What is USDC: Understanding the Popular Stablecoin and Its Role in the Crypto Ecosystem

USD Coin's Positioning and Significance

In 2018, Circle and Coinbase launched USD Coin (USDC) to address the need for a fully collateralized, transparent, and regulated stablecoin in the cryptocurrency ecosystem.

As one of the leading fiat-backed stablecoins, USDC plays a crucial role in various sectors, including DeFi, cross-border payments, and as a stable store of value in volatile crypto markets.

As of 2025, USDC has become one of the top 10 cryptocurrencies by market capitalization, with widespread adoption across multiple blockchain networks and a significant presence in the digital asset ecosystem.

Origins and Development History

Birth Background

USD Coin was created by Centre, a consortium founded by Circle and Coinbase, in 2018. It aimed to solve the issues of transparency and trust in the stablecoin market, providing a fully collateralized alternative to existing options.

USDC was born during a period of growing demand for stable digital assets in the cryptocurrency space, targeting users who needed a reliable way to transact and store value in the volatile crypto market.

The launch of USDC brought new possibilities for traders, investors, and businesses looking to leverage blockchain technology while mitigating cryptocurrency price volatility risks.

Important Milestones

- 2018: USDC launched on the Ethereum blockchain, offering 1:1 USD backing and regular audits.

- 2020: Major expansion to other blockchains, including Algorand and Stellar, enhancing interoperability.

- 2021: USDC's market cap surpassed $25 billion, marking significant adoption and trust in the stablecoin.

- 2023: Ecosystem explosion with USDC becoming a cornerstone in DeFi protocols across multiple chains.

With ongoing support from Circle and the broader cryptocurrency community, USDC continues to enhance its technology, regulatory compliance, and real-world applications.

How Does USD Coin Work?

No Central Control

While USDC is not decentralized like some cryptocurrencies, it operates on various blockchain networks worldwide, reducing reliance on a single point of control.

These networks collaborate to validate transactions, ensuring system transparency and attack resistance, while Circle and Coinbase maintain oversight of the collateral backing.

Blockchain Core

USDC utilizes multiple blockchain infrastructures, including Ethereum, Algorand, and Solana, among others.

Transactions are recorded on these public, immutable digital ledgers, grouped into blocks, and cryptographically linked to form secure chains.

Anyone can view the records, establishing trust without intermediaries.

Ensuring Fairness

USDC maintains its 1:1 peg to the US dollar through full collateralization, with regular attestations by Grant Thornton LLP to verify the backing.

The stablecoin's value is preserved through a centralized minting and burning process managed by Circle, ensuring that each USDC token is backed by one US dollar held in reserve.

Secure Transactions

USDC uses public-private key encryption to protect transactions:

- Private keys (like secret passwords) are used to sign transactions

- Public keys (like account numbers) are used to verify ownership

This mechanism ensures fund security while transactions remain pseudonymous.

Additional security features include blacklisting capabilities for compromised addresses and compliance with regulatory requirements.

USDC's Market Performance

Circulation Overview

As of November 14, 2025, USDC's circulating supply is 75,562,914,516.50774 coins, with a total supply of 75,573,720,295.80647.

New coins enter the market through minting backed by USD reserves, influencing its supply and demand dynamics.

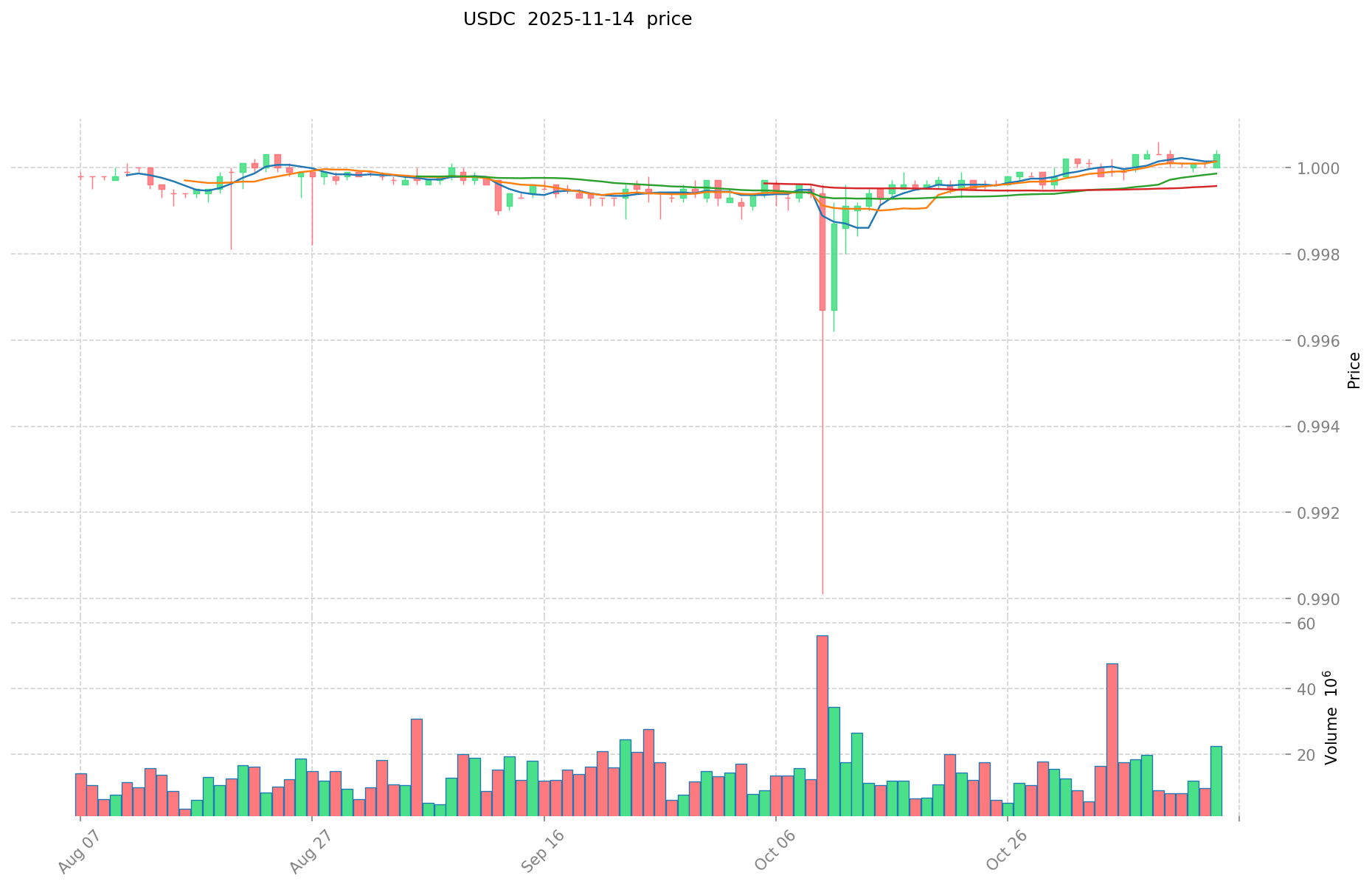

Price Fluctuations

USDC reached its all-time high of $1.17 on May 8, 2019, driven by increased demand for stablecoins during market volatility.

Its lowest price was $0.877647, occurring on March 11, 2023, due to temporary depegging concerns.

These fluctuations reflect market sentiment, adoption trends, and external factors.

Click to view the current USDC market price

On-Chain Metrics

- Daily Transaction Volume: $12,950,894.446714 (indicating network activity)

- Active Addresses: 4,161,541 (reflecting user engagement)

USDC Ecosystem Applications and Partnerships

Core Use Cases

USDC's ecosystem supports various applications:

- DeFi: Aave, providing lending and borrowing services.

- Payments: Circle, enabling cross-border transactions.

Strategic Collaborations

USDC has established partnerships with Visa, Mastercard, and major financial institutions, enhancing its technical capabilities and market influence. These partnerships provide a solid foundation for USDC's ecosystem expansion.

Controversies and Challenges

USDC faces the following challenges:

- Regulatory Scrutiny: Potential regulatory changes in stablecoin oversight.

- Competition: Emergence of other stablecoins and CBDCs.

These issues have sparked discussions within the community and market, driving continuous innovation for USDC.

USDC Community and Social Media Atmosphere

Fan Enthusiasm

USDC's community is vibrant, with daily transaction volumes reaching billions.

On X, posts and hashtags like #USDC frequently trend, with monthly post volumes in the millions.

Price stability and institutional adoption have ignited community enthusiasm.

Social Media Sentiment

Sentiment on X shows a general consensus:

- Supporters praise USDC's transparency and reliability, viewing it as the "future of digital dollars".

- Critics focus on centralization concerns and regulatory risks.

Recent trends indicate overall positive sentiment due to USDC's stability and widespread adoption.

Hot Topics

X users actively discuss USDC's role in DeFi, regulatory compliance, and potential for mainstream adoption, highlighting both its transformative potential and challenges in achieving widespread use.

More Information Sources for USDC

- Official Website: Visit USDC's official website for features, use cases, and latest updates.

- Whitepaper: USDC whitepaper authored by Centre Consortium, detailing its technical architecture, goals, and vision.

- X Updates: On X, USDC uses @circle, with over 1 million followers as of November 2025, Posts cover technology updates, community events, and partnership news, generating thousands of likes and retweets.

USDC Future Roadmap

- 2026: Launch enhanced cross-chain interoperability, improving transaction speed and security.

- Ecosystem Goal: Support integration with major global payment systems.

- Long-term Vision: Become the standard for digital dollar transactions worldwide.

How to Participate in USDC?

- Purchase Channels: Buy USDC on Gate.com

- Storage Solutions: Use secure wallets for storage

- Participate in Ecosystem: Use USDC in DeFi applications or for payments

- Stay Informed: Follow official channels for updates and developments

Summary

USDC has redefined digital currency through blockchain technology, offering transparency, security, and efficient payments. Its active community, rich resources, and strong market performance set it apart in the cryptocurrency space. Despite facing regulatory challenges, USDC's innovative spirit and clear roadmap secure its important position in the future of decentralized technology. Whether you're a newcomer or an experienced player, USDC is worth watching and participating in.

FAQ

Is USDC always $1 dollar?

No, USDC aims to maintain a 1:1 peg with the US dollar, but slight fluctuations can occur due to market dynamics. Generally, it stays very close to $1.

Is USDC a good investment?

USDC is generally considered a stable investment, as it's pegged to the US dollar. It's useful for preserving value and reducing volatility in crypto portfolios.

Can I transfer USDC to my bank account?

Yes, you can transfer USDC to your bank account. First, convert USDC to fiat currency on a crypto exchange, then withdraw the funds to your linked bank account.

What is USDC used for?

USDC is used as a stable digital dollar for payments, remittances, trading, and as a safe haven in volatile crypto markets.

Share

Content