Bitcoin Price: Current Trends, Influencing Factors, and Investment Strategies

Current Bitcoin Price

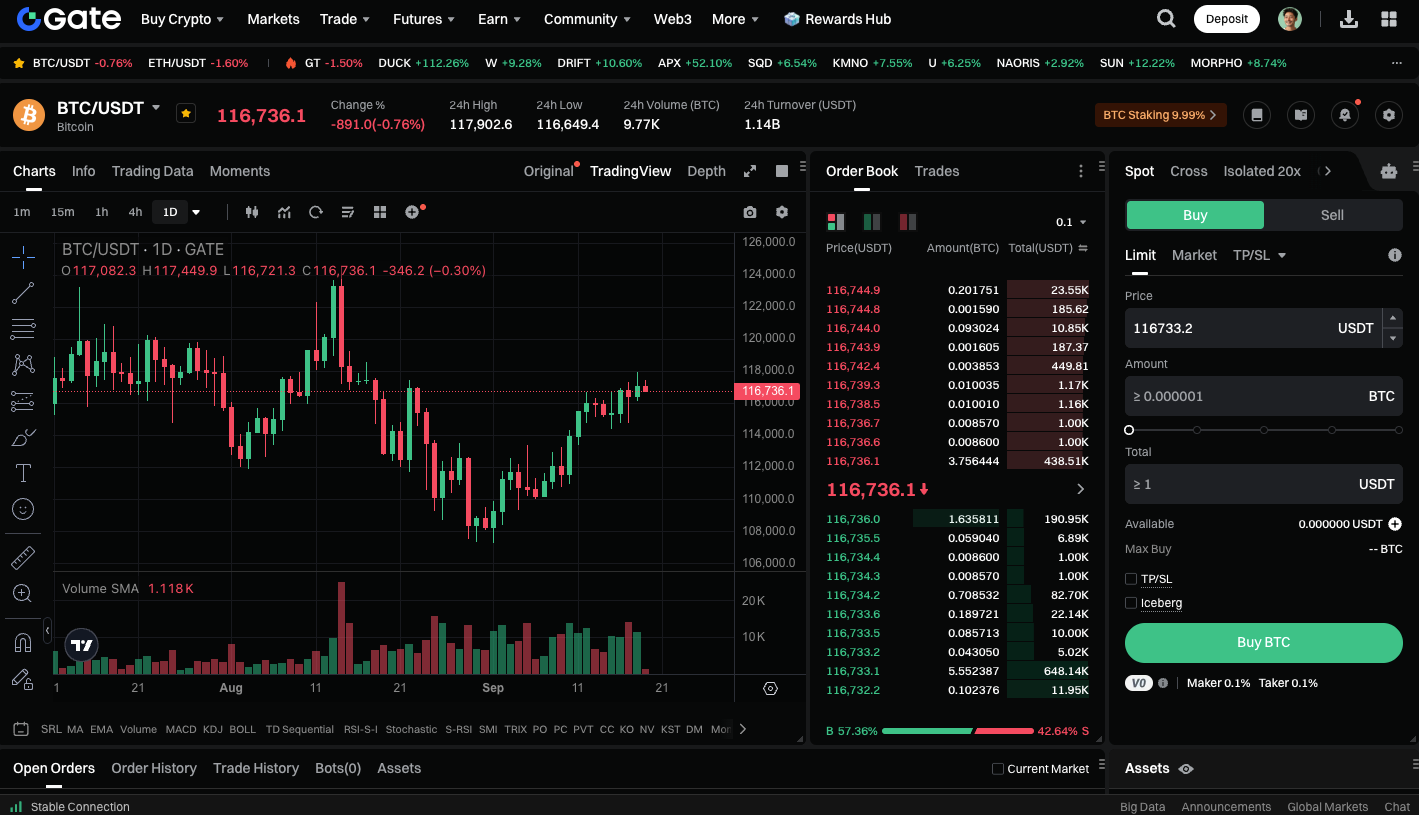

At the time of publication, 1 BTC trades at approximately $117,000. Seasoned investors and newcomers alike closely track Bitcoin prices. This helps guide their buying, holding, or selling strategies. As the world’s first decentralized cryptocurrency, Bitcoin (BTC) consistently commands attention for its price volatility across the entire crypto market.

Key Drivers of Bitcoin Price

1. Market Supply and Demand

The Bitcoin protocol strictly caps supply at 21 million coins. Its inherent scarcity makes the price highly responsive to demand shifts; rising demand drives prices higher, while declining demand leads to lower prices.

2. Investor Sentiment

- Market sentiment is a primary catalyst for Bitcoin’s price fluctuations.

- Bullish: Optimistic investors anticipate price increases, open long positions, and push prices higher.

- Bearish: Pessimistic investors trigger panic selling, resulting in price declines.

3. Policy and Regulation

Global cryptocurrency regulations have a direct impact on Bitcoin’s pricing. Policy updates from the United States, the European Union, or major Asian economies often drive sharp, immediate moves in Bitcoin’s market value.

4. Macroeconomic Factors

Key economic indicators—such as inflation, interest rate trends, and fluctuations in the U.S. Dollar Index—influence investor allocation to Bitcoin, affecting its price and overall market behavior.

5. Technical Analysis Factors

Technical analysis plays a critical role, with factors like support/resistance levels, moving averages (MA), and trading volume shaping trading decisions and impacting price movements.

Recent Price Trends and Market Outlook

At approximately $117,000 per BTC at publication time, the market is experiencing heightened volatility.

- If macroeconomic conditions remain stable and institutional inflows persist, Bitcoin’s price may continue to climb.

- Conversely, if regulation becomes more restrictive or global economic uncertainty intensifies, a near-term market correction could occur.

Investors maintain discipline and develop strategies by weighing technical analysis, fundamentals, and prevailing market sentiment.

Access BTC spot trading instantly: https://www.gate.com/trade/BTC_USDT

Summary

Bitcoin’s price is a key indicator for the broader crypto market. By analyzing driving factors, historical patterns, and major events, investors gain a better understanding of Bitcoin’s volatility. Whether you are investing long-term or engaging in short-term trading, understanding the underlying factors influencing Bitcoin price movements, paired with robust risk management, is essential for navigating the crypto landscape. With BTC at roughly $117,000 as of publication, the market presents significant opportunities. However, it also poses challenges. Success depends on strategic knowledge and informed decision-making in a volatile market.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

What is N2: An AI-Driven Layer 2 Solution

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article