Gate Research: Market Under Continued Pressure with Declining Risk Appetite | Institutional Capital Keeps Piling into BTC and ETH

Summary

- Bitcoin continues to consolidate within a bottom-range, with $85,000–$86,000 forming the most important near-term support zone, while Ethereum has broken below the $2,900 level.

- Benefiting from post-airdrop capital reallocation, H surged 35.58% over the past 24 hours; driven by reward-based demand and exchange risk adjustments, GHST rose 21.17% in the same period.

- TradFi heavyweight EquiLend invested in Digital Prime; Ripple partnered with AMINA Bank to provide cross-border settlement services; Securitize plans to launch a fully on-chain stock trading platform in early 2026.

- BitMine increased its holdings by another 102,259 ETH, while Strategy added over 10,000 BTC for a second consecutive week, indicating continued contrarian positioning by institutional capital amid market pressure.

- RedotPay completed a $107 million funding round to expand in stablecoin payments; ETHGAS raised $12 million to explore gas marketization; YO secured $10 million to build in decentralized social networking and digital identity.

Market Overview

Market Commentary

- BTC Market Update — The crypto market remains under pressure, with market sentiment and derivatives data also pointing to further downside risks in the short term. Over the past 24 hours, Bitcoin has continued to consolidate within a bottom range, with USD 85,000–86,000 forming the most important near-term support zone. From a daily chart perspective, BTC is still trading within a clearly defined descending channel. Repeated rejections near the upper boundary of the channel (around USD 90,000) have further confirmed that the bearish trend remains intact and that sellers continue to dominate the market. Currently, price action is fluctuating around the USD 87,000 level. Both the 100-day and 200-day moving averages remain above USD 100,000 and are trending downward, forming a key source of medium-term dynamic resistance. Technically, the MACD has formed another bearish crossover, with momentum bars staying below the zero line, indicating that downside pressure has yet to be fully released. Price continues to track along the lower Bollinger Band, while the bands themselves are narrowing, signaling sustained volatility compression and a buildup toward the next directional move. Within this structure, a technical rebound remains possible if the USD 85,000 support holds; however, a break below this level could open the door to a further decline toward the USD 82,000–80,000 demand zone.

- ETH Market Update — Over the past 24 hours, Ethereum has broken below the key USD 2,900 support level and extended its decline, briefly dipping toward the USD 2,800 area. On the daily chart, price has fallen below the MA5, MA10, and MA30, with short-term moving averages forming a clear bearish alignment. At the same time, ETH continues to gravitate toward the lower Bollinger Band, while the MACD has once again produced a bearish crossover, indicating that downside momentum remains dominant. ETH is currently showing tentative signs of stabilization around the USD 2,830 level. If this area can be effectively defended, a short-term technical rebound is possible, with initial resistance around the USD 2,950 zone. However, a decisive break below the USD 2,800 psychological level would likely shift support lower, potentially accelerating a pullback toward the next key demand area near USD 2,600. Overall, until ETH reclaims and holds above USD 2,900, it remains in a structure characterized by weak consolidation and persistent downside pressure.

- Altcoins — The broader market continues to trend lower, with the Altcoin Season Index at 19, indicating persistently low risk appetite. From a market-structure perspective, aside from Bitcoin and stablecoins, major altcoins have generally declined by 2–3%, with most sectors weakening in tandem, reflecting a market stance dominated by capital contraction, defensiveness, and wait-and-see sentiment.

- Stablecoins — Total stablecoin market capitalization currently stands at $311.7 billion, down $2.2 billion over the past week, representing a 0.71% decline.

- Gas Fees — Ethereum network gas fees have largely remained below 1 Gwei over the past week, with the highest single-hour peak at 0.109 Gwei. As of December 17, the daily average gas fee was 0.081 Gwei.

Trending Tokens

Over the past 24 hours, the market has continued its downward trend, with risk appetite remaining subdued. Despite the broadly pressured environment, a handful of tokens have moved higher against the trend, highlighting areas of short-term capital focus. The following section provides a detailed analysis of these assets.

H Humanity Protocol (+35.58%, Market Cap: $176 million)

According to Gate market data, H is currently priced at $0.09751, up 35.58% over the past 24 hours. Humanity Protocol is a blockchain designed to resist Sybil attacks, focusing on secure, private, and decentralized identity verification. zkProofers play a core role by using zero-knowledge proofs to verify human identity and are rewarded with the protocol’s native token, $H.

H’s rally reflects a combination of post-airdrop capital reallocation and a technical rebound. After a major exchange airdrop on December 3–4 triggered heavy selling and a 35% price drop, trading volume surged 354% within 24 hours, signaling accumulation by new buyers near the $0.076 support level. Traders may have interpreted the oversold RSI and MACD reversal between December 4 and 17 as contrarian buy signals. The price reclaiming the 7-day simple moving average ($0.067) also triggered algorithmic buy orders.

GHST Aavegotchi (+21.17%, Market Cap: $10.30 million)

According to Gate market data, GHST is currently trading at $0.2027, up 21.17% over the past 24 hours. GHST is the native token of the Aavegotchi ecosystem, used for governance, staking, and participation in the creation and development of NFT digital ghosts (Gotchis). Aavegotchi combines DeFi yield from collateral with gamified mechanics, forming a sustainable NFT gaming and community governance system built on Polygon.

GHST’s price increase is driven by a combination of reward-driven demand and exchange-related risk adjustments. On December 5, Aavegotchi announced an upgraded reward scheme that increased incentives by 50% compared with November. Higher rewards boosted demand for GHST while locking mechanisms reduced circulating supply, supporting prices. In addition, a major exchange resumed GHST deposits and withdrawals on December 12 after a seven-day suspension due to network delays. The suspension period saw 34% volatility, and the resumption helped ease selling pressure.

ACT Act I: The AI Prophecy (+25.86%, Market Cap: $24.05 million)

According to Gate market data, ACT is currently priced at $0.02560, up 25.86% over the past 24 hours. ACT (Act I: The AI Prophecy) is a blockchain project and ecosystem token built around artificial intelligence themes, positioning itself as a collection of AI-driven decentralized applications and interactive experiences. The token is used for ecosystem incentives, governance participation, and community engagement, with price movements often influenced by market sentiment and thematic momentum.

Act I: The AI Prophecy (ACT) has risen 25.86% over the past 24 hours, significantly outperforming the broader crypto market’s -1.73% move. This rally aligns with its 32.52% gain over the week and is primarily driven by technical momentum. ACT has broken above both the 7-day and 200-day moving averages, RSI is approaching overbought territory, and the MACD histogram turned positive on December 17, signaling accelerating upside momentum.

Key Market Data Highlights

TradFi Giant EquiLend Invests in Digital Prime to Connect a $40 Trillion Asset Pool with Tokenized Markets

On December 17, securities lending infrastructure giant EquiLend announced a strategic minority investment in regulated crypto financing provider Digital Prime Technologies. The goal is to connect approximately $40 trillion in traditional financial market assets with tokenized markets through Digital Prime’s institutional lending network, Tokenet.

The partnership will center on Tokenet, which supports multi-custodian and multi-collateral, full-lifecycle management, exposure monitoring, and institutional-grade reporting. Future phases plan to introduce compliant stablecoins as collateral and additional tokenized financial instruments.

EquiLend stated that the initiative responds to client demand for compliant, transparent, and governable workflows, enabling trading, clearing, settlement, and reporting across both traditional financial and digital asset instruments. EquiLend’s involvement signals an acceleration in institutional capital opening to on-chain credit, clearing, and asset-backed transaction mechanisms, potentially serving as a bridge for traditional assets to enter blockchain ecosystems. Overall, the collaboration may improve efficiency in brokerage, margin financing, and securities lending while advancing the scalable, compliant development of tokenized assets and deeper institutional connectivity between TradFi and DeFi.

Ripple Partners with Crypto Bank AMINA Bank to Provide Cross-Border Settlement Services

On December 17, Ripple announced a partnership with Swiss crypto bank AMINA Bank, marking the first formal adoption of Ripple Payments by a regulated European bank—a significant milestone. By integrating Ripple Payments, AMINA Bank can offer clients 24/7, near-instant cross-border settlements without relying on traditional correspondent banking networks. Ripple Payments supports both fiat and stablecoin rails (including Ripple USD, RLUSD), which is particularly important for crypto-native firms and digital asset–related businesses, helping to ease structural constraints of traditional banking systems when handling on-chain fund flows.

AMINA stated that the partnership will significantly reduce cross-border settlement friction and strengthen its service capabilities for digital asset companies and institutional clients. Ripple emphasized that the collaboration further reinforces the connection between fiat and blockchain payment rails, delivering seamless, multi-currency payment and clearing experiences for institutions. Notably, AMINA was among the first banks to support custody and trading of RLUSD. The deployment of Ripple Payments under strict regulatory standards demonstrates that blockchain payment infrastructure is rapidly entering the mainstream banking system, setting a reference case for broader adoption by European and global financial institutions.

Securitize Plans to Launch a Fully On-Chain Stock Trading Platform in Early 2026

On December 17, tokenization service provider Securitize announced plans to launch what it describes as the first fully compliant, entirely on-chain trading platform for shares of real publicly listed companies in early 2026, further bridging traditional financial markets and Web3 infrastructure. Unlike “synthetic stocks” that track share prices via derivatives or offshore structures, Securitize’s model provides full legal ownership: shares are issued directly by the company and recorded on the official shareholder registry. During market hours, prices will align with major exchanges and comply with the National Best Bid and Offer (NBBO) rules; outside market hours, automated market-making mechanisms will provide pricing, enabling 24/7 trading.

Securitize noted that on-chain shareholders will enjoy genuine shareholder rights, including dividends and voting rights, with assets self-custodied by users and no risk of intermediaries rehypothecating shares. However, for compliance reasons, transfers will be restricted to approved, whitelisted wallets. Overall, the service combines traditional regulatory frameworks with Web3 features to deliver compliant, around-the-clock on-chain trading, addressing inefficiencies in traditional stock settlement and limited trading hours while promoting deeper integration and innovation between traditional finance and blockchain infrastructure.

Focus of the Week

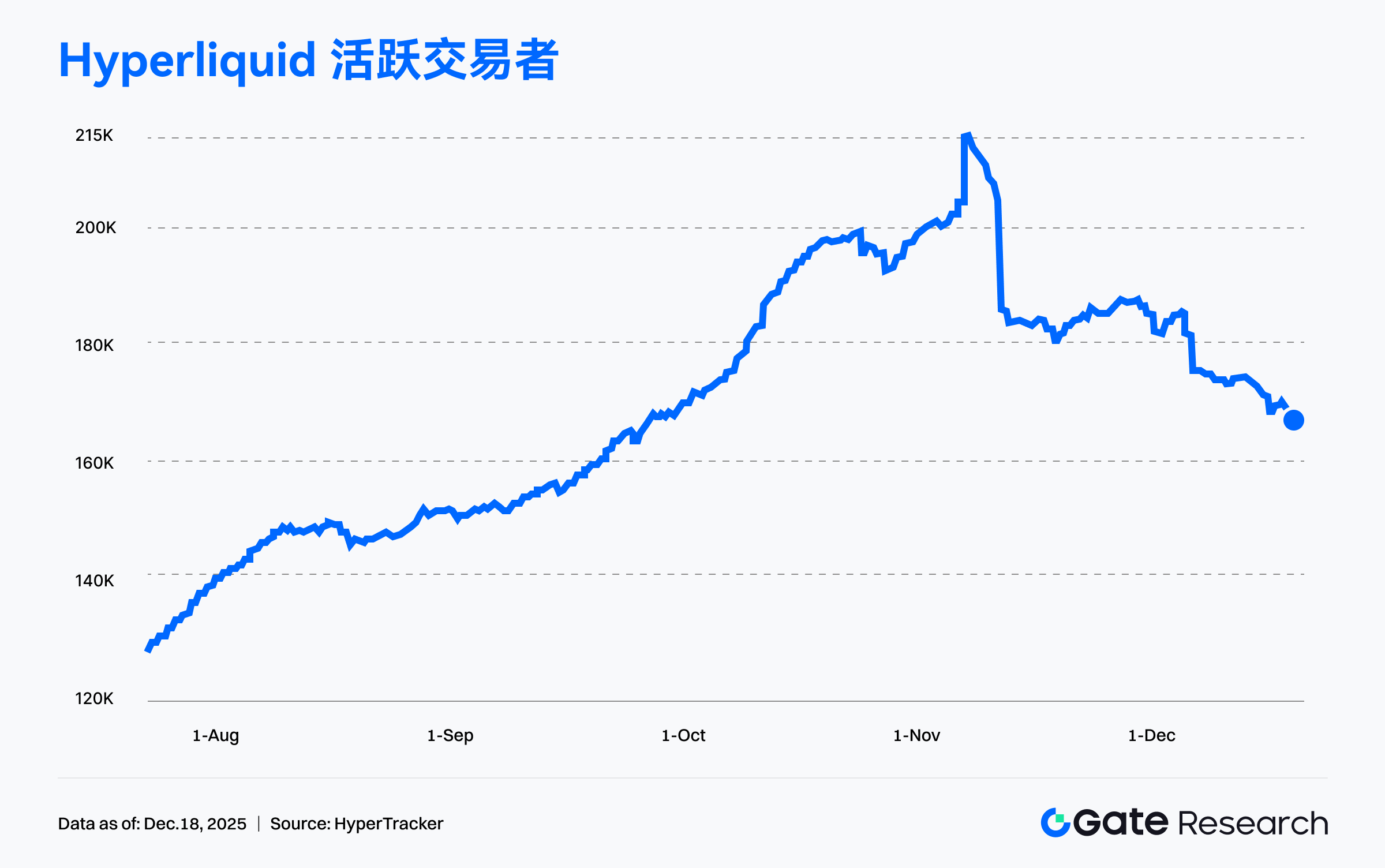

Hyperliquid Active Traders Continue to Decline as Perp DEX Competition Intensifies

This week, the number of daily active traders on Hyperliquid continued its downward trend, with current active users at around 167,000, down more than 20% from the early-November peak of over 210,000. This decline reflects shifts in Hyperliquid’s competitive environment. As the decentralized perpetuals (perp DEX) sector enters an accelerated expansion phase, both new platforms and established protocols are ramping up product development and operational spending. More aggressive fee discounts, trading point incentives, market-making subsidies, and faster contract launches are increasingly targeting high-frequency and professional traders, leading to a marginal dispersion of activity that was previously highly concentrated on Hyperliquid.

At the same time, as major assets enter a high-level consolidation phase with declining short-term volatility, some active accounts that rely on volatility and funding-rate arbitrage are reducing trading frequency or temporarily migrating to platforms with relatively higher funding-rate fluctuations. This dynamic has further amplified the pullback in active trader numbers.

That said, this does not imply that Hyperliquid has lost its competitiveness. To date, Hyperliquid remains one of the highest fee-capturing on-chain protocols in the entire crypto market, second only to stablecoin issuers, and it continues to execute token buybacks. The current cooling in activity appears more like a natural normalization and rebalancing amid intensifying industry competition. Its longer-term performance will depend on the pace of product iteration, the sustainability of liquidity depth, and its ability to continue attracting professional traders during high-volatility market conditions.

BitMine Increases ETH Holdings by Another 102,000 ETH, Total Near 4 Million ETH

BitMine’s combined crypto assets and cash reserves now total approximately $13.3 billion, including about 3,967,210 ETH (valued at roughly $12.2 billion). This represents more than 3.2% of total ETH supply, meaning BitMine has completed roughly two-thirds of its stated goal of acquiring 5% of all ETH. In addition, BitMine holds 193 BTC, approximately $38 million in equity of Eightco Holdings, and $1 billion in cash. This asset scale not only makes BitMine the largest ETH treasury company, but also positions it as the world’s second-largest corporate crypto treasury, behind Strategy.

In terms of recent activity, BitMine added another 102,259 ETH over the past week, continuing to scale its long-term accumulation strategy despite weak market conditions. Chairman Tom Lee stated that the passage of pro-digital-asset legislation in the U.S. in 2025 has gradually improved crypto market fundamentals, further reinforcing the company’s confidence in expanding its ETH reserves. Beyond asset accumulation, BitMine is also investing in infrastructure, developing its proprietary Ethereum staking solution MAVAN, which is expected to go live in early 2026 and aims to deliver improved staking returns on its ETH holdings.

Strategy Continues to Add BTC, Total Holdings Exceed 670,000 BTC

The world’s largest BTC treasury company, Strategy, increased its Bitcoin holdings again over the past week, purchasing 10,645 BTC for a total consideration of approximately $980 million, at an average price of around $92,098 per BTC. This brings Strategy’s total BTC holdings to 671,268 BTC. Based on cumulative historical purchase costs, the company has invested roughly $50.33 billion, with an average acquisition cost of about $74,972 per BTC, solidifying its position as one of the most important corporate Bitcoin reserve holders globally.

Notably, this marks the second consecutive week in which Strategy has purchased more than 10,000 BTC, signaling strong management conviction in current price levels and Bitcoin’s long-term investment value, while also addressing market FUD stemming from recent declines in its share price.

Funding Weekly Recap

According to data from RootData, between December 12 and December 18, 2025, a total of 11 crypto and crypto-related projects announced completed funding rounds or M&A transactions, spanning multiple sectors including payments, stablecoins, DeFi, and infrastructure. Below is a brief overview of the top projects by funding size this week:

RedotPay

On December 16, RedotPay announced the completion of a $107 million funding round led by Goodwater Capital. RedotPay is a blockchain payments and digital wallet technology company focused on building stablecoin-centric global payment solutions. By bridging blockchain infrastructure with traditional financial systems, it enables users to quickly and securely use crypto assets for everyday payments, remittances, and settlements worldwide. Its product suite includes multi-currency wallets, stablecoin payment cards, global remittance rails, and P2P marketplaces, aiming to enable seamless real-world crypto usage and accelerate the transition of digital assets from stores of value to payment instruments, while enhancing financial inclusion and cross-border payment efficiency.

ETHGAS

On December 17, ETHGAS announced the completion of a $12 million funding round led by Polychain. ETHGAS is an innovative market infrastructure project focused on Ethereum blockspace access and trading. Its core mission is to build a hybrid marketplace within the Ethereum ecosystem that provides price discovery and risk management for blockspace for traders, developers, and validators. Unlike traditional spot-bid gas mechanisms, ETHGAS treats blockspace commitments and base fees as tradable market assets, matching buyers and sellers via a central limit order book (CLOB) and supporting validator commitments through non-custodial smart contracts holding collateral. This enables users to more efficiently hedge gas fee volatility or lock in future blockspace usage in advance.

YO

On December 14, YO announced the completion of a $10 million funding round led by Foundation Capital. YO is a blockchain project targeting Web3 communities and decentralized social ecosystems, positioned as a digital-identity-driven decentralized network and interaction platform. It aims to reshape user participation in the digital world through on-chain identity, token incentives, and content contribution mechanisms. YO positions itself around community governance, user incentive alignment, and value sharing, allowing users to earn YO tokens by publishing content, participating in community activities, completing tasks, and contributing value. These tokens can be used for governance participation, creator support, or redeeming platform-related services and benefits.

Next Week to Watch

Token Unlocks

According to data from Tokenomist, over the next seven days (December 19–December 25, 2025), the market will see several large token unlock events. The top three upcoming unlocks are as follows:

- ZRO will unlock tokens worth approximately $33.16 million, accounting for 12.4% of its circulating supply.

- H will unlock tokens worth approximately $10.16 million, representing 5.6% of its circulating supply.

- MBG will unlock tokens worth approximately $7.94 million, equivalent to 12.2% of its circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Gate, https://www.gate.com/crypto-market-data

- DeFiLlama, https://defillama.com/stablecoins

- Etherscan, https://etherscan.io/gastracker

- Coingecoko, https://www.coingecko.com/en/cryptocurrency-heatmap

- HyperTracker, https://app.coinmarketman.com/hypertracker/stats

- PR Newswire, https://www.prnewswire.com/news-releases/bitmine-immersion-bmnr-announces-eth-holdings-reach-3-97-million-tokens-and-total-crypto-and-total-cash-holdings-of-13-3-billion-302641888.html

- The Fintech Times, https://thefintechtimes.com/ripple-payments-secures-first-european-bank-adoption-with-amina-bank-partnership/

- CoinDesk, https://www.coindesk.com/business/2025/12/17/tradfi-giant-equilend-backs-digital-prime-to-link-usd40-trillion-pool-with-tokenized-markets

- CoinDesk, https://www.coindesk.com/business/2025/12/17/securitize-to-offer-first-fully-onchain-trading-for-real-public-stocks-in-early-2026

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

12 Best Sites to Hunt Crypto Airdrops in 2025