Before You Ape Any ICO, Read This

ICO is the latest hot topic on crypto Twitter.

Everyone is talking about it now.

Everyone thinks they found the next MegaETH or Plasma.

But here is the part most people are ignoring.

Only a few of these ICOs will actually be profitable.

Crypto has always worked like this.

One project start a meta. It become successful

Then ten other teams copy the same playbook thinking success is transferable. It rarely is, 9 out of 10.

Right now, every team wants to run an ICO because MegaETH and Plasma worked.

They figured instead of giving you an airdrop, they can just make you have skin in the game.

But those two examples actually planned well before execution.

Before you put money into any ICO now, here are the things that you need to look at 👇

1. The Product Comes First

Ignore the pitch decks and fancy kol shill posts

Ask a simple question

Does this product solve a real problem today? Is it unique?

Why do they need top have a token (a wallet does not need a token)?

If the product only makes sense in a future narrative or needs ten assumptions to work, that is risk.

Good ICOs usually have something working already.

Not fake promises or testnet metrics.

If they cannot explain what the product does in one sentence, that is your first red flag.

2. The Team

A good project is as good as the team behind it

Look at the team’s track record

Have they shipped anything before in crypto or outside of it?

Having an experience is a plus because it means they walk this path before.

Anon teams are not an instant red flag tho.

but they need to overdeliver to earn trust.

A strong team can pivot if the market shifts.

A weak team dies the moment hype fades. We are in an attentuon driven space.

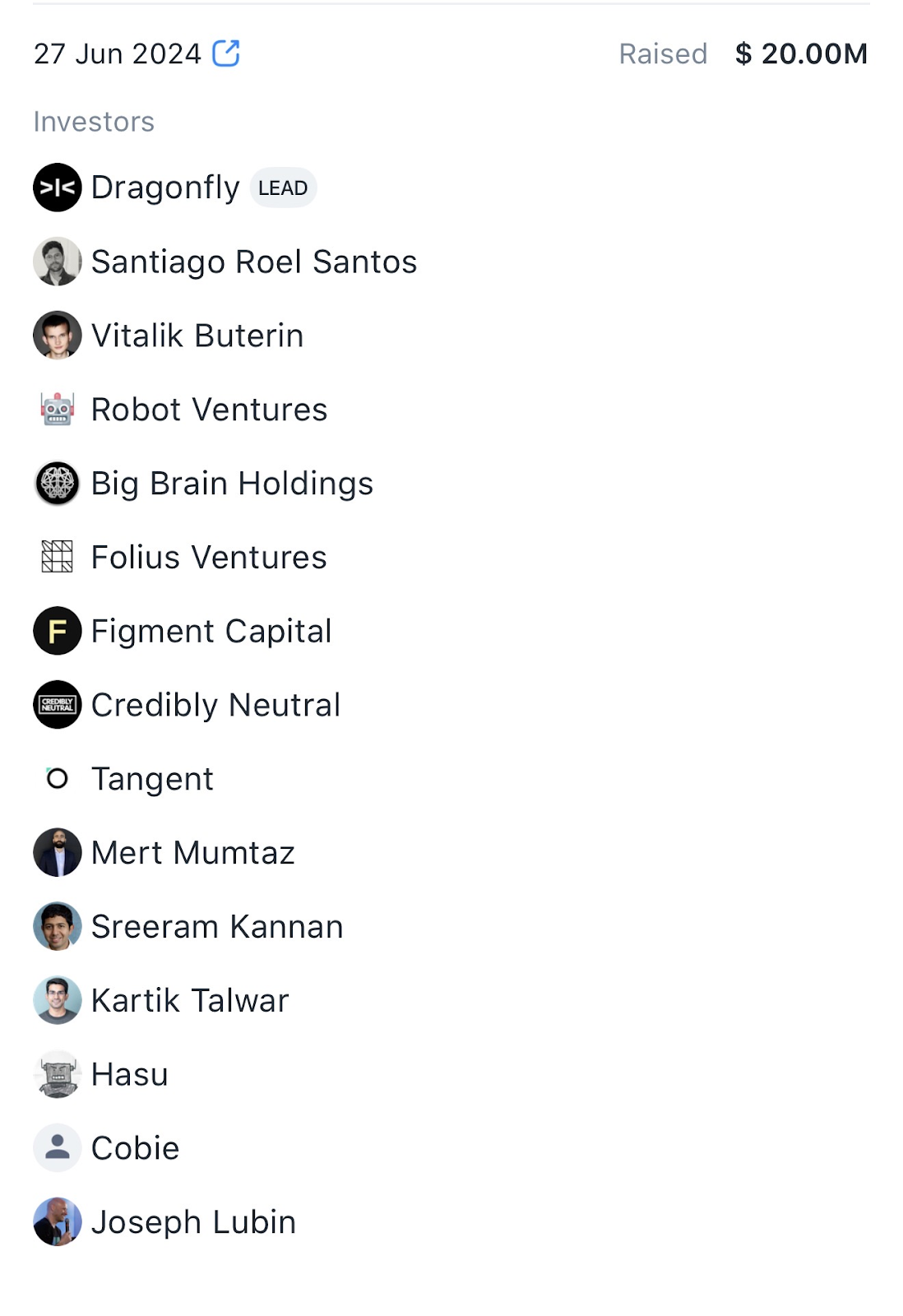

3. Investors and Valuation

Who backed the project? are they A-tier or D-tier Vcs

How much they raised and at what valuation?

This matters more than people think.

If insiders and early investors already got in at very low valuations, you are their exit liquidity.

Good ICOs usually make sense on paper even without the hype.

Bad ones rely on attention, and vanity metrics to justify their ask.

4. Real Metrics, Not Vanity Numbers

Are they generating revenue?

Number of active users And TVL?

and most importantly the quality of those metrics. Any metrics can be gamed

Testnet numbers mean nothing if they can be botted.

A dashboard full of fake activity does not turn into real usage overnight. You can ask Monad about this.

Look how organic their demand is and if people are willing to use the product without incentives

or only because there is an airdrop at the end?

Out of all the ICOs announced, only fdf I can say the early users had no idea there will be an airdrop or future token in the beginning (this isnt a financial advice btw. personally using the app and made solid 5 figs flipping players).

5. Marketing and Narrative

Marketing matters more than people want to admit.

MegaETH did justice to their marketing.

team was 100% on top of everything and they controlled the narrative.

Everyone was talking about MegaEth positively.

Attention is everything in web3.

If no one cares about the ICO before launch, do not expect magic after. see Monad again.

Good projects know how to tell their story clearly from the get go.

Bad ones hide behind buzzwords. “we are building the next chatgpt nvidia prediction market of web..” okay, cool story bro.

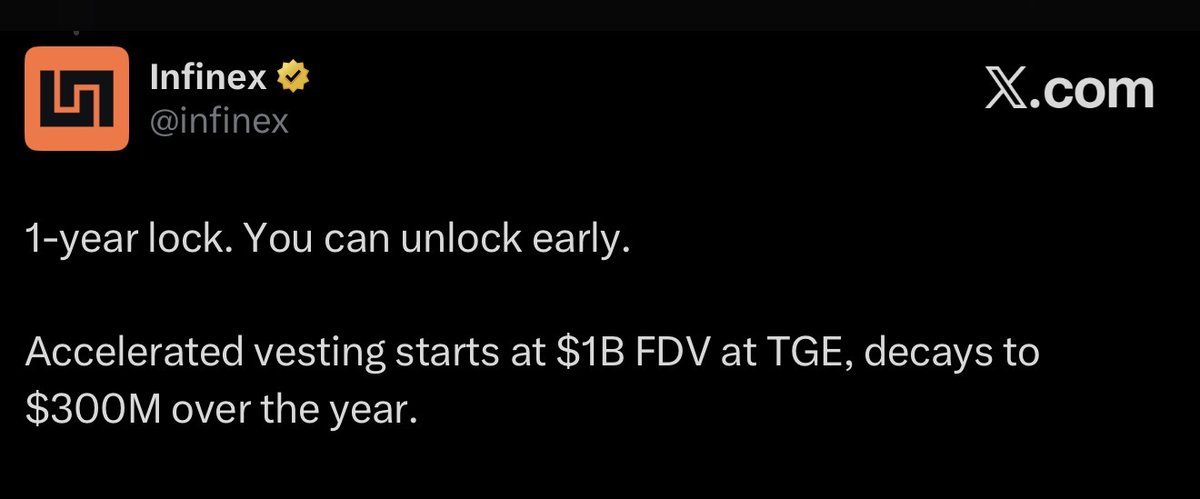

6. Terms and Valuation of the Offering

Read the terms.

Token unlocks

vesting schedules

circulating supply

FDV at launch.

Understanding the full tokenomics is very important. if you don’t know how to read, use llm to dissect it.

If the ICO structure favors insiders heavily and dumps risk on retails, walk away.

A fair launch does not mean cheap. It means aligned incentives for both sides of the coin.

7. Market Conditions Matter

This is the part most people ignore.

In a real bull market, a decent project can trade at 500M to 1B FDV on narrative alone.

Right now, even the loudest launches are struggling to hold 100M to 300M FDV.

That changes how you should think about risk and upside.

Same project

different market

very different outcome.

Timing is not everything

but it is never irrelevant.

Final Thoughts

ICO is not free money.

It never was.

The current meta will create winners

and a long list of lessons.

Do not buy because everyone else is buying or your fav KOL is shilling it.

Do not assume everything being marketed right now will be the next MegaETH.

Slow down.

Check the product.

Check the team.

Check the numbers.

Check the valuation.

Check the market.

The best opportunities usually survive scrutiny. unlike Fogo.

The worst ones prey on your FOMO and trending meta. Zero substance

Choose wisely anon!

Disclaimer:

- This article is reprinted from [thegreatola]. All copyrights belong to the original author [thegreatola]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?