Gate Leveraged ETF Tokens: A Spot-Based Approach to Unlocking High-Leverage Trading

The Next Evolution of ETFs and Derivative Products

Exchange-Traded Funds (ETFs) are investment vehicles that bundle various asset classes, enabling investors to trade them directly on exchanges just like stocks. Unlike holding a single asset, ETFs offer risk diversification and the ability to track specific markets or indices, making them a consistent favorite among market participants. As financial innovation progresses, more aggressive derivative ETFs have gained traction. Leveraged ETFs, for instance, amplify the price movements of underlying assets by a set factor, allowing users to rapidly magnify returns during strong short-term market trends while streamlining the trading process.

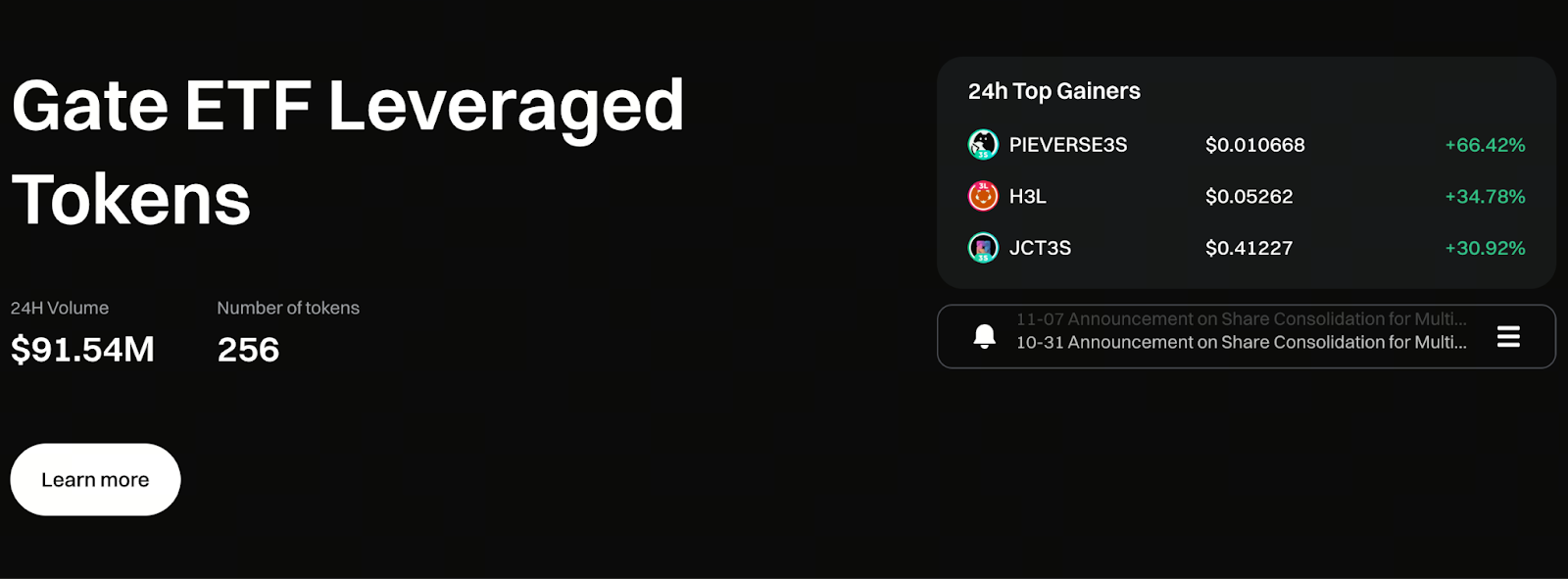

Gate Leveraged ETF Tokens

Gate’s leveraged ETF tokens are derivatives structured as funds. These products maintain a fixed leverage ratio through perpetual contract positions, but investors do not need to engage in contract trading themselves. By simply buying or selling spot tokens, users achieve the same leveraged exposure without facing the liquidation risks common to traditional derivatives.

Trade Gate ETF leveraged tokens now: https://www.gate.com/leveraged-etf

Core Operating Model

Gate leveraged ETF tokens are managed by a professional team, with operations that include:

- Futures Position Support

Each leveraged ETF token is backed by perpetual contract positions to maintain its designated leverage ratio (such as 3x or 5x). - Daily Rebalancing

The team adjusts positions daily based on market volatility to keep the token’s leverage stable and within its set parameters. - Leverage via Spot Trading

Users do not need to open contract accounts or provide additional margin. They can directly establish leveraged positions simply by trading spot tokens. - Daily Management Fee

The platform charges a daily management fee of 0.1%, which covers hedging, position adjustment, and contract trading costs.

Product Advantages

- Immediate Exposure to Magnified Price Movements

Preset leverage ratios (such as 3x or 5x) allow users to quickly amplify returns when market direction is clear. - No Liquidation Risk

Since users are not trading contracts directly, the system manages positions on their behalf, eliminating forced liquidations from excessive losses. - Automated Compounding Effect

When the market moves favorably, the system automatically increases positions, compounding profits over time. - Spot-Like Trading Experience

Buying and selling tokens is straightforward—no borrowing or margin required—making it highly accessible for beginners.

Key Risks to Consider

Despite their simplicity, leveraged ETFs carry notable risks:

- Amplified Volatility

Gains and losses are multiplied, resulting in greater price swings. - Rebalancing May Cause Long-Term Decay

Frequent position adjustments in volatile markets can erode long-term returns, making these products unsuitable for prolonged holding. - Returns May Not Scale Linearly with Leverage

Due to rebalancing and position adjustments, overall price changes may not always match the intended leverage ratio. - High Holding Costs

Daily management fees and hedging costs can impact net performance.

Leveraged ETFs are best suited for short-term trades or clear market trends, rather than long-term investment.

Why Management Fees Are Necessary

Leveraged ETF operations rely on perpetual contract markets for hedging and leverage maintenance, incurring:

- Contract trading fees

- Funding rate costs

- Spread and slippage

Gate’s daily management fee of 0.1% covers these essential expenses. This rate is among the lowest in the industry, with the platform subsidizing some costs.

Conclusion

Leveraged ETFs allow users to access leveraged opportunities through familiar spot trading methods. They eliminate liquidation risk and operational complexity, lowering the entry barrier. Given the effects of rebalancing and market volatility, these tools are best suited for short-term strategies or clear market trends. Investors seeking amplified returns should combine these products with risk management to identify the optimal approach for their investment goals.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution