From Explosive Growth to Stagnation: The Rise, Disillusionment, and Structural Failure of SocialFi

Introduction: The Vision Behind SocialFi

SocialFi (Social Finance) was initially hailed as a breakthrough, with its core premise being the fusion of blockchain and decentralized finance principles with social media. The goal: empower creators to control their own data and directly monetize it. For example, the Lens protocol turns personal profiles, follows, and collections into NFTs using ERC-721, granting users ownership over the value generated by their social activity and enabling seamless transfer across different apps. CyberConnect proposed the concept of “social graph NFTization,” with roughly 1.3 million users having created on-chain social profiles. This model allows users to set prices for content and establish paid subscriptions—similar to Patreon—while encouraging community governance and using token rewards to address issues like creator compensation and data misuse on traditional platforms.

Fueled by this vision, SocialFi gained momentum following the NFT boom. Industry statistics from 2024 reveal that SocialFi platforms have amassed millions of registered users, daily active user counts in the hundreds of thousands, and steadily rising on-chain interactions. However, the total market cap of SocialFi tokens remains in the low billions—just a tiny fraction of the overall crypto market. These figures suggest that despite significant participation, SocialFi’s scale lags far behind mainstream tracks like DeFi and NFTs. Even so, project teams and investors are making aggressive bets on this emerging sector, hoping to birth the next “killer app” for decentralized social.

The Rise of SocialFi

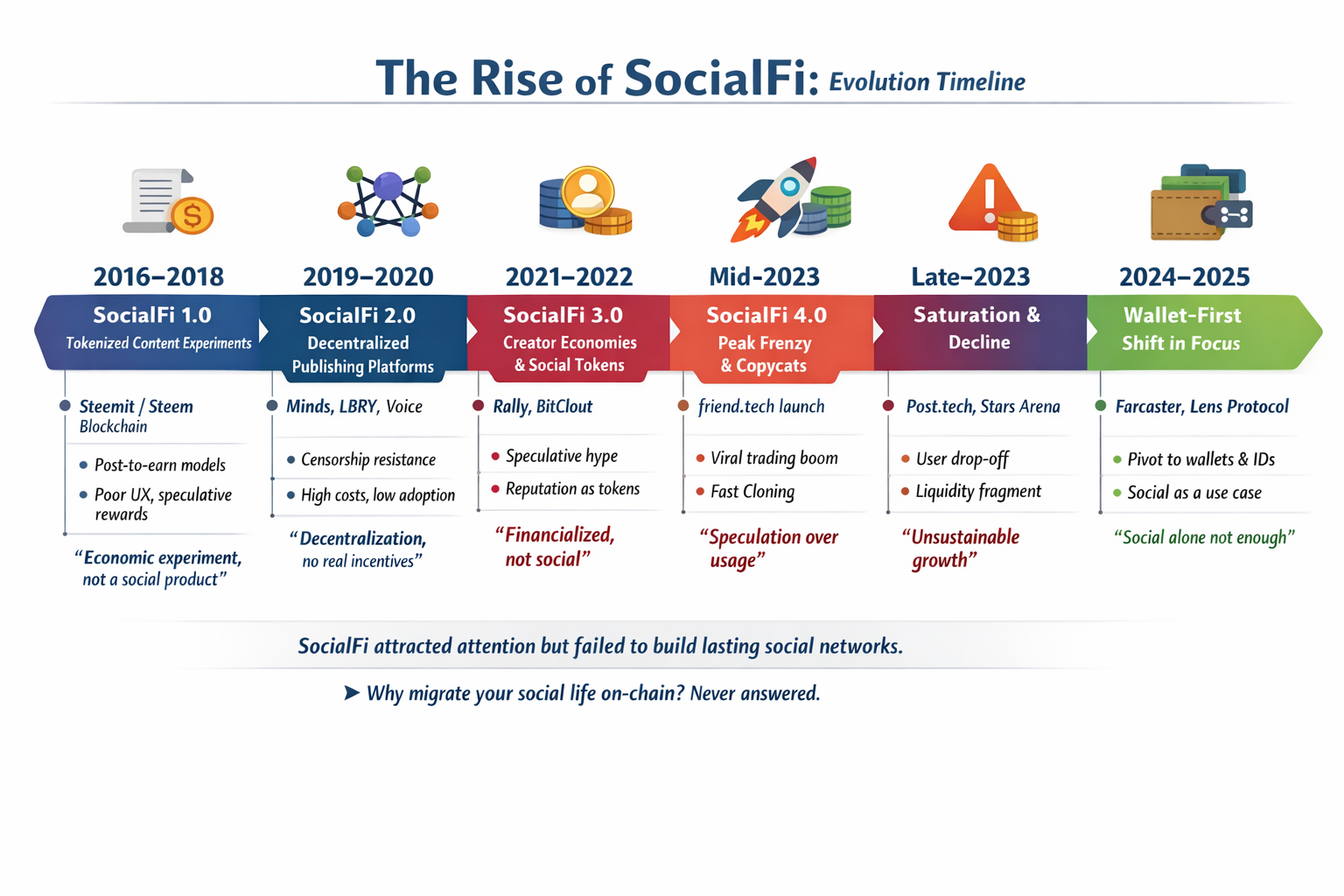

SocialFi Historical Development Timeline

SocialFi’s evolution can be broken down into distinct phases. SocialFi 1.0 (circa 2016–2017) featured projects like Steemit and Peepeth. These platforms used early tokenomics to reward content creation and interaction, focusing on decentralized publishing. However, complex interfaces and high on-chain barriers led to poor user experiences and limited adoption. In the SocialFi 2.0 era (2018–2020), some projects aimed to improve usability within a decentralized framework. Platforms like Minds, LBRY, and Voice leveraged blockchain to ensure content immutability and full user control, but putting all content on-chain proved costly and failed to deliver satisfactory experiences.

Source: https://www.friend.tech/keys

By 2021–2023, SocialFi 3.0 ushered in new experiments. Flagship projects such as Friend.tech, BitClout, and Rally tightly integrated social networking with financial features: users could buy “influence tokens” for celebrities or friends to unlock additional social privileges, effectively monetizing relationships. This model drove massive initial traffic—Friend.tech saw explosive growth within weeks of launch, reaching daily trading volumes in the tens of millions of dollars by September 2023; BitClout and Rally quickly replicated the approach. However, these models depended heavily on token price volatility to sustain engagement; once speculative fervor faded, the economic engine struggled to retain long-term participants.

Source: https://farcaster.xyz/

With the arrival of SocialFi 4.0 (from 2023 onward), projects began building more diverse social-financial ecosystems. DeSo (Decentralized Social Blockchain) and Farcaster are emblematic of this phase. While providing core social features, they started integrating elements from NFTs and DeFi. Farcaster’s vision is to create an open on-chain social protocol where users own their decentralized identities and data. By early 2024, innovations like Farcaster’s “Frames” (on-chain mini-apps) and community-driven $DEGEN tokens sparked rapid daily active user growth. According to TechCrunch, prior to Frames’ launch at the end of January 2024, Farcaster had just around 2,200 daily actives; within a week, DAU surged to roughly 60,000 with total registrations surpassing 140,000. Meanwhile, Lens Protocol reached nearly 370,000 registered users within its first year—backed by investments from Tencent and others—and CyberConnect’s on-chain profiles exceeded 900,000.

The ascent of these projects underscores strong market demand for on-chain social and content monetization. New SocialFi platforms keep emerging with novel incentive structures: some let creators sell access (e.g., Stars Arena’s Friend.tech-like model), while others use social tokens or NFTs for community governance. The consensus during this period is clear: innovative experiences paired with economic incentives attract users to Web3 social—though seeds of risk are sown alongside the excitement.

The Onset of Decline

Yet this momentum proved short-lived as the SocialFi bubble quickly began to burst. Take Friend.tech: the hottest SocialFi app of mid-2023 saw meteoric growth followed by an equally dramatic collapse. In September 2023, Friend.tech’s daily trading volume topped $10 million, with user addresses skyrocketing past 600,000 in under a month. But enthusiasm soon faded—by year-end, monthly protocol revenue had dropped 90% to about $1 million. In 2024, daily active users plummeted into the hundreds (recent figures show only about 170 at the start of the month), while Key token prices crashed from nearly $3 in May to below $0.10—a drop exceeding 98%, leaving market cap around $5 million. User numbers fell from peak to near zero; transaction volume shrank from $20 million daily to just a few thousand—a collapse from tens of thousands of daily actives to mere hundreds.

Source: https://defillama.com/protocols/sofi

This decline wasn’t isolated. According to DeFiLlama and other sources, SocialFi as a whole saw a steep downturn in fall 2023: total protocol TVL peaked above $53 million in October before dropping over 25%; average daily on-chain transaction volume plummeted nearly 98%. Copycat projects (Post.tech, Stars Arena, Friendzy) also went quiet as trading dried up. This correlated with waning interest and user exodus across the SocialFi sector—even long-standing decentralized social projects hit growth bottlenecks. For example, before Farcaster’s founder spoke out in late 2025, official client DAU remained limited, centered around niche communities; Lens Protocol boasted a million registrations but actual daily actives lagged far behind—a clear sign that many “airdrop farmers” never became regular users.

In short, since H2 2023, SocialFi traffic and prices have rapidly retreated: Friend.tech collapsed in users and revenue; speculators exited opportunistic projects; on-chain engagement shrank from mania to a trickle. Early signs of decline were mirrored in token prices and chain metrics: total SocialFi token market cap dropped sharply from its peak; sector activity cratered. Industry observers largely agree this marks a cooling-off period for SocialFi—a correction of earlier speculative excess.

Structural Roots of SocialFi’s Decline

SocialFi’s downturn isn’t random—it stems from deep-rooted issues in product design, user needs, and market conditions. Several recurring structural challenges limit SocialFi’s development:

- Experience & Accessibility Issues: Many SocialFi apps lag far behind traditional social platforms in user experience—especially with complex onboarding and crypto concepts that create steep learning curves. As Farcaster’s founder noted repeatedly, decentralization concepts (“protocol,” “decentralized identity”) are daunting for non-crypto users; UX falls short compared to familiar Web2 platforms. Blockchain tech is often “invisible” to mainstream users—they care about fresh experiences rather than how data is stored under the hood. As a result, most SocialFi projects fail to offer compelling alternatives to Web2 platforms. For example, while Farcaster and Lens store identity data on-chain, average users only care about smooth posting and interactions—not underlying mechanisms. The cost of switching is high—unless a new platform delivers vastly superior experiences over current social networks, migration is unlikely. As product manager Yu Jun put it: the value of a new product depends on “(new experience – old experience) – migration cost.” Most SocialFi platforms lack enough novelty to offset high migration barriers—making mainstream adoption elusive.

- Financial Incentives Undermine Social Value: Many current SocialFi projects emphasize financial aspects so much that social interactions become one-dimensional economic games. Critics point out that some SocialFi products function more like incentive-driven ranking apps—money, liquidity, attention all chase financial returns rather than authentic human connections. In this setup, social value is consumed rather than created; users join for speculation or quick gains—not genuine interest or passion. Friend.tech is a case in point: it attracted crowds seeking high yields but failed to build a loyal community; many left after short-term profits dried up, draining platform liquidity as user churn accelerated. SocialFi networks rely on reward mechanics reminiscent of past DeFi/GameFi bubbles—once early high-yield incentives fade, hype dissipates and “escape velocity” proves unattainable.

- Lack of Differentiated New Experiences: Many SocialFi projects tout themselves as next-gen social but offer little functional difference from Web2 platforms—crypto tech is buried deep but doesn’t deliver standout experiences beyond traditional apps. Farcaster was even mocked for being “too vanilla,” avoiding crypto assets and token topics for a long time—making content dull and failing to attract broader attention. Even after launching on-chain features like Frames, fragmented wallet authorization flows kept UX clunky. Only after sustained community calls for unified experiences did Farcaster deeply integrate wallet capabilities—highlighting gaps between product innovation and user needs. Without enough novel use cases, “decentralization” alone won’t lure non-crypto users; on-chain features may even hinder adoption.

- Users Don’t Feel Decentralization Benefits: A common pitfall in SocialFi is assuming decentralization alone attracts users—yet most people care little about who controls their data; content, relationships, and experience matter far more. Concepts like decentralized identity or user sovereignty sound noble but lack tangible benefits or urgency for mainstream users. Farcaster’s pivot toward wallet-first onboarding acknowledges that preaching decentralization falls flat—it’s better to offer practical entry points like wallets that quietly make users part of on-chain identity.

- Unclear Core Positioning & Weak Community Building: Some projects struggle with shifting focus or internal team/community discord—worsening instability and user doubts. Friend.tech changed strategy multiple times (e.g., exploring chain migration or tech roadmap adjustments); team infighting added uncertainty for users. When foundational problems compound structural weaknesses—and crypto market sentiment shifts—sustained breakout growth becomes unattainable.

In summary, SocialFi’s failure is multifaceted—a mismatch between product form, incentive logic, and user needs. Relying solely on financialization fails to deliver sticky engagement or trusted interactions; instead it fuels brief traffic bubbles.

SocialFi’s Legacy & Lessons

While most SocialFi projects failed to achieve sustained scale, their exploratory approaches offer valuable insights:

- User Data Ownership & Creator Monetization Are Foundational: Across various SocialFi experiments, giving creators ownership over content/following relationships—and token-based value capture—has proven viable multiple times. Users gain control over content access/pricing strategies; NFTs validate digital ownership rights. These ideas will shape future Web3 social—even if most people don’t care about decentralization now, these mechanisms can empower creator economies and niche communities going forward. Many projects experimented with DAO governance for community autonomy; involving token holders in platform decisions remains worth pursuing.

- On-Chain Identity & Interaction Lay Technical Groundwork: Farcaster’s wallet integration in social apps, development of Mini Apps (Frames), and Lens/CyberConnect’s on-chain profiles are noteworthy trials—they show seamless value connections as a key direction for merging social platforms with blockchain: enabling natural on-chain actions within social contexts without forcing external wallet jumps each time. As Farcaster observed, wallet apps become “super gateways” for crypto identity—embedded wallets mean every protocol interaction is a value exchange by default. This concept can be expanded—combining NFT tipping or on-chain paid subscriptions—to make blockchain identity truly serve social scenarios.

- Core Lesson: Content & Experience Trump Economic Stimulus in Social Products: As UXLink’s founders emphasize—users love successful platforms because they meet their needs with compelling content/functions—not because they offer token rewards alone. This lesson is universally relevant—Web3 social design must avoid letting “Fi” hijack “Social.” Financial tools should enable goals—not become central tenets themselves; future iterations must prioritize user-centric value.

- Pushing Web3 Social Infrastructure Forward: Despite no mass-market breakthrough yet, foundational protocols and open ecosystems are maturing—projects like Nostr, ActivityPub, Farcaster, Lens are building open data flows and permissionless development capabilities. These investments will pay off long-term—creating bridges between on-chain/off-chain worlds.

Conclusion: Reflections on the Endgame for Social

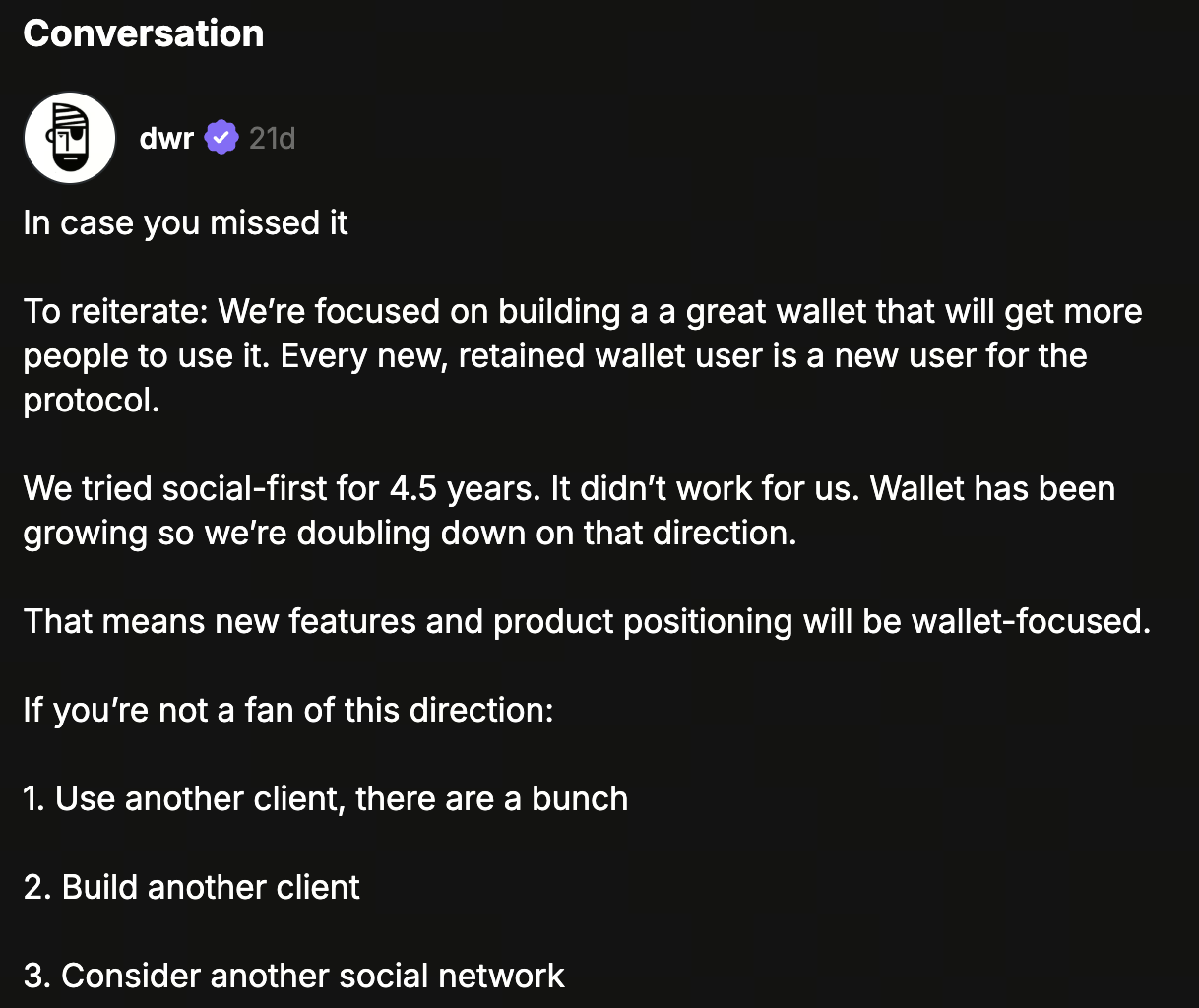

Source: https://farcaster.xyz/dwr/0x4368f6be

Looking at SocialFi’s ups and downs suggests this: Web3’s social endgame may not be an isolated “on-chain social platform,” but rather a connector bridging blockchain value with mainstream social realms. As Farcaster’s founder put it—their strategy shifted from “building a social app with crypto features” to “making crypto onboarding via social contexts,” using wallets as entry points so users naturally immerse in protocol-driven open economies without realizing it. Going forward, more Web3 apps may serve this bridge role—seamlessly mapping on-chain assets/identities/rights onto mainstream platforms and real-world scenarios. Only then can blockchain’s advantages truly flourish while fitting everyday user habits.

This is the real lesson from the current wave of SocialFi: let these experiences guide future exploration so meaningful decentralized innovation can take root in more mature soil.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?