DePIN Spotlight: Decentralized Energy Network Daylight Raises $75M Led by Framework Ventures

What Is the DePIN Sector?

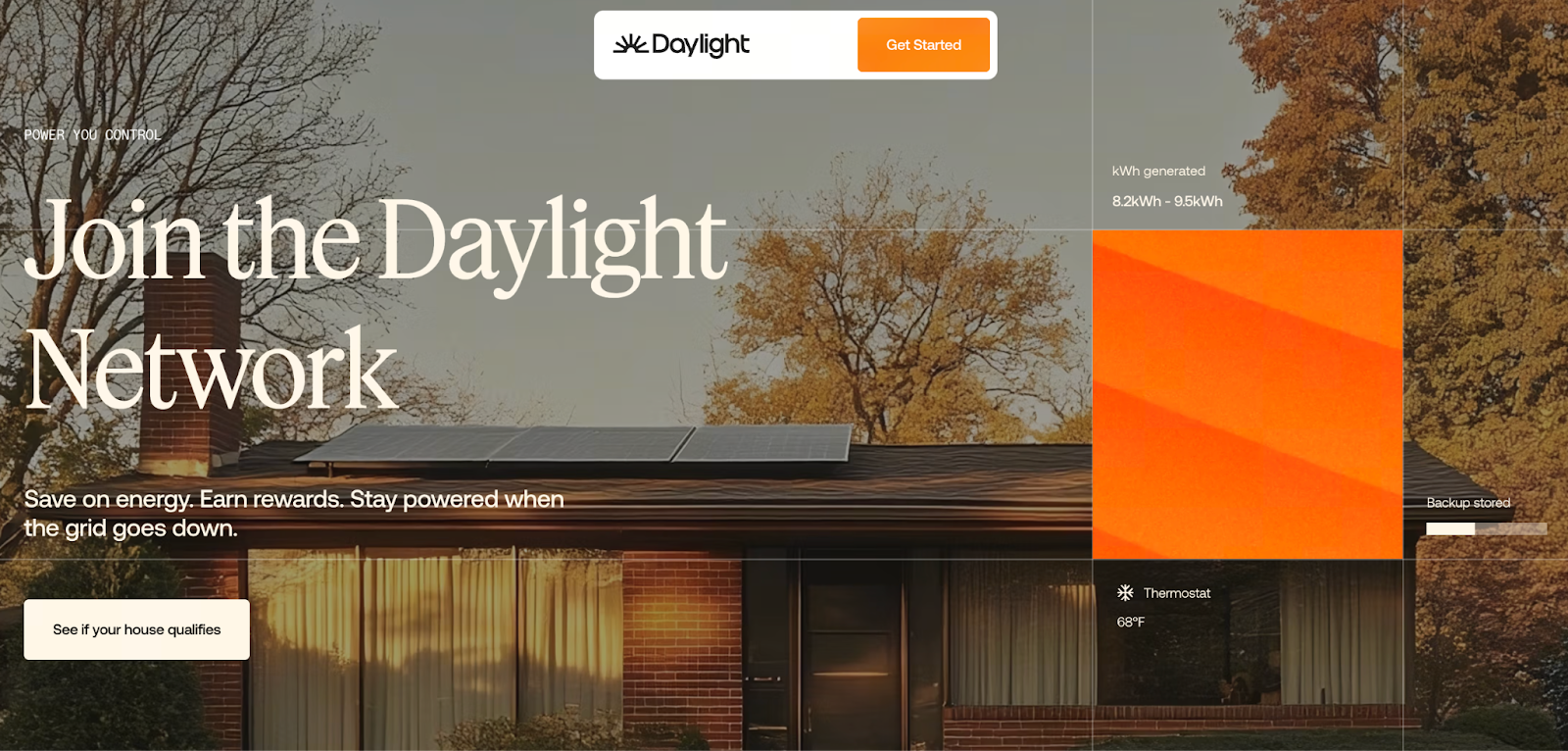

Image source: https://godaylight.com/

DePIN, or Decentralized Physical Infrastructure Networks, refers to leveraging blockchain and DeFi (Decentralized Finance) systems to build and operate real-world infrastructure—such as energy, connectivity, and transportation—in a decentralized manner. Unlike traditional models dominated by large corporations or government entities, the DePIN sector enables individual participation, asset tokenization, and revenue sharing. For example, residential solar panels and energy storage systems can be networked and incentivized using tokens, creating a decentralized physical infrastructure network.

This concept has recently drawn significant attention from both the crypto community and infrastructure investors, as it extends the Web3 paradigm into the physical world.

In energy, a typical scenario involves homeowners installing solar and storage systems connected to a network. During periods of high grid demand, these home devices can be integrated to support the grid, effectively acting as part of a “virtual power plant.” Participants not only reduce their electric bills but may also earn network tokens or other rewards. This model exemplifies the convergence of decentralized technology and physical infrastructure within the DePIN sector.

Daylight: Funding Overview and Key Stakeholders

Recently, Daylight Energy—a U.S. company specializing in decentralized energy networks—secured $75 million in funding. The round was split into two segments: $15 million in equity financing led by Framework Ventures, and $60 million in project development financing managed by Turtle Hill Capital.

- Additional participants included a16z crypto, Lerer Hippeau, M13, Room40 Ventures, EV3, Crucible Capital, Coinbase Ventures, and Not Boring Capital.

- Daylight’s business model transforms home solar and battery installations into “distributed power stations,” allowing users to subscribe for reduced electricity costs and provide energy storage to the grid during peak times for revenue. Additionally, the company has launched the DayFi protocol, connecting electricity infrastructure yields to the DeFi marketplace.

What Does This Funding Signal?

- DePIN’s energy sector has hit a key milestone: Daylight’s funding demonstrates that decentralized infrastructure networks are moving beyond concept stage and gaining capital traction. As a core component of infrastructure, decentralized and on-chain energy solutions are attracting serious investor interest.

- From hardware to monetization: Traditional solar-plus-storage models are expensive and slow to yield returns. By integrating residential devices into a network and introducing DeFi revenue mechanisms, Daylight is turning electricity into an investable asset. In short, hardware, services, and finance are converging.

- Major institutional endorsement: Backing from leading investors like Framework Ventures and a16z crypto signals that “crypto and real-world infrastructure” is now on the mainstream capital radar, providing direction for future projects.

- Significant commercial expansion potential: Daylight is currently piloting in Illinois and Massachusetts. With this funding, it can rapidly scale to new regions and upgrade the DayFi protocol, facilitating new connections between DeFi and the energy market.

Future Outlook and Risk Considerations

Key areas to watch:

- Daylight’s global expansion strategy: With rising energy demand, more households may opt into distributed systems.

- Evolution of the DayFi protocol: Can it enable mainstream investors to participate in the returns from residential generation and storage networks through digital channels?

- Policy and regulatory environment: Subsidies are being reduced in many regions, and both traditional and distributed energy policies are shifting rapidly.

Potential risks include:

- Market adoption remains uncertain: Will homeowners embrace the idea of treating their rooftops and batteries as “power plants” and participate?

- Challenges persist around grid support capabilities, equipment maintenance costs, and return cycles.

- The combination of crypto financial mechanisms with physical infrastructure is complex. It may encounter regulatory, technical, and security risks.

- Local adaptation and operational costs for regional expansion could exceed expectations.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution