USDG vs GMX: A Comparative Analysis of Two Leading Decentralized Trading Platforms

Introduction: USDG vs GMX Investment Comparison

In the cryptocurrency market, the comparison between USDG vs GMX has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positions in the crypto asset landscape.

Global Dollar (USDG): Since its launch, it has gained market recognition as a stablecoin backed by the US dollar available on Ethereum and Solana blockchains.

GMX (GMX): It has been recognized as a decentralized perpetual exchange since its inception, with its token serving as both a utility and governance token.

This article will comprehensively analyze the investment value comparison between USDG vs GMX, focusing on historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

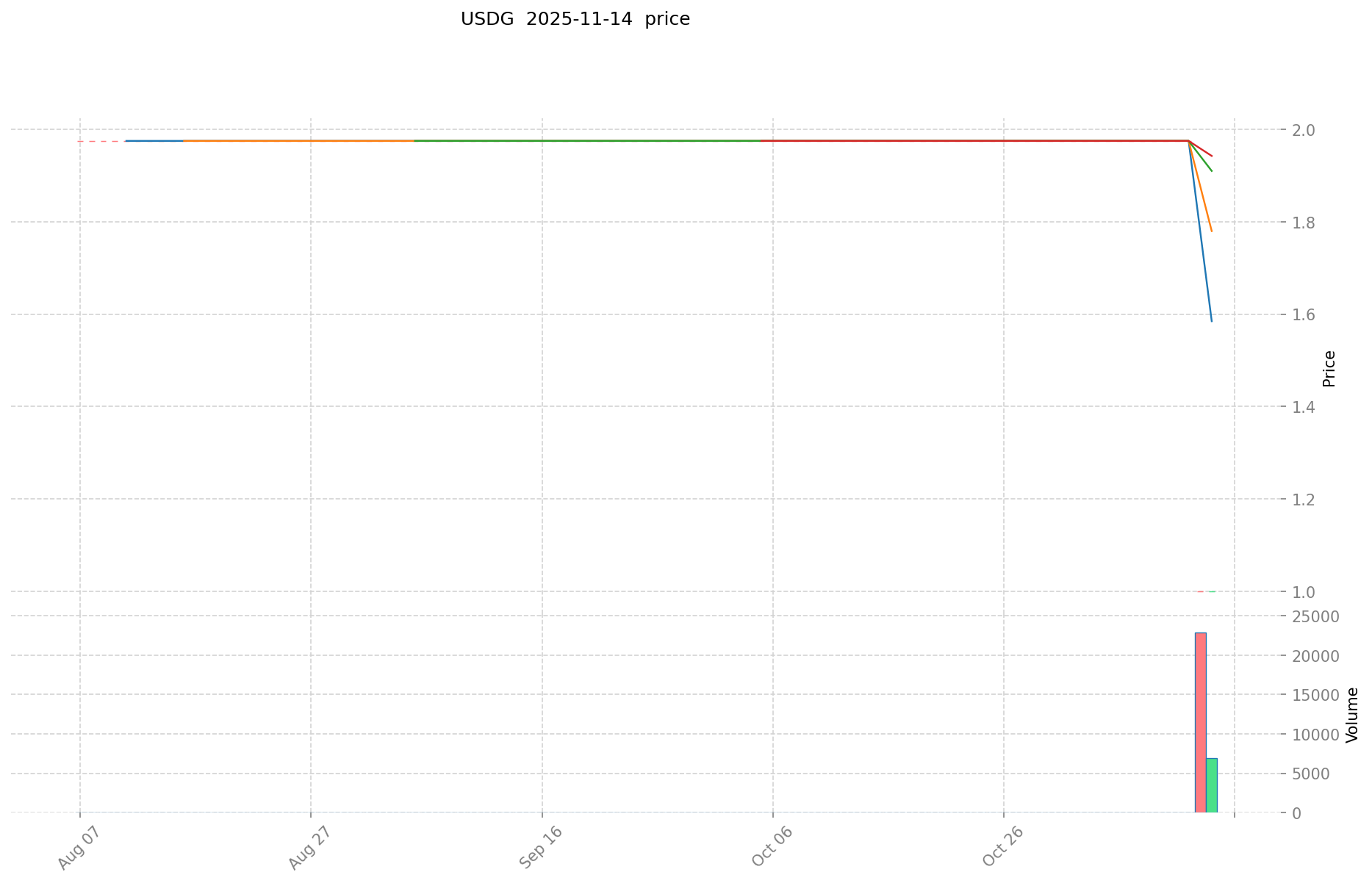

Global Dollar (USDG) and GMX (GMX) Historical Price Trends

- 2025: USDG maintained its stability as a stablecoin, with minimal price fluctuations around $1.

- 2023: GMX reached its all-time high of $91.07 on April 18, 2023, likely due to increased adoption or positive market sentiment.

- Comparative analysis: While USDG has remained relatively stable as designed, GMX has experienced significant volatility, dropping from its all-time high of $91.07 to a low of $6.92 on October 11, 2025.

Current Market Situation (2025-11-15)

- USDG current price: $1.0008

- GMX current price: $8.868

- 24-hour trading volume: USDG $319,448.29 vs GMX $22,814.85

- Market Sentiment Index (Fear & Greed Index): 16 (Extreme Fear)

Click to view real-time prices:

- View USDG current price Market Price

- View GMX current price Market Price

II. Core Factors Affecting Investment Value of USDG vs GMX

Supply Mechanism Comparison (Tokenomics)

-

USDG: Stablecoin within the GMX ecosystem with 1:1 USD backing, minted when users deposit assets and burned when redeemed, creating a flexible supply model tied to platform usage

-

GMX: Fixed maximum supply of 13.25 million tokens with emissions that decrease over time, creating a deflationary model where 30% of platform fees are used for token buybacks

-

📌 Historical pattern: GMX's deflationary model has historically supported price stability during market volatility, while USDG maintains its peg regardless of market conditions due to its collateralized nature.

Institutional Adoption and Market Application

- Institutional holdings: GMX has gained more institutional interest due to its revenue-generating capabilities, with several crypto funds including it in their portfolios

- Enterprise adoption: GMX is increasingly used by trading firms and market makers for leveraged trading, while USDG primarily serves as a utility token within the GMX ecosystem

- Regulatory stance: Both tokens face varying regulatory scrutiny, with USDG potentially facing more stablecoin-specific regulations in jurisdictions like the US

Technical Development and Ecosystem Building

- GMX technical upgrades: Implementation of GMX V2 featuring improved price impact mechanisms, dynamic fees, and expanded trading pairs

- USDG technical development: Enhanced stability mechanisms and collateralization strategies tied to the overall GMX platform development

- Ecosystem comparison: GMX has a more robust ecosystem including leveraged trading, yield farming, and liquidity provision, while USDG serves primarily as the platform's stable asset medium

Macroeconomic Factors and Market Cycles

- Performance during inflation: GMX tends to perform better during inflation as users seek leveraged trading opportunities, while USDG maintains its dollar peg regardless of inflation rates

- Macroeconomic monetary policy: Interest rate increases typically affect GMX trading volume as market volatility shifts, while USDG demand remains tied to platform usage

- Geopolitical factors: Market volatility from geopolitical events often increases GMX trading volume and fees, indirectly benefiting token holders through increased revenue sharing

III. 2025-2030 Price Prediction: USDG vs GMX

Short-term Forecast (2025)

- USDG: Conservative $0.94 - $1.00 | Optimistic $1.00 - $1.26

- GMX: Conservative $5.67 - $8.87 | Optimistic $8.87 - $11.35

Mid-term Forecast (2027)

- USDG may enter a growth phase, with expected prices $1.31 - $1.92

- GMX may enter a consolidation phase, with expected prices $7.08 - $13.59

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Forecast (2030)

- USDG: Base scenario $1.24 - $1.90 | Optimistic scenario $1.90 - $2.00

- GMX: Base scenario $11.04 - $15.13 | Optimistic scenario $15.13 - $20.87

Disclaimer

USDG:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.26126 | 1.001 | 0.94094 | 0 |

| 2026 | 1.6288272 | 1.13113 | 0.8483475 | 13 |

| 2027 | 1.918170254 | 1.3799786 | 1.31097967 | 37 |

| 2028 | 1.8139818697 | 1.649074427 | 1.22031507598 | 64 |

| 2029 | 2.07783377802 | 1.73152814835 | 1.1254932964275 | 73 |

| 2030 | 1.99991501134425 | 1.904680963185 | 1.23804262607025 | 90 |

GMX:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 11.3472 | 8.865 | 5.6736 | 0 |

| 2026 | 12.733686 | 10.1061 | 9.09549 | 13 |

| 2027 | 13.58967267 | 11.419893 | 7.08033366 | 28 |

| 2028 | 14.5055480886 | 12.504782835 | 7.12772621595 | 41 |

| 2029 | 16.746405172632 | 13.5051654618 | 10.80413236944 | 52 |

| 2030 | 20.87358373775808 | 15.125785317216 | 11.04182328156768 | 70 |

IV. Investment Strategy Comparison: USDG vs GMX

Long-term vs Short-term Investment Strategy

- USDG: Suitable for investors seeking stability and a hedge against market volatility

- GMX: Suitable for investors looking for exposure to DeFi trading platforms and potential high returns

Risk Management and Asset Allocation

- Conservative investors: USDG: 70% vs GMX: 30%

- Aggressive investors: USDG: 30% vs GMX: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- USDG: Risk of de-pegging in extreme market conditions

- GMX: High volatility due to market sentiment and trading volume fluctuations

Technical Risk

- USDG: Smart contract vulnerabilities, collateral management issues

- GMX: Platform security, smart contract risks, oracle manipulation

Regulatory Risk

- Global regulatory policies may impact both tokens differently, with stablecoins like USDG potentially facing stricter oversight

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- USDG advantages: Stability, potential for use as a trading pair, ecosystem utility

- GMX advantages: Exposure to DeFi trading growth, revenue sharing model, deflationary tokenomics

✅ Investment Advice:

- New investors: Consider a balanced approach with a higher allocation to USDG for stability

- Experienced investors: Explore GMX for higher potential returns, but with increased risk

- Institutional investors: Evaluate GMX for its revenue potential and USDG for liquidity provision opportunities

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between USDG and GMX? A: USDG is a stablecoin pegged to the US dollar, while GMX is a utility and governance token for a decentralized perpetual exchange. USDG aims for price stability, whereas GMX's value fluctuates based on platform performance and market conditions.

Q2: Which token is considered less risky for investment? A: USDG is generally considered less risky due to its design as a stablecoin, maintaining a value close to $1. GMX, as a volatile asset, carries higher risk but also potential for greater returns.

Q3: How do the supply mechanisms of USDG and GMX differ? A: USDG has a flexible supply model tied to platform usage, minted when assets are deposited and burned when redeemed. GMX has a fixed maximum supply of 13.25 million tokens with a deflationary model, where 30% of platform fees are used for token buybacks.

Q4: What factors could drive the future value of GMX? A: Factors that could drive GMX's value include increased adoption of the GMX trading platform, expansion of its ecosystem, implementation of technical upgrades like GMX V2, and overall growth in the DeFi sector.

Q5: How might regulatory changes affect USDG and GMX differently? A: Regulatory changes could have a more significant impact on USDG as a stablecoin, potentially facing stricter oversight and compliance requirements. GMX may be less affected directly but could see indirect impacts through changes in DeFi regulations.

Q6: What are the key considerations for institutional investors looking at USDG vs GMX? A: Institutional investors should consider USDG for liquidity provision opportunities and as a stable asset within the crypto ecosystem. For GMX, they should evaluate its revenue-generating potential through trading fees and its role in the growing DeFi trading landscape.

Share

Content