Bitcoin Price Prediction: Miners' Debt Surges 505%! AI Transformation Could Emerge as the Market's Next Support

Bitcoin Miner Debt Surges

According to the latest report from investment giant VanEck, over the past 12 months, the total debt held by Bitcoin miners has skyrocketed from $2.1 billion to $12.7 billion—a year-over-year increase exceeding 505%. This surge highlights how miners, facing the AI boom and intensifying competition in Bitcoin production, are rapidly ramping up capital expenditures to maintain their share of global hash rate.

VanEck analyst Nathan Frankovitz and Head of Digital Assets Research Matthew Sigel emphasize that miners who fail to continually invest in new hardware will see their global hash rate share steadily decline, resulting in reduced daily BTC rewards. They describe this phenomenon as the "Melting Ice Cube Problem": without ongoing investment in equipment upgrades, miners’ revenues will quickly melt away like an ice cube.

Traditional Financing Challenges Drive Debt Leverage Higher

Historically, miners primarily relied on equity markets for funding. However, given Bitcoin’s extreme price volatility and unpredictable returns, the cost of equity capital often exceeds that of debt. As a result, a growing number of mining companies are turning to bond and convertible note markets to raise capital.

According to data from The Miner Mag, the combined total of debt and convertible bonds for 15 publicly listed miners reached $4.6 billion in Q4 2024, with an additional $1.5 billion in new issuances by Q2 2025.

AI and HPC Emerge as New Cash Flow Sources for Miners

Following the Bitcoin block reward halving in April 2024 (reducing rewards to 3.125 BTC), miner profit margins have been significantly compressed. Consequently, some mining firms have begun redirecting energy capacity toward AI (Artificial Intelligence) and HPC (High Performance Computing) hosting services in pursuit of stable, predictable cash flows. These long-term fixed contract revenues enable miners to further expand debt financing, lower overall capital costs, and reduce reliance on Bitcoin’s price cycles.

For example:

Bitfarms completed $588 million in convertible bond financing to build out AI and HPC infrastructure in North America.

TeraWulf announced a $3.2 billion senior secured note issuance to expand its Lake Mariner data center in New York.

IREN completed a $1 billion convertible bond offering in October, with a portion of proceeds allocated to general operations and expansion.

AI Integration Will Not Weaken the Bitcoin Network

Some worry that miners shifting to AI computing could undermine Bitcoin network security, but VanEck analysts argue the opposite. They note that AI’s high electricity demand actually spurs upgrades to energy infrastructure, which in turn strengthens the foundation of Bitcoin mining operations. Additionally, AI inference workloads fluctuate cyclically throughout the day, enabling miners to flexibly allocate both hash rate and energy resources for optimal efficiency.

Miners Seek to Balance Energy Efficiency and Cost

Some miners are exploring ways to reinvest surplus electricity into Bitcoin mining during periods of low AI demand, thereby boosting energy utilization rates. This strategy not only helps offset the high standby power costs (such as those associated with diesel generators) but also further enhances both capital and energy efficiency.

The VanEck report concludes that the convergence of AI and Bitcoin is set to become a major industry trend, driving miners toward deeper integration of technology and financial strategies.

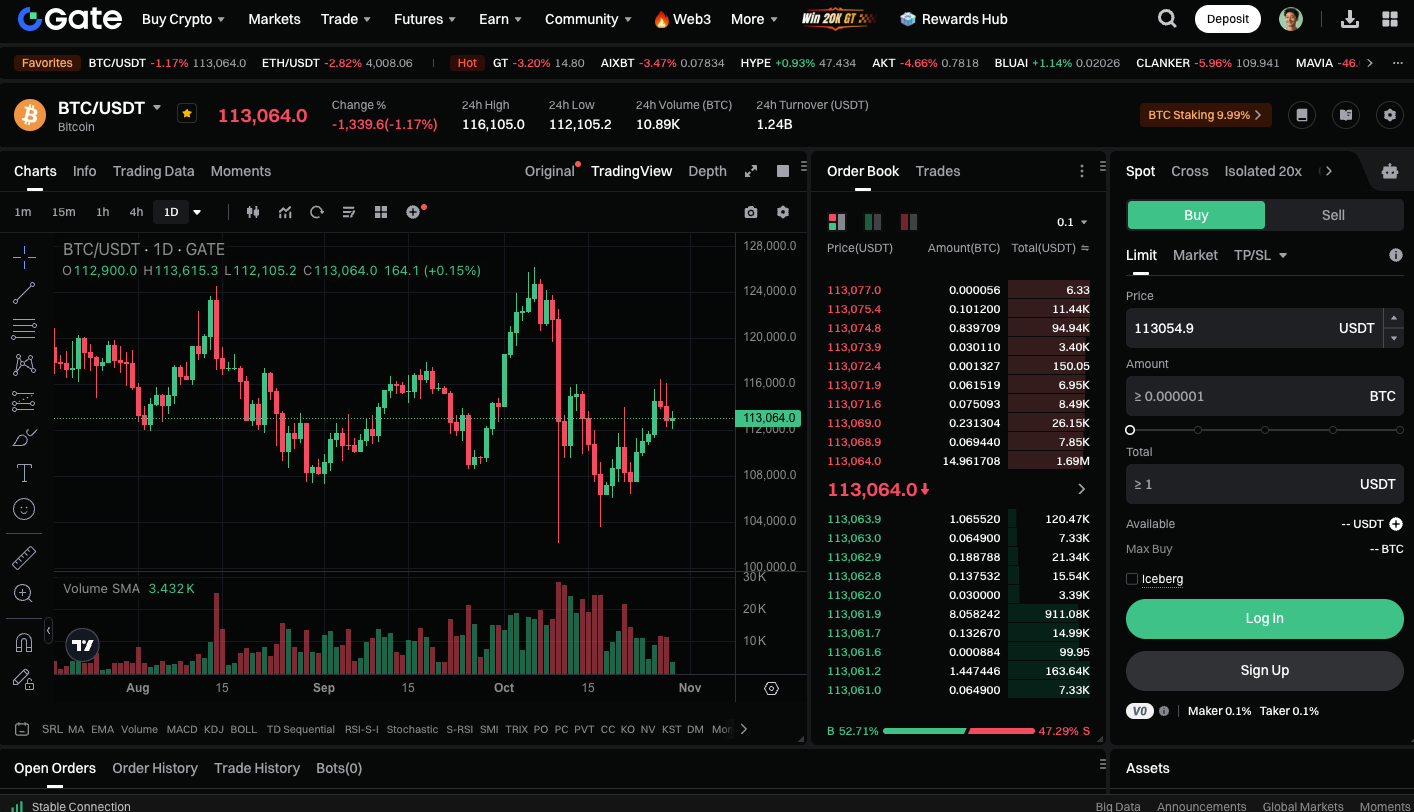

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Summary

With miner debt leverage rising and AI-driven energy infrastructure expanding, the market widely anticipates that Bitcoin prices could break through $120,000 and potentially reach $130,000. AI stands not only at the heart of the technological revolution but may also serve as the hidden catalyst for the next Bitcoin bull run.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution