Bitcoin Price Prediction: Institutional Inflows Could Drive BTC to 200,000 USD by 2026

Recent Bitcoin Market Analysis

Ryan Rasmussen, Head of Research at Bitwise, stated in a Yahoo Finance interview that Bitcoin remains on track to reach its $200,000 target price by 2026. He stressed that the current price correction does not disrupt the overall trend, but rather reflects the natural volatility typical of a maturing market.

Rasmussen views Bitcoin as nearing a short-term bottom, driven by decreased risk appetite and capital flows in the period following the introduction of spot Bitcoin ETFs. He highlighted that Bitcoin led the market’s decline starting in mid-October and could also spearhead the next rebound.

ETF Impact and Market Volatility

Addressing the effect of spot Bitcoin ETFs, Rasmussen explained that they have deepened market liquidity and introduced new cross-market dynamics. He described Bitcoin as one of the most significant technologies of the past 15 years. While institutional involvement has expanded both market participation and liquidity, it has also magnified volatility during periods of risk.

Rasmussen emphasized that the profile of market buyers is shifting toward greater stability, with more long-term investors—such as wealth managers and investment advisors—regularly integrating Bitcoin into standard portfolios and rebalancing positions. This sustained demand contributes to lower overall volatility, though price swings remain in the short term.

Institutional Capital Driving Price Action

Rasmussen noted that the wave of corporate treasury purchases has subsided this year, partly due to the October market downturn. Nevertheless, he sees a continued upward trajectory over the medium term, with institutional capital flowing in waves—from wealth managers, endowments, pension funds, corporations, and even government entities—leading to supply-demand imbalances that drive price growth.

He pointed out that Bitcoin performs well in environments of low interest rates and rising risk appetite. Markets largely expect no rate cuts at the December FOMC meeting. As a result, investors are already shifting their focus to 2026.

Bitcoin Price Target for 2026

Rasmussen does not expect Bitcoin to reach $200,000 in the short term this year, but he remains confident that the cryptocurrency will achieve that target by 2026. He believes that sustained institutional inflows will create a structural excess demand, which will support higher Bitcoin prices.

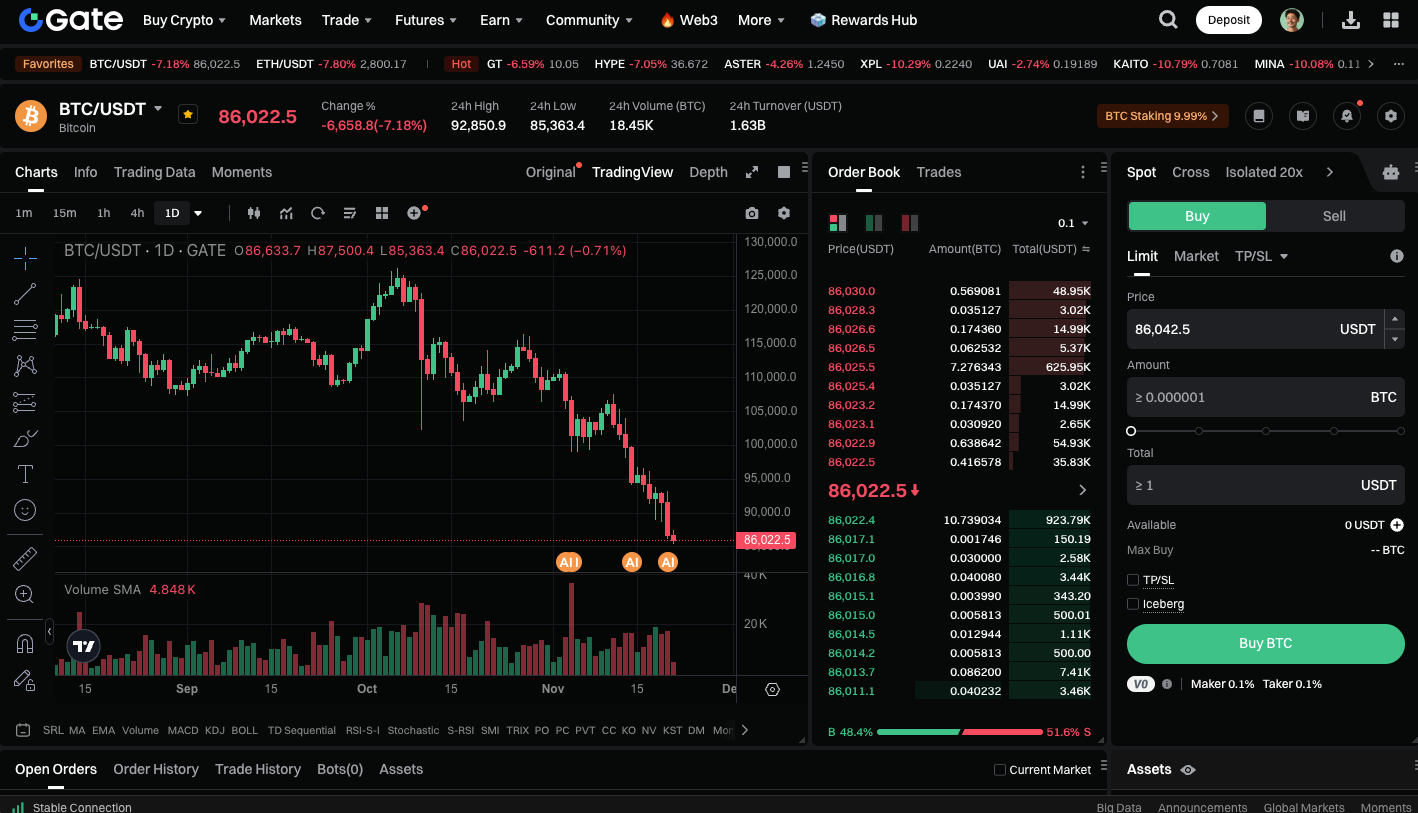

Access BTC spot trading here: https://www.gate.com/trade/BTC_USDT

Conclusion

Drawing from market analysis and the ongoing influx of institutional capital, Bitcoin is likely to experience continued price volatility in the short term. However, robust structural demand in the medium term sustains the possibility of achieving the $200,000 price target by 2026. As more wealth managers, endowments, and corporate capital enter the market, the supply-demand imbalance for Bitcoin will become increasingly evident. For investors, the current correction may present an attractive opportunity for long-term positioning, while continued institutional inflows could be the main force driving future price increases.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution