How to Turn $6,800 into $1.5M With a Maker Rebate Bot on HyperLiquid

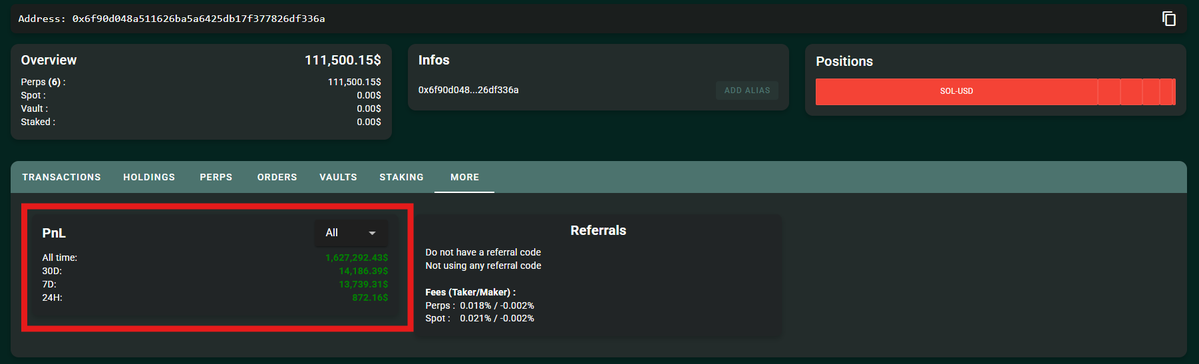

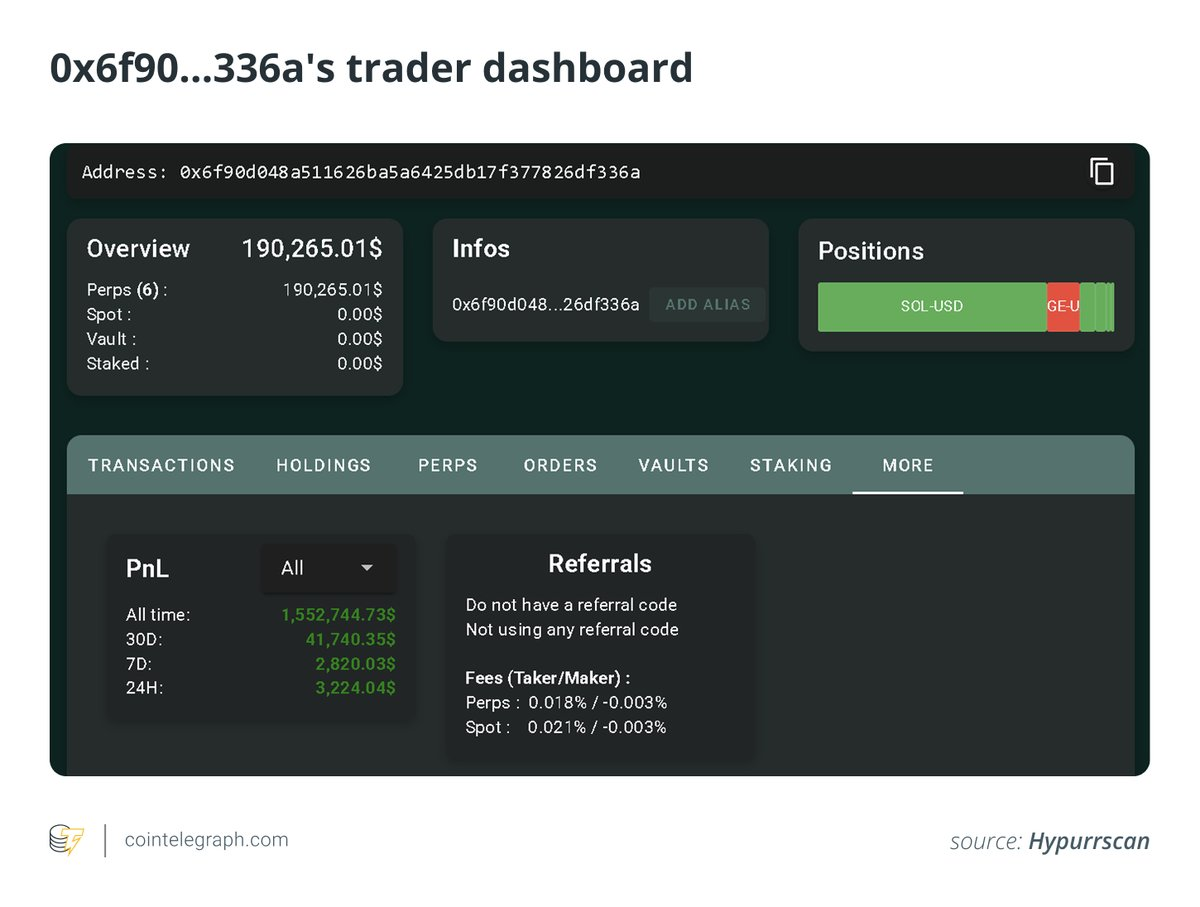

This is a great example of why you should learn to code. It can enable you to turn $6,800 into $1.5 million in just two weeks on @ HyperliquidX.

That’s exactly what this HL trader did not long ago.

What makes this impressive is that almost no risk was taken. The trader didn’t bet on market direction or speculate on hype. He just relied on a sophisticated market-making strategy built on maker rebates, automation, and strict risk discipline.

1. Market Making on HyperLiquid

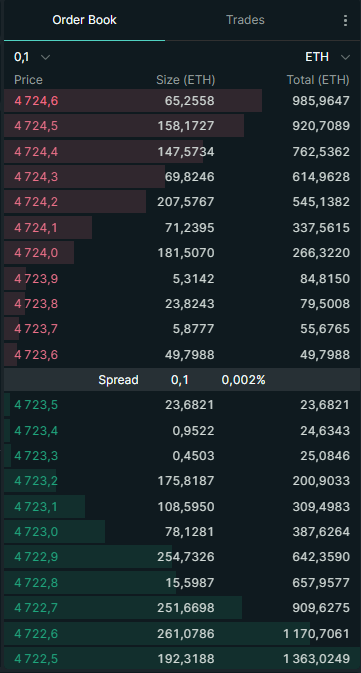

Before we dive into the details of the strategy, it’s important to understand how market making works on HyperLiquid. HL is an order book exchange, where users can place:

- Bids = buy orders (e.g., “I want to buy SOL at $100”)

- Asks = sell orders (e.g., “I want to sell SOL at $101”)

These pending orders make up the order book. Traders who place bids and asks are called makers.

- A maker provides liquidity by placing limit orders in advance.

- A taker executes an existing order from the order book (e.g., a market buy at the best available ask).

Market makers are essential because they provide liquidity and keep spreads tight. Without them, traders would face poor pricing and heavy slippage.

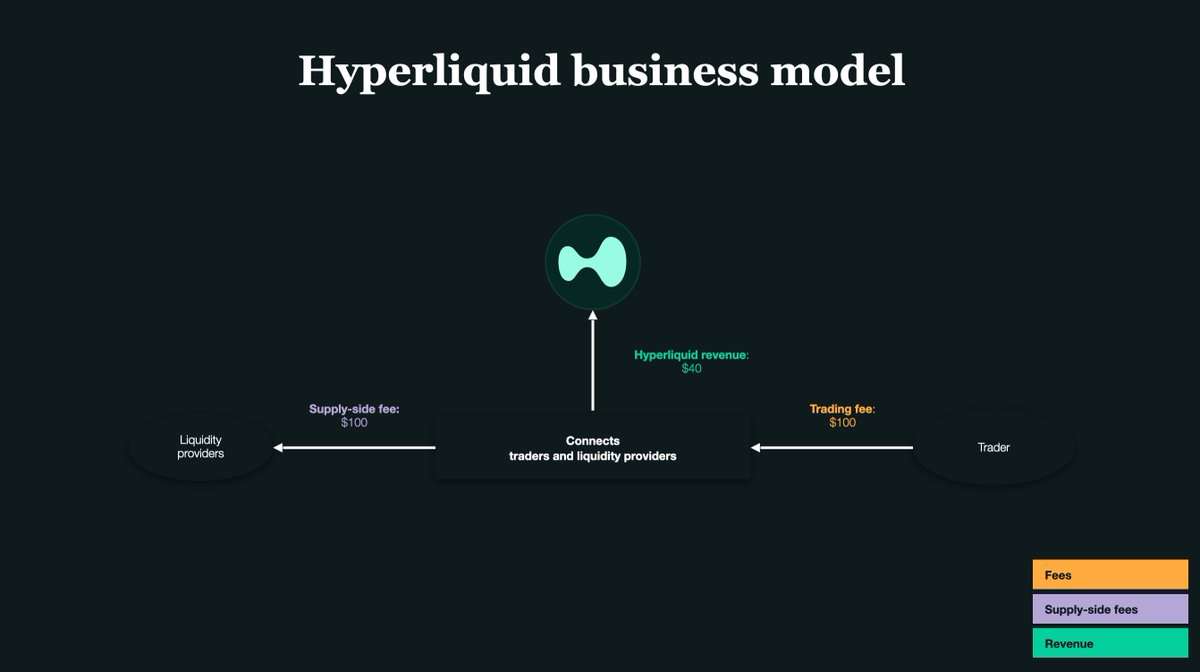

2. It’s All About Maker Rebates

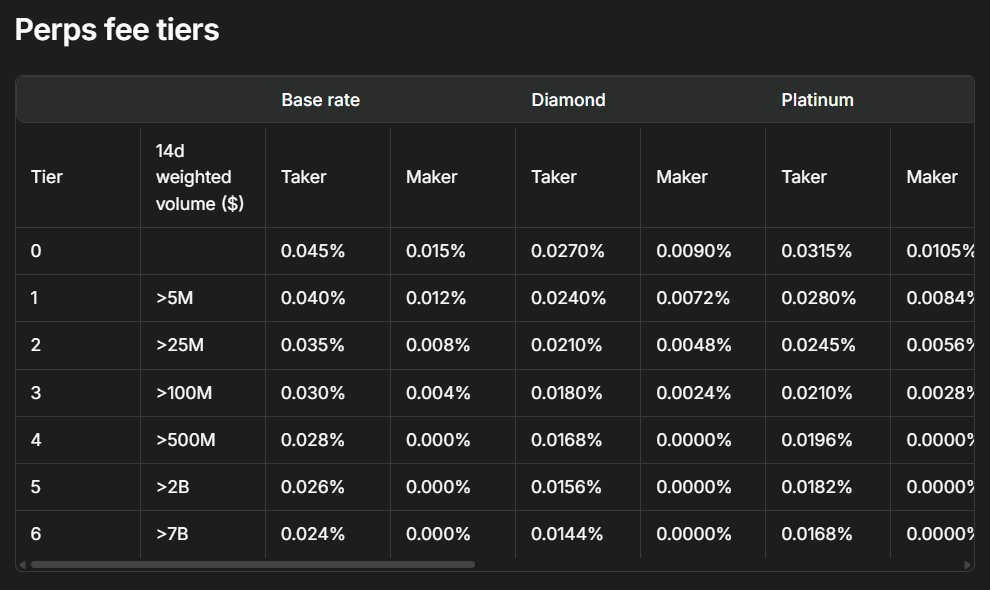

The backbone of any exchange is liquidity. To encourage liquidity providers, HyperLiquid pays makers a small rebate whenever their orders are filled.

On HL, the rebate is around 0.0030% per trade. That’s $0.03 for every $1,000 traded.

This tiny rebate is exactly what allowed the trader to scale his $6,800 into $1.5M. His strategy was based on one-sided quoting, placing limit orders only on one side of the book (either just bids or just asks), and then quickly canceling or flipping sides whenever the market moved.

In short, he provided liquidity only on one side, collected micro-gains from rebates, and used his bot to switch sides before exposure became dangerous. Small rebates turned into huge profits thanks to massive automated volume.

3. The Classic Market Maker Problem

Most market makers post both bids and asks at the same time.

For example, you post a bid for 1 SOL at $100 and an ask for 1 SOL at $101.

If both fill, you’ve bought at 100 and sold at 101, making a small spread profit.

But there’s a problem: you may accumulate inventory risk.

- If bids fill but asks don’t, you’re stuck holding SOL.

- If asks fill but bids don’t, you’re stuck holding stablecoins.

If the market moves against you while holding inventory, you can lose heavily.

That’s why this trader always used one-sided quoting. It gave him much tighter control over his inventory and avoided being stuck with unwanted assets. The trade-off is a higher vulnerability to being “picked off.”

4. What Does “Being Picked Off” Mean?

Imagine you post a bid at $100 to buy SOL. Suddenly, unexpected news hits, and the price instantly drops to $90.

- Your bid at 100 is still in the order book.

- A faster trader immediately sells to you at 100.

- Result: you overpaid by 10%, and even though you earn the rebate, you still took a major loss.

This is called adverse selection, or being “picked off.”

That’s why precision and speed are everything when using one-sided quoting. The entire strategy depends on how efficient and responsive your bot is.

5. High-Frequency Trading Infrastructure

To avoid being picked off, the trader needed an ultra-fast execution system:

- Colocation: running servers physically close to HL’s servers to minimize latency.

- Automation: bots adjusting quotes thousands of times per second.

- Real-time risk control: cutting inventory before it spiraled out of control.

This infrastructure is both costly and complex, which explains why only a few market makers can deploy it.

The bot was almost certainly coded in C++ or Rust (for speed and low latency). The server infrastructure was colocated near HL’s matching engine to ensure his orders were always first in line.

It consumed real-time order book feeds through WebSockets or gRPC, placing and canceling one-sided quotes within milliseconds to collect rebates while avoiding stale orders.

6. How He Stayed Delta-Neutral

What impressed me most was the trader’s ability to stay delta-neutral. Despite moving billions in trades, he kept net delta exposure under $100,000.

How?

- The bot constantly tracked how much SOL was being accumulated.

- A strict exposure cap was set (never exceed $100K).

- If exposure got too high, the bot stopped trading that side and switched to the opposite side to rebalance.

He didn’t attempt spot vs. futures arbitrage. Instead, he stayed entirely in perpetual futures, which made neutrality easier since everything was in one market.

It required discipline and precision, even the smallest mistake could be costly.

7. The Math Behind it

The math is surprisingly clean.

- In two weeks, the trader processed $1.4 billion in trading volume.

- Maker rebate = 0.003% per fill.

- Profit from rebates = $1.4B × 0.003% = ~$420,000.

On top of that, he compounded the profits, every rebate earned was redeployed into more trading. This exponential effect boosted total profit to $1.5 million.

And all of this started with just $6,800 actively deployed capital.

8. Why You Can’t Just Copy This

You might be thinking: “Why not just copy trade and make the same returns?” The reality is, it doesn’t work that way.

- You don’t have the execution speed he had.

- You don’t have the capital scale he deployed.

- You don’t have the same precision coding or bots tuned to every micro-move of the order book.

- You don’t have 24/7 infrastructure and monitoring.

This was a professional-grade HFT system, not something retail traders can easily replicate.

9. Risks of the Strategy

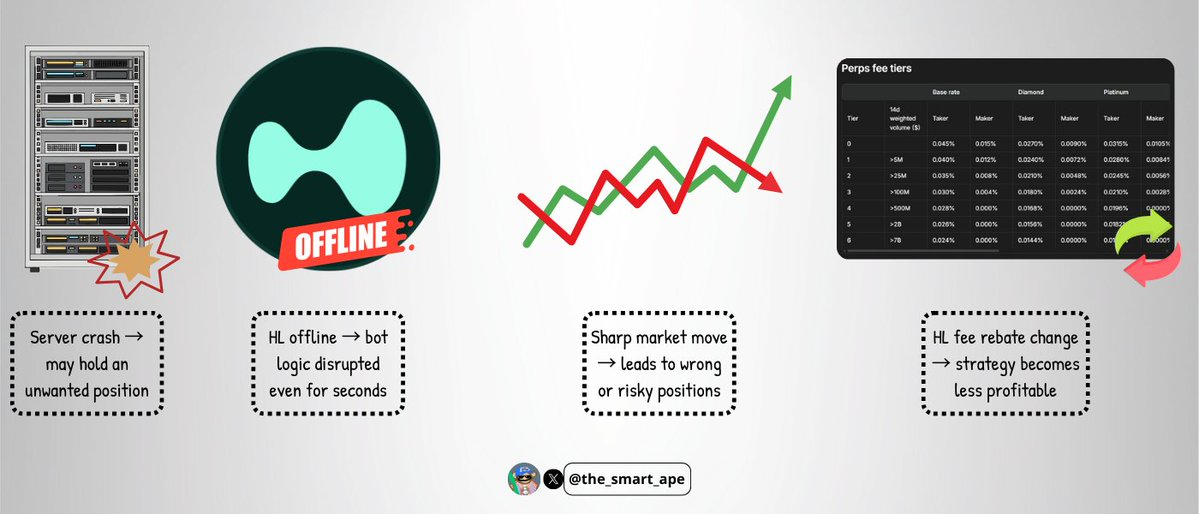

Even for a highly engineered bot, there are always risks:

- Server crashes could leave him holding unwanted positions.

- HyperLiquid outages, rare but possible, could break the bot’s logic in seconds.

- Extreme market volatility could disrupt one-sided quoting and cause losses.

- Fee structure changes on HL could instantly make the strategy less profitable.

The strategy is elegant but not bulletproof.

10. Conclusion

Turning $6,800 into $1.5M in two weeks might sound like meme-coin luck, but it was actually about technical skill, discipline, and precision engineering.

It’s a brilliant case study of how to exploit maker rebates at scale, stay delta-neutral, and minimize directional risk.

The key takeaway is that trading isn’t only about predicting prices. Sometimes, the most profitable play is to master the rules of the market structure itself, and build systems that harvest value where others don’t even look.

Disclaimer:

- This article is reprinted from [the_smart_ape]. All copyrights belong to the original author [the_smart_ape]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What is Stablecoin?

Arweave: Capturing Market Opportunity with AO Computer