GUSD: The Evolution of Yield-Bearing Stablecoins

Stablecoins Enter a New Era

In the past, stablecoins acted as a buffer during market volatility, providing a safe harbor for capital and helping mitigate loss risk. With the rise of DeFi and the growing adoption of Real World Assets (RWA), stablecoins are being reimagined—not just as passive stores of value, but as yield-generating instruments.

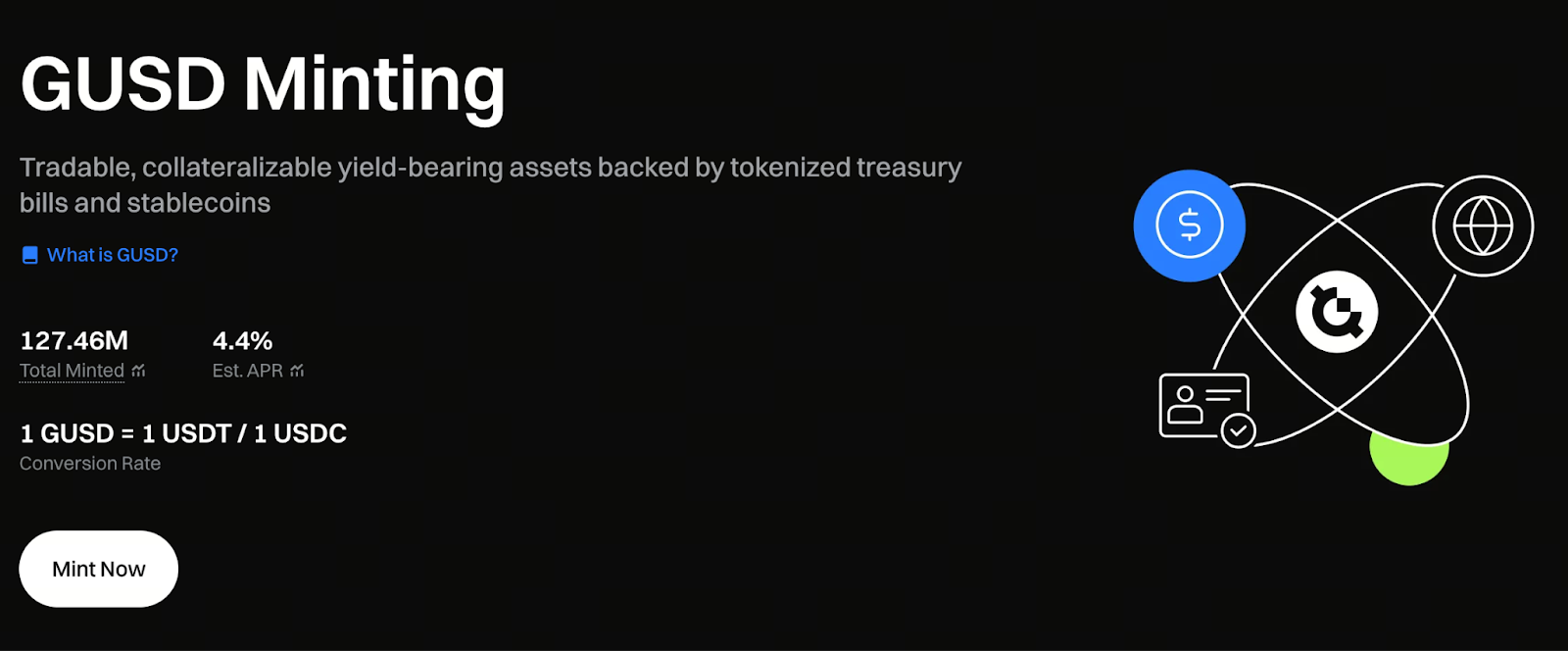

Leading this transformation, GUSD plays a crucial role. It maintains a one-to-one peg with the US dollar and automatically pays interest to holders, establishing itself as a new generation yield-bearing on-chain dollar.

Traditional Financial Yields Power the Foundation

GUSD’s yield doesn’t rely on typical crypto mechanisms like token emissions or inflation. Instead, it’s driven by a portfolio of low-risk, real-world assets, such as:

- U.S. short-term Treasury bills

- High-grade corporate commercial paper

- Other fixed-income instruments

This structure gives GUSD two core advantages:

- Stable Peg, Immune to Market Sentiment

GUSD consistently maintains a 1:1 value with the US dollar, even during sharp market swings. - Transparent and Sustainable Yields

Interest comes directly from the cash flows of traditional financial instruments, ensuring both reliability and traceability—without relying on market speculation.

For investors seeking stability, GUSD acts as a smart dollar asset that automatically accumulates yield.

Two Simple Ways to Access GUSD

GUSD offers multiple entry points for easy participation:

- Fast Exchange on Trading Platforms

Swap leading stablecoins like USDT and USDC for GUSD in a quick, streamlined process. - On-Chain Smart Contract Minting

Mint GUSD at a 1:1 ratio, with the yield distribution process fully transparent and on-chain.

Whether you prefer CeFi or DeFi, you’ll find a way to participate that suits your needs.

Mint GUSD now and earn yields calculated on an annualized basis, paid daily: https://www.gate.com/staking/GUSD?gt_disable_intercept_jump=1

Automatic Yield Distribution Drives Compound Growth

One of GUSD’s standout features is its smart yield mechanism. It automatically accrues interest and distributes it to users periodically, enabling true compound growth on your funds.

Example: If you mint GUSD by depositing 100 USDT and the annual yield is roughly 20%, you could redeem approximately 120 USDT after one year.

This approach blends on-chain efficiency with the steady returns of traditional finance, giving users greater control over their crypto earnings.

Diverse Applications in the Web3 Ecosystem

GUSD is evolving beyond simply storing value and is now a core financial infrastructure for Web3. Common uses include:

- Long-term staking or vesting

- Ecosystem rewards and airdrops

- Lending protocols and yield pools

- Launchpool and leveraged products

These use cases make GUSD a key driver of capital efficiency and ecosystem liquidity.

Three Core Advantages

GUSD stands out from its peers thanks to these features:

- Stronger Incentives for Long-Term Holding

Yields compound over time. This provides a compelling reason to hold for the long term. - High Liquidity and Flexible Redemption

Users can exchange GUSD freely on trading platforms or on-chain, allowing for flexible capital management. - Deep Integration with Leading DeFi Protocols

This enhances capital utilization and expands the range of available applications.

Compliance and Risk Management

While GUSD follows strict asset allocation and compliance protocols, users should remain aware of risks from regulatory changes or market volatility. Always review product terms and assess your own risk tolerance before investing in any yield-generating products.

User Agreement: https://www.gate.com/legal/user-agreement

Summary

GUSD marks the next stage in stablecoin evolution: from a simple risk-hedging tool to a yield-generating on-chain smart asset. Backed by real-world assets and a transparent yield structure, GUSD delivers both stability and growth. It serves as a crucial link between TradFi and Web3. As Web3 finance matures, every GUSD becomes more than just a stablecoin. It’s an asset that keeps working for you.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution