[8]

Lastly, the crypto ETP landscape continued to expand, thanks to the new generic listing standards approved by the SEC (Securities and Exchange Commission) in September. Issuersbrought both XRP and Dogecoin ETPs to market last month, and more listings for single-token crypto ETPs are expected before year-end. According to Bloomberg data there are now 124 US-listed crypto-focused ETPs with assets under management totaling $145bn.[9]

Lower Rates, Bipartisan Legislation

In many ways 2025 has been an exceptionally good year for the digital assets industry. Most importantly, regulatory clarity drove a wave of institutional investment that will likely become the foundation for continued growth over the coming years. However, valuations have not tracked the improvement in longer-term fundamentals: our market cap-weighted Crypto Sectors index is down 8% since the start of the year.[10] Although 2025 has been uneven for crypto markets, eventually fundamentals and valuations will converge, and we are optimistic about the crypto market outlook into year-end and 2026.

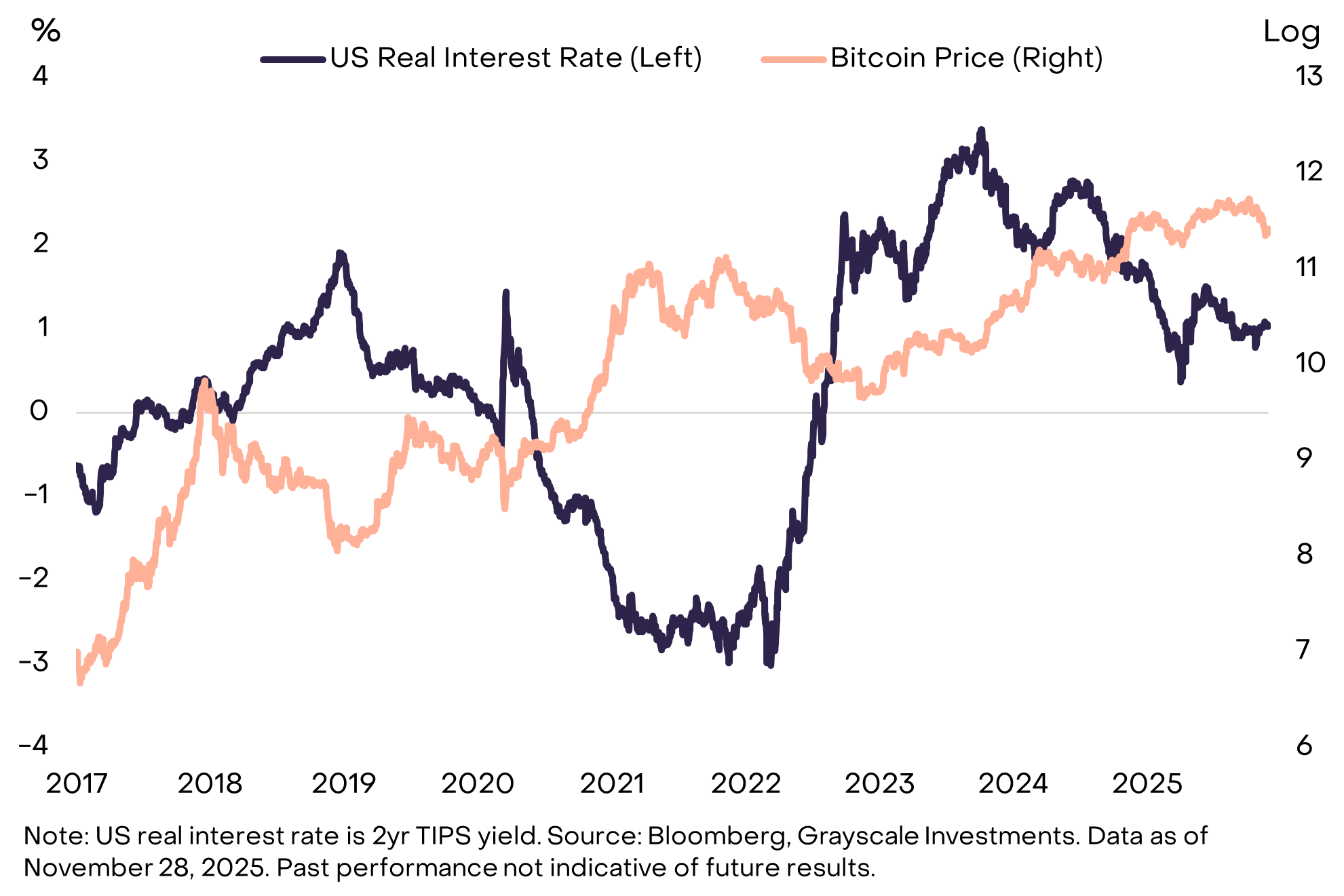

Over the short term the key swing factor will likely be whether the Federal Reserve cuts rates at its December 10 meeting, and what guidance it offers about policy rates for next year. Recent press reports have indicated that National Economic Council Director Kevin Hassett is the leading candidate to replace Fed Chair Powell.[11] Hassett would likely support lower policy rates: he said in a CNBC interview in September that the Fed’s 25-basis-point rate cut was “a good first step” in the direction of “much lower rates.”[12] All else equal, lower real interest rates should be considered negative for the value of the U.S. Dollar and positive for assets that compete with the Dollar, including physical gold and certain cryptocurrencies (Exhibit 8).

Exhibit 8: Fed rate cuts would likely support Bitcoin, all else equal

Another potential catalyst could be continued bipartisan efforts on crypto market structure legislation. The Senate Agriculture Committee (which oversees the Commodity Futures Trading Commission) released its bipartisan draft text in November.[13] If crypto can remain a bipartisan issue — and does not become a partisan topic for the midterm elections — the market structure bill could make further progress next year, potentially driving more institutional investment in the industry and ultimately higher valuations. Although we are optimistic about the near-term market outlook, the most meaningful gains are likely to come from HODL-ing for the long-term.

Some links are for articles which may sit behind a paywall and may require a subscription to access them in full.

Index Definitions: FTSE/Grayscale Crypto Sectors Total Market Index measures the price return of digital assets listed on major global exchanges. The FTSE Grayscale Smart Contract Platforms Crypto Sector Index was developed to measure the performance of crypto assets that serve as the baseline platforms, upon which self-executing contracts are developed and deployed. The FTSE Grayscale Utilities and Services Crypto Sector Index was developed to measure the performance of crypto assets that aim to deliver practical and enterprise-level applications and functionalities. The FTSE Grayscale Consumer and Culture Crypto Sector Index was developed to measure the performance of crypto assets that support consumption-centric activities across a variety of goods and services. The FTSE Grayscale Currencies Crypto Sector Index was developed to measure the performance of crypto assets that serve at least one of three fundamental roles: store of value, medium of exchange, and unit of account. The FTSE Grayscale Financials Crypto Sector Index was developed to measure the performance of crypto assets that seek to deliver financial transactions and services.

Disclaimer:

- This article is reprinted from [Grayscale]. All copyrights belong to the original author [Grayscale]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?