How can mining companies seize a share of the trillion-dollar AI infrastructure market?

Reposted from the original article: “Power is King: How Mining Companies Are Seizing the Trillion-Dollar AI Infrastructure Track?”

This year, mining companies like IREN, CORZ, and HUT have pivoted to AI data centers, with their stock prices surging severalfold. This article examines the logic driving these price gains and the critical factors shaping the outlook for the sector.

Following Bitcoin’s 2024 halving, intensifying miner competition, and tepid BTC price growth, crypto mining firms are rapidly pivoting to AI compute centers. By leveraging their existing power infrastructure, miners are closing the AI compute gap. In 2025, several mining companies are expected to achieve significant revenue and valuation increases by expanding into AI/HPC (High Performance Computing), ushering in a classic Davis Double Play—where both company earnings and market valuation rise in tandem, fueling outsized share price gains.

1. Crypto Mining’s Profit Squeeze and the Rise of the AI Compute Wave

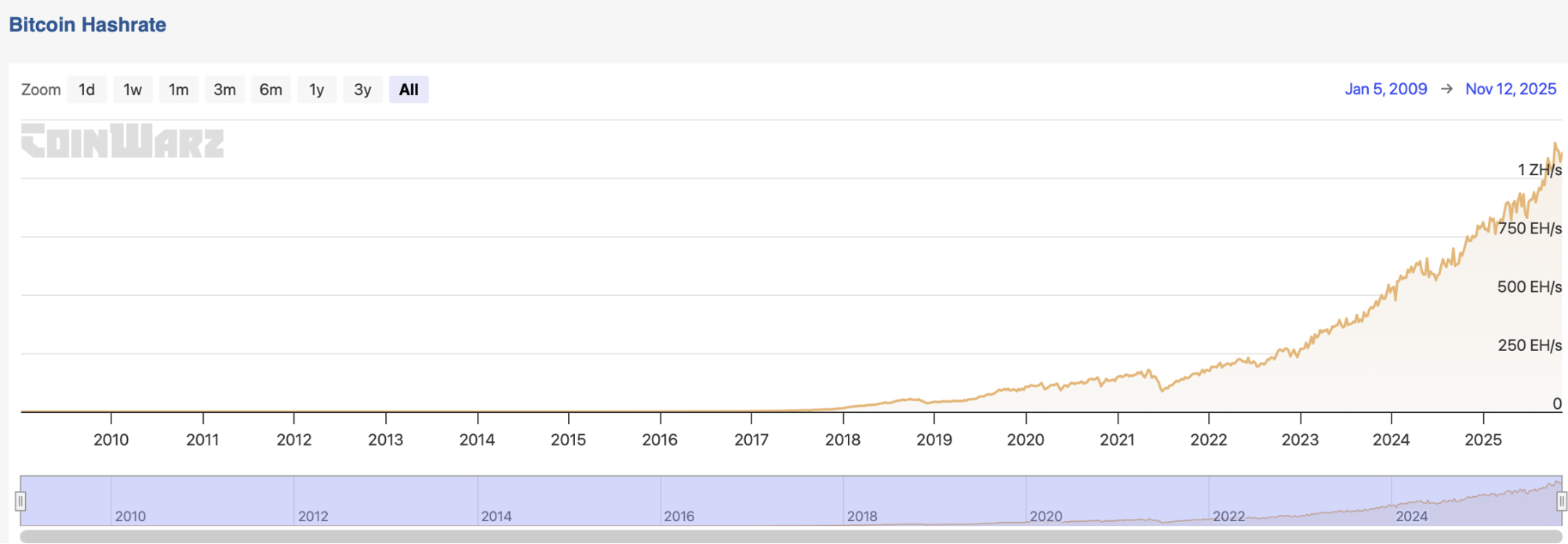

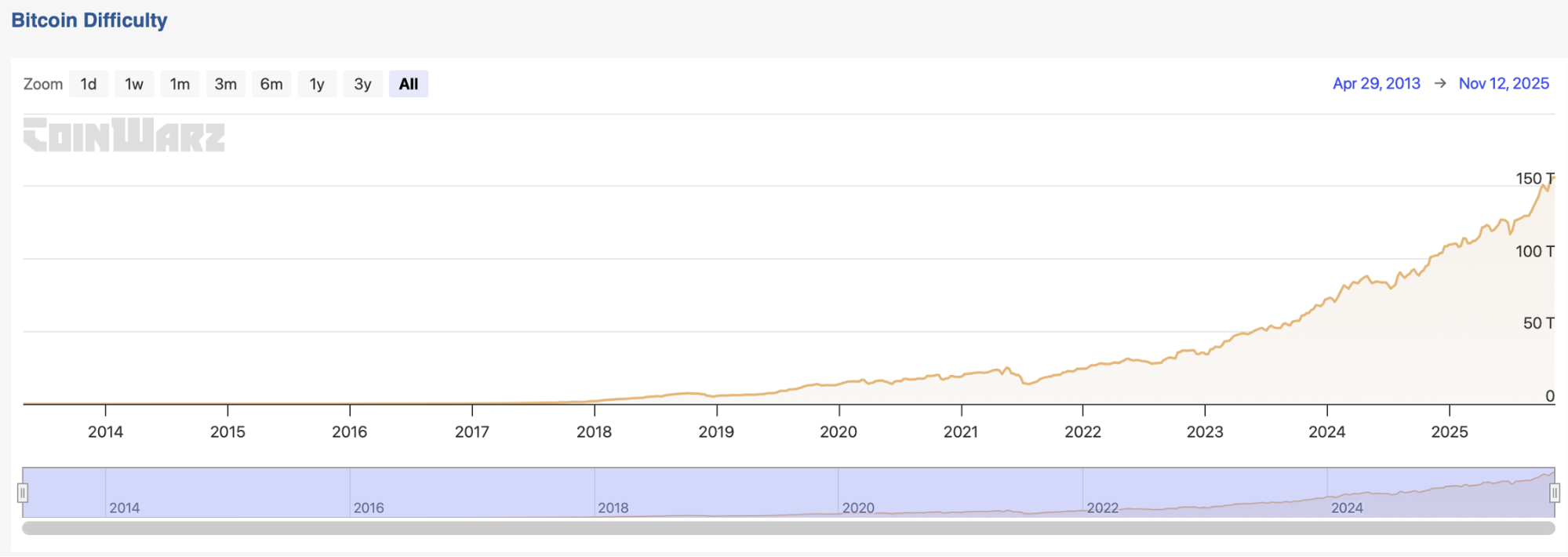

In April 2024, Bitcoin underwent its fourth halving, slashing block rewards from 6.25 BTC to 3.125 BTC. At the same time, total network hash rate soared past 1,000 EH/s—double its level from April 2024. Yet, BTC’s price increased just 60%, highlighting a further squeeze on mining profitability amid intensifying competition. For some miners, shutdown prices have approached $100,000.

Figure: Network hash rate hits record high

Source: Coinwarz

Figure: Mining difficulty at new high

Source: Coinwarz

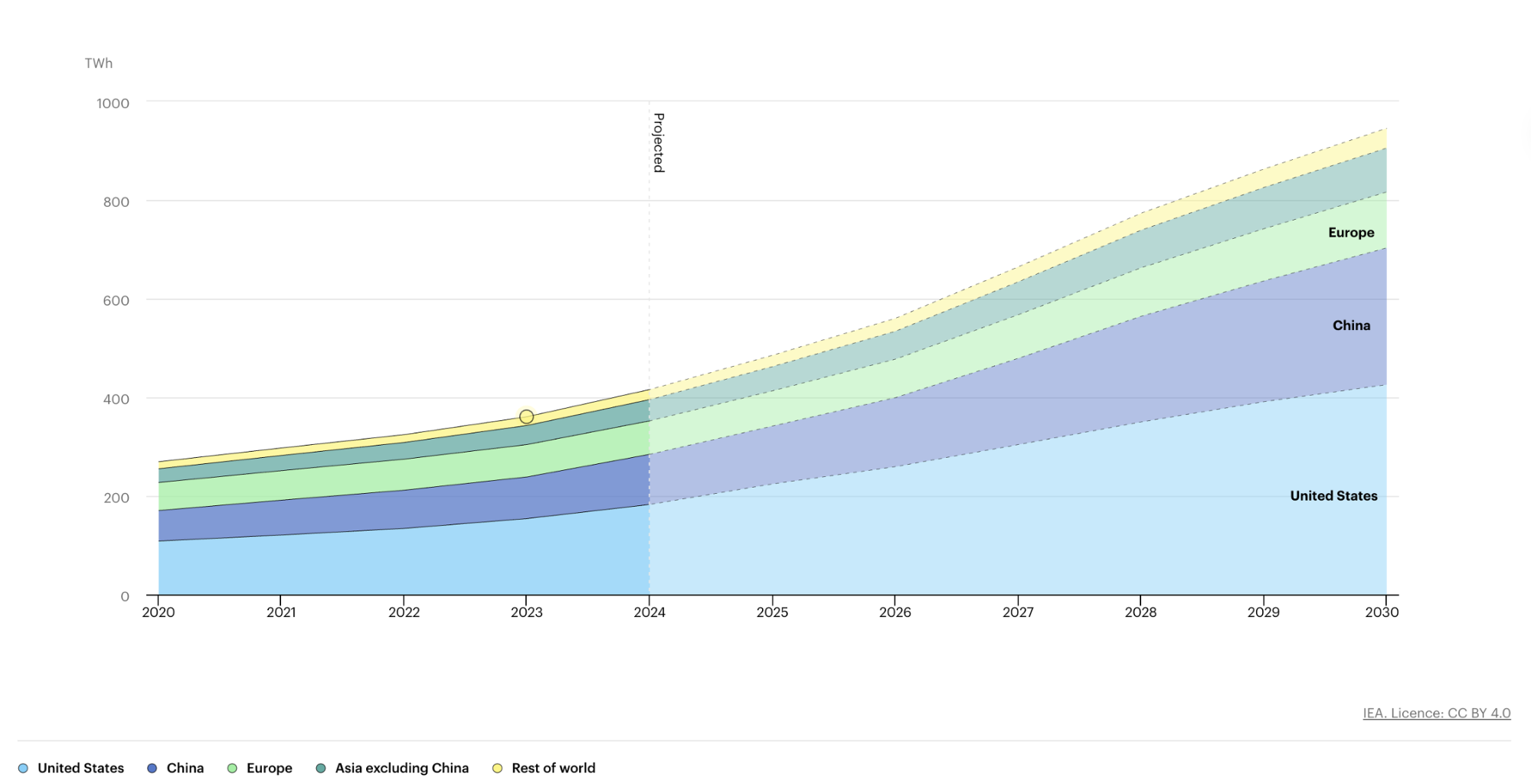

In parallel, explosive growth in AI models has driven massive compute demand—and behind that, massive electricity demand. Energy is fast becoming the “new oil” of the digital era. The International Energy Agency (IEA) projects global data center power consumption will double from 415 TWh in 2024 to 945 TWh by 2030, representing 2.5–3% of the world’s electricity usage. The US Department of Energy (DOE) reports that AI data center workloads have tripled over the past decade and are expected to double again by 2028.

Figure: Data center electricity use projected to reach 945 TWh by 2030

Source: International Energy Agency (IEA)

2. AI’s Soaring Power Needs Are Hard to Meet—Mining Companies Have Natural Advantages as Compute Centers

Surging AI-driven power demand is tough to satisfy in the near term, mainly because:

1. The current power grid has limited capacity and can’t expand quickly;

2. AI data centers require high-density, base-load power, making site selection challenging;

3. Utilities can’t easily predict the volatility in AI-driven electricity demand, leading to lagging generation investments;

4. Core components like transformers and cables have long production cycles, and it takes 2–5 years to bring a new data center online;

5. Power interconnection approvals for AI data centers take 12–18 months on average, and as long as three years in some US states.

These constraints make qualified power and infrastructure scarce for AI model training. However, large crypto miners already have power permits, locked-in low-cost electricity contracts, are located where power is cheap and reliable (such as Texas, Quebec, and Iceland), and have mature substations, power infrastructure, and cooling systems.

Most miners also own large tracts of land, industrial facilities, and robust network connectivity that can be quickly repurposed for AI compute. These structural advantages make it seamless for miners to transition to data centers. Key mining firms to watch include:

1. IREN Ltd (Ticker: IREN)

Founded in Australia in 2018, IREN focused on renewable energy for crypto mining. Between 2018 and 2021, it expanded rapidly and began building data centers in North America. IREN went public on Nasdaq in 2021. From 2023 to 2024, it started rolling out GPU cloud platforms and signed AI compute contracts, gradually shifting its data centers from Bitcoin mining to AI/HPC (High Performance Computing) services. In 2024, it rebranded as IREN Limited, signaling a full pivot to digital infrastructure.

Unlike its peers, IREN manages the entire value chain in-house—from energy procurement to data center operations. By completing its strategic transition before the 2024 halving, it avoided the post-halving collapse in mining profits and now boasts exceptional growth potential and vision.

IREN has now locked in 2.9 GW of power capacity, with six built or in-development data center campuses, industry-low energy costs at around $0.035/kWh, and a green power profile that attracts ESG-minded clients and investors. IREN is endorsed by Nvidia as a key partner and signed a $9.7 billion deal with Microsoft on November 3.

2. Core Scientific (Ticker: CORZ)

Core Scientific, founded in 2017, was a leading US Bitcoin miner. It went public via SPAC in 2022, but the BTC crash and heavy debt forced it into bankruptcy that same year. After restructuring, it relisted in January 2024 and leveraged its infrastructure to quickly pivot to AI/HPC services.

In 2024, Core Scientific entered a 12-year agreement with AI cloud provider CoreWeave to offer up to 200 MW of infrastructure hosting, with projected total revenue over $3.5 billion. In 2025, CoreWeave proposed a $9 billion acquisition, but Core Scientific shareholders rejected the offer in October, preferring independent growth.

3. Hut 8 (Ticker: HUT)

Hut 8, founded in 2017 and listed on Nasdaq in 2021, was one of North America’s earliest crypto miners. The pivotal moment came in November 2023, when it merged with USBTC, boosting its compute scale and acquiring USBTC’s HPC and AI cloud business, turning Hut 8 into a diversified digital infrastructure provider.

In 2024, Hut 8 raised $150 million via convertible bonds to build AI infrastructure. By August 2025, it will add 1.5 GW of capacity by constructing four new sites. In March 2025, it joined forces with the Trump family to establish American Bitcoin, with Eric Trump as Chief Strategy Officer. Hut 8 will secure an 80% equity stake in the new company by supplying mining rigs. The company went public on Nasdaq in September 2025, and Hut 8 has drawn attention for its political and business ties to the Trump family.

Figure: IREN up 987% YTD, HUT up 249% YTD, CORZ up 131% YTD

Source: TradingView

3. Key Market Catalysts and Risks Ahead

1. In the short term, monitor large contract awards and upstream capital expenditure trends. The AI/HPC market is highly concentrated, with CoreWeave, Microsoft, Google, and a few others accounting for most demand. Watch for upward revisions to Q4 Capex guidance from these upstream players, as this signals increased demand for mining companies’ AI/HPC services. Also, track contract signings and execution schedules for direct insight into sector momentum.

2. Longer term, focus on miners’ scalable power capacity, their ability to maintain low power costs, and whether ongoing AI expansion can sustain robust power demand—supporting high sector valuations. Data centers are capital intensive, so scrutinize companies’ financing abilities and financial health, the risk of fixed asset depreciation from tech advances, and the fact that the sector remains story-driven and in heavy build-out mode—raising the risk of hype and underperformance if expectations aren’t met.

Statement:

- This article is reprinted from [TechFlow], original title “Power is King: How Mining Companies Are Seizing the Trillion-Dollar AI Infrastructure Track?”, copyright belongs to [Yuuki, Deep Tide TechFlow]. For any copyright concerns, please contact the Gate Learn Team) for prompt resolution.

- Disclaimer: The views and opinions in this article are those of the author only and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Without proper attribution to Gate, copying, distribution, or plagiarism of translated content is strictly prohibited.

Related Articles

Arweave: Capturing Market Opportunity with AO Computer

The Upcoming AO Token: Potentially the Ultimate Solution for On-Chain AI Agents

AI Agents in DeFi: Redefining Crypto as We Know It

What is AIXBT by Virtuals? All You Need to Know About AIXBT

Dimo: Decentralized Revolution of Vehicle Data