From Allocation to Execution: How Leveraged ETFs Evolved into Trading Instruments

How ETFs Are Being Redefined

Traditionally, ETFs have been recognized as instruments that reduce trading frequency within investment portfolios. Their main role has been to diversify risk and smooth volatility, allowing investors to earn average returns over time. However, as markets move toward higher-frequency volatility and rapid price swings, the old approach of trading patience for returns no longer meets the needs of traders who now value speed and efficiency.

The focus of capital flows has shifted from how long assets are held to how quickly traders can react. In this new landscape, ETFs are evolving beyond passive allocation tools. They’re being reengineered and repurposed as direct trading vehicles for strategy execution.

Leveraged ETFs: The Middle Ground Between Spot and Futures

In short-term markets, standard single-exposure products often can’t amplify trading insights enough, while full-fledged futures trading demands a steep learning curve and constant risk management. Leveraged ETFs bridge this gap. They maintain the familiar spot trading experience but deliver greater capital impact from price swings. For many traders, leveraged ETFs aren’t meant to replace other tools—they serve as a strategic amplifier, balancing efficiency with complexity.

Gate Leveraged ETF Token Design Approach

Gate Leveraged ETF tokens derive their exposure from corresponding perpetual contract positions, but the system manages this layer entirely. For users, the experience feels much like simple token trading, not futures trading.

During trading, users don’t need to manage:

- Margin and maintenance calculations

- Forced liquidation risk

- Loan and funding rate changes

- Position adjustments and rebalancing timing

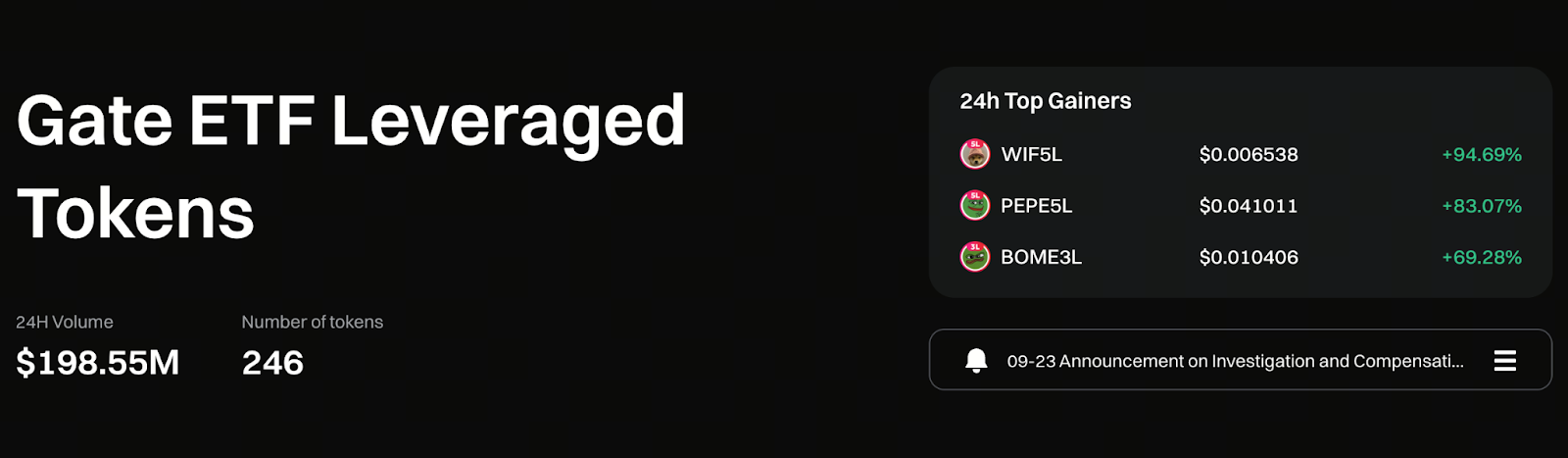

Start trading Gate ETF leveraged tokens now: https://www.gate.com/leveraged-etf

Why Leverage Ratios Remain Stable Over Time

Leveraged ETFs are dynamic by design. To keep exposure within the intended leverage range, the system routinely rebalances and adjusts underlying contract positions. These processes happen behind the scenes but are crucial for product stability.

Leveraged ETFs are more than simple price multipliers—they’re dynamic, continuously adjusted strategy systems. Their performance depends on market trends and volatility patterns, letting traders focus on the core: market direction and timing entries and exits.

Amplifying Market Moves Without Engaging in Futures

For many traders, the stress doesn’t come from leverage itself but from the real-time, unforgiving risk controls of futures trading. Leveraged ETFs don’t eliminate risk—they transform it into a more intuitive form, with price changes directly impacting the token’s net asset value. This approach removes the threat of liquidations or forced closures, allowing traders to concentrate on trend analysis and capital allocation.

When Trends Are Clear, Efficiency Is Maximized

In trending or one-directional markets, leveraged ETFs reflect price changes in multiples, allowing capital to work harder in the same timeframe. With the rebalancing mechanism, these products can sometimes deliver a compounding effect during strong trends.

Because their trading logic closely mirrors spot transactions, leveraged ETFs are often used as a transitional tool before adopting more advanced leverage strategies. They let traders test their risk tolerance without taking on the full risk management burden of futures.

Key Structural Limitations to Recognize

Leveraged ETFs don’t outperform in every market condition. In sideways or choppy markets, the rebalancing mechanism can gradually erode net asset value, leading to outcomes that differ from intuition.

Moreover, final returns aren’t simply the underlying asset’s movement multiplied by the leverage factor. Trading costs, volatility, and adjustment paths all play a role. As a result, leveraged ETFs are generally not recommended for long-term holding.

Why There’s a Daily Management Fee

Gate Leveraged ETFs charge a daily management fee of 0.1% to cover the essential costs of ongoing operation, including:

- Perpetual contract opening and closing fees

- Funding rate costs

- Hedging and position adjustment expenses

- Slippage from rebalancing

These fees are not extra add-ons—they’re fundamental to maintaining the structural stability of leveraged ETFs over time.

The Right Way to Use Leveraged ETFs

Leveraged ETFs are not passive investment vehicles. They’re strategy execution modules best suited for traders with clear market outlooks, defined entry and exit plans, and the ability to handle short-term volatility—not for buy-and-hold investing. Only by fully understanding their structure, costs, and use cases can traders unlock the capital efficiency benefits of leveraged ETFs.

Summary

Leveraged ETFs don’t make trading easier; they make strategy implementation more direct. They amplify both price swings and the significance of every decision. For traders who can read market trends and manage risk proactively, Gate Leveraged ETFs are powerful tools for maximizing capital efficiency. But overlooking their structural features and cost implications can expose traders to risks beyond their expectations.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution