MSTR's Tribulation: Short Selling and Palace Intrigue

Recently, MSTR (Strategy) holders have likely been losing sleep.

This so-called “Central Bank of Bitcoin,” once held in high esteem, has seen its stock price devastated. As Bitcoin plunged from its historic high of $120,000, MSTR’s share price and market cap collapsed by more than 60% in a short time. There’s even a chance that MSTR could be removed from the MSCI stock index.

The drop in Bitcoin’s price and MSTR’s stock price are only the symptoms. What’s truly unsettling for Wall Street is the mounting evidence that MSTR is caught in a battle for monetary supremacy.

This is no exaggeration.

In recent months, seemingly unrelated events have started to connect: JPMorgan has been accused of sharply increasing its short positions against MSTR; users have experienced settlement delays when transferring MSTR shares out of JPM; the derivatives market has seen frequent moves to suppress Bitcoin; and policy debates around “Treasury stablecoins” and the “Bitcoin reserve model” have heated up rapidly.

These are not isolated events.

MSTR stands at the crossroads of two competing US monetary systems.

On one side is the established financial institutions: the Federal Reserve, Wall Street, and commercial banks (with JPMorgan at the center). On the other is the emerging financial system: the Treasury, stablecoin infrastructure, and a financial system leveraging Bitcoin as long-term collateral.

In this structural conflict, Bitcoin isn’t the end goal—it’s the battlefield. MSTR is the critical bridge: it transforms traditional institutions’ dollars and debt into Bitcoin exposure.

If the new system takes hold, MSTR is the core conduit. If the old system prevails, MSTR is the entity that must be suppressed.

That’s why MSTR’s recent plunge is not just ordinary market volatility. Three forces are colliding: Bitcoin’s natural price correction, MSTR’s own structural vulnerabilities, and the spillover from shifting power dynamics within the dollar system.

Bitcoin has strengthened the Treasury’s future monetary architecture while weakening the Fed’s position. The government faces a tough decision: to keep the window open for low-cost accumulation, JPM must continue to suppress Bitcoin.

The campaign against MSTR is systematic. JPMorgan understands this playbook perfectly—they established the rules. They’ve put MSTR on the table, dissecting its capital flows (veins), debt structure (skeleton), and market narrative (soul) with surgical precision.

Let’s break down the four potential “collapse scenarios” MSTR may face—each a calculated blow crafted by the old order.

Posture One: Exploiting the Crisis

This is the most obvious and widely discussed scenario: if BTC keeps falling, MSTR’s leverage amplifies losses, its stock price drops, refinancing options disappear, and a chain reaction collapse follows.

This logic is straightforward, but it’s not the crux of the issue.

Everyone knows “if BTC drops too far, MSTR is in trouble,” but few can pinpoint the level where MSTR shifts from “rock solid” to “on shaky ground.”

MSTR’s balance sheet hinges on three key figures:

Total BTC holdings exceed 650,000 coins (about 3% of all Bitcoin)

Average cost per coin is roughly $74,400

Some debt carries embedded price risk (not forced liquidation, but it affects net assets)

Many “MSTR to zero” stories treat it like an exchange contract with forced liquidation, but in reality, MSTR doesn’t have a forced liquidation price—it has a “narrative liquidation price.”

What does that mean?

Even if creditors won’t liquidate, the market can crush the stock. When the price falls far enough, MSTR can’t issue new bonds or convertible notes to shore up its position.

JPMorgan and other old-guard players are shorting MSTR in the US options market. Their approach is simple: take advantage of Bitcoin’s pullback to aggressively dump MSTR, sparking panic. Their goal: break the Michael Saylor legend.

This is MSTR’s first major risk: Bitcoin drops to a point where no one is willing to extend more capital.

Posture Two: Debt at the Door

Before diving into convertible notes, let’s clarify the “magic” behind MSTR CEO Michael Saylor’s strategy.

Many newcomers think MSTR just spends profits to buy Bitcoin. That’s not the case. MSTR is engaged in an aggressive “leveraged arbitrage game.”

Saylor’s core tactic: issue convertible notes, borrow dollars, and buy Bitcoin.

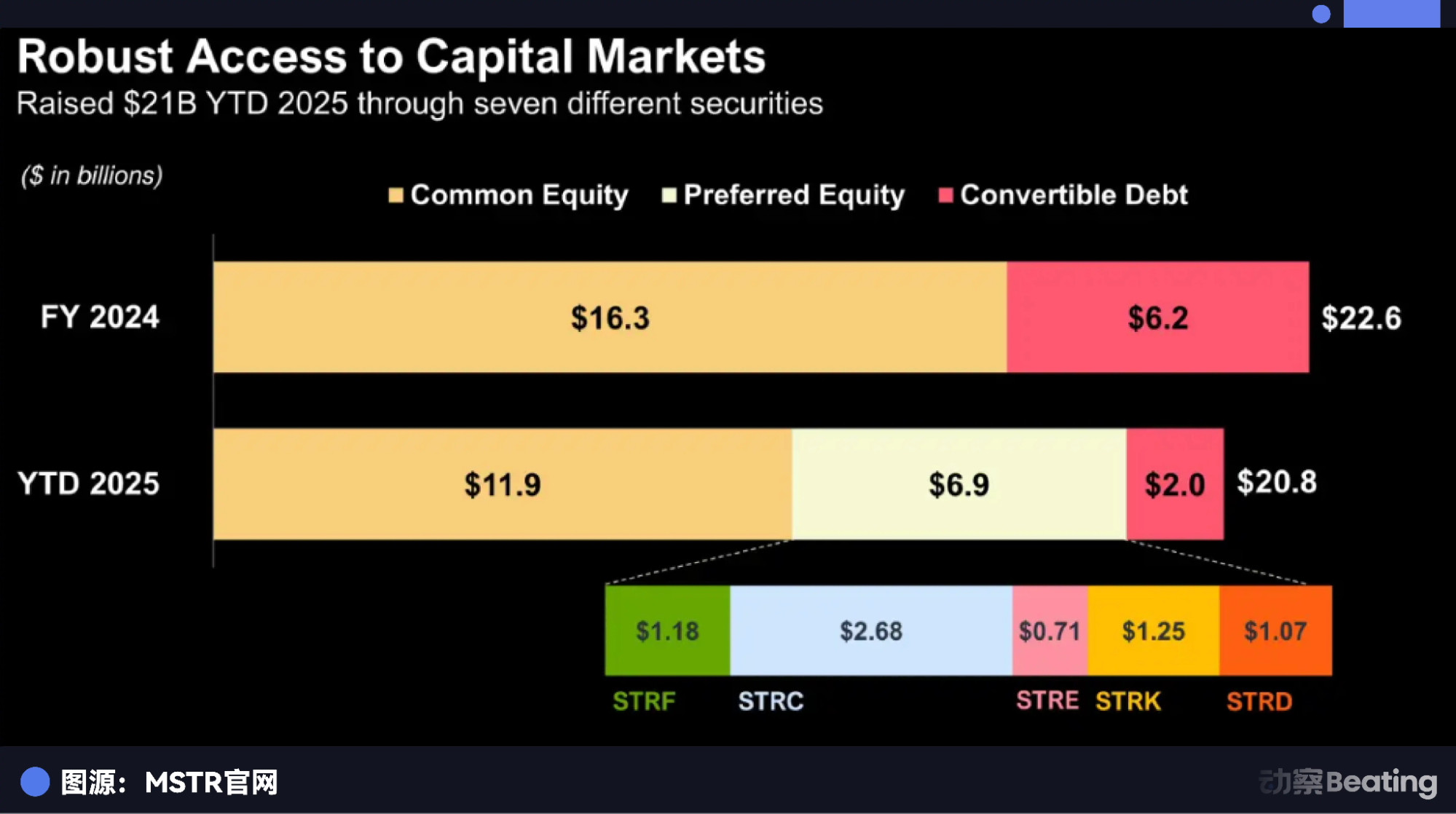

This year, MSTR issued securities totaling $20.8 billion—a scale rarely seen among US-listed companies in a single year. The breakdown: $11.9 billion in common stock, $6.9 billion in preferred stock, and $2 billion in convertible notes.

It sounds routine, but the details matter.

These bonds pay extremely low interest (some under 1%). Why do investors buy? Because the bonds include a call option. If MSTR’s stock rises, creditors can convert debt to shares and profit; if not, MSTR pays back principal and interest at maturity.

This is the well-known “flywheel”: issue debt to buy Bitcoin, Bitcoin rises, MSTR stock soars, creditors are happy, the stock premium increases, more debt is issued, and more Bitcoin is bought.

This creates an “upward spiral.” But every upward spiral has a corresponding death spiral.

This collapse mode is called “forced deleveraging under liquidity exhaustion.”

Picture this: in the future, Bitcoin enters a prolonged sideways market (not a crash, just stagnation). Old bonds come due. Creditors see MSTR’s stock below the conversion price.

Creditors aren’t philanthropists—they are opportunistic institutional investors. They won’t convert bonds to stock. They’ll demand, “Pay us in cash.”

Does MSTR have cash? No. It’s all in Bitcoin.

MSTR faces a grim choice: issue new debt to pay off old debt—but with low Bitcoin prices and poor sentiment, new bonds will carry sky-high interest rates, eating up what little software business cash flow remains.

Or, sell Bitcoin to repay debt.

If MSTR is forced to announce, “We’re selling Bitcoin to pay off debt,” this would have a highly destabilizing effect on the market.

Panic erupts: “The ultimate Bitcoin bull has surrendered!” Panic drives Bitcoin lower, MSTR’s stock crashes, more bonds can’t be converted, and more creditors demand repayment.

This is an opportunistic attack reminiscent of Soros’s strategies.

This is the most perilous collapse scenario. It doesn’t require a Bitcoin crash—just time. When debt matures during a stagnant market, the funding chain breaks abruptly.

Posture Three: Shattering Confidence

If the second posture is “out of cash,” the third is “out of faith.”

This is MSTR’s biggest hidden risk and the blind spot most retail traders miss: the valuation premium.

Let’s break it down: buy one share of MSTR for $100. Only $50 of that is actual Bitcoin value. The other $50?

It’s air—or more charitably, “faith premium.”

Why pay double for Bitcoin?

Before spot ETFs like BlackRock’s IBIT, institutions had no choice but to buy stocks. After spot ETFs launched, people still bought MSTR because they believed Saylor’s debt-fueled strategy would outperform simple holding.

But this logic has a fatal flaw.

MSTR’s stock price depends on the narrative, “I can borrow cheap money to buy Bitcoin.” If that narrative breaks, the premium evaporates.

Imagine Wall Street keeps the pressure on, and the White House also forces MSTR to give up its holdings. What if the SEC suddenly rules, “Public companies holding Bitcoin are non-compliant”? In that instant, faith collapses.

This is known as the “Davis Double Kill” scenario.

At that moment, the market asks: “Why pay $2 for $1 of value? Why not just buy BlackRock’s ETF, which is 1:1?”

Once this thinking becomes consensus, MSTR’s premium will drop from 2.5x or 3x to 1x, or even to a 0.9x discount (since it’s a company with operational risk).

This means that even if Bitcoin’s price stays flat, MSTR’s stock could be cut in half.

This is a narrative collapse. It’s not as bloody as a debt default, but it’s more devastating. Your Bitcoin holdings don’t drop, but your MSTR position shrinks by 60%. You start to question everything. This is a severe valuation loss.

Posture Four: The Index Trap

The fourth posture is the most subtle, least known, and most ironic.

What is MSTR desperately doing now? It’s working to boost its market cap to be included in more indexes, like the MSCI stock index, NASDAQ, and potentially the S&P 500.

Many cheer: “Once it joins the S&P 500, trillions in passive capital will have to buy it, and the stock will soar forever!”

But as the saying goes, fortune and misfortune are interwoven.

By joining US stock indexes, MSTR is no longer just a manipulated stock—it’s become a cog in the US financial system. Wall Street is shorting MSTR with one hand while spreading news about its potential removal from indexes, triggering panic selling among retail investors.

MSTR is no longer in control. It tried to use Wall Street’s capital, but ended up trapped by Wall Street’s rules.

It tried to climb using Wall Street’s rules, but may ultimately be undone by those same rules.

Epilogue: The Fate of Power Struggles

Michael Saylor is both a genius and a madman. He saw through fiat devaluation and seized a generational opportunity. He transformed an average software company into a Noah’s Ark for millions of risk-takers.

But the scale of Bitcoin he holds now far exceeds what the company can withstand.

Many speculate that the US government may someday directly invest in MSTR.

This could mean swapping US Treasuries for MSTR equity, supporting government-backed preferred shares, or even direct intervention to upgrade its credit rating.

The climax of this drama has yet to unfold. The struggle between the old and new US financial orders is still unfolding. MSTR’s structure is fragile: it is exposed to volatility but constrained by time.

If a single critical factor is disrupted, any of the four postures—price collapse, debt default, premium evaporation, or index exclusion risk—could destabilize MSTR in short order.

But if all these forces align, MSTR could become one of the most explosive assets in global markets.

That’s the allure—and the danger—of MSTR.

References:

1. Trump’s Gambit: The Quiet War Between the White House and JPMorgan

Statement:

- This article is reprinted from [BlockBeats]. Copyright belongs to the original author [Lin Wanwan]. If you have concerns about this reprint, please contact the Gate Learn team. We will address the issue promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or plagiarize these translations without referencing Gate.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market