Gate Research: BTC Continues Upward, CONSCIOUS Leads With 900% Surge on Volume, Small-Cap Narrative Plays Intensify

Crypto Market Overview

According to CoinGecko data, from September 2 to 15, 2025, the crypto market maintained its diversified growth trajectory.【1】

- BTC continued to edge higher along its ascending trendline, repeatedly testing the $117,400 resistance level.

- ETH briefly surged to $4,950, before entering a consolidation phase after encountering resistance at the top.

Altcoin Performance:

Mid- and small-cap assets led this round of capital rotation.

- MYX and CONSCIOUS posted over 900% gains, both accompanied by substantial volume expansion.

- PUMP rallied over 120%, driven by strong community engagement and speculative trading momentum—contributing to a sharp rebound in market sentiment.

Overall, narrative-driven tokens with high elasticity were the primary beneficiaries of capital inflows, acting as key drivers of the rebound in an otherwise range-bound market.

Ecosystem Developments:

- On Solana, the DeFi Development treasury project launched “.dfdv” domain services, aiming to advance on-chain identity infrastructure.

- Arbitrum saw a net inflow of $204M, with TVL rising to $3.531B, fueled by the DRIP incentive program and increased activity in stablecoin and lending protocols.

- Pump.fun regained market leadership via token buybacks and creator incentives, resulting in a resurgence in both platform trading volume and revenue.

On the institutional front, Asset Entities and Strive Enterprises announced a $1.5B capital raise to acquire Bitcoin, signaling renewed institutional confidence in the long-term value of crypto assets.

Sectors such as stablecoins, lending protocols, and the creator economy attracted strong capital inflows, with both trading activity and TVL on the rise. Combined with the BTC and ETH rebound, these trends reflect a strengthening of market confidence and the parallel evolution of structural rotations and institutional adoption.

1. Overview of Price Performance

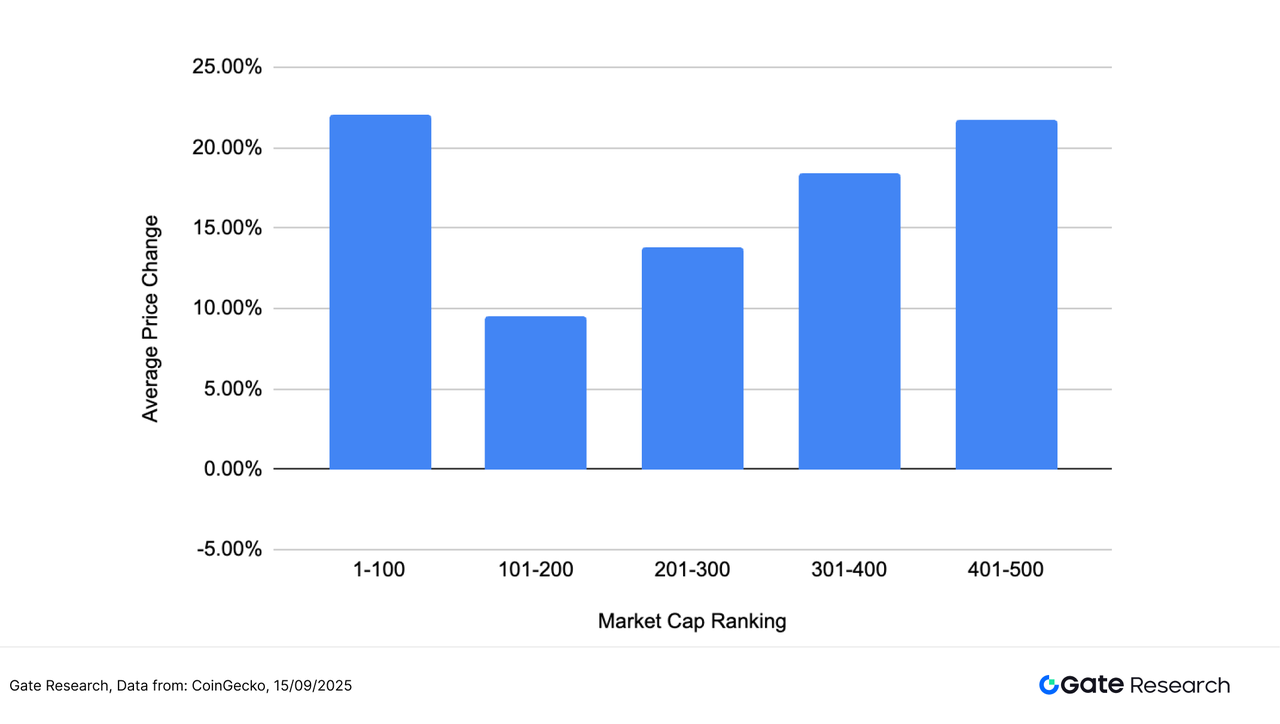

This section presents a grouped performance analysis of the top 500 tokens by market capitalization, based on their average price change between September 2 and September 15.

The overall average return was 17.12%, with the market displaying a distinct “Top and Bottom Heavy” structure—where the largest-cap (Top 100) and smallest-cap (401–500) segments outperformed all other tiers. Specifically:

- Top 100 tokens recorded an impressive +22.07%, reflecting strong institutional interest in large-cap assets.

- Rank 401–500 tokens posted a similar +21.76%, showcasing the high-beta, high-volatility nature of lower-cap tokens attracting risk-on capital.

- The 301–400 (+18.45%) and 201–300 (+13.84%) segments also showed healthy gains, indicating steady momentum across the mid-cap range.

- In contrast, the 101–200 tier underperformed with a modest +9.48%, the weakest among all groups.

These results suggest a bifurcated market structure: institutional flows into blue-chip tokens at the top, and retail speculation driving activity in smaller-cap assets at the bottom. This “barbell-shaped” performance distribution indicates increasing market rotation and diversification, potentially laying the groundwork for the next phase of narrative- or ecosystem-driven rallies.

Methodology: Based on CoinGecko rankings, the top 500 tokens by market cap were divided into 5 groups of 100 (i.e., ranks 1–100, 101–200, etc.). Each group’s average price return was calculated from September 2 to September 15, 2025. The overall average (+17.12%) represents the unweighted mean of all individual token returns within the top 500.

Figure 1: The overall average gain was 17.12%, led by the top 100 market cap tokens with an average return exceeding 22%.

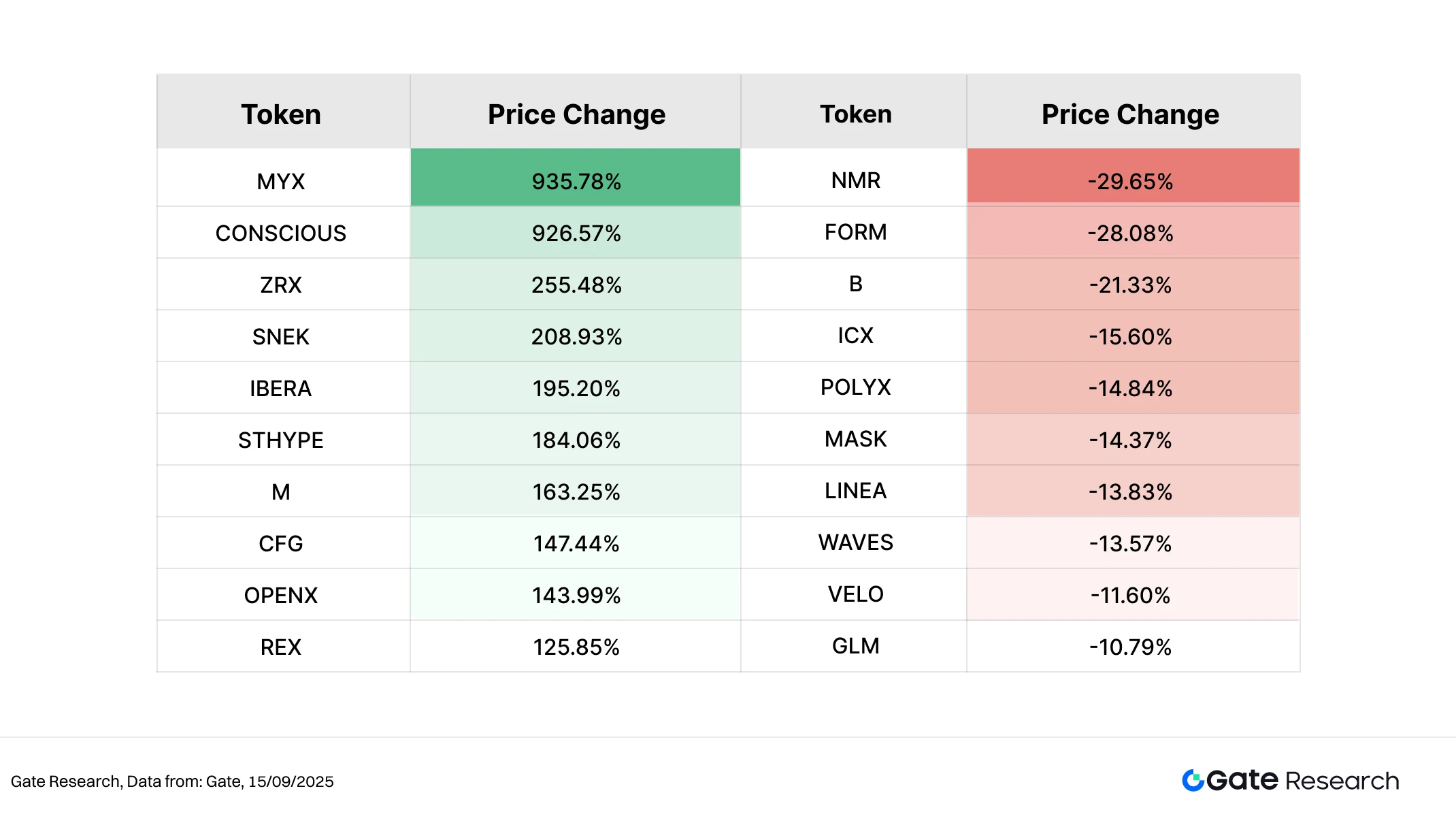

Top Gainers and Losers

Over the past two weeks, the crypto market has sustained its upward trajectory, with notable capital rotation fueling explosive rallies across multiple mid- and small-cap tokens. The top 10 gainers list is heavily populated by meme coins, early-stage projects, and emerging application ecosystems—assets characterized by both high narrative value and speculative momentum, drawing intense interest from short-term capital.

Leading the surge is MYX (+935.78%), which delivered a standout performance. MYX is a non-custodial derivatives exchange focused on on-chain perpetual trading of virtually any asset. It features a unique Matching Pool mechanism that offers low slippage, high leverage, and USDC-based collateral, attracting a significant influx of high-frequency traders. The platform’s recent V2 upgrade expectations, whale accumulation, token unlock narrative, and growing community hype have combined to create a flywheel of liquidity and momentum—making MYX a textbook example of dual narrative and social-driven performance.

Following closely is CONSCIOUS (+926.57%), which fuses popular narratives including decentralized identity (DID), AI, and SocialFi. Its rapid ascent was powered by liquidity incentives and strong community engagement. Other notable performers include ZRX (+255.48%), SNEK (+208.93%), and IBERA (+195.20%), each benefiting from strong elasticity and underlying ecosystem support. Additional tokens such as STHYPE, CFG, OPENX, and REX also made the list, driven by clear narrative frameworks and incentive structures—becoming focal points for short-term speculative capital.

In contrast, decliners posted relatively moderate losses. NMR (-29.65%) led the laggards, followed by FORM (-28.08%) and B (-21.33%). Other underperformers such as ICX, POLYX, MASK, LINEA, and WAVES saw -10% to -20% declines, primarily due to fading narratives or declining market attention.

In summary, the market remains tilted toward high-beta, narrative-rich assets. Tokens with strong community activation and capital inflow mechanisms continue to attract traders, while illiquid or hype-fading projects face increasing marginalization. The current structural rotation trend is likely to persist in the near term.

Figure 2: MYX leads the rally as the top-performing token, fueled by V2 upgrade anticipation, whale activity, and vibrant community buzz. Its Matching Pool model—offering low slippage and high leverage—helped propel a 935.78% surge over the past two weeks.

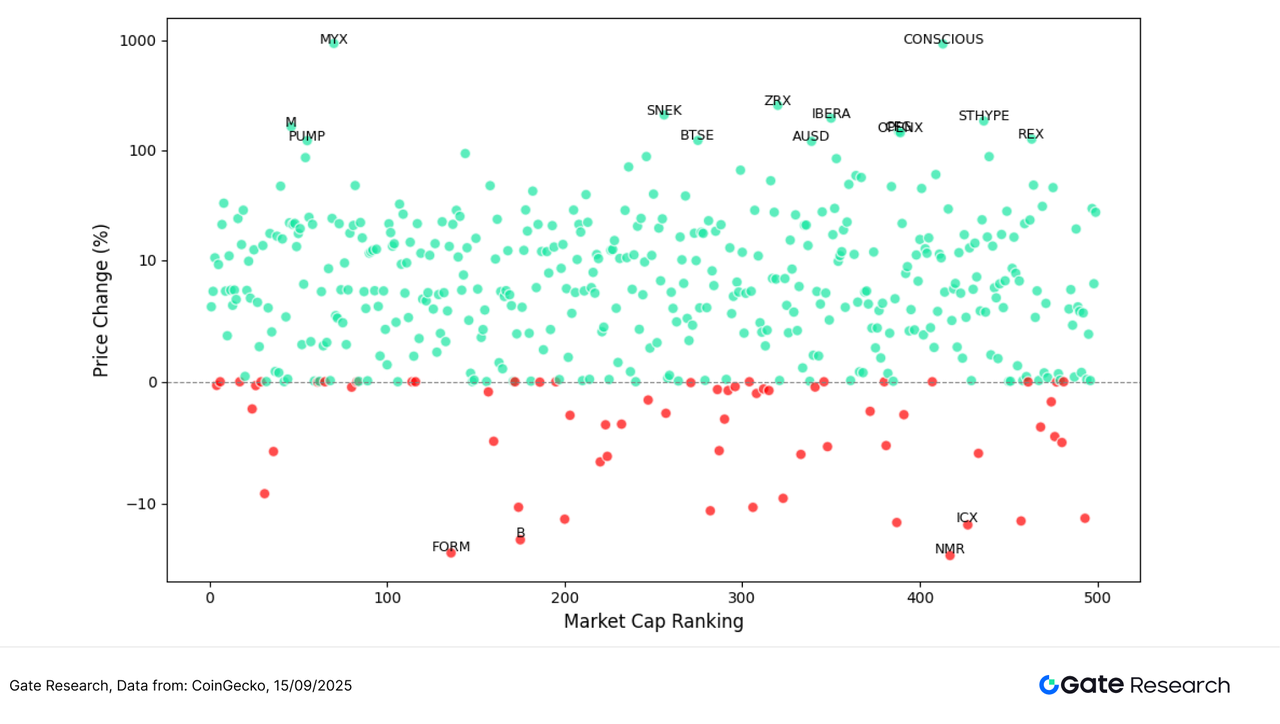

Relationship Between Market Cap Ranking and Price Performance

To further analyze the structural characteristics of token performance during the recent market rally, a scatter plot of the top 500 tokens by market cap was created. The x-axis represents market cap rank (lower ranks = larger market cap), and the y-axis shows price change from September 2 to September 15, displayed on a logarithmic scale. Each dot represents a token—green indicates positive returns, red indicates negative.

Overall, gainers significantly outnumber losers, signaling a clear shift in market sentiment from broad-based correction to a new phase of structural rotation. Most gainers posted 10–100% increases, while high-beta outliers with 100%+ returns were predominantly concentrated in mid- and lower-cap segments.

Standout performers include:

- MYX (+935.78%): A decentralized derivatives platform that surged on V2 upgrade hype, whale accumulation, and strong community momentum.

- CONSCIOUS (+926.57%): A narrative-heavy token combining DID, AI, and SocialFi themes, which exploded in popularity due to a liquidity mechanism and viral exposure.

- ZRX, SNEK, REX, OPENX, and others also recorded significant gains—mainly mid-to-small cap tokens fueled by clear narratives and capital inflows.

In contrast, the steepest losers were mostly tokens suffering from waning narrative relevance or cooling hype cycles:

- NMR (-29.65%) and FORM (-28.08%) ranked among the top decliners.

- Other underperformers like B, ICX, and POLYX saw double-digit drops, largely driven by declining investor interest and capital outflows.

In summary, capital is currently flowing toward high-volatility, community-driven mid- to low-cap tokens with strong narratives, while large-cap assets remain relatively stable. Structural rotation remains the dominant theme in this phase of the market.

Figure 3: Among the top 500 tokens, gainers clearly outnumber decliners. Capital is concentrated in narrative-driven, volatile mid-to-low cap assets, underscoring the ongoing structural rotation.

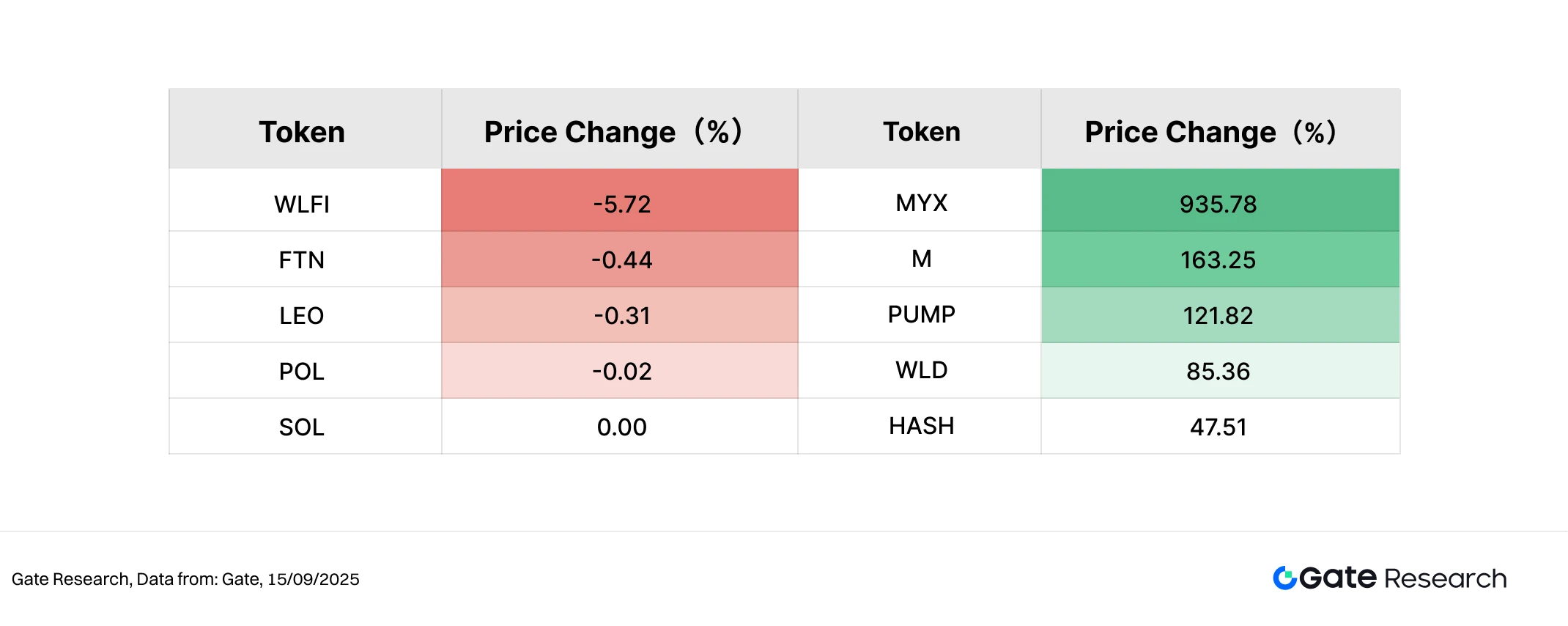

Top 100 Market Cap Leaders

In the current phase of market consolidation, the top 100 crypto assets by market cap posted steady performance, with an average gain of 22%, highlighting the resilience and capital absorption strength of mainstream assets under volatile conditions. While most tokens traded sideways, several high-beta, community-driven tokens recorded notable gains and became key targets for short-term speculative capital.

The top five gainers were largely narrative- and community-fueled tokens. MYX surged to the top on the back of innovative derivatives mechanisms and rising community momentum. M token rallied as MemeCore hosted a limited-access offline event, “HALLO MEME,” available only to holders, reinforcing a scarcity-driven membership narrative and triggering strong FOMO demand. PUMP also emerged as a market highlight, benefiting from a surge in platform trading volume, consistent buybacks, and viral social media exposure—despite limited fundamental change. Other notable performers like WLD and HASH gained attention due to ecosystem development prospects and sustained narrative relevance.

On the downside, token pullbacks were relatively mild, with no signs of panic selling, suggesting that top-cap assets continue to enjoy solid liquidity support. Major Layer 1s like SOL and POL remained range-bound, indicating that structural rotations have yet to extend fully into core assets.

Figure 4: Among the top 100 tokens, the five best performers featured high volatility and strong community narratives, making them prime targets for short-term capital rotation.

2. Volume Surge Analysis

Trading Volume Growth Analysis

Building upon the earlier analysis of price performance, this section further explores trading volume dynamics of select tokens during the current market cycle. Using pre-rally volumes as a baseline, we calculate each token’s volume growth multiple up to September 15, offering insights into market interest and trading activity shifts.

The data reveals that HASH, ATH, and UB recorded volume increases of 27.50x, 26.05x, and 25.94x, respectively. Their prices also rose 47.51%, 92.95%, and 47.92%, forming clear volume-price resonance structures. This suggests strong market consensus and heightened trading sentiment around these tokens. Notably, HASH, as a top-100 market cap token, stands out for attracting significant capital and achieving a strong volume-driven rally, backed by fundamentals.

In contrast, MYX, while showing a relatively lower 18.77x volume increase, achieved an extraordinary +935.78% price gain, signaling exceptional speculative intensity and social hype. Similarly, OPENX posted an 11.90x volume increase with a 143.99% price rebound, making it a standout among mid-to-low cap tokens with both momentum and flexibility.

From a structural perspective, most of these high-volume tokens are concentrated in the mid-to-lower market cap segments, where volume growth and price surges exhibit a strong correlation. This trend highlights a trading pattern where market participants gravitate toward active, narrative-driven tokens for short-term speculation. Spikes in trading volume often precede price movements and can serve as a leading indicator for identifying capital rotation targets.

Figure 5: HASH, ATH, UB, and others demonstrated significant volume expansion accompanied by strong price gains, exemplifying classic volume-price resonance and serving as key focal points for short-term capital flows.

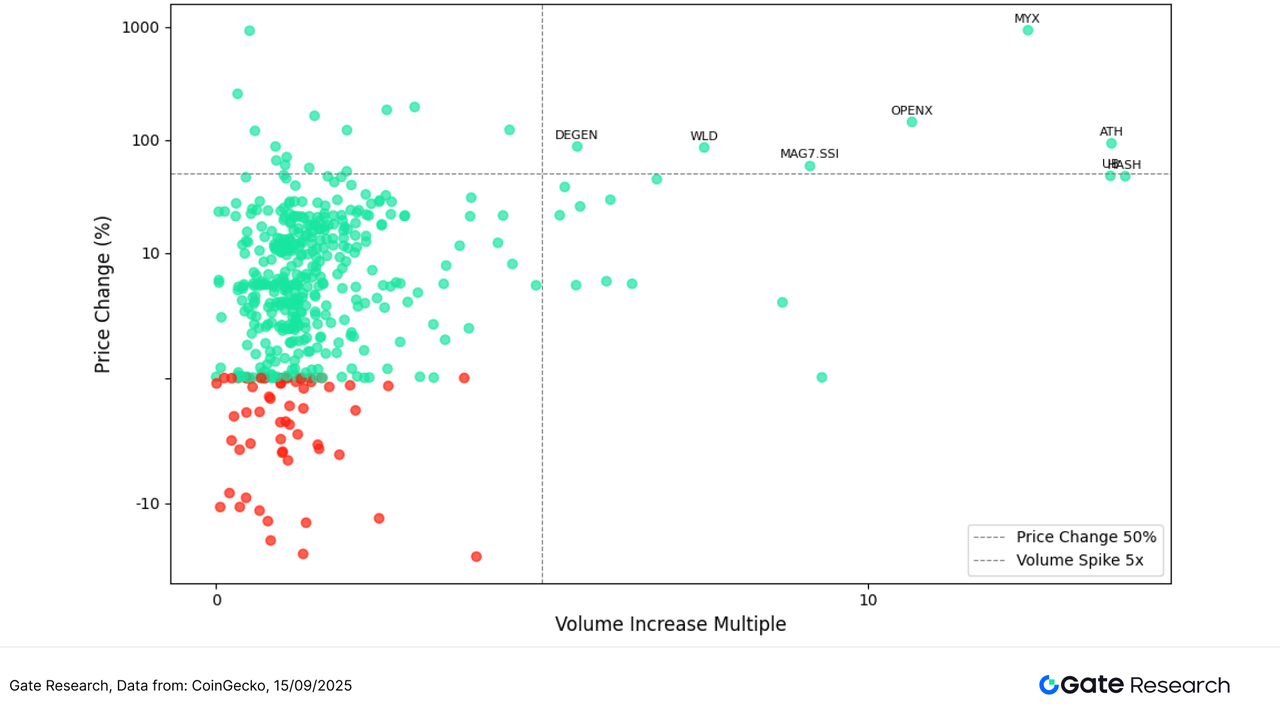

Volume-Price Relationship Analysis

Building on the previous analysis of tokens with significant volume spikes, this section incorporates price performance to map out a scatter plot of Volume Increase Multiple (x-axis) versus Price Change % (y-axis). A symmetric log scale is applied to both axes to clearly visualize the structural relationship between volume expansion and price movements over the past two weeks.

From the chart, we observe a concentration of tokens in the upper-right quadrant, representing the core targets of capital rotation with both substantial volume increases and strong price gains. Standout performers include:

- MYX: Volume surged by 18.77x, with price rocketing +935.78%, driven by strong community momentum and speculative enthusiasm.

- OPENX: Recorded 11.9x volume growth and a +143.99% price gain, showcasing classic volume-price resonance.

- ATH, UB, HASH: Each saw 25x+ volume increases with 40–90% price rebounds, highlighting rising investor interest in mid-to-lower-cap tokens.

Other tokens such as WLD, MAG7, SSI, and DEGEN also occupy the upper-right quadrant. While their volume increases may not be as extreme, their price rallies were supported by catalysts like new listings or narrative-driven momentum, reflecting sustained market interest in high-storyline-value tokens.

In contrast:

- The left-side regions include a few tokens with moderate price gains but limited volume growth, suggesting less conviction behind the moves.

- The lower-right quadrant—tokens with high volume increases but minimal price appreciation—reveals “volume without price” cases, indicating weak fundamental or narrative support, and limited capital follow-through.

Overall, tokens in the upper-right quadrant share a common structure: clear catalysts, strong community engagement, and liquidity support, making them prime targets for short-term speculative capital. This volume-led rally pattern underscores the importance of narrative strength and hints at a market shift from sentiment-driven trading to more fundamental and story-driven positioning.

Figure 6: Tokens such as MYX, OPENX, and ATH fall into the upper-right quadrant, exhibiting classic “high-volume, high-price” structures, and are key focus areas for short-term capital rotation.

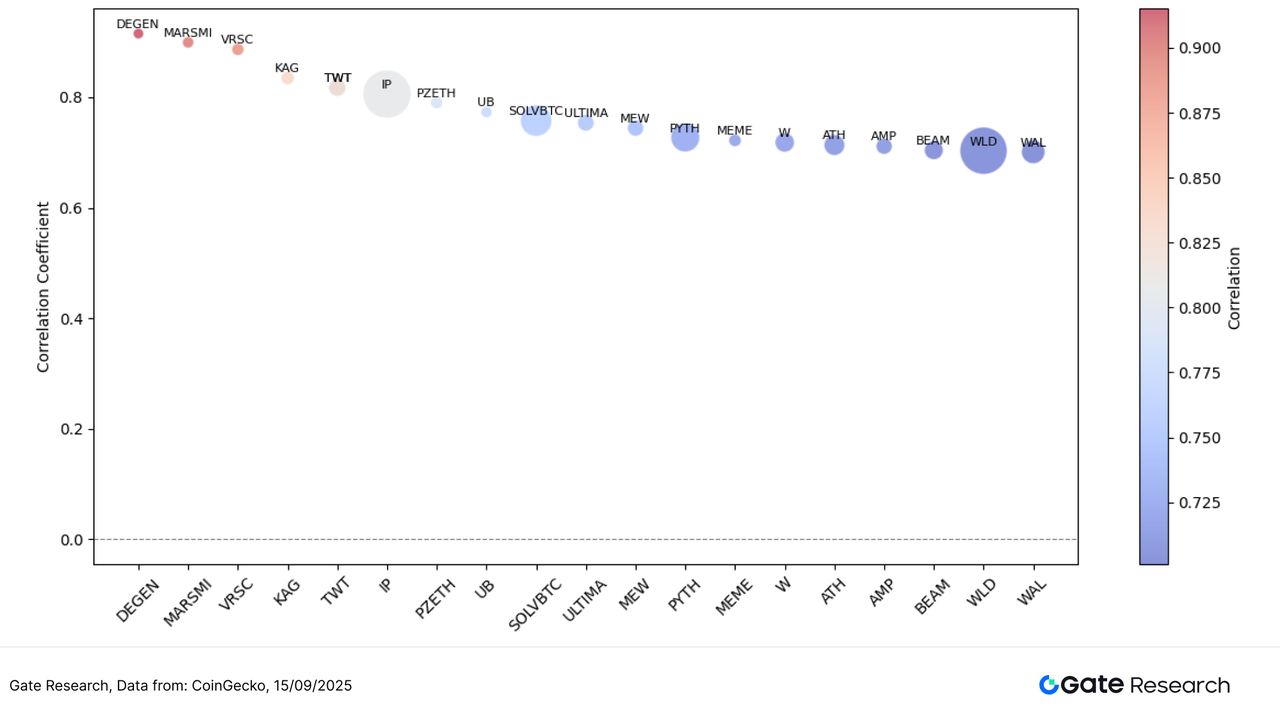

Correlation Analysis

This section delves deeper into the structural relationship between token trading volume and price performance from a statistical perspective. To evaluate whether market liquidity activity systematically impacts price volatility, we introduce the Volume-to-Market Cap ratio as a proxy for relative activity level, and calculate its correlation with price changes. This analysis helps identify tokens most sensitive to capital inflows and sheds light on the strength of volume-price linkages across the market.

As shown in the chart, most tokens exhibit correlation coefficients between 0.70 and 0.85, indicating a generally positive relationship between trading activity and price movements. Bubble color represents the strength of this correlation (with red indicating higher correlation and blue lower), while bubble size reflects market capitalization, helping distinguish structural differences across token tiers.

Tokens in the upper-left quadrant—such as DEGEN, MARSMI, and VRSC—have the highest correlation coefficients, nearing 0.9, suggesting that price movements are highly responsive to trading volume changes. These small- to mid-cap tokens are typical “high elasticity” assets, often favored by short-term speculative capital due to their strong volume-price resonance.

On the right side of the chart, tokens like WLD, WAL, BEAM, and ATH show moderate correlation coefficients (~0.72–0.75) despite notable volume and price increases. These projects tend to have larger market caps (larger bubbles), indicating better liquidity depth and capital absorption, but less price sensitivity, which results in more stable trends—potentially making them attractive to long-term or institutional investors.

In summary, the current market structure shows a clear “elasticity stratification”:

- Small- and mid-cap tokens exhibit high correlation and volatility, suited for short-term trading strategies.

- Large-cap tokens offer lower correlation and higher price stability, aligning with the preferences of risk-averse, long-term investors.

- Investors can tailor their participation strategies based on their individual risk appetite and investment horizon.

Figure 7: Tokens like DEGEN, VRSC, and MARSMI exhibit the strongest volume-price correlation, representing highly elastic and volatile assets; whereas large-cap tokens like WLD and ATH show weaker correlation but greater price stability.

In summary, the current crypto market continues to exhibit structural rotation, with sentiment recovering and stronger volume-price correlation emerging. Small- and mid-cap tokens such as MYX, OPENX, and ATH have surged on rising trading volumes, becoming focal points for short-term speculative capital. Meanwhile, larger-cap tokens like WLD, ATH, and WAL have demonstrated steady performance, attracting long-term investors with their superior liquidity and depth—highlighting a clear divergence in risk appetite across market segments.

Beyond market price action, several potential airdrop projects are actively progressing. These span popular sectors such as modular AI blockchains, Web3 community incentives, stablecoin-based DeFi protocols, and decentralized node networks. By staying engaged and participating in on-chain interactions, users can secure early eligibility for token rewards and airdrops, gaining a strategic edge during this period of market consolidation. The following section outlines four noteworthy projects and how to participate—helping users systematically position for upcoming Web3 incentive opportunities.

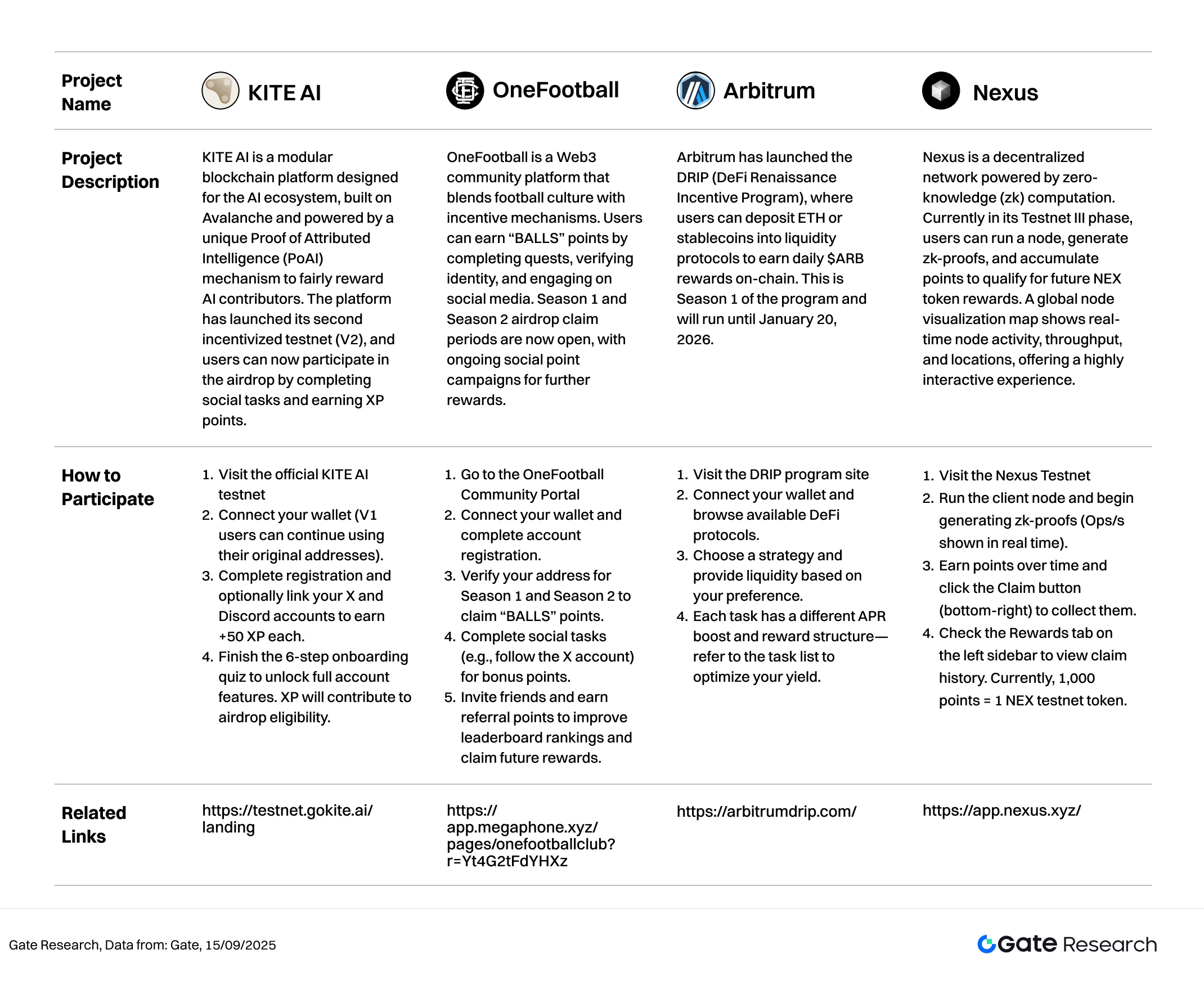

Airdrop Highlights

This article summarizes key airdrop-worthy early-stage projects worth tracking from September 2 to September 15, 2025, including KITE AI (a modular AI blockchain built on Avalanche), OneFootball (a community platform combining football culture and Web3 incentive mechanisms), Arbitrum DRIP (a Layer 2 rewards program focused on stablecoin deposits and lending incentives), and Nexus (a decentralized node network based on zero-knowledge proofs).

Users can accumulate early participation credentials by registering accounts, connecting wallets and social platforms, completing tasks, and staking assets. The following sections outline each project’s positioning, current incentive paths, and main interaction processes to help users capture potential Web3 airdrop opportunities.

KITE AI

KITE AI is a modular blockchain platform designed for the AI ecosystem, built on Avalanche and powered by a unique Proof of Attributed Intelligence (PoAI) mechanism to fairly reward AI contributors. The platform has launched its second incentivized testnet (V2), and users can now participate in the airdrop by completing social tasks and earning XP points.【2】

How to Participate:

- Visit the official KITE AI testnet

- Connect your wallet (V1 users can continue using their original addresses).

- Complete registration and optionally link your X and Discord accounts to earn +50 XP each.

- Finish the 6-step onboarding quiz to unlock full account features. XP will contribute to airdrop eligibility.

OneFootball

OneFootball is a Web3 community platform that blends football culture with incentive mechanisms. Users can earn “BALLS” points by completing quests, verifying identity, and engaging on social media. Season 1 and Season 2 airdrop claim periods are now open, with ongoing social point campaigns for further rewards.【3】

How to Participate:

- Go to the OneFootball Community Portal

- Connect your wallet and complete account registration.

- Verify your address for Season 1 and Season 2 to claim “BALLS” points.

- Complete social tasks (e.g., follow the X account) for bonus points.

- Invite friends and earn referral points to improve leaderboard rankings and claim future rewards.

Arbitrum

Arbitrum has launched the DRIP (DeFi Renaissance Incentive Program), where users can deposit ETH or stablecoins into liquidity protocols to earn daily $ARB rewards on-chain. This is Season 1 of the program and will run until January 20, 2026.【4】

How to Participate:

- Visit the DRIP program site

- Connect your wallet and browse available DeFi protocols.

- Choose a strategy and provide liquidity based on your preference.

- Each task has a different APR boost and reward structure—refer to the task list to optimize your yield.

Nexus

Nexus is a decentralized network powered by zero-knowledge (zk) computation. Currently in its Testnet III phase, users can run a node, generate zk-proofs, and accumulate points to qualify for future NEX token rewards. A global node visualization map shows real-time node activity, throughput, and locations, offering a highly interactive experience.【5】

How to Participate:

- Visit the Nexus Testnet

- Run the client node and begin generating zk-proofs (Ops/s shown in real time).

- Earn points over time and click the Claim button (bottom-right) to collect them.

- Check the Rewards tab on the left sidebar to view claim history. Currently, 1,000 points = 1 NEX testnet token.

Reminder

Airdrop plans and participation methods are subject to change at any time. Therefore, it is recommended that users follow the official channels of the above projects for the latest updates. Additionally, users should exercise caution, be aware of the risks, and conduct thorough research before participating. Gate does not guarantee the distribution of subsequent airdrop rewards.

Conclusion

From September 2 to September 15, 2025, the crypto market continued its trend of “sector rotation + narrative-driven” performance, with increasing signs of synchronized price-volume movement. BTC and ETH respectively tested key resistance levels at $117,400 and $4,950, maintaining their upward momentum and anchoring broader market sentiment.

Top 100 market cap tokens remained steady, attracting ongoing institutional interest, while small- and mid-cap tokens saw explosive gains amid capital rotation. High-beta assets like MYX and CONSCIOUS surged over 900%, accompanied by sharp increases in trading volume, becoming standout examples of narrative-driven tokens in this cycle. On average, tokens ranked 1–100 and 401–500 performed best, reflecting simultaneous strength at both the top and bottom ends of the market, pushing the overall average return above 17%.

Data trends show a strong positive correlation between trading volume and price. Tokens such as HASH, ATH, and OPENX recorded more than 20x increases in volume, with prices rising in tandem. These projects are concentrated in the upper-right quadrant of the scatter plot, indicating that capital favors “high activity + strong narrative” small-cap assets. Most tokens exhibited a volume/market cap to price correlation coefficient between 0.70–0.90, confirming that market activity is increasingly influential in driving price gains.

Overall, the market is currently in a bifurcated structure, where narrative-driven speculation dominates while blue-chip assets consolidate in anticipation of macro or technical catalysts. Capital continues to favor highly active, community-driven small caps for short-term rotations, while mainstream assets await stronger momentum signals.

In addition, this report tracks four notable early-stage projects: KITE AI, OneFootball, Arbitrum, and Nexus. These focus on modular AI blockchains, football-themed Web3 communities, Layer2 incentive programs, and decentralized zk computation networks, respectively. All are in early incentive phases with clear participation routes and reward mechanisms. Users can earn future token rewards or airdrops by completing tasks, linking social accounts, depositing assets, or running nodes. Continued engagement is encouraged—not only to stay informed on project development but also to capture potential upside from the next wave of Web3 opportunities.

Reference:

- CoinGecko, https://www.coingecko.com/

- KITE AI, https://testnet.gokite.ai/landing

- OneFootball, https://app.megaphone.xyz/pages/onefootballclub?r=Yt4G2tFdYHXz

- Arbitrum, https://arbitrumdrip.com/

- Nexus, https://app.nexus.xyz/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

12 Best Sites to Hunt Crypto Airdrops in 2025

Top 20 Crypto Airdrops in 2025

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Perpetual Contract Funding Rate Arbitrage Strategy in 2025

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time