Gate Research: Liquid Staking Landscape|TVL Exceeds $87B, Main Protocol Overview

Gate Research: Liquid Staking Landscape|TVL Exceeds $87B, Main Protocols Overview

Abstract

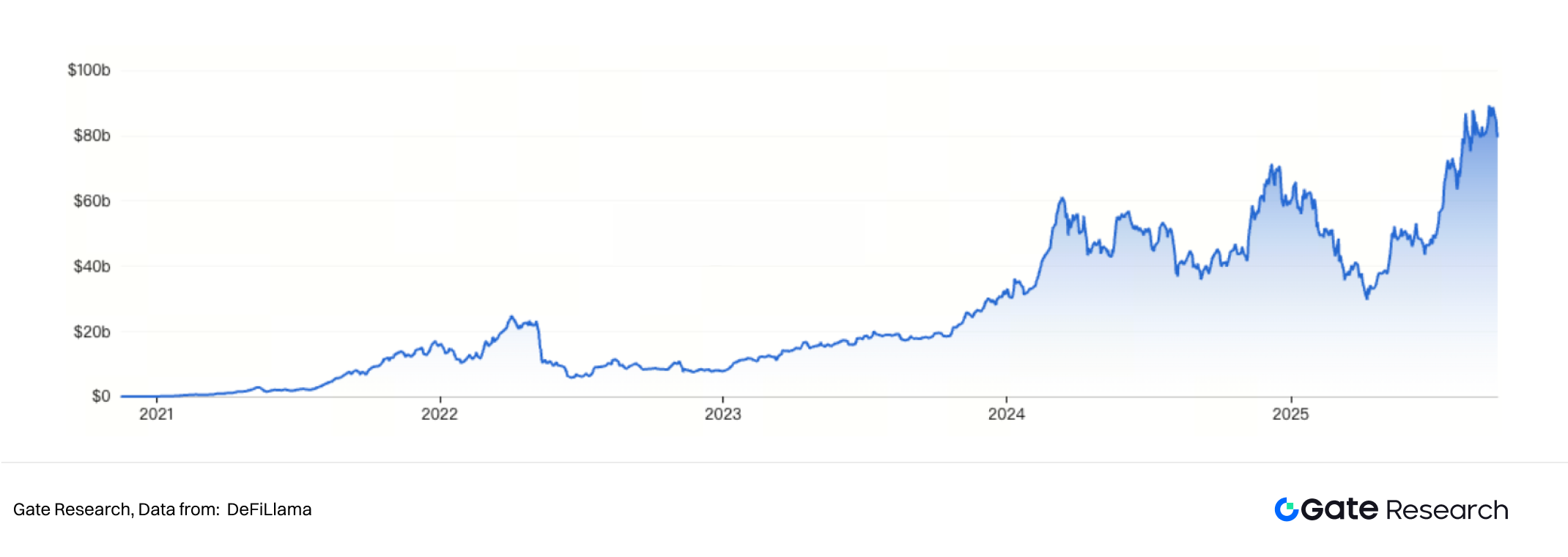

- Liquid staking is regarded as an important bridge connecting PoS and DeFi. As of September 19, 2025, the total value locked (TVL) in this sector has exceeded USD 87 billion.

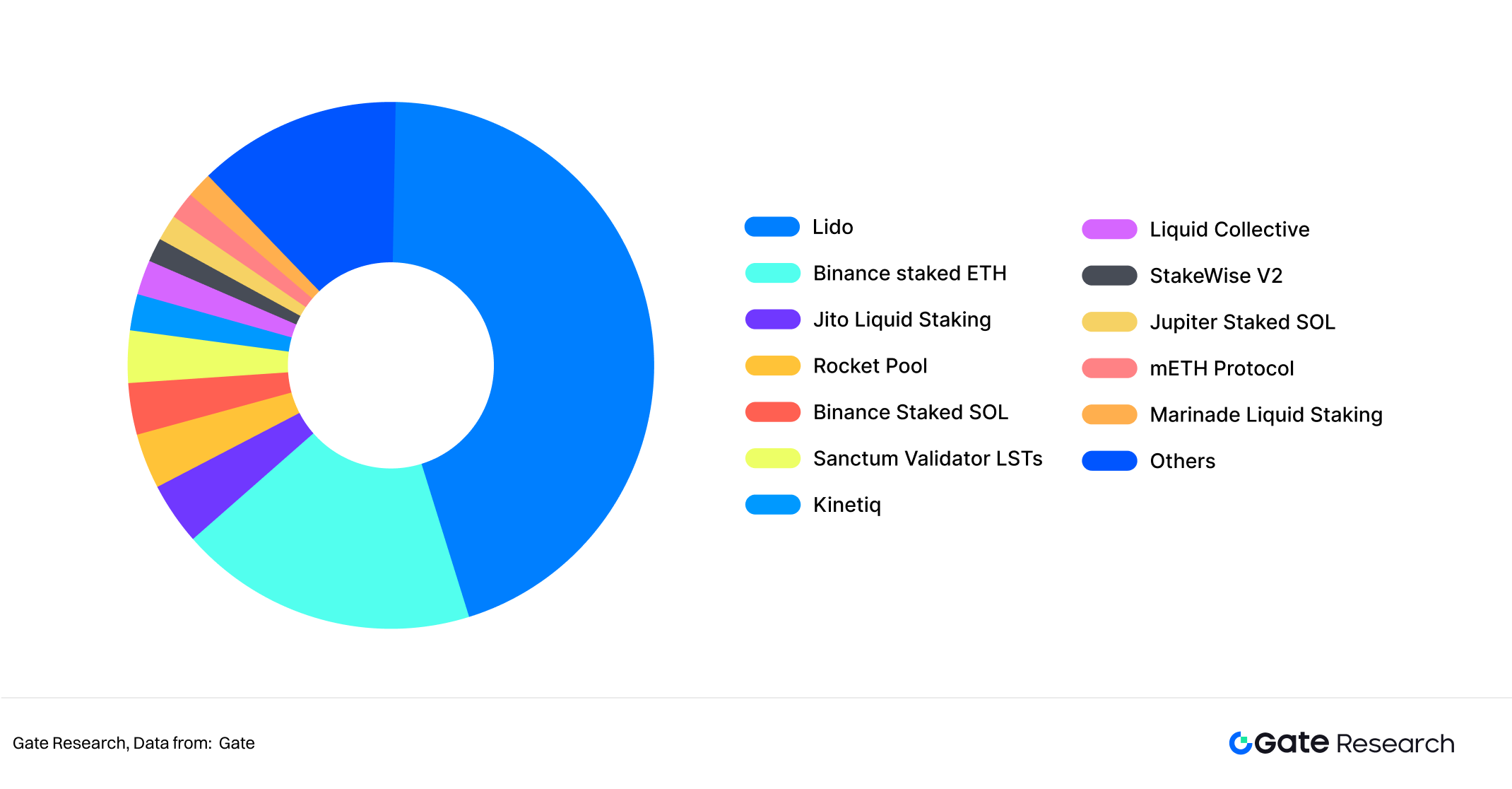

- As of September 19, 2025, there are 12 liquid staking protocols with a TVL of more than USD 1 billion. Among them, Lido holds over 45% market share, accounting for nearly half of the market.

- Mainstream liquid staking protocols generally adopt a dual-token model, corresponding respectively to the functions of staking value representation and protocol governance.

- With the rapid development of liquid staking protocols on public chains such as Ethereum and Solana, they provide users with staking liquidity and capital efficiency, but also bring challenges such as smart contract risk, ecosystem risk, and decentralization risk.

- Looking at profitability over the past three years, Lido has been the most stable and outstanding, Jito has maintained small profits overall, while Rocket Pool has yet to achieve profitability.

- Thanks to their relatively low-risk and stable yield characteristics, liquid staking has attracted massive user and capital inflows. Furthermore, it has given rise to innovative financial products represented by Pendle, continuously expanding the application boundaries of crypto assets.

Introduction

With the development of the blockchain industry, Proof of Stake (PoS) has gradually replaced Proof of Work (PoW) and become the core consensus mechanism of mainstream public chains. Under the PoS model, users are required to stake assets to support the security and operation of the network while earning corresponding block rewards. However, traditional staking mechanisms suffer from liquidity issues: once staked, assets are usually locked for a long period and cannot be freely transferred or used in other financial activities. This constraint not only limits capital efficiency but also dampens user enthusiasm for participating in staking.

To address this contradiction, Liquid Staking (LSD) protocols have emerged. The basic principle is that users stake native assets (such as ETH) into the protocol, which then returns a token (such as stETH, rETH, frxETH, etc.) representing the staked assets and their yield rights. These tokens can circulate freely in the secondary market or be used as collateral in DeFi applications, allowing users to both earn staking rewards and maintain asset liquidity. Therefore, liquid staking is seen as an important bridge between PoS and DeFi. As of September 19, 2025, the total TVL of this sector has exceeded USD 85 billion.

Currently, liquid staking protocols such as Lido, Jito, and Rocket Pool dominate the Ethereum ecosystem, while gradually expanding into other public chains including Cosmos, Polkadot, and Solana. With the rapid growth of the liquid staking market, it has not only changed how users participate in staking, but also had profound impacts on blockchain security, decentralization, and the financial derivatives ecosystem.

This report aims to conduct a systematic study of liquid staking protocols, analyzing their mechanism design, economic models, risk factors, and future development trends. By comparing the practices and data performance of different protocols, this paper hopes to provide valuable insights and references for industry participants.

Principles of Liquid Staking

2.1 Limitations of Traditional Staking

In the Proof of Stake (PoS) mechanism, users participate in network security maintenance by staking tokens and earn block rewards and transaction fees. However, the traditional staking model has the following limitations:

- Asset lock-up: Staked tokens usually require an unbonding period ranging from several days to several weeks (e.g., Ethereum’s staking exit requires a queue), making them unavailable for immediate withdrawal.

- High opportunity cost: Staked assets cannot be used in other financial activities, reducing capital efficiency.

- High entry threshold: Some networks require a high minimum staking amount (e.g., Ethereum requires 32 ETH to run a validator), making it difficult for ordinary users to participate directly.

These issues limit the adoption of staking and also affect the degree of decentralization of PoS networks.

2.2 Core Mechanism of Liquid Staking

Liquid staking solves the liquidity problem of traditional staking by issuing transferable derivative tokens. Its basic process is as follows:

- Users stake native tokens (e.g., ETH) into a liquid staking protocol;

- The protocol delegates the assets to validator nodes to participate in network staking and earn rewards;

- Users receive staking certificate tokens (e.g., stETH, rETH, frxETH) representing the staked assets and their future yield rights;

- These staking certificate tokens can circulate freely in the secondary market or be used as collateral in the DeFi ecosystem (lending, trading, derivatives, etc.).

This mechanism allows users to enjoy both staking rewards and liquidity simultaneously, greatly improving capital efficiency.

Analysis of Mainstream Liquid Staking Protocols

As of September 19, 2025, there are 12 liquid staking protocols with a TVL exceeding USD 1 billion, among which Lido holds over 45% of the market share, accounting for nearly half of the market. Launched in December 2020, Lido enjoys a significant first-mover advantage. Notably, the TVL gap among the other protocols is relatively small. Protocols with TVL below USD 1 billion account for 12.4% of the market share, indicating that the current liquidity market landscape is still unformed, leaving vast potential for future growth and product innovation.

3.1 Lido

3.1.1 Introduction

Lido is an Ethereum liquid staking protocol governed by Lido DAO, designed to address liquidity constraints in the early stages of Ethereum 2.0 staking. Traditional Ethereum 2.0 staking required users to lock 32 ETH into validator nodes, with withdrawals unavailable until future phases, resulting in frozen funds and insufficient liquidity.

Lido solves this problem by issuing the liquid staking token stETH, enabling users to maintain liquidity while earning staking rewards. Users can deposit ETH into Lido’s smart contract and receive an equivalent amount of stETH, which can be used for trading, transfers, or as collateral in DeFi. Compared with centralized exchange staking, Lido’s decentralized architecture makes it more secure and transparent.

3.1.2 Operating Mechanism

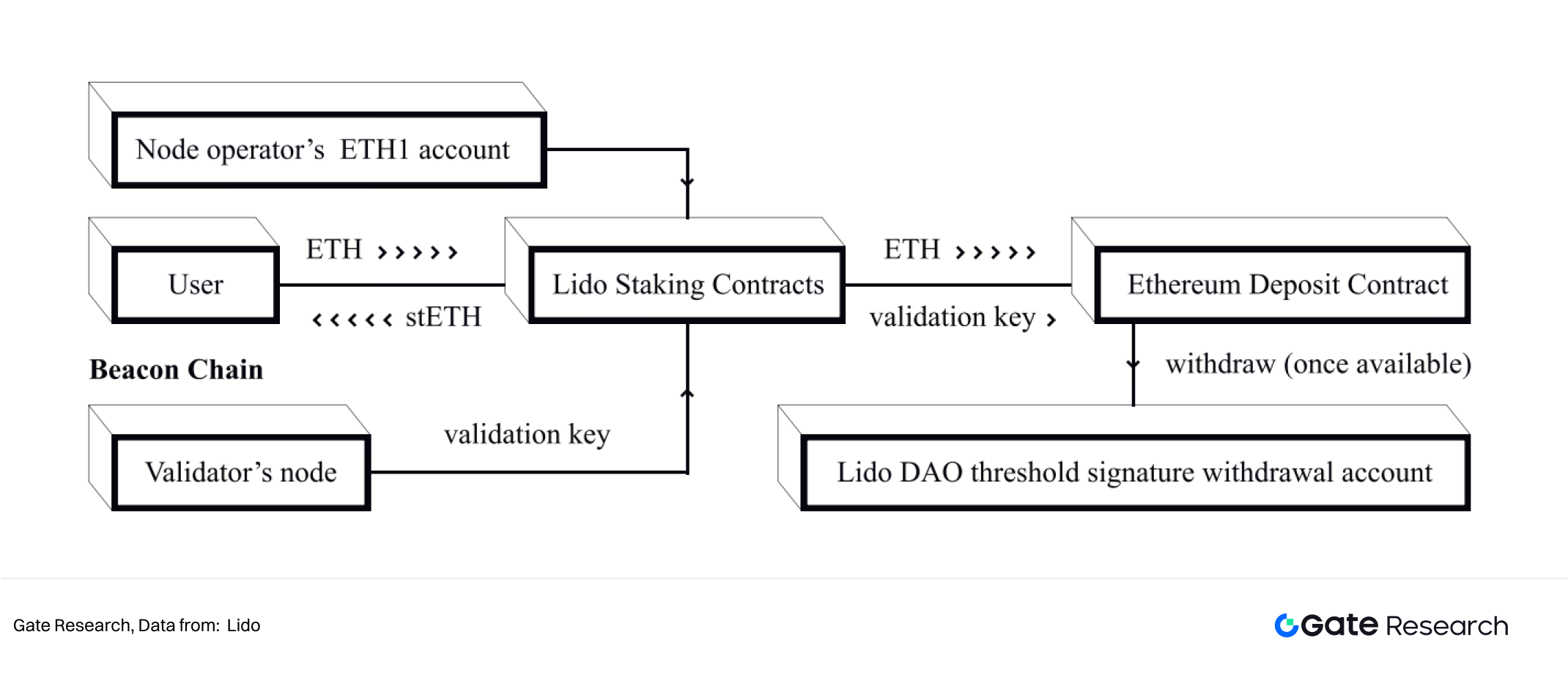

Lido’s operating mechanism is built upon the coordination of smart contracts, node operators, and DAO governance, aiming to provide users with a solution that allows them to earn Ethereum 2.0 staking rewards without locking up funds, while ensuring security.

Specifically, users deposit ETH into Lido’s smart contracts deployed on the Ethereum 1.0 network. These funds are then transferred into the Ethereum 2.0 Beacon Chain staking contract. In return, users receive an equivalent amount of stETH tokens. The balance of stETH dynamically adjusts according to validator rewards and penalties, ensuring its value accurately reflects both the yield and risks of staked assets. Unlike traditional staking, users do not need to wait for the Ethereum 2.0 Phase 2 withdrawal functionality to go live. Instead, they can trade stETH on secondary markets or use it as DeFi collateral, significantly improving liquidity and capital efficiency.

At the node operation level, Lido adopts a DAO-based selection mechanism for node operators. These operators maintain validator nodes and ensure the proper functioning of staking. Importantly, they do not directly control user funds, which are fully governed by smart contracts, reducing the possibility of single-operator misconduct. Meanwhile, Lido DAO manages withdrawal keys through a BLS m-of-n threshold signature scheme, which offers stronger security than a single private key while retaining governance flexibility. To further mitigate risks, Lido distributes funds across multiple professional node operators, reducing potential losses from individual node failures or malicious activity.

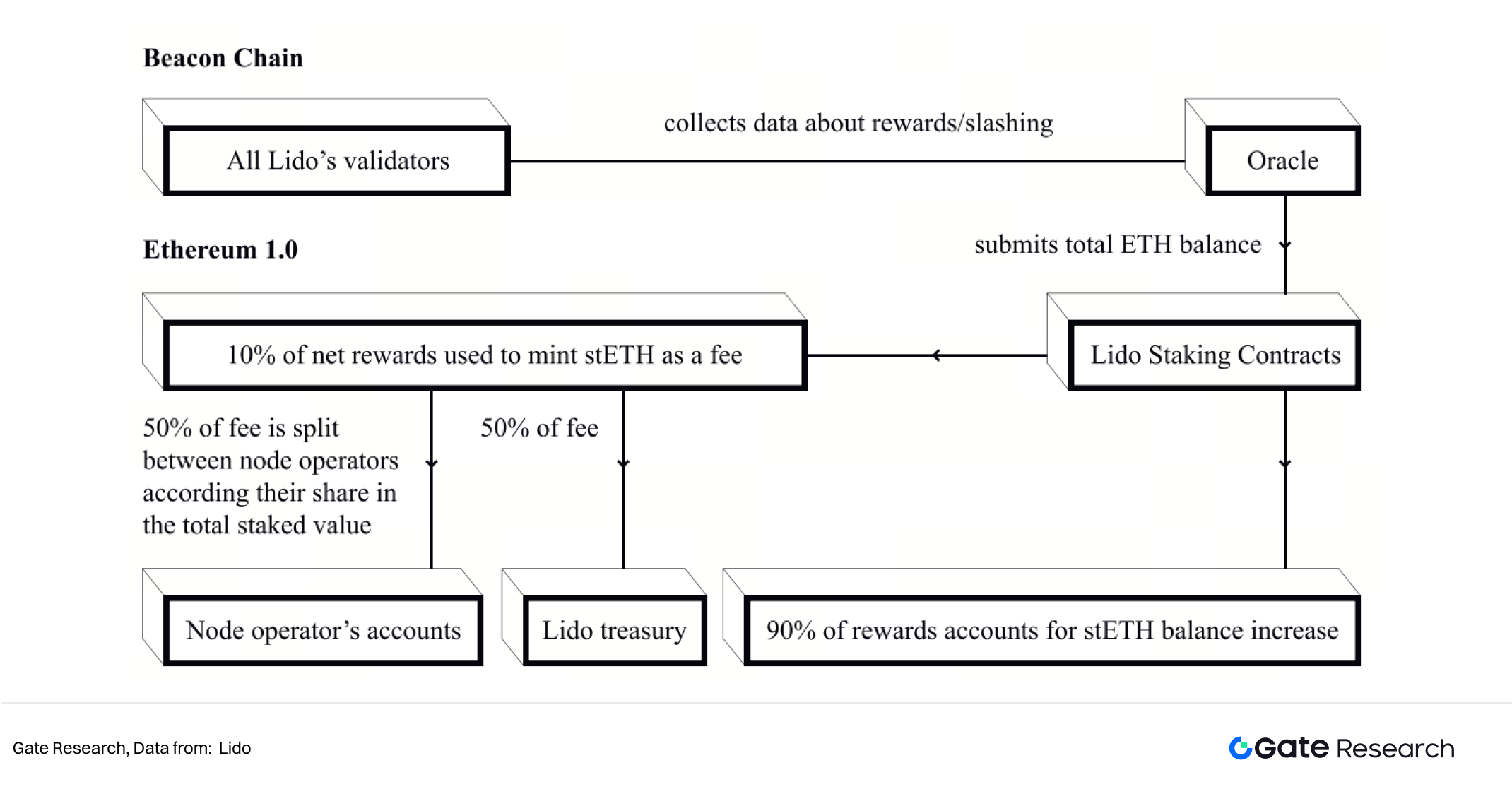

Reward and fee distribution is implemented through an oracle mechanism. Oracles appointed by the DAO regularly monitor validator performance on the Beacon Chain and report reward and penalty data to Ethereum 1.0 smart contracts. Based on this data, stETH’s exchange ratio is automatically adjusted. Staking rewards are subject to around a 10% protocol fee, which is shared among node operators, the DAO treasury, and a slashing insurance fund. The insurance fund is designed to cover losses from small-scale slashing events, thereby enhancing the protocol’s overall resilience.

3.1.3 Token Model

Lido’s token system primarily consists of stETH and LDO, which respectively serve as value representation and governance empowerment within the ecosystem.

- stETH: The liquid staking certificate token, highly liquid and tradable, and widely accepted across DeFi protocols. Its value depends on staking rewards and DeFi adoption.

- LDO: The governance token, granting holders the right to participate in key protocol decisions, such as node selection, fee adjustments, and feature upgrades. As the protocol scales and revenue accumulates, the governance value and potential influence of LDO increase accordingly.

3.2 Jito

3.2.1 Introduction

Jito is a liquid staking service on Solana that combines staking rewards with MEV (Maximum Extractable Value) income, enabling users to maximize yield while maintaining liquidity. Currently, 97.8% of Solana’s network staking weight runs on the Jito-Solana validator client. Users who delegate SOL to Jito’s staking pool receive the liquid staking token JitoSOL, which can be used in DeFi and automatically reflects both staking rewards and MEV income over time. Jito sets strict requirements for validators, delegating only to those operating MEV-enabled clients and meeting performance and security standards, thereby balancing yield with network health.

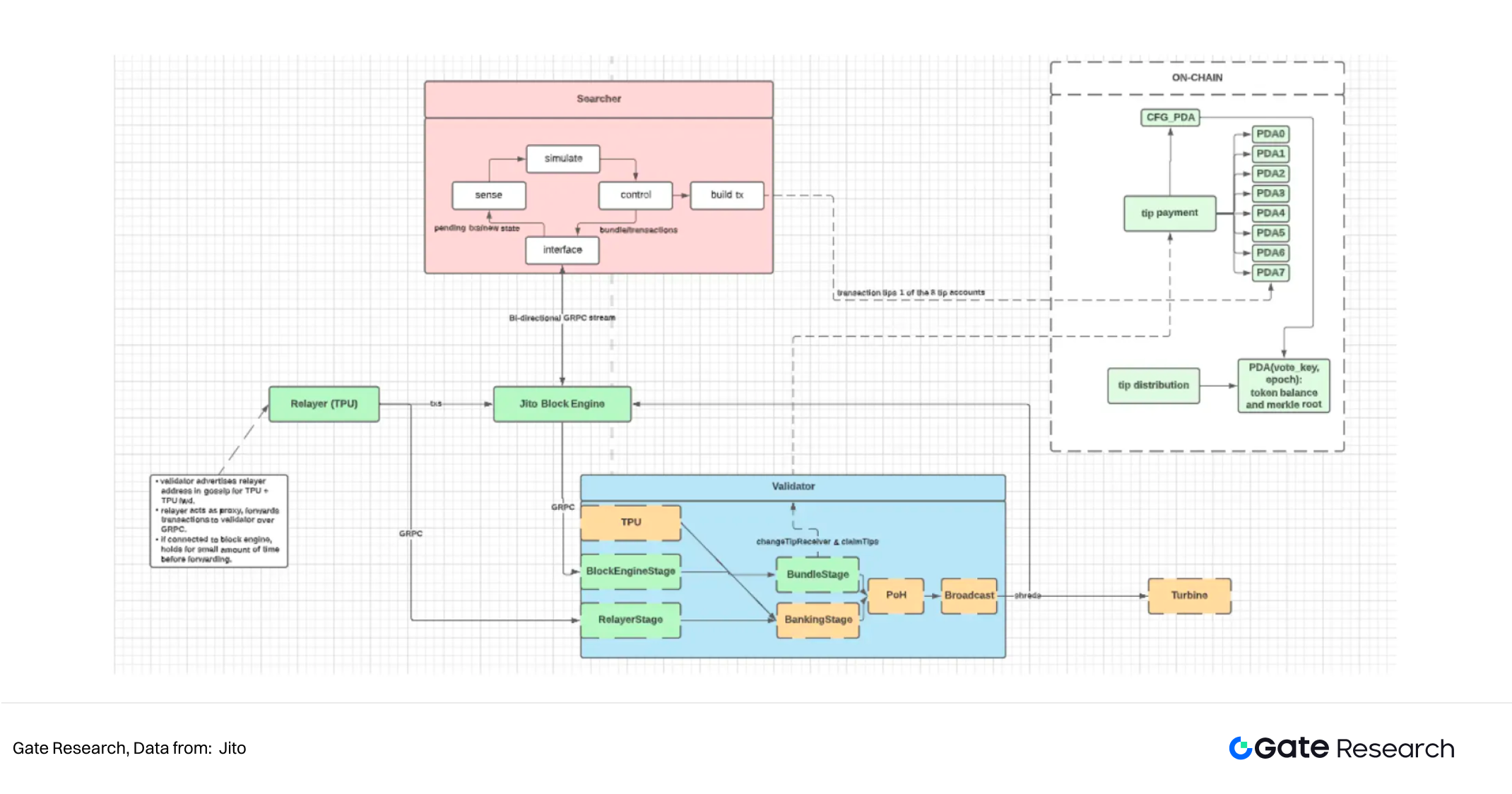

3.2.2 Operating Mechanism

Jito employs an automated system called StakeNet to manage validator selection and staking distribution. Validators must meet a series of binary admission requirements, such as running MEV-enabled clients, maintaining low commission rates, ensuring high voting rates and stable performance, avoiding unsafe consensus modifications, and not being part of validator superminorities. StakeNet further uses historical performance data and the Steward program to dynamically score and allocate stake, ensuring regular rebalancing among qualified validators, thereby balancing network security and yield optimization.

To effectively capture MEV value, Jito introduces an auction mechanism. In this model, MEV searchers submit transaction bundles, which Jito’s Block Engine simulates and evaluates to identify the most profitable combinations. The selected bundles are then passed to validators running MEV-enabled clients for on-chain inclusion. This approach prioritizes high-value transactions, alleviates network congestion and spam, and fairly distributes MEV revenue and priority fees between validators and stakers, achieving yield sharing.

The value of JitoSOL is reflected by an increasing exchange ratio that accumulates both staking rewards and MEV revenue. Unlike traditional periodic reward distributions, the quantity of JitoSOL in a user’s wallet remains fixed, while its value grows over time. This design avoids token inflation and enables users to benefit from compounding effects. At the same time, JitoSOL is highly compatible with DeFi and can be used in lending, liquidity provision, and other scenarios, thus improving capital efficiency. Jito’s stake/unstake operations and JitoSOL–SOL exchange processes are optimized for a low-friction user experience, with the foundation and DAO providing APIs and tools for real-time tracking of MEV rewards and priority fee accumulation.

3.2.3 Token Model

Jito’s token model consists of JitoSOL and JTO, corresponding respectively to staking value representation and protocol governance.

- JitoSOL: Issued when users delegate SOL to Jito’s staking pool. Unlike inflationary reward tokens, JitoSOL reflects rewards via a continuously rising exchange ratio, giving it an automatic compounding effect. Users can hold it long-term to earn staking + MEV income, or use it in DeFi for lending, liquidity provision, or derivatives trading. Its value anchoring depends on both Solana’s network stability and the MEV revenue distribution mechanism, as well as market acceptance in DeFi.

- JTO: The governance token, granting holders voting rights over key protocol parameters and strategic directions, such as validator selection criteria, commission and reward distribution, DAO treasury usage, and new feature implementation. As staking scales and MEV income grows, DAO treasury resources also expand, amplifying governance influence. Although JTO does not directly distribute revenue, it is indirectly tied to protocol growth through governance rights, giving it long-term value capture potential.

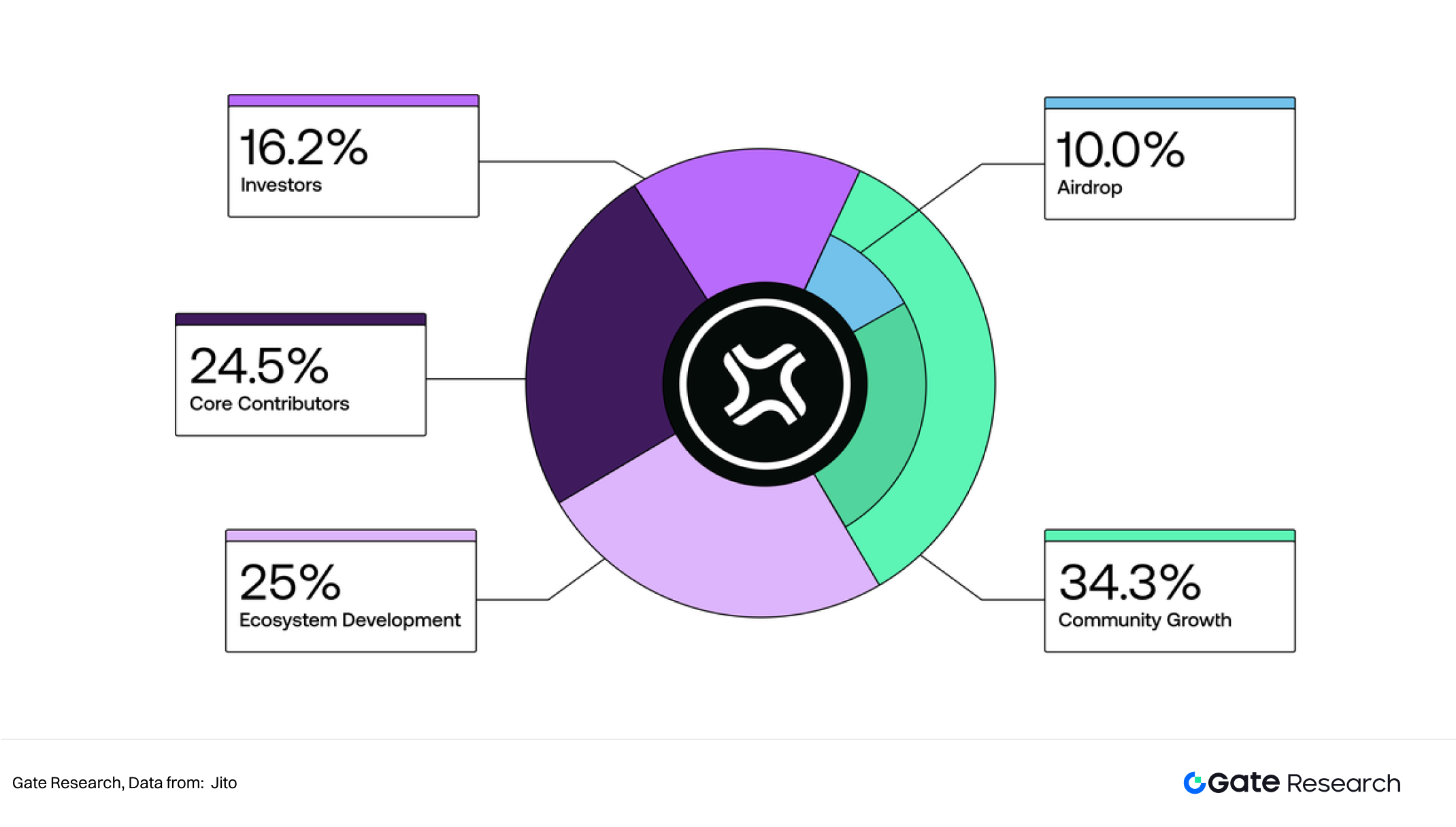

The total supply of JTO is 1 billion tokens, distributed mainly across four categories: community growth (34.3%), ecosystem development (25%), core contributors (24.5%), and investors (16.2%).

- The community growth allocation supports Jito’s community building. The first 10% (100 million tokens) was distributed retroactively via airdrop to early JitoSOL holders, DeFi users of JitoSOL, validators running the Jito-Solana client, and active MEV searchers. The remainder is governed by the DAO.

- The ecosystem development portion supports infrastructure such as StakeNet and the broader Solana network.

- Investors and core contributors’ allocations are subject to a 3-year vesting period with a 1-year cliff, ensuring long-term alignment.

The overall supply will gradually unlock over time until the full 1 billion tokens are in circulation.

3.3 Rocket Pool

3.3.1 Introduction

Rocket Pool is one of the earliest and most representative decentralized liquid staking (LSD, Liquid Staking Derivatives) protocols in the Ethereum ecosystem. The concept was first proposed in 2016 and officially founded by David Rugendyke in Australia in November 2017. After years of development and testing, the Rocket Pool mainnet launched on November 9, 2021. Positioned as a community-driven decentralized staking pool, it provides users with a secure and decentralized ETH staking solution.

Rocket Pool’s mission is to lower the barriers to Ethereum staking and enhance network decentralization. Unlike traditional staking, which requires running a node and committing 32 ETH, Rocket Pool allows users to participate with as little as 0.01 ETH, receiving rETH as the staking certificate. To become a node operator, only 16 ETH is required (the other 16 ETH is supplemented by the pool), along with additional incentives.

3.3.2 Operating Mechanism

The core mechanism of Rocket Pool connects ordinary stakers and node operators via a two-tier participation model. Ordinary users deposit ETH into the protocol and receive rETH, which maintains a fixed supply but grows in value over time as staking rewards accumulate, embodying automatic compounding. Users can hold rETH for staking yields or use it in DeFi for collateral, lending, or liquidity provision, enhancing capital efficiency.

For node operators, Rocket Pool lowers the entry barrier: only 16 ETH plus a collateralized portion of RPL tokens is required to run a validator. The remainder of the ETH is supplied by the staking pool. Node operators earn Ethereum staking rewards plus commissions from the pool, while RPL serves as insurance—if. If nodes misbehave or are slashed, the staked RPL is slashed to compensate users. This Minipool model ensures security while promoting Ethereum decentralization.

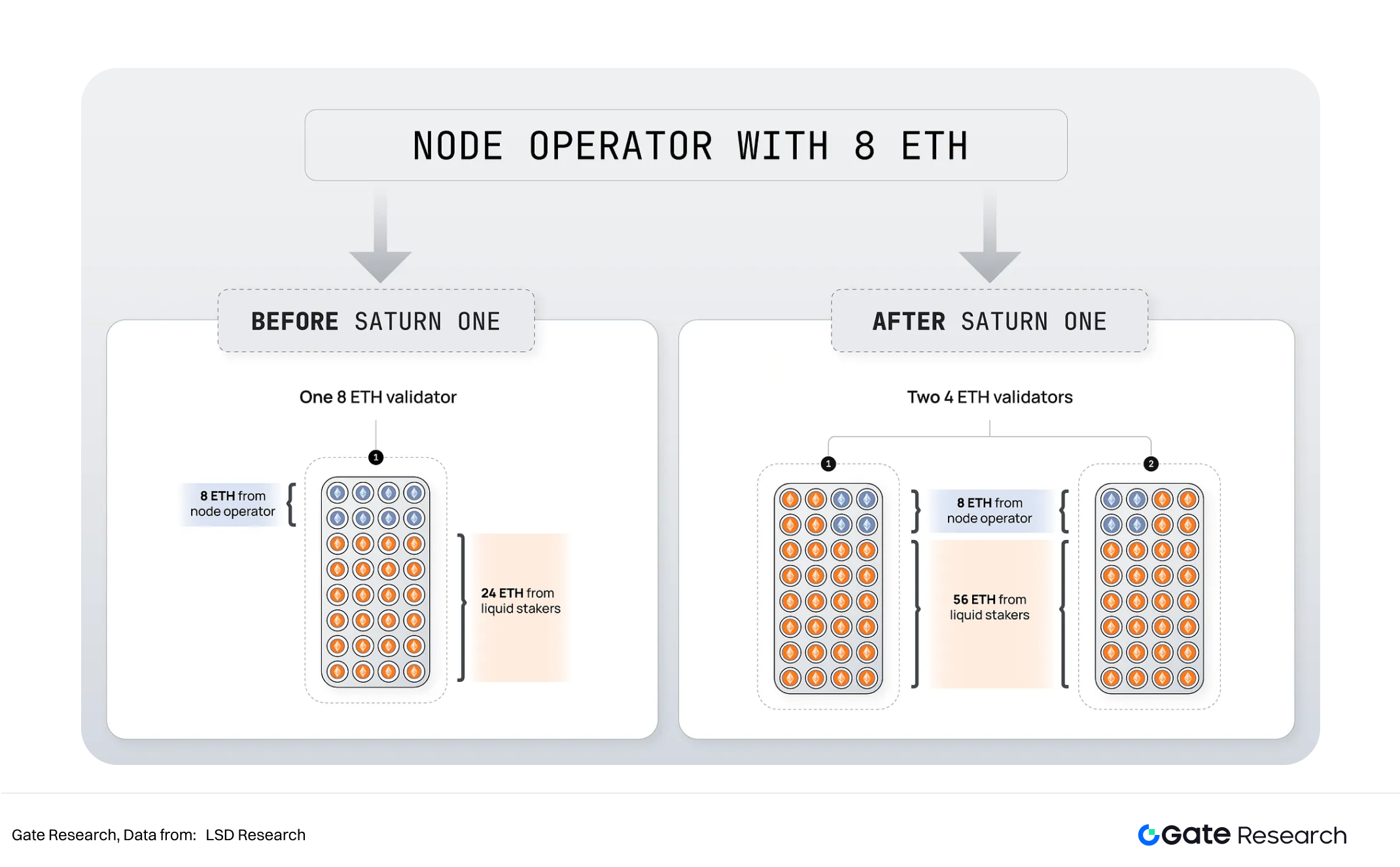

In the Saturn upgrade of 2025, Rocket Pool further lowered participation thresholds and optimized the reward structure:

- Saturn-0 removed the requirement for node operators to stake RPL to create a Minipool and eliminated cliff conditions in rewards, enabling faster maximization of node operator returns.

- The new commission structure set node commission rates between 10%–14%, depending on whether RPL is staked, balancing fairness and reinforcing RPL demand.

- Saturn-1 will introduce a 4 ETH node requirement and Megapools, drastically lowering entry costs for small node operators and reducing operating costs through aggregation contracts.

- A new dynamic reward distribution system will also be introduced, making incentives among nodes, rETH holders, and RPL holders more flexible and adjustable.

Overall, the Saturn upgrade evolves Rocket Pool from a simple liquid staking protocol into a staking infrastructure balancing low entry thresholds, decentralization, and capital efficiency.

3.3.3 Token Model

Rocket Pool’s token system consists of rETH and RPL, respectively serving as value representation and governance/security empowerment.

- rETH: Issued when users deposit ETH into Rocket Pool’s smart contracts. Unlike Lido’s stETH, rETH does not expand in supply to reflect rewards. Instead, its exchange ratio against ETH increases over time, meaning each rETH becomes redeemable for more ETH. Users can hold rETH for compounding returns, trade it on secondary markets, or use it in DeFi for collateral, lending, derivatives, and liquidity mining. Its value depends on staking reward stability, validator network security, and DeFi adoption. Although rETH’s ETH peg is more robust due to contract design rather than market sentiment, extreme liquidity crunches could still cause depegging.

- RPL: Rocket Pool’s native governance and staking token, serving dual roles of insurance and governance. Node operators must stake a portion of RPL to launch a Minipool, forming an “insurance pool.” If misbehavior or slashing occurs, the RPL is slashed to compensate stakers, enhancing network trust. Additionally, RPL grants holders governance rights over protocol parameters such as node commission rates, tokenomics adjustments, and upgrade proposals. As Rocket Pool scales, fee accumulation and reward pools amplify RPL’s governance influence and economic incentive, giving it potential value capture ability.

3.4 Comparison of Mainstream Liquid Staking Protocols

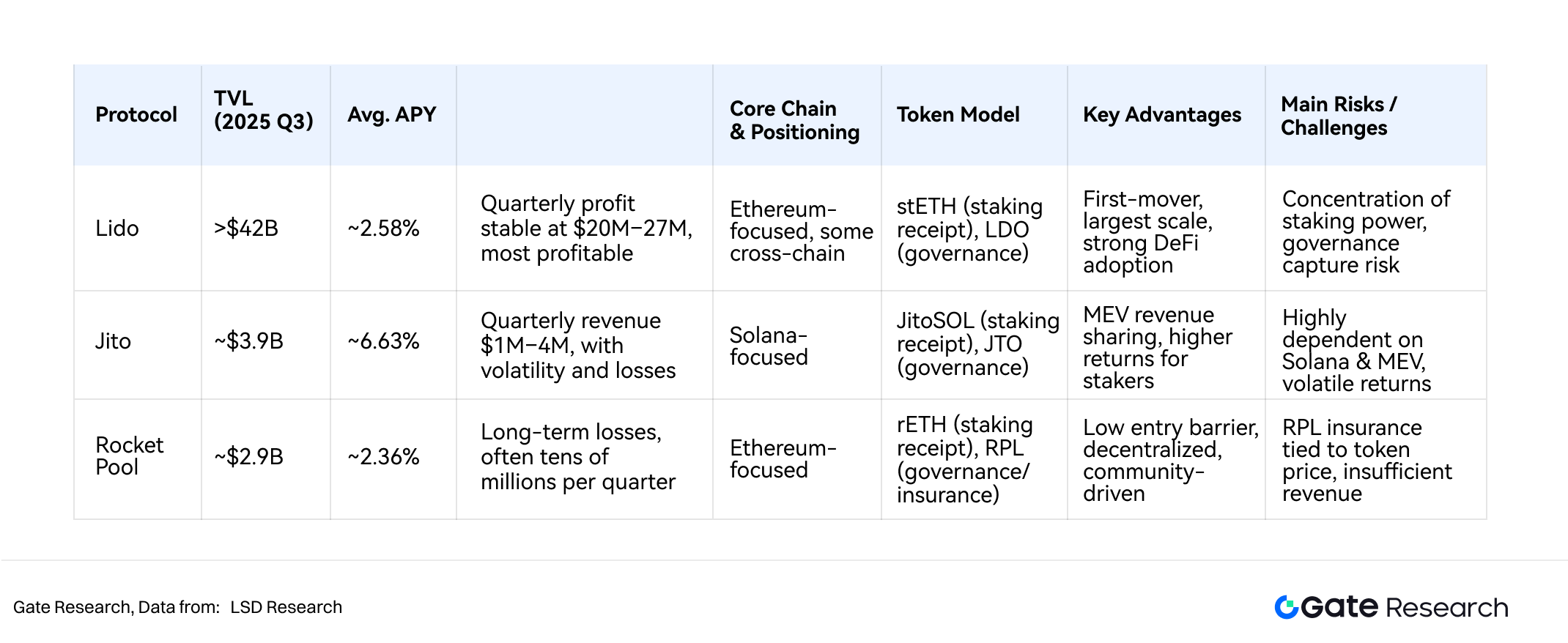

In summary, the three mainstream liquid staking protocols all adopt a dual-token model consisting of a staking certificate token and a governance token. In terms of TVL and profitability, Lido performs the best, while Jito delivers the highest annualized yield.

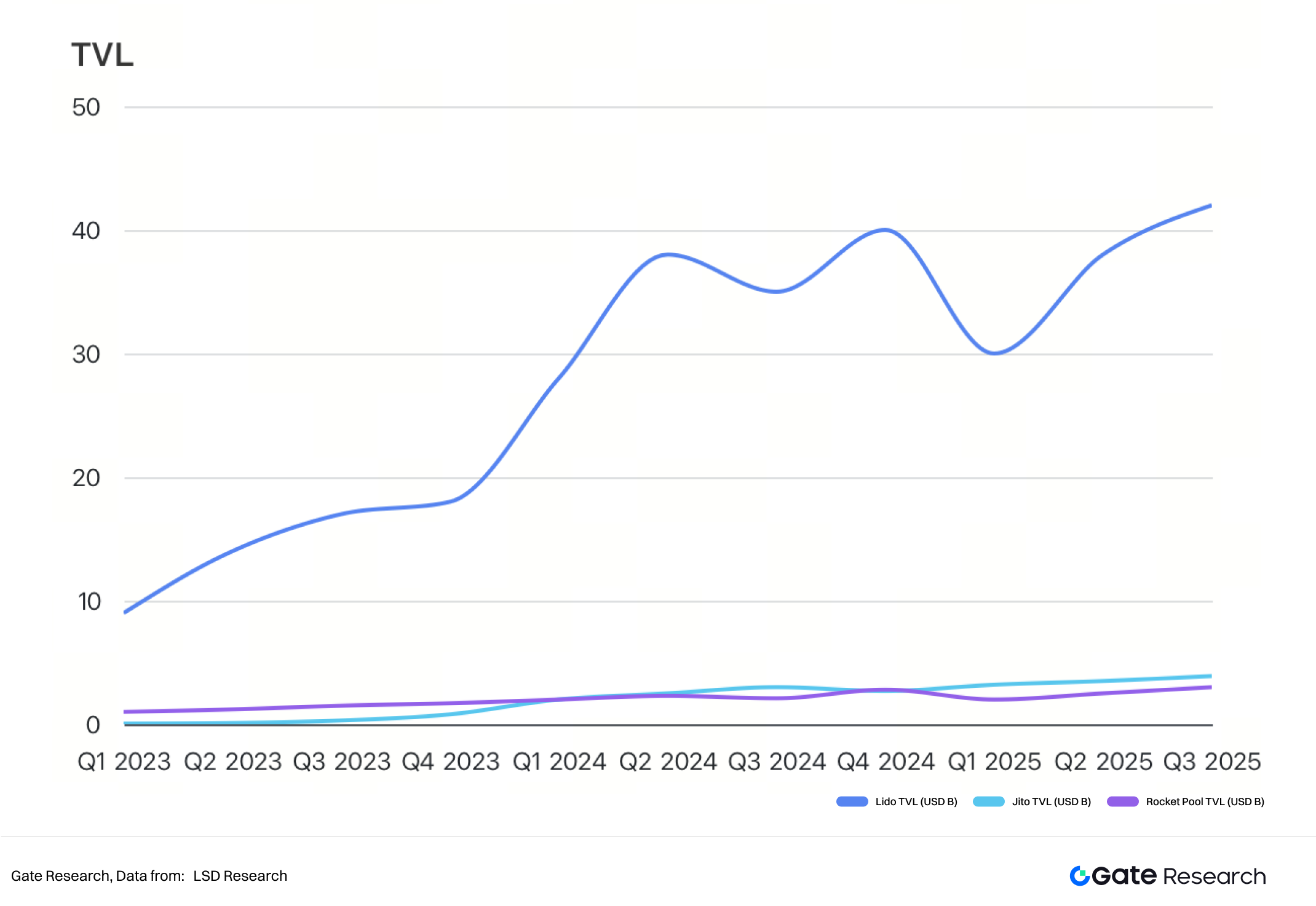

3.4.1 TVL Comparison

From the quarterly performance of TVL (Total Value Locked), Lido has consistently maintained an absolute leading position. Since 2023, Lido’s TVL has grown rapidly from around USD 9 billion, surpassing USD 40 billion in 2024. Although it experienced some fluctuations in early 2025, it has steadily recovered to above USD 42 billion. This trend highlights Lido’s strong market foundation and user stickiness in the Ethereum liquid staking sector. Its enormous scale makes it not only the core entry point for Ethereum staking but also an increasingly important liquidity pillar for the entire DeFi ecosystem.

In comparison, Jito’s scale is far smaller than Lido’s, but its growth rate is equally impressive. Jito grew from less than USD 100 million in early 2023 to nearly USD 4 billion by Q3 2025, exploding within the Solana ecosystem and becoming one of the most representative liquid staking protocols on Solana.

3.4.2 Yield (APY)

Lido’s average APY is around 2.58%, roughly in line with Rocket Pool’s 2.36%, reflecting the relatively stable returns of Ethereum staking across mainstream protocols. By contrast, Jito’s average APY reaches 6.63%, significantly higher than Ethereum-based liquid staking protocols. Its advantage comes from Solana’s unique MEV capture and distribution mechanism, which allows stakers to earn additional rewards from block space auctions on top of regular staking income. This makes Jito more attractive in terms of yield, though its returns may also be more volatile. In comparison, Lido and Rocket Pool offer more stable and long-term consistent yields.

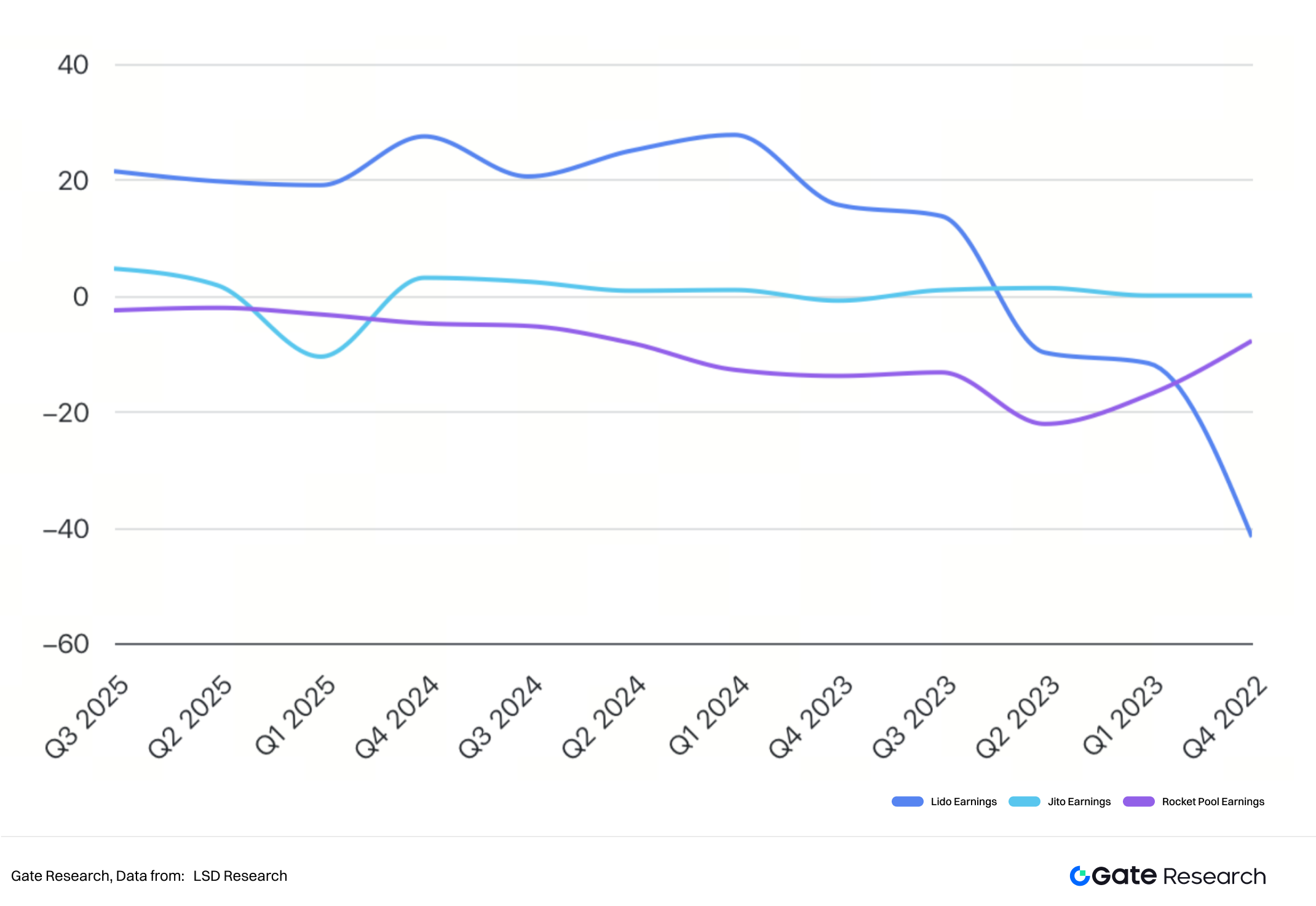

3.4.3 Revenue-Generating Capability

Looking at profitability over the past three years, Lido is by far the most stable and outstanding among the three. Since returning to profitability in mid-2023, its quarterly earnings have generally stabilized between USD 20 million and 27 million, demonstrating its large market scale and strong ability to convert revenue. Although it recorded a loss as high as –USD 41.7 million at the end of 2022, Lido quickly turned profitable again, supported by its leading user base and well-developed staking ecosystem, and has maintained steady positive growth since then. This stability cements its dominance in liquid staking, making it a benchmark difficult for others to challenge.

By contrast, Jito and Rocket Pool’s profitability is less stable. Jito has overall maintained small profits, with quarterly earnings typically between USD 1 million and 4 million, but it suffered a large loss in early 2025, suggesting volatility in its revenue structure and incentive mechanisms. Nevertheless, with the ongoing growth of the Solana ecosystem, Jito still shows certain growth potential. Rocket Pool, however, has remained in long-term losses, with quarterly deficits often in the tens of millions of dollars. Even in 2025, it has not turned profitable, as its incentive expenditures far exceed its revenues—reflecting an economic model more geared toward community expansion rather than direct profitability.

3.4.4 Supported Public Chains Comparison

- Lido primarily serves Ethereum and is the absolute leader in Ethereum liquid staking. Beyond Ethereum, Lido also supports staking on other chains such as Polygon, Solana (though gradually exiting), Polkadot, and Kusama. By providing liquidity solutions, Lido has broadened staking participation across these chains and lowered user barriers. However, this concentration of stake has also sparked debates about centralization risks in the Ethereum community.

- Jito is dedicated exclusively to Solana. Its JitoSOL token is directly tied to Solana’s staking mechanism and MEV capture system. Jito’s uniqueness lies in offering not just basic staking rewards but also MEV revenue distribution via the modified Jito-Solana validator client, allowing users to share in additional income from block space auctions. This makes Jito deeply intertwined with Solana—not just as a protocol, but also as a crucial component of Solana’s performance optimization and MEV infrastructure.

- Rocket Pool is focused exclusively on Ethereum, with its mission centered on enhancing Ethereum’s security and decentralization by lowering node operation thresholds. Unlike Lido, Rocket Pool does not depend on large-scale node operators, but instead enables small-scale operators to participate by staking just 16 ETH and some RPL. However, as yields decline, its TVL has been gradually decreasing.

Potential Risks

With the rapid development of liquid staking protocols on public chains such as Ethereum and Solana, while they provide users with staking liquidity and capital efficiency, they also introduce risks across multiple dimensions. Overall, the risks can be divided into the following six categories:

Smart Contract and Technical Risks

Liquid staking protocols are highly dependent on smart contracts. Any vulnerabilities, oracle manipulation, or insufficient security audits may result in fund theft or systemic failures. Considering that these protocols often manage assets worth tens of billions or even hundreds of billions of dollars, the technical risks carry a very strong incentive for attackers.

Validator and Staking Risks

The value of staking tokens is tied to the underlying staked assets. If validators misbehave, go offline, or are slashed, this directly reduces the value of the corresponding assets. Particularly under mechanisms involving multiple validators, a single validator failure can trigger larger-scale cascading losses.

Decentralization and Governance Risks

Some protocols rely on a small number of large validators, which may lead to stake centralization and weaken the decentralization and security of the underlying blockchain. At the same time, if governance tokens are concentrated in the hands of a few holders, this could lead to governance attacks or rent-seeking behavior, affecting the long-term healthy development of the protocol.

Liquidity and Market Risks

Although staking tokens are tradable, their peg to the underlying asset is not absolute. In times of market stress or widespread panic, significant depegging may occur, preventing users from redeeming the underlying assets at a 1:1 ratio. Historically, stETH has experienced depegging during market volatility.

Ecosystem Risks

Liquid staking protocols are deeply tied to specific public chains. If the underlying blockchain suffers a technical failure (e.g., network downtime, consensus failure), the risk will directly transmit to the protocol. In addition, with tightening global regulations, liquid staking protocols may in the future be classified as securities or other regulated financial products, exposing them to regulatory uncertainty.

Protocol-Specific Risks

- Lido: With over 30% market share in Ethereum liquid staking, further concentration could pose challenges to Ethereum’s decentralization. At the same time, its DAO governance faces potential risks of being dominated by large token holders.

- Jito: Its yield depends on Solana’s MEV auctions and the modified Jito-Solana client. If MEV activity declines or technical flaws exist in the client, both yields and stability would be significantly impacted. Due to its deep dependence on Solana, its risk resilience is relatively weak.

- Rocket Pool: Its mechanism relies on node operators staking RPL tokens as an insurance pool. In the event of large-scale slashing, the price of RPL could collapse, leading to insufficient insurance coverage. In addition, by attracting more small and medium-sized nodes, Rocket Pool strengthens decentralization but also increases operational risks.

Conclusion

The rise of liquid staking protocols has solved the structural contradiction of asset lock-up and lack of liquidity in traditional PoS staking, enabling users to maximize capital efficiency while safeguarding network security. With relatively low risk and stable yield characteristics, liquid staking has attracted a massive influx of users and funds. Moreover, it has given rise to innovative financial products represented by Pendle, continuously expanding the application boundaries of crypto assets. Lido, Jito, and Rocket Pool, as mainstream protocols, each feature distinct advantages—first-mover advantage, MEV yield innovation, and decentralization design—jointly driving the rapid expansion of liquid staking markets within ecosystems such as Ethereum and Solana.

However, the rapid development of liquid staking protocols also comes with challenges such as smart contract risks, governance centralization, market depegging, and regulatory uncertainty. Looking ahead, their evolution trends will mainly be reflected in four aspects:

- Enhanced security: Through stricter audits and distributed key management to reduce systemic risks.

- Deepened decentralization: Lowering node entry thresholds and optimizing incentive mechanisms to increase diversity and decentralization of networks.

- Integration with broader DeFi: Achieving deep integration with DeFi, derivatives, and cross-chain applications, gradually evolving into critical infrastructure for crypto finance.

- Regulatory adaptation: Actively responding to tightening global regulations, exploring compliance pathways to achieve long-term sustainable development.

Reference

- Defillama, https://defillama.com/protocols/liquid-staking

- Defillama, https://defillama.com/protocol/yields/rocket-pool

- Defillama, https://defillama.com/protocol/yields/lido

- Defillama, https://defillama.com/protocol/yields/jito

- Lido, https://lido.fi/static/Lido:Ethereum-Liquid-Staking.pdf

- Lido, https://blog.lido.fi/

- Jito, https://www.jito.network/

- RocketPool, https://rocketpool.net/protocol/why-rocket-pool

- CoinMarketCap, https://coinmarketcap.com/currencies/steth/

Gate Research

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What is Stablecoin?

Arweave: Capturing Market Opportunity with AO Computer