From All-In to Perpetual Leverage: A Breakdown of MicroStrategy’s $1.44 Billion Cash Reserves

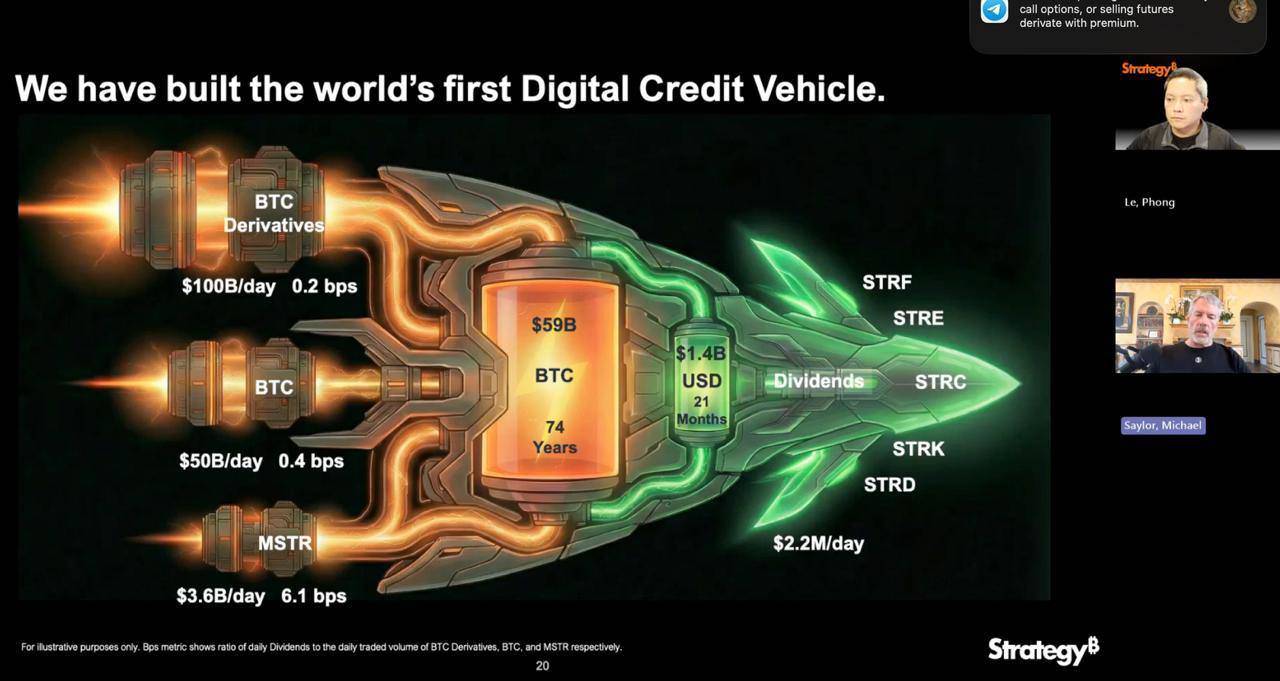

As the publicly listed company with the largest BTC holdings worldwide, MicroStrategy announced on December 1, 2025, that it had raised $1.44 billion by selling Class A common stock to establish a reserve fund.

According to the official statement, this move is intended to support preferred stock dividends and interest payments on outstanding debt over the next 21 to 24 months, reinforcing commitments to credit investors and shareholders.

Often called the “BTC shadow ETF,” the company’s core strategy in recent years has been remarkably simple and aggressive: secure low-cost financing and immediately convert funds into Bitcoin as soon as they arrive.

Guided by Michael Saylor’s sweeping “Cash is Trash” philosophy, MicroStrategy typically maintains only the minimum fiat reserves needed for daily operations on its balance sheet.

This latest announcement stands in stark contrast to that approach. With BTC prices recently pulling back from record highs and market volatility intensifying, MicroStrategy’s move has once again unsettled market sentiment. When the largest BTC holder stops buying—or even considers selling—what kind of impact will that have?

Strategic Turning Point

The most significant aspect of this event is that MicroStrategy has, for the first time, publicly acknowledged the possibility of selling its BTC reserves.

Founder and Executive Chairman Michael Saylor has long been hailed as a steadfast Bitcoin evangelist, with a core strategy of “always buy and hold.” Yet, CEO Phong Le stated in a podcast that if the company’s mNAV (the ratio of enterprise value to crypto asset value) drops below 1 and alternative financing isn’t available, MicroStrategy would sell Bitcoin to replenish its U.S. dollar reserves.

This shift shatters the market’s perception of MicroStrategy as “all-in on BTC.” It’s seen as a major strategic inflection point and has sparked doubts about the sustainability of the company’s business model.

Market Reaction

MicroStrategy’s strategic pivot triggered a swift and severe negative chain reaction across the market.

After the CEO hinted at potential BTC sales, MicroStrategy’s stock price plummeted as much as 12.2% intraday, reflecting investor anxiety over the strategic change.

Following the announcement, BTC prices dropped more than 4%. While this decline wasn’t solely caused by MicroStrategy’s actions, the market clearly recognized the risk signal as the largest buyer paused its aggressive accumulation.

This expectation that major capital would move to the sidelines further amplified the market’s risk-off retracement.

Beyond the visible drops in stock and BTC prices, a deeper concern comes from institutional investors’ reactions.

Data shows that in Q3 2025, top investment firms—including Capital International, Vanguard, and BlackRock—proactively cut their exposure to MSTR, reducing holdings by a combined $5.4 billion.

This trend signals that, with the rise of direct and regulated investment vehicles like BTC spot ETFs, Wall Street is steadily abandoning the old “MSTR as a BTC proxy” strategy.

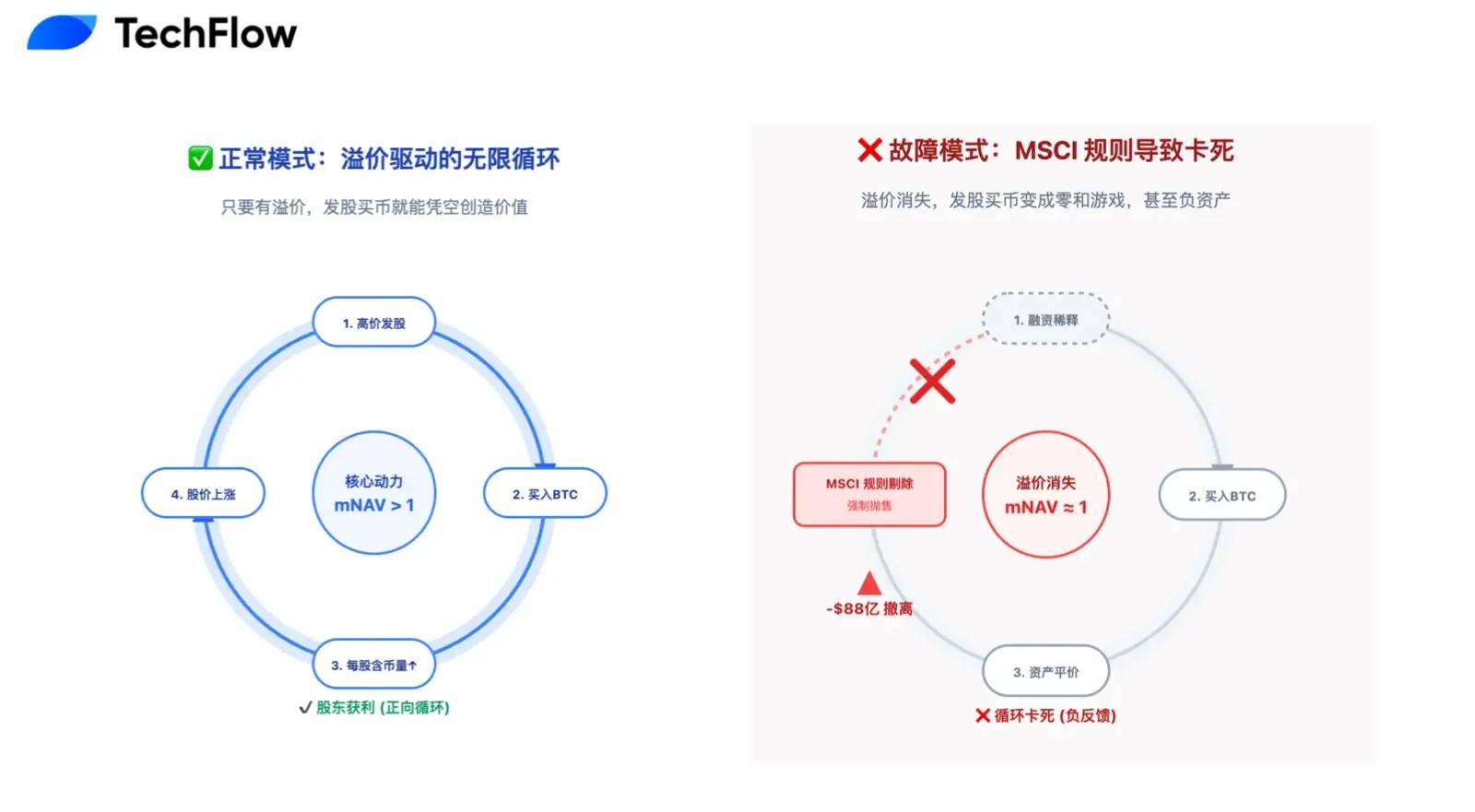

For DAT companies, mNAV is the key metric for understanding their business models.

During bull markets, investors pay hefty premiums for MSTR (mNAV far above 1, peaking at 2.5), fueling a flywheel of “stock issuance → Bitcoin purchases → share price gains from premium.”

But as the market cools, that mNAV premium has vanished, settling near 1.

This means issuing new shares to buy BTC has become a zero-sum game, no longer boosting shareholder value. The company’s core growth engine may have stalled.

The Breakdown of the Perpetual Motion Narrative

From a short-term, rational financial perspective, the current bearish sentiment toward MicroStrategy is well-founded.

This $1.44 billion cash reserve effectively marks the end of the once-hyped “BTC perpetual motion machine” narrative. The previous logic—issuing new shares to buy BTC—was built on the optimistic assumption that share prices would always exceed convertible bond conversion prices.

MicroStrategy now carries $8.2 billion in convertible bonds. S&P Global has downgraded its credit rating to “B-“ (junk) and warned of possible liquidity crises.

The core risk is that if share prices remain depressed, bondholders will refuse to convert at maturity (since conversion would mean bigger losses) and demand full cash repayment. One $1.01 billion bond could face redemption as early as 2027, creating real medium-term cash flow stress.

In this context, the reserve fund isn’t just for interest payments—it’s a buffer against potential “runs.” Yet with mNAV premiums gone, the funding comes at the cost of diluting existing shareholders.

In effect, the company is drawing down shareholder value to fill past debt holes.

If debt pressure is a chronic illness, being removed from the MSCI index is an acute, potentially fatal crisis.

As MicroStrategy aggressively increased its BTC holdings over the past two years, BTC now accounts for over 77% of total assets—far above the 50% threshold set by MSCI and other index providers.

Related reading: “Countdown to $8.8 Billion Outflow: MSTR Is Becoming an Orphan of Global Index Funds“

This creates a critical classification issue: MSCI is considering reclassifying MicroStrategy from an “operating company” to an “investment fund.” Such a move could trigger a disastrous domino effect.

If classified as a fund, MSTR would be removed from major stock indexes, forcing trillions of dollars in index-tracking funds to liquidate their holdings.

JPMorgan estimates that this could trigger up to $8.8 billion in passive selling. For MSTR, whose average daily trading volume is only several billion dollars, that level of selling would create a liquidity black hole likely to cause a steep share price drop—without any fundamental buying support.

An Expensive but Essential Premium

In the crypto market, which moves in cycles, MicroStrategy’s seemingly self-imposed defensive measure may be the expensive but essential premium it needs to pay to win over the long term.

“Staying at the table is what matters most.”

History shows that investors are rarely wiped out by falling coin prices alone. The real culprit is reckless “all-in” bets and ignoring risk, which leads to sudden events that force them out of the game for good.

From this angle, MicroStrategy’s $1.44 billion cash reserve is designed to keep it in the game at the lowest possible cost.

By sacrificing short-term shareholder equity and market premium, MicroStrategy is buying strategic flexibility for the next two years. It’s a calculated move—lower the sails before the storm, survive the turbulence, and wait for the next liquidity wave. When the sun shines again, MicroStrategy, holding 650,000 BTC, will remain the crypto sector’s irreplaceable blue-chip stock.

Victory isn’t about living the brightest—it’s about living the longest.

Beyond its own survival, MicroStrategy’s actions have broader implications. They chart a compliant path for all DAT companies.

If MicroStrategy had kept “all-in,” collapse would have been likely, disproving the annual narrative of “public companies holding crypto” and triggering an unprecedented bearish storm in the industry.

But by introducing a traditional finance “reserve system” and balancing BTC’s volatility with financial stability, MicroStrategy can become more than just a Bitcoin hoarder—it can forge a new path.

This transformation is a clear message to S&P, MSCI, and traditional Wall Street investors: MicroStrategy combines passionate conviction with professional risk management, even in extreme conditions.

This mature approach may be its ticket to mainstream index inclusion and lower-cost financing in the future.

MicroStrategy’s ship carries the hopes and capital of the crypto industry. It’s not about speed in fair weather—it’s about whether the vessel can withstand the storm.

This $1.44 billion reserve is both a correction to its previous one-sided strategy and a pledge for navigating future uncertainty.

In the short term, this transition is painful: the loss of mNAV premium, passive equity dilution, and a temporary pause in the growth flywheel are all necessary costs of evolution.

But in the long run, this is a test that MicroStrategy—and countless future DAT companies—must pass.

To reach for the sky, you first need solid ground beneath your feet.

Statement:

- This article is republished from [TechFlow] with copyright belonging to the original author [伞, TechFlow]. If you have any concerns regarding this republication, please contact the Gate Learn team for prompt resolution through the proper channels.

- Disclaimer: The opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions have been translated by the Gate Learn team. Unless Gate is referenced, reproduction, distribution, or plagiarism of translated articles is strictly prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?