USDE vs ZIL: Comparing Two Cryptocurrencies in the Decentralized Finance Ecosystem

Introduction: USDE vs ZIL Investment Comparison

In the cryptocurrency market, the comparison between USDE and ZIL has always been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance but also represent different positioning in crypto assets.

USDE (USDE): Since its launch, it has gained market recognition for its role as a censorship-resistant, scalable, and stable crypto-native solution for money.

ZIL (ZIL): Introduced in 2018, it has been hailed as a high-throughput public blockchain platform, aiming to solve transaction speed and scalability issues in the blockchain space.

This article will provide a comprehensive analysis of the investment value comparison between USDE and ZIL, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

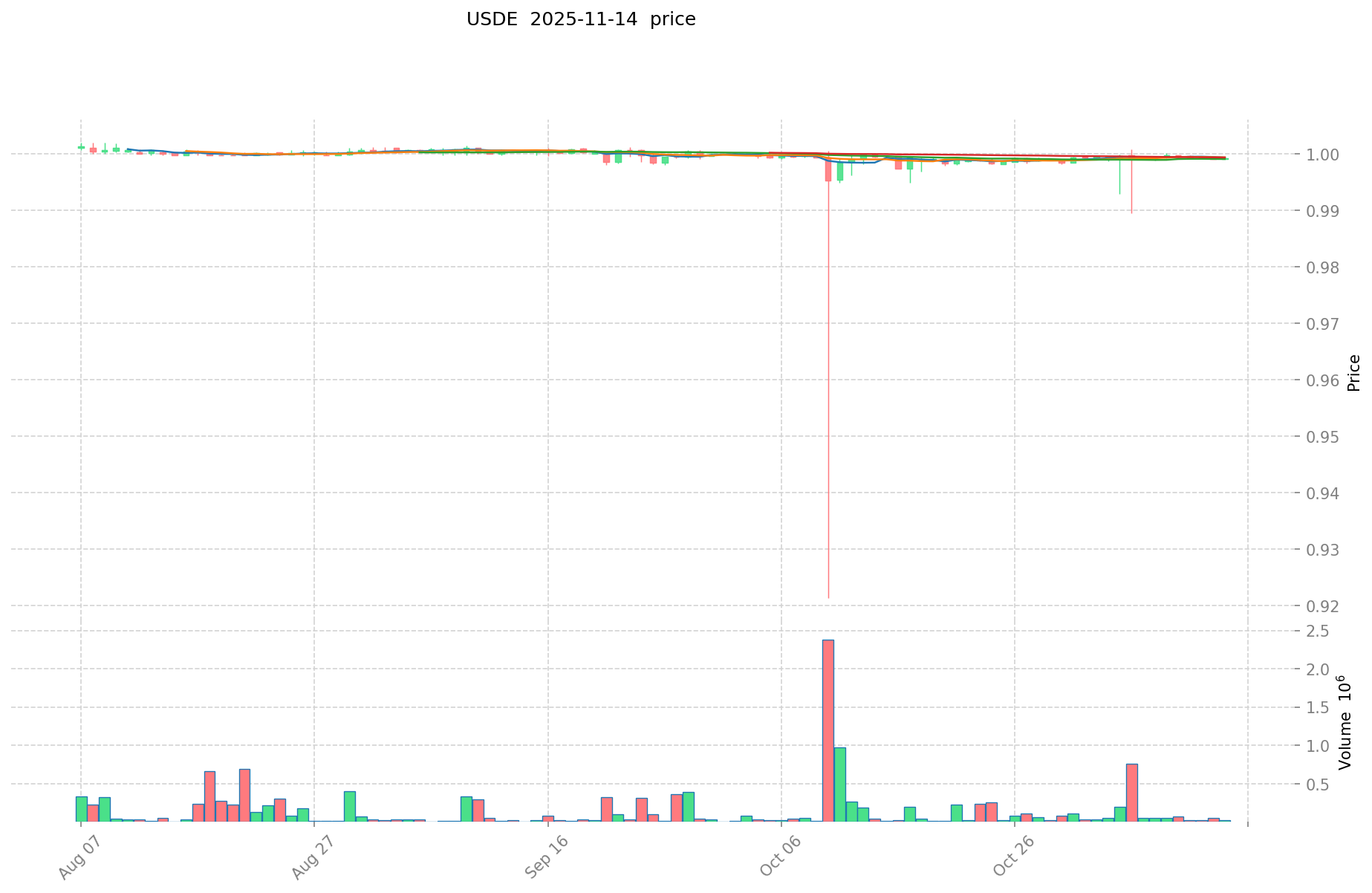

I. Price History Comparison and Current Market Status

USDE and ZIL Historical Price Trends

- 2024: USDE reached its all-time high of $1.5 on November 14, 2024.

- 2020: ZIL hit its all-time low of $0.00239616 on March 13, 2020.

- Comparative analysis: USDE, being a stablecoin, has maintained a relatively stable price near $1, while ZIL has experienced significant volatility, reaching an all-time high of $0.255376 on May 7, 2021, before declining to its current price.

Current Market Situation (2025-11-14)

- USDE current price: $0.9991

- ZIL current price: $0.006986

- 24-hour trading volume: USDE $33,657.74 vs ZIL $259,046.60

- Market Sentiment Index (Fear & Greed Index): 16 (Extreme Fear)

Click to view real-time prices:

- Check USDE current price Market Price

- Check ZIL current price Market Price

II. Core Factors Affecting Investment Value of USDE vs ZIL

Supply Mechanism Comparison (Tokenomics)

- USDE: Stable-asset backed token with supply determined by market demand and collateral ratio

- ZIL: Fixed maximum supply with deflationary mechanisms through transaction burning

- 📌 Historical pattern: ZIL's deflationary model has historically created upward price pressure during bull markets, while USDE maintains stability as designed for a stablecoin

Institutional Adoption and Market Applications

- Institutional holdings: ZIL has attracted more institutional interest through its staking infrastructure and enterprise solutions

- Enterprise adoption: ZIL offers enterprise blockchain solutions with scalability benefits, while USDE serves primarily as a stablecoin for trading and settlements

- Regulatory attitudes: Stablecoins like USDE face increasing regulatory scrutiny globally, while ZIL benefits from Singapore's supportive blockchain ecosystem

Technical Development and Ecosystem Building

- USDE technical features: Asset-backed stablecoin designed for stability and consistent value

- ZIL technical development: Implements sharding technology for high throughput and scalability, with ongoing development of Zilliqa 2.0

- Ecosystem comparison: ZIL supports a more diverse ecosystem with DeFi applications, NFT marketplaces, and smart contract functionality, while USDE primarily serves as a trading pair and value storage medium

Macroeconomic Factors and Market Cycles

- Inflation environment performance: USDE designed to maintain stable value during inflation, ZIL more volatile but potentially appreciative during market uptrends

- Macroeconomic monetary policy: Interest rate changes affect ZIL more significantly than USDE, which is designed to maintain stability

- Geopolitical factors: USDE offers stability during geopolitical uncertainty, while ZIL represents technological investment with higher risk-reward profile

III. 2025-2030 Price Prediction: USDE vs ZIL

Short-term Prediction (2025)

- USDE: Conservative $0.819262 - $0.9991 | Optimistic $0.9991 - $1.378758

- ZIL: Conservative $0.00621131 - $0.006979 | Optimistic $0.006979 - $0.00774669

Mid-term Prediction (2027)

- USDE may enter a growth phase, with estimated prices ranging from $0.984433212 to $1.804794222

- ZIL may enter a growth phase, with estimated prices ranging from $0.005977157571 to $0.0133127600445

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- USDE: Base scenario $2.010851351986386 - $2.3113233930878 | Optimistic scenario $2.3113233930878 - $2.634908668120092

- ZIL: Base scenario $0.012706626751483 - $0.013963326100531 | Optimistic scenario $0.013963326100531 - $0.019688289801749

Disclaimer: The above predictions are based on historical data and current market trends. Cryptocurrency markets are highly volatile and subject to rapid changes. These forecasts should not be considered as financial advice or guarantees of future performance.

USDE:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.378758 | 0.9991 | 0.819262 | 0 |

| 2026 | 1.5456077 | 1.188929 | 1.09381468 | 19 |

| 2027 | 1.804794222 | 1.36726835 | 0.984433212 | 36 |

| 2028 | 2.33146599042 | 1.586031286 | 0.84059658158 | 58 |

| 2029 | 2.6638981479656 | 1.95874863821 | 1.6845238288606 | 96 |

| 2030 | 2.634908668120092 | 2.3113233930878 | 2.010851351986386 | 131 |

ZIL:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00774669 | 0.006979 | 0.00621131 | 0 |

| 2026 | 0.0107497537 | 0.007362845 | 0.00434407855 | 5 |

| 2027 | 0.0133127600445 | 0.00905629935 | 0.005977157571 | 29 |

| 2028 | 0.011520065588167 | 0.01118452969725 | 0.00805286138202 | 60 |

| 2029 | 0.016574354558354 | 0.011352297642708 | 0.010557636807719 | 62 |

| 2030 | 0.019688289801749 | 0.013963326100531 | 0.012706626751483 | 99 |

IV. Investment Strategy Comparison: USDE vs ZIL

Long-term vs Short-term Investment Strategies

- USDE: Suitable for investors seeking stability and value preservation

- ZIL: Suitable for investors focused on ecosystem potential and technological innovation

Risk Management and Asset Allocation

- Conservative investors: USDE: 80% vs ZIL: 20%

- Aggressive investors: USDE: 30% vs ZIL: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- USDE: Potential depegging risk, market confidence fluctuations

- ZIL: High volatility, susceptible to market sentiment shifts

Technical Risk

- USDE: Scalability, network stability

- ZIL: Network congestion during high traffic, potential smart contract vulnerabilities

Regulatory Risk

- Global regulatory policies have different impacts on stablecoins (USDE) and public blockchain platforms (ZIL)

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- USDE advantages: Stability, potential for consistent value preservation

- ZIL advantages: Scalability technology, diverse ecosystem development

✅ Investment Advice:

- Novice investors: Consider a higher allocation to USDE for stability

- Experienced investors: Balanced portfolio with both USDE and ZIL based on risk tolerance

- Institutional investors: Strategic allocation to both, with ZIL for long-term blockchain technology exposure

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between USDE and ZIL? A: USDE is a stablecoin designed for price stability, while ZIL is a high-throughput blockchain platform focused on scalability. USDE maintains a relatively stable value near $1, whereas ZIL's price is more volatile and subject to market fluctuations.

Q2: Which asset is considered more stable for investment? A: USDE is generally considered more stable for investment as it's designed to maintain a consistent value. ZIL, being a traditional cryptocurrency, experiences higher volatility and is subject to more significant price fluctuations.

Q3: How do the supply mechanisms of USDE and ZIL differ? A: USDE's supply is determined by market demand and collateral ratio, while ZIL has a fixed maximum supply with deflationary mechanisms through transaction burning.

Q4: What are the key factors affecting the future value of USDE and ZIL? A: For USDE, key factors include market demand for stablecoins and regulatory developments. For ZIL, factors include technological advancements, ecosystem growth, institutional adoption, and overall market sentiment towards blockchain platforms.

Q5: How do macroeconomic factors impact USDE and ZIL differently? A: USDE is designed to maintain stable value during inflation and geopolitical uncertainty. ZIL is more sensitive to macroeconomic factors, with interest rate changes and market cycles having a more significant impact on its price.

Q6: What are the potential risks associated with investing in USDE and ZIL? A: USDE risks include potential depegging and regulatory challenges. ZIL risks include high volatility, network congestion during high traffic, and potential smart contract vulnerabilities.

Q7: How should investors approach allocating between USDE and ZIL in their portfolio? A: Conservative investors might consider allocating 80% to USDE and 20% to ZIL, while aggressive investors might opt for 30% USDE and 70% ZIL. The exact allocation should be based on individual risk tolerance and investment goals.

Share

Content