Gate Research: Base's Daily Token Issuance Surpasses Solana, Bitcoin Market Share Hits Four-Year High

Abstract

- Bitcoin price rose by 0.90% to $88,056; Ethereum fell by 3.79% to $1,575.05.

- The number of tokens created on Base in a single day surpassed Solana for the first time.

- Spot gold broke above $3,480, and Bitcoin’s market dominance hit a four-year high.

- Graduation rate on Pump.fun rebounded, potentially signaling a resurgence in the Solana memecoin market.

- The Bank of Korea is advancing legislation for stablecoin regulation, aiming to build a comprehensive compliance framework.

- The Ethereum Foundation is undergoing a strategic shift to accelerate core protocol upgrades.

Market Analysis

- BTC —— Bitcoin rose 0.90% over the past 24 hours, currently trading at $88,056. Technically, after briefly breaking above the short-term resistance at $88,500, BTC quickly pulled back. The price is now testing support at an ascending trendline while still trading above key moving averages—indicating that the short-term uptrend remains intact. On the volume side, the post-breakout pullback hasn’t triggered heavy selling. Overall trading activity remains neutral, reflecting a cautious market sentiment with no significant capital outflows. Looking at the MACD, the fast and slow lines are converging at high levels, and the histogram is shrinking—suggesting that bullish momentum may be cooling off in the short term. Traders should watch closely to see if BTC can find support and stabilize around the trendline.[1]

- ETH —— Ethereum fell 3.79% over the past 24 hours, currently trading at $1,575.05. From a technical standpoint, ETH briefly rebounded after breaking below support near $1,580, but failed to break through resistance around $1,650. In the short term, the price remains range-bound between key support and resistance levels. ETH is currently trading near its 5-day and 10-day moving averages, with overall momentum leaning bearish. The 30-day moving average continues to act as strong resistance. On the volume side, there was no sustained buying interest following the initial sell-off, indicating a lack of short-term confidence in the market. The MACD indicator shows the fast and slow lines still below zero. While bearish momentum has slightly weakened, no clear reversal signal has emerged yet, suggesting that the short-term trend remains bearish.

- ETFs — According to SoSoValue data, on April 21, U.S. spot Bitcoin ETFs recorded a total net inflow of $381 million[3]; U.S. spot Ethereum ETFs saw a total net outflow of $25.42 million. (Data as of April 22, 12:00 PM UTC+8)[4].

- Altcoins — The Bitcoin Sidechains, Analytics, and Sidechains sectors changed by +10.0%, +9.5%, and +7.9% , respectively[5].

- U.S. Stock Market — On April 21, the S&P 500 Index fell by 2.36%, the Dow Jones Industrial Average dropped 2.48%, and the Nasdaq Composite declined 2.55%[6].

- Spot Gold — The price of spot gold fell to $3,445.75 per ounce, down 0.70% on the day. (Data as of April 22, 10:00 AM UTC+8)[7].

- Fear & Greed Index — The Fear & Greed Index stands at 47, indicating a neutral market sentiment[8].

Top Performers

According to Gate.com market data[9], the top-performing altcoins over the past 24 hours, based on trading volume and price movement, are as follows:

OBT (Orbiter Finance) — Daily gain of approximately 66.66%, with a circulating market cap of $54.69 million.

Orbiter Finance (OBT) is a decentralized cross-Rollup bridging protocol built on the Ethereum ecosystem. It leverages zero-knowledge proof (ZK) technology and focuses on enhancing the performance of Layer 2 (L2) networks while reducing gas fees. Its goal is to create a more efficient and seamless multi-chain asset transfer experience, addressing the issue of fragmented liquidity between L2s.

The recent price surge of the OBT token was mainly driven by two community partnerships. First, Orbiter Finance partnered with Superboard, enabling users to earn 50 SUPR tokens by bridging assets to the Superposition platform, which stimulated cross-chain activity and user engagement. Second, the project announced a joint airdrop campaign with Monda, distributing 1,000 MON tokens, which attracted wide user participation and social media interaction. Both events were announced on April 21, 2025, quickly drawing user attention and boosting trading volume year-over-year[10].

GFI (Goldfinch) — Daily gain of approximately 32.65%, with a circulating market cap of $82.35 million.

Goldfinch (GFI) is a decentralized finance protocol that aims to provide capital to emerging markets through unsecured crypto loans. Its core mechanism combines off-chain credit evaluation with on-chain capital deployment, representing a cutting-edge integration of real-world assets (RWA) within DeFi.

The latest GFI token surge appears to be primarily driven by developments in Goldfinch Prime, which recently welcomed major private equity firm KKR’s FS Income Trust to the platform. This fund utilizes a hybrid strategy combining senior secured loans and asset-backed financing, backed by KKR’s $100 billion+ credit platform. This move not only strengthens Goldfinch Prime’s institutional credibility in the RWA space but also boosts confidence in the protocol’s long-term yield stability. As the news spread through the community, GFI saw increased buying pressure, driving a sharp rise in token price[11].

MLK (MiL.k) — Daily gain of approximately 22.17%, with a circulating market cap of $93.54 million.

MiL.k (MLK) is a blockchain-based loyalty point integration platform designed to connect service providers across the travel, leisure, and lifestyle sectors. Its core functionality lies in enabling the integration and exchange of reward points across different companies, with MLK serving as the key currency for users to easily swap and utilize rewards from various services, enhancing the flexibility and value of loyalty programs.

Recently, MiL.k completed its mainnet migration to Arbitrum and formed a strategic partnership with Galxe, a key player within the Arbitrum ecosystem. Joint marketing initiatives were also launched on Galxe. These developments reflect solid project progress, accelerated ecosystem expansion, and increased visibility within Arbitrum, attracting market attention and boosting demand for the MLK token, thereby driving its price upward[12].

Data Highlights

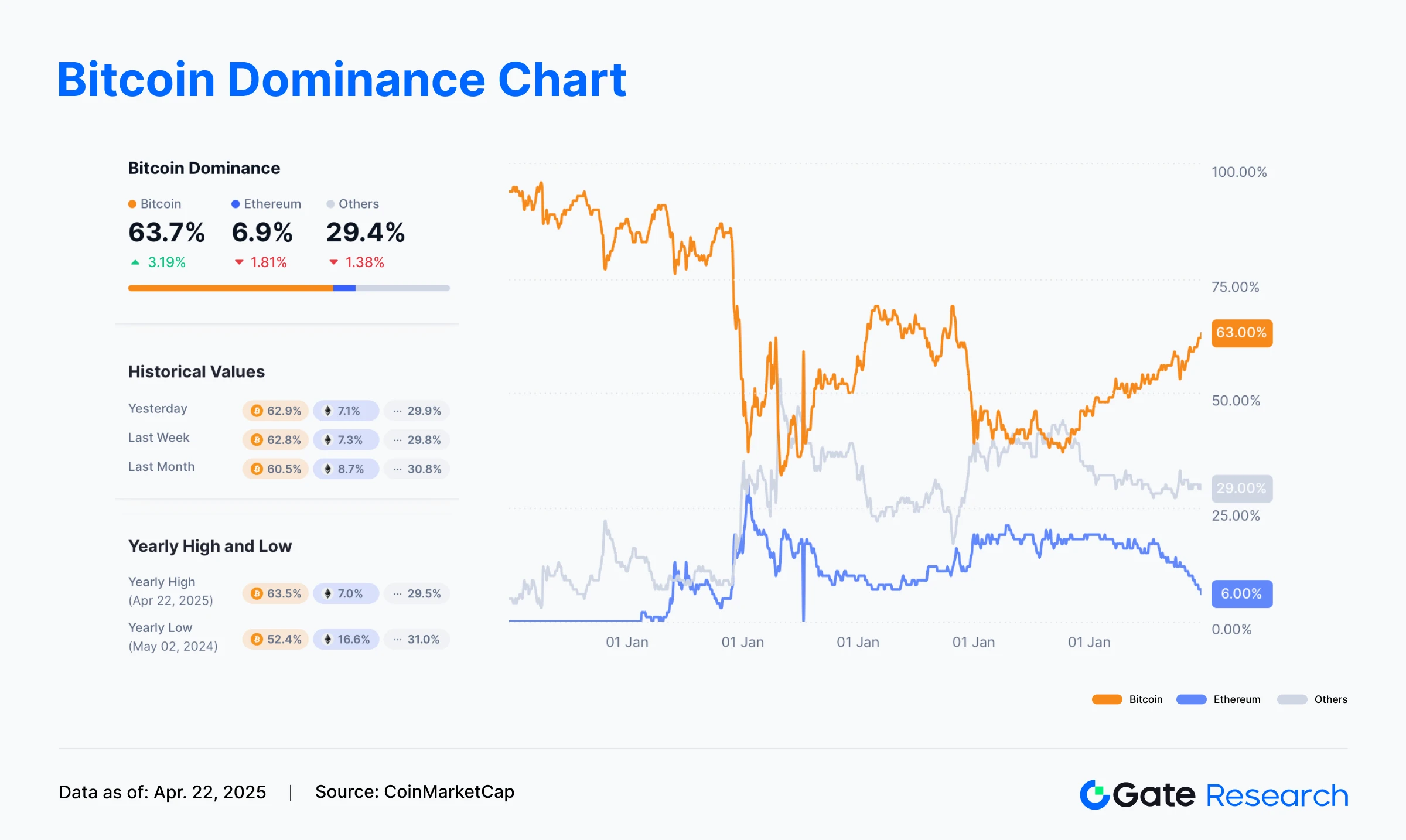

Rising Risk Aversion: Spot Gold Surges Past $3,480, Bitcoin Dominance Hits Four-Year High

Amid escalating global economic uncertainty, market demand for safe-haven assets has significantly intensified. Spot gold prices have continued to climb, breaking through the historical high of $3,480 per ounce, reflecting investors’ strong preference for traditional safe-haven assets. At the same time, the crypto market is also exhibiting clear risk-averse behavior, with Bitcoin’s market dominance soaring to 63.6%—its highest level since February 2021—further reinforcing its positioning as “digital gold.”

This trend suggests that under the current market conditions, investors are increasingly allocating funds to mainstream crypto assets like Bitcoin rather than riskier altcoins. Ethereum and other cryptocurrencies now collectively account for only 36.4% of market share, indicating a potential capital flow from altcoins into Bitcoin, or that new capital is being directed primarily toward Bitcoin as a preferred allocation target. This shift not only underscores Bitcoin’s central role within the crypto market but also reflects a broader decline in investor risk appetite.

Notably, while risk-aversion sentiment is rising, overall crypto trading activity continues to decline. Trading volumes on both centralized and decentralized exchanges have dropped to their lowest levels in nearly six months. Bitcoin spot trading volume has fallen to levels not seen since August 2024, while Ethereum’s volume has hit a new low since December 2023. Despite a brief rebound in early April due to policy-related factors, overall market liquidity remains under pressure, indicating that investors currently prefer holding over active trading[13].

Base Chain Surpasses Solana in Daily Token Launch for the First Time

According to on-chain data, on April 20, the Base chain saw approximately 50,000 new tokens launched in a single day, surpassing Solana’s 35,417 on the same day for the first time. This milestone marks Base as one of the most active blockchains for token launch. Jesse Pollak, a core developer of Base, confirmed the news on X, signaling the rapidly growing appeal of Base within the developer community.

Base is an Ethereum Layer 2 public chain that has recently attracted a surge of project deployments and token launches due to its low-cost and high-efficiency attributes. These tokens span various categories including memecoins, AI agents, and LP tokens. Data trends show that since mid-March, the number of tokens created on Base has been steadily rising, reaching an all-time high on April 20. In contrast, Solana has continued its two-month decline in token creation, dropping from a peak of over 80,000 tokens per day to under 22,000.

The growing activity on Base is drawing increased attention from developers and users alike. Driven by emerging trends such as the memecoin narrative and on-chain AI agent experiments, Base is becoming a hotspot for token innovation. However, whether this surge in token creation can translate into the development of truly valuable projects remains a key test for the sustainability of the Base ecosystem[14].

Pump.fun Graduation Rate Rebounds, Potential Sign of Meme Coin Revival on Solana

According to Dune data, the meme coin market on Pump.fun has shown clear signs of recovery. Firstly, the graduation rate—defined as the percentage of meme coins that complete their bonding curve phase and enter open market trading—dropped to a yearly low of just 0.58% in the first week of April. However, it quickly rebounded to 1.08% in the second week, returning to levels seen in early February. This indicates that the lifecycle of new projects and overall market liquidity are improving.

At the same time, total trading volume on the platform has also increased. Data shows that Pump.fun’s meme coin trading volume has steadily risen over the past three weeks, growing from $873.8 million in early April to $1.3 billion currently, reflecting a significant boost in market activity.

From a chart-based perspective, Pump.fun’s graduation rate had experienced several weeks of decline since the beginning of 2025. However, the recent strong rebound could signal a resurgence of the meme narrative within the Solana ecosystem. As trading momentum picks up, more meme projects may overcome early-stage liquidity challenges and transition into more mature market phases[15].

Spotlight Analysis

Bank of Korea to Advance Stablecoin Regulation Legislation, Build Comprehensive Compliance Framework

The Bank of Korea (BoK) is set to push forward with stablecoin regulation legislation, aiming to require Virtual Asset Service Providers (VASPs) to register prior to conducting cross-border stablecoin transactions starting in the second half of 2025. These providers would also be required to report transaction details to the BOK on a monthly basis. The initiative seeks to curb illicit financial activities such as money laundering and tax evasion—especially given the growing use of USD-pegged stablecoins like Tether in cross-border payments.

According to data from Korean Customs, from 2020 to July 2023, violations involving virtual assets accounted for 81.3% of total foreign exchange violations, totaling approximately 9 trillion KRW (about $6.4 billion). To address this, the Korean government plans to revise the Foreign Exchange Transactions Act in the first half of 2025, defining virtual assets as a distinct third category of exchange. Related businesses will be required to register in advance and regularly report transaction information, including dates, amounts, asset types, and the identities of transaction parties.

In parallel, the BoK is actively advancing its Central Bank Digital Currency (CBDC) pilot, inviting participation from the public, retailers, and regional banks to assess the currency’s commercial viability in real-world scenarios. This initiative aligns with Korea’s broader policy direction of enhancing stablecoin oversight while fostering innovation, aiming to strike a balance between safety and progress in digital finance. By establishing a clear regulatory framework, Korea hopes to enhance market transparency and user trust, laying a solid foundation for the compliant and sustainable development of crypto assets[16].

Circle Launches Stablecoin Cross-Border Payment Network, Aims to Set New Global Settlement Standard

On April 22, 2025, Circle announced the launch of the “Circle Payments Network,” designed to provide stablecoin-based cross-border payments and real-time settlement services for banks, payment processors, and tech companies. The network seeks to eliminate reliance on intermediaries in traditional remittance systems, reduce costs, and increase transaction speed—using USDC and EURC as the foundation for a global payment infrastructure.

The new network will connect Virtual Asset Service Providers (VASPs), Payment Service Providers (PSPs), digital wallets, and banking applications. It supports payments and automatic settlement in both local currencies and stablecoins. At its core, the network utilizes Circle’s proprietary cross-chain protocol, CCTP, which is compatible with 19 blockchains including Solana, Base, Avalanche, and Algorand—creating a unified cross-chain payment experience.

This launch comes as Circle prepares for its IPO and coincides with the U.S. Congress advancing stablecoin legislation. Circle aims to use the network to boost institutional adoption of stablecoins and promote their use as mainstream settlement assets, beyond just crypto-native applications. The launch of the Circle Payments Network not only directly challenges traditional cross-border payment models, but also underscores the rising strategic role of stablecoins in global financial infrastructure. As regulatory windows begin to open, this compliant, efficient, and natively on-chain settlement mechanism, if scaled effectively, could shift stablecoins from “asset alternatives” to “foundational payment layers”[17].

Ethereum Foundation Strategy Shift: Separating R&D from Management to Accelerate Core Upgrades

Tomasz Stańczak, Co-Executive Director of the Ethereum Foundation, stated that following a leadership restructuring in March this year, the Foundation has refocused its efforts on user experience and Layer-1 scalability. This move aims to reduce Vitalik Buterin’s involvement in day-to-day operations, allowing him to concentrate on deep research and innovation.

In recent months, Ethereum has faced criticism on three main fronts: deteriorating user experience due to high gas fees, Layer-1 performance bottlenecks limiting ecosystem growth, and the longstanding absence of privacy features. Especially amid rising competition from high-performance chains like Solana and post-EIP-4844 Layer-2 fragmentation, the pace of Ethereum core protocol evolution has come under scrutiny.

The Foundation’s restructuring directly addresses these pain points. By freeing Vitalik from daily management, his role as Ethereum’s “intellectual engine” is preserved, while the executive team can focus on delivering short-term, actionable solutions. This “dual-track” strategy ensures that upcoming upgrades—such as Pectra—will directly tackle Layer-1 throughput and cross-chain interoperability, while Vitalik’s visionary research lays the groundwork for future breakthroughs.

Notably, this shift also hints at improved community governance models. Stańczak emphasized that Vitalik’s proposals “must be debated, refined, or rejected by the community,” signaling a move toward retaining technical leadership without centralizing decision-making—a key concern previously raised by developers. While debates continue over Solana’s short-term performance advantages, Ethereum appears to be pursuing a more balanced path: maintaining competitiveness through immediate protocol enhancements, while reinforcing long-term value capture with foundational innovation[18].

Funding Updates

According to RootData, in the past 24 hours, one project publicly announced a new funding round, primarily in the infrastructure sector. Details of the funded project are as follows[19]:

StakeStone —— StakeStone received investment from Animoca Brands, though the exact amount was not disclosed. StakeStone is a decentralized omnichain liquidity protocol aimed at enabling efficient and sustainable asset flows across blockchains. By transforming yield-bearing assets into liquidity instruments usable in DeFi and token economies, StakeStone extends liquidity applications to culture, intellectual property (IP), and Web3 consumer sectors.

This round of funding will be allocated across three areas: integrating assets backed by Real World Assets (RWA) and IP, building infrastructure to support Web3 consumer use cases, and developing DeFi strategies tied to cultural IP—ultimately promoting liquidity in the creative economy[20].

Airdrop Opportunity

GPUnet

GPUnet is a decentralized GPU computing network focused on connecting idle GPU resources from global data centers and individuals to power high-performance tasks such as AI inference, scientific computing, and 3D rendering. The project has raised $5.8 million and aims to advance compute-sharing infrastructure integrated with Web3 applications[21].

Currently, GPUnet is hosting its “Road to TGE” airdrop campaign. Users can earn GXP points by completing various tasks, which will be redeemable for future GPU token airdrops. Tasks include social media engagement, on-chain interactions, and development contributions. Daily check-ins also grant additional points, and the more tasks completed, the greater the future airdrop reward.

How to participate:

- Visit the airdrop campaign page

- Connect an EVM-compatible wallet (e.g., MetaMask)

- Add Ganchain to your wallet

- Complete “Social Tasks” and “Getting Started Tasks” (e.g., follow on social media, check in daily)

Note:

Airdrop campaign terms and participation details may change at any time. Users are advised to follow GPUnet’s official channels for the latest updates. Participation should be approached with caution; proper research is recommended before engaging. Gate.com does not guarantee future airdrop reward distributions.

References:

- Gate.com,https://www.Gate.com/trade/BTC_USDT

- Gate.com,https://www.Gate.com/trade/ETH_USDT

- SoSoValue,https://sosovalue.xyz/assets/etf/us-btc-spot

- SoSoValue,https://sosovalue.xyz/assets/etf/us-eth-spot

- CoinGecko,https://www.coingecko.com/en/categories

- Investing,https://investing.com/indices/usa-indices

- Investing,https://investing.com/currencies/xau-usd

- Gate.com,https://www.Gate.com/bigdata

- Gate.com,https://www.Gate.com/price

- X,https://x.com/Superboard_/status/1913472768470901095

- X,https://x.com/goldfinch_fi/status/1912841220239556824

- X,https://x.com/milk_alliance/status/1913034807237611738

- Coinmarketcap,https://coinmarketcap.com/charts/bitcoin-dominance/

- X,https://x.com/jessepollak/status/1914330662485807299

- X,https://dune.com/adam_tehc/pumpfun

- The Block,https://www.theblock.co/post/351351/south-koreas-central-bank-vows-active-stablecoin-legislation-development?utm_source=twitter&utm_medium=social

- Coindesk,https://www.coindesk.com/business/2025/04/21/stablecoin-giant-circle-is-launching-a-new-payments-and-remittance-network?utm_content=editorial&utm_source=twitter&utm_term=organic&utm_campaign=coindesk_main&utm_medium=social

- Cointelegraph,https://cointelegraph.com/news/ethereum-foundation-user-experience-layer-1-scaling-leadership-shift

- Roodata,https://www.rootdata.com/Fundraising

- Roodata,https://www.rootdata.com/Projects/detail/StakeStone?k=ODQ5MQ%3D%3D

- X,https://x.com/Airdrop_Adv/status/1913401976374903093

Gate Research

Gate Research is a comprehensive blockchain and crypto research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Click the Link to learn more

Disclaimer

Investing in the cryptocurrency market involves high risk, and it is recommended that users conduct independent research and fully understand the nature of the assets and products they are purchasing before making any investment decisions. Gate.com is not responsible for any losses or damages caused by such investment decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

12 Best Sites to Hunt Crypto Airdrops in 2025