Gate Research|The New Era of Stablecoins: A Comprehensive Study on Compliance, Innovation, and Adoption

10-30-2025, 10:22:21 AM

Download the Full Report (PDF)

This report highlights that as of August 2025, the global stablecoin market capitalization has reached $280 billion, with annual on-chain settlement volumes surpassing $30 trillion. Stablecoins are evolving from mere crypto trading instruments into global financial infrastructure. This explosive growth is driven by regulatory implementation and the entry of major enterprises. The enactment of the GENIUS Act, the Stablecoin Bill, and the MiCA Regulation mark the beginning of a “compliance grand era” for stablecoins. Their model has advanced into a “Peg + Yield + Application” triad, expanding across payments, yield generation, and real-world applications. At the same time, competition has shifted from “token battles” to “infrastructure battles,” with players such as Tether, Circle, Stripe, and Alchemy Pay building proprietary blockchains to capture dominance in payments and settlements.Key Takeaways:

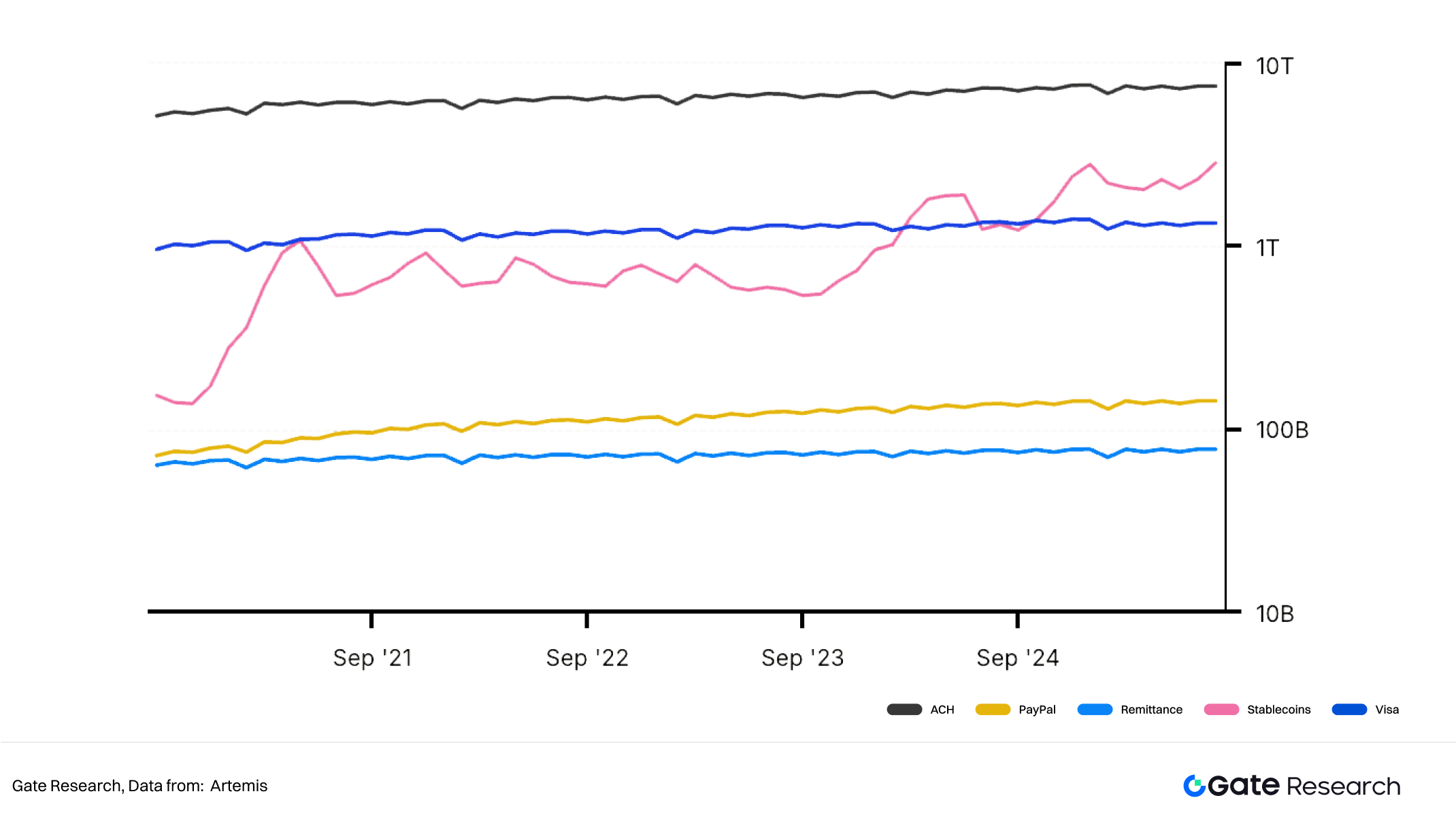

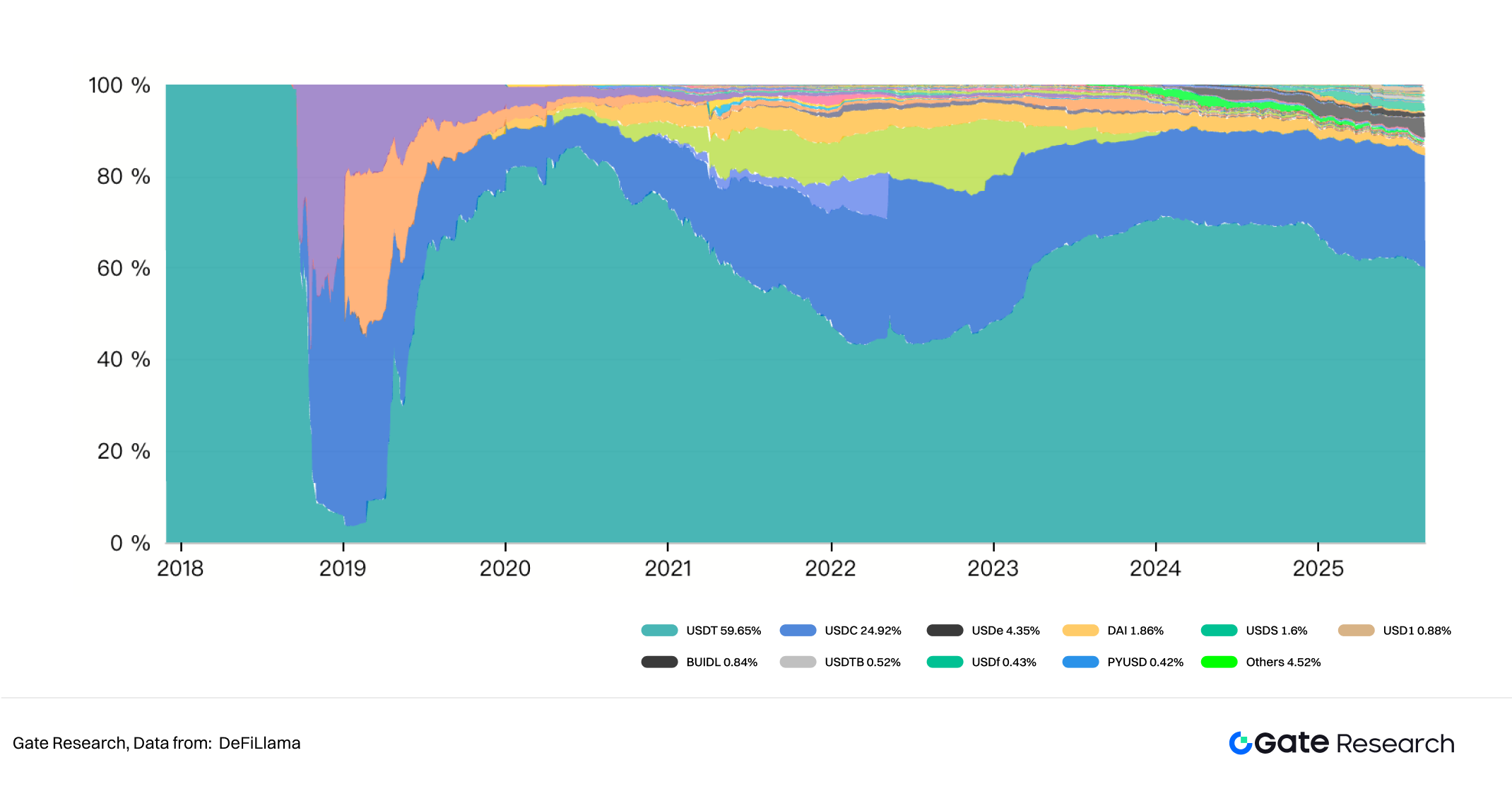

- Explosive Growth of the Stablecoin Market: As of August 2025, the global stablecoin market capitalization has surpassed $280 billion, representing a more than 660-fold increase since early 2019. On-chain annual settlement volumes have exceeded $30 trillion, placing stablecoins on par with SWIFT and Visa in transaction capacity. This surge has been driven by both regulatory momentum and the entry of major enterprises.

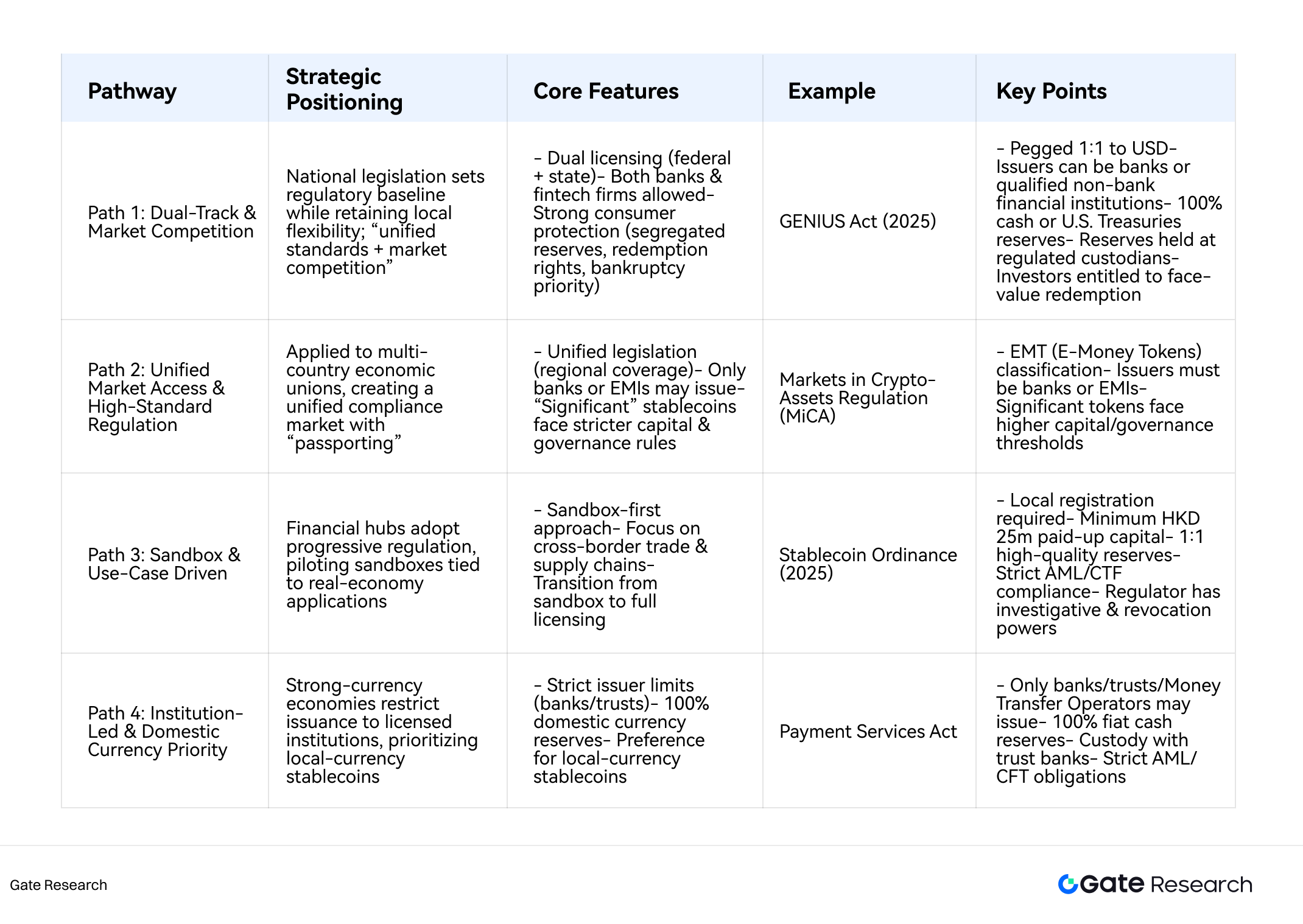

- Regulatory Acceleration and Compliance: The full implementation of the GENIUS Act, the Stablecoin Ordinance, and the MiCA framework, alongside diverse regulatory regimes in other jurisdictions, marks the beginning of the “Age of Compliance.” Stablecoins are moving toward institutionalization and mainstream adoption.

- Corporate Giants Enter the Arena: Traditional financial leaders such as PayPal, Visa, and Mastercard are actively integrating stablecoins into cross-border, retail, and enterprise payment systems, building multi-asset compatible payment networks.

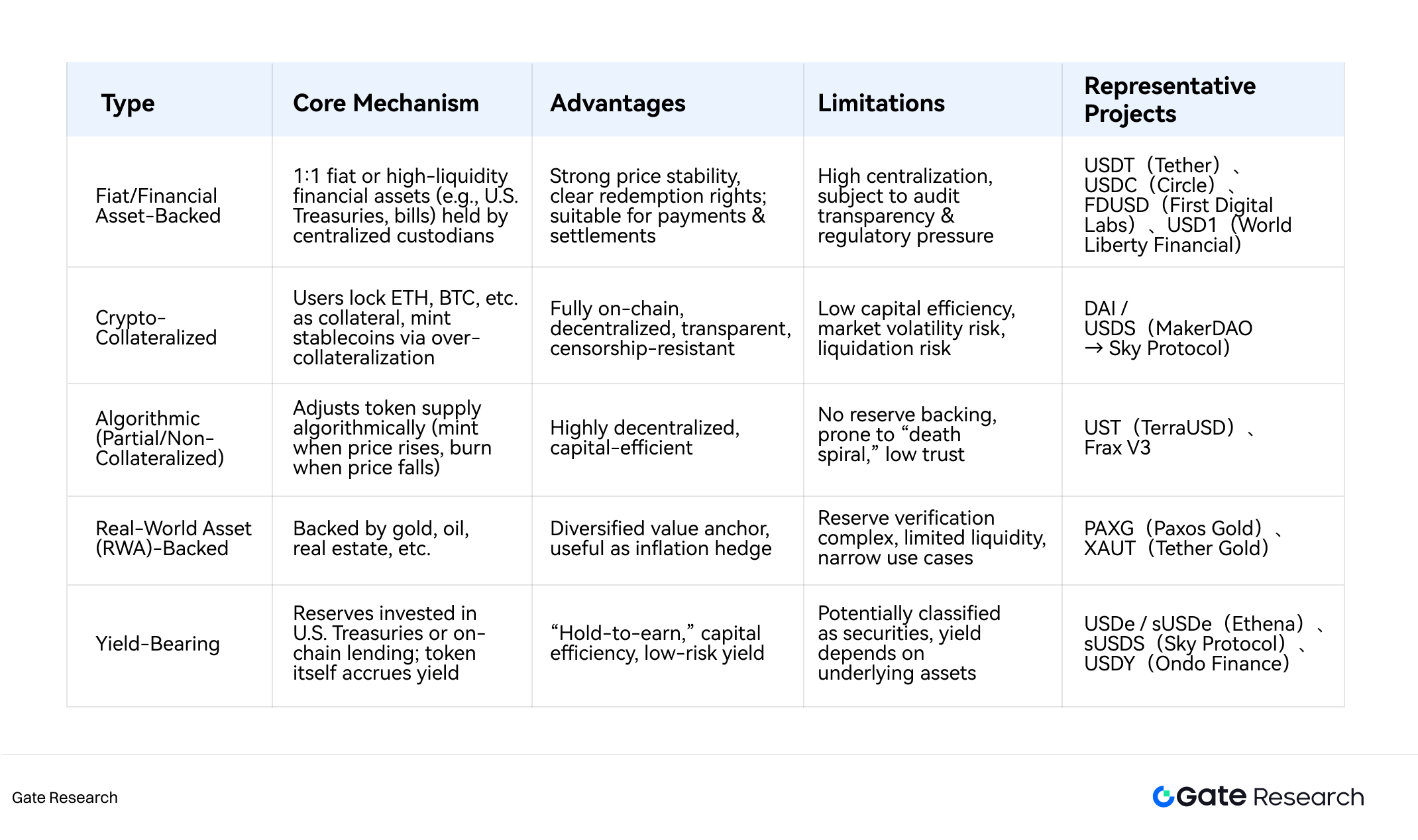

- Market Structure and Emerging Forces: While USDT and USDC remain dominant, USDC is more widely used in payments and settlements. Meanwhile, innovative yield-bearing stablecoins such as USDe (by Ethena Labs) are rising quickly, capturing significant market share in a short period.

- The “Three-in-One” Model: Stablecoins are evolving from a single-use payment tool into a “Peg + Yield + Application” model. On the payment side, cross-border, enterprise, and retail use cases are expanding; on the yield side, yield-bearing and RWA-backed stablecoins are becoming key portfolio tools; on the application side, stablecoins are penetrating supply chain finance, payroll, and capital market collateralization, extending on-chain finance into the real economy.

- Infrastructure Competition Intensifies: The stablecoin race has shifted from “token competition” to “infrastructure competition.” Key players including Tether, Circle, Stripe, Alchemy Pay, and Converge are building proprietary blockchains to capture control over payment settlement “highways.”

- Future Pathways: Technologically, stablecoins will achieve cross-chain settlement and multi-chain compatibility; in markets, they will operate in parallel with traditional payment networks and enter capital markets through RWAs; institutionally, they will coexist with CBDCs under regulatory frameworks. Stablecoins are transitioning from explosive growth to compliance establishment, from token competition to infrastructure competition, and from U.S. dollar dominance to regional multipolarity. Over the next 3–5 years, those who first build a closed loop across compliance, infrastructure, and application ecosystems may define the next generation of the global value network.

Gate Research is a comprehensive blockchain and crypto research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Author: Ember, Audrey Zhou

Reviewer(s): Puffy, Shirley

* The information is not intended to be and does not constitute financial advice or any other recommendation of any sort offered or endorsed by Gate.

* This article may not be reproduced, transmitted or copied without referencing Gate. Contravention is an infringement of Copyright Act and may be subject to legal action.

Related Articles

Beginner

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Yala inherits the security and decentralization of Bitcoin while using a modular protocol framework with the $YU stablecoin as a medium of exchange and store of value. It seamlessly connects Bitcoin with major ecosystems, allowing Bitcoin holders to earn yield from various DeFi protocols.

11-29-2024, 10:10:11 AM

Beginner

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

This article explores the development trends, applications, and prospects of cross-chain bridges.

12-27-2023, 7:44:05 AM

Advanced

Solana Need L2s And Appchains?

Solana faces both opportunities and challenges in its development. Recently, severe network congestion has led to a high transaction failure rate and increased fees. Consequently, some have suggested using Layer 2 and appchain technologies to address this issue. This article explores the feasibility of this strategy.

6-24-2024, 1:39:17 AM

Intermediate

Sui: How are users leveraging its speed, security, & scalability?

Sui is a PoS L1 blockchain with a novel architecture whose object-centric model enables parallelization of transactions through verifier level scaling. In this research paper the unique features of the Sui blockchain will be introduced, the economic prospects of SUI tokens will be presented, and it will be explained how investors can learn about which dApps are driving the use of the chain through the Sui application campaign.

8-13-2025, 7:33:39 AM

Beginner

12 Best Sites to Hunt Crypto Airdrops in 2025

If you want to learn how to find airdrops correctly in 2025, this guide will cover a variety of topics including how airdrops work, different airdrop strategies, and most importantly, the best websites to find legitimate cryptocurrency airdrops. We'll explore the latest trends in crypto airdrops, emerging platforms like DropScan.io and ChainDrop, evolved distribution strategies, smart contract innovations, and enhanced security measures. You'll also learn about optimizing airdrop value, navigating new regulatory considerations, and leveraging cutting-edge features like simulation modes and blockchain-based reputation systems to maximize your airdrop hunting success in 2025's advanced crypto ecosystem.

5-29-2025, 2:49:59 AM

Advanced

Navigating the Zero Knowledge Landscape

This article introduces the technical principles, framework, and applications of Zero-Knowledge (ZK) technology, covering aspects from privacy, identity (ID), decentralized exchanges (DEX), to oracles.

1-4-2024, 4:01:13 PM