From High Yields to Potential Collapse: Dissecting the Logic Chain Behind USDe Incentives

Since 2024, the stablecoin market has been undergoing a transformation driven by structural innovation. After years of dominance by fiat-backed stablecoins like USDT and USDC, Ethena Labs launched USDe—a synthetic stablecoin designed without fiat backing—that quickly surged in popularity. Its market cap once exceeded $8 billion, making it a “high-yield dollar” within the DeFi ecosystem.

Recently, Ethena and Aave’s joint Liquid Leverage staking campaign has become a hot topic. Despite an annualized yield of nearly 50%, which is eye-catching, which on the surface seems like a typical incentive scheme, the program also signals an important underlying issue: USDe’s model faces structural liquidity pressure during ETH bull markets.

This article analyzes the mechanics of this incentive program, briefly introduces USDe, sUSDe, and their related platforms, and then dissects core systemic challenges—across yield structure, user behavior, and capital flows. It also compares these challenges to historical cases such as GHO, exploring whether future protocol mechanisms are resilient enough to weather extreme market conditions.

I. USDe & sUSDe Overview: Crypto-Native Synthetic Stablecoins

USDe, launched by Ethena Labs in 2024, is a synthetic stablecoin specifically designed to eliminate reliance on traditional banking systems and fiat issuance. Its circulating supply now exceeds $8 billion. Unlike stablecoins such as USDT or USDC—which rely on fiat reserves—USDe’s peg mechanism depends on on-chain crypto assets, mainly ETH and its staked derivatives (such as stETH and WBETH).

Image source: Coingecko

USDe’s core mechanism is a “delta-neutral” structure: the protocol holds spot positions in assets like ETH, while simultaneously opening equal-value short positions in ETH perpetuals on centralized derivatives exchanges. This hedged structure brings the protocol’s net exposure close to zero, helping keep USDe’s price anchored near $1.

sUSDe is a representative token that users receive when staking USDe through the protocol. It automatically accumulates yield, which comes from two primary sources: funding rate income from ETH perpetual contracts, and derivative yield from the underlying staked assets. The model is built to provide stablecoin holders with consistent yield while maintaining price stability.

II. Aave & Merkl Overview: Lending Protocols & Incentive Distribution Mechanisms

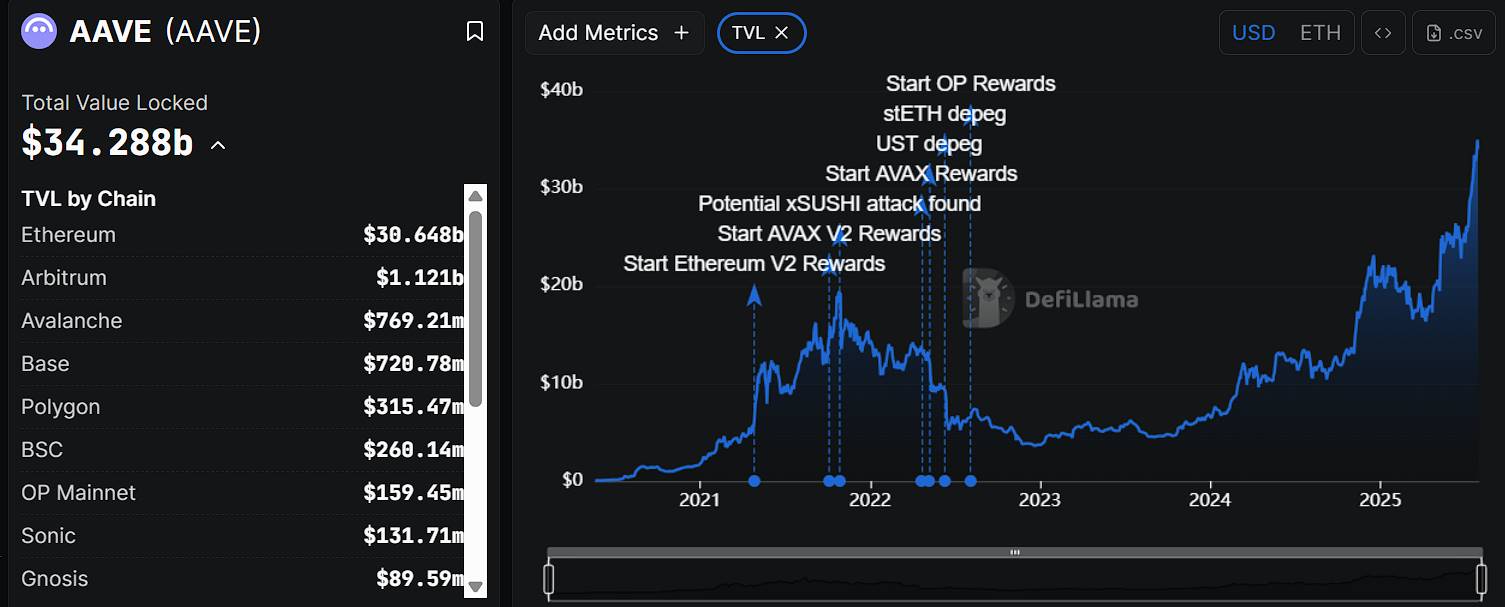

Aave is one of the most established and widely used decentralized lending protocols on Ethereum—dating back to 2017. By pioneering “flash loans” and flexible interest models, it played a pivotal role in the early DeFi lending wave. Users can deposit crypto assets into Aave for interest, or borrow other tokens against collateral, all without intermediaries. Aave’s total value locked (TVL) is currently about $34 billion, with nearly 90% deployed on Ethereum mainnet. Its native token, AAVE, has a market cap of about $4.2 billion, ranking 31st on CoinMarketCap.

Data source: DeFiLlama

Merkl, a product of the Angle Protocol team, is an on-chain incentive distribution platform tailored for DeFi protocols. It provides programmable, conditional tools that allow teams to set precise reward structures based on factors like asset type, holding duration, and liquidity contribution. To date, Merkl has supported more than 150 on-chain projects and protocols, distributing over $200 million in incentives across chains including Ethereum, Arbitrum, and Optimism.

In this joint USDe initiative, Aave manages the lending market, configures parameters, and matches collateral assets, while Merkl handles incentive logic design and on-chain reward distribution.

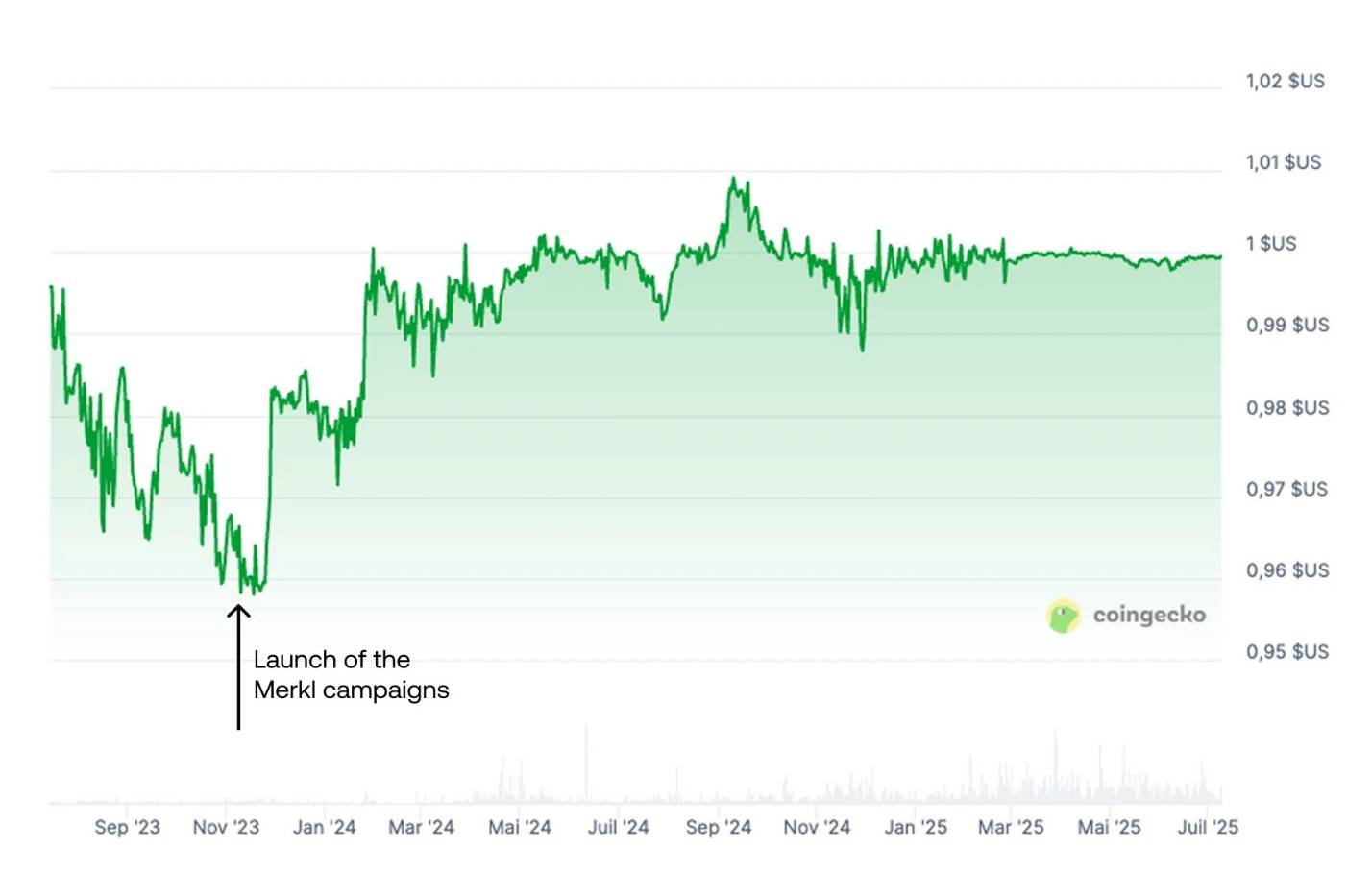

Aave and Merkl have also established a stable partnership on previous projects—the most notable being their joint response to GHO’s depegging episode.

GHO is an overcollateralized native stablecoin launched by Aave, mintable with ETH, AAVE, and other assets. Early on, GHO’s limited traction and poor liquidity caused its price to fall below its peg, lingering between $0.94 and $0.99 and losing its dollar anchor.

To address the divergence, Aave and Merkl launched a liquidity incentive scheme on Uniswap V3 for GHO/USDC and GHO/USDT pairs. Their program rewarded market makers who provided concentrated liquidity near $1, driving trading depth to the peg zone and creating an on-chain “price wall.” The results were significant, with GHO’s price steadily rebounding to approximately $1.

This case highlighted Merkl’s role in stabilization: programmable incentives can sustain liquidity density at key price points—much like subsidizing “market vendors” to anchor pivotal rates. But there’s a clear challenge: once incentives end or liquidity providers exit, the price peg may fail.

III. Explaining the 50% Annualized Yield Mechanism

On July 29, 2025, Ethena Labs officially introduced the “Liquid Leverage” module on Aave. The feature requires users to deposit sUSDe and USDe in a 1:1 ratio into Aave, creating a leveraged, dual-collateral structure with additional incentive rewards.

Qualified users can tap into three streams of yield:

Merkl-powered automatic USDe incentive (currently ~12% APY);

sUSDe’s protocol yield—sourced from delta-neutral strategy funding/hedge returns and staking income;

Standard Aave deposit interest, depending on market utilization and pool demand.

Here’s how to participate:

Acquire USDe via the Ethena website (ethena.fi) or a decentralized exchange like Uniswap;

Stake your USDe on the Ethena platform to mint sUSDe;

Deposit equal amounts of USDe and sUSDe (1:1 ratio) into Aave;

Enable “Use as Collateral” within the Aave interface;

Once the system verifies, Merkl automatically tracks eligible addresses and distributes rewards on schedule.

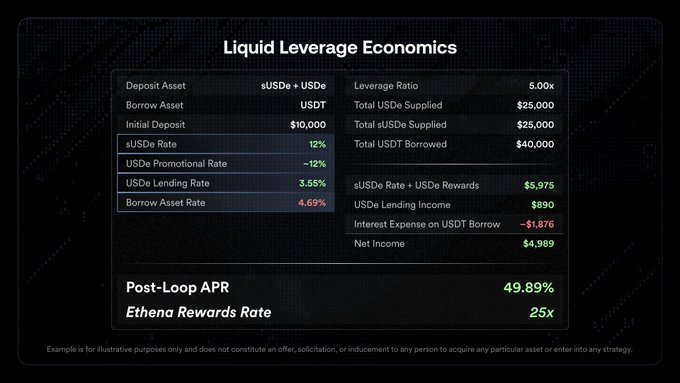

Image source: Official Twitter

Official example and breakdown of the mechanics:

Assume you start with a $10,000 principal, apply 5x leverage, and borrow $40,000—allocating $25,000 each to USDe and sUSDe.

How leverage works:

The yield is driven by a cyclical “borrow–deposit–re-borrow” process. The initial principal is used for a first round of staking; the borrowed funds are then recycled into additional USDe and sUSDe deposits in multiple rounds. With 5x leverage, your total deployed capital reaches $50,000, amplifying both incentives and base yield.

IV. Do Incentives Reveal Structural Challenges Shared by USDe and GHO?

While both USDe and GHO are stablecoins collateralized by crypto assets, their mechanisms are fundamentally different. USDe utilizes a delta-neutral hedging framework to sustain its peg and has thus far maintained a stable trading range near $1—avoiding the major depegging and reliance on emergency incentives that GHO experienced. Still, USDe’s risk is not negligible: its hedging model presents vulnerabilities, particularly during sharp market swings or upon withdrawal of external incentives. The result: potential stability shocks akin to those that plagued GHO.

The most acute risks boil down to two key issues:

Negative funding rates undermine protocol yield

sUSDe yield comes from LST rewards on staked ETH and positive funding payments from ETH perpetual shorts. In bullish conditions, longs pay shorts and returns stay positive. If the market turns bearish and shorts prevail, funding rates flip negative and the protocol must pay for hedges, which reduces or even inverts user returns. Although Ethena has an insurance fund, its capacity to cover prolonged negative yields is uncertain.End of incentives—12% bonus yield vanishes

The Aave Liquid Leverage campaign currently provides an extra 12% APY in USDe rewards. When that ends, actual user returns will drop to sUSDe’s native (funding plus LST) yield plus the Aave deposit rate, likely in the 15–20% range. Under high leverage (such as 5x), borrowing costs (e.g., USDT’s 4.69% rate) further compress profits. In a scenario of negative funding and rising rates, net returns could be wiped out or even go negative.

If incentives end, ETH falls, and funding turns negative, the delta-neutral yield model for USDe comes under real stress. sUSDe returns could fall to zero or turn negative; if mass redemptions and selling follow, USDe’s peg may break. This “multiple negative stack” is the core systemic risk in Ethena’s design—and likely the reason for its aggressive incentive strategies.

V. Does ETH’s Price Rally Guarantee Stability?

USDe’s stability relies on spot staking and derivatives hedging of ETH. During sharp ETH rallies, this structure faces systemic outflow pressure. As ETH nears perceived peaks, users tend to redeem staked assets early to lock in profits or pursue higher-yielding opportunities elsewhere. This triggers a familiar cycle: “ETH bull market → LST withdrawals → USDe contraction.”

According to DeFiLlama data, during ETH’s surge in June 2025, USDe and sUSDe TVLs declined in sync, and APY did not increase. In contrast, the previous bull run (late 2024) saw TVL decrease more gradually after ETH topped, with no mass early redemptions.

This cycle, TVL and APY have both dropped together, reflecting market skepticism about sUSDe yield sustainability. When volatility and funding costs threaten negative returns for the delta-neutral model, users respond more quickly—exiting sooner. This liquidity drain hampers USDe’s growth and amplifies its contraction risk during ETH bull phases.

Summary

The eye-catching 50% APY is a temporary result of layered incentives (Merkl airdrop + Aave campaign), not an organic protocol yield. When ETH stabilizes at highs, incentives end, and funding rates turn negative, USDe’s delta-neutral structure will be challenged. sUSDe returns may converge to zero or go negative, jeopardizing the peg anchor.

Current data shows synchronized TVL drops for USDe and sUSDe during ETH rallies, with no offsetting APY hike—a clear sign that the market is preemptively pricing in risk. Like GHO’s prior “peg crisis,” USDe’s liquidity today is heavily dependent on ongoing stabilization incentives.

When this incentive cycle ends—and whether it gives the protocol time to structurally adapt—will be the key test of whether USDe can truly become stablecoins’ “third pillar.”

Disclaimer:

- This article is republished from [TechFlow] and is copyrighted by the original author [Trendverse Lab]. If you have any concerns regarding this repost, please contact the Gate Learn team, and we will process your request promptly according to our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article were translated by the Gate Learn team. Unless Gate is explicitly cited, no translation may be copied, distributed, or plagiarized.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.