TDROP ve ADA: İki Başlıca Blockchain Stake Mekanizmasının Karşılaştırılması ve Ağ Güvenliğine Etkileri

Giriş: TDROP ile ADA Yatırımı Karşılaştırması

Kripto para piyasasında TDROP ve ADA arasındaki karşılaştırma, yatırımcıların sürekli gündeminde yer almaktadır. Bu iki varlık, piyasa değeri sıralaması, kullanım alanları ve fiyat hareketleri açısından önemli farklar gösterirken, kripto para ekosisteminde de farklı yaklaşımları temsil eder.

TDROP (TDROP): İlk çıkışından itibaren, Theta blokzincirinde NFT likidite madenciliğine odaklanmasıyla piyasanın dikkatini çekmiştir.

ADA (ADA): 2017’de faaliyete geçtiğinden beri “üçüncü nesil” blokzincir platformu olarak tanınır. ADA, küresel işlem hacmi ve piyasa değeri açısından en büyük kripto paralardan biridir.

Bu makalede, TDROP ve ADA’nın yatırım değerleri; geçmiş fiyat hareketleri, arz modelleri, kurumsal benimsenme, teknolojik ekosistem ve gelecek öngörüleri başlıkları altında kapsamlı biçimde karşılaştırılacak ve yatırımcıların en çok merak ettiği şu soruya yanıt aranacaktır:

"Şu anda hangisi daha avantajlı bir yatırım?"

I. Fiyat Geçmişi Karşılaştırması ve Güncel Piyasa Durumu

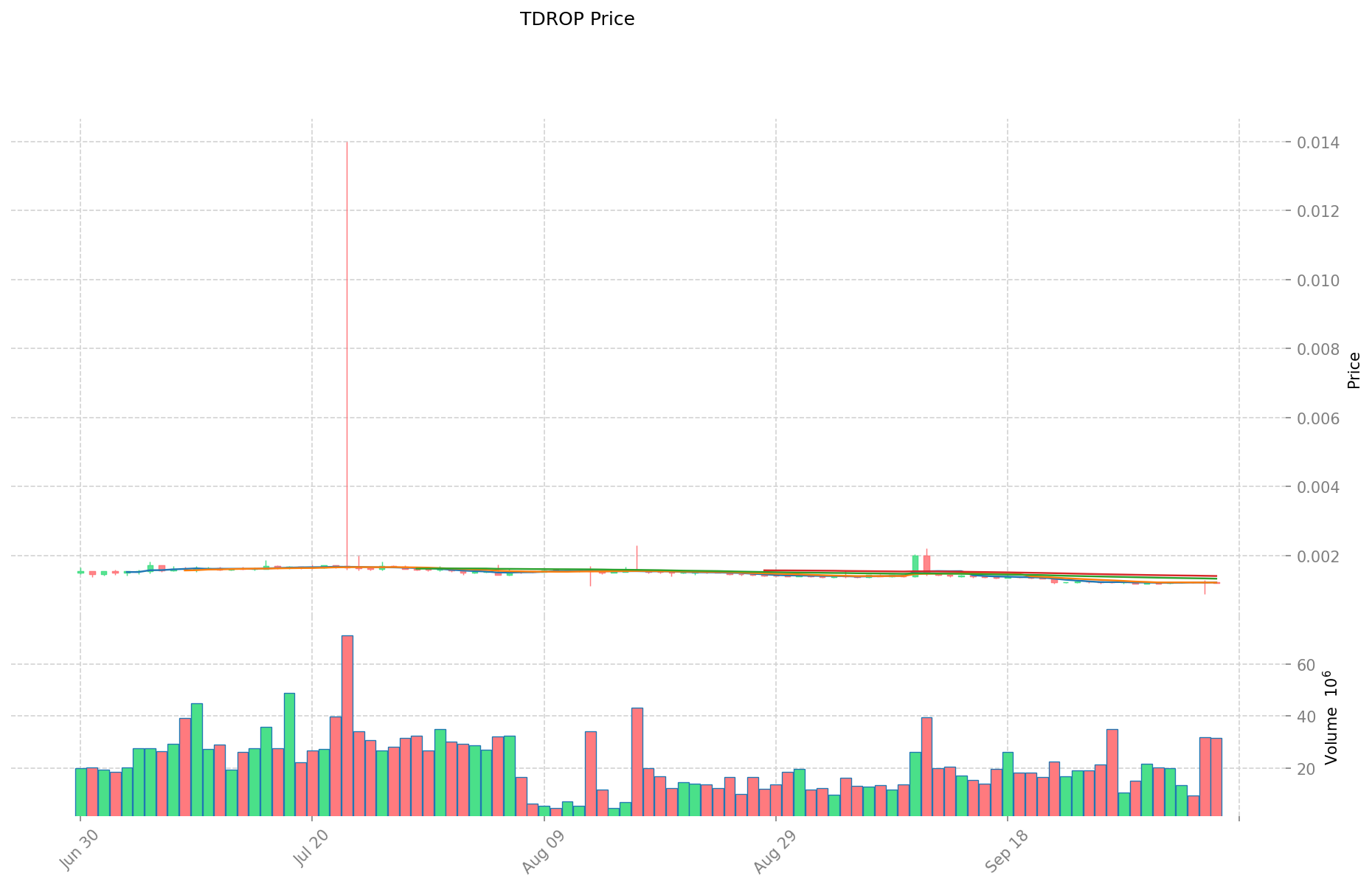

ThetaDrop (TDROP) ve Cardano (ADA) Tarihsel Fiyat Eğilimleri

- 2021: ADA, akıllı kontrat fonksiyonu ile birlikte 3,09 $’lık tarihi zirveye ulaştı.

- 2023: TDROP, genel kripto piyasası düşüşünde en düşük fiyatı olan 0,00113699 $’ı gördü.

- Kıyaslama: 2022-2023 ayı piyasasında TDROP, zirvesi olan 0,061086 $’dan 0,00113699 $’a kadar gerilerken; ADA, 3,09 $’dan 0,2300 $’a indi.

Güncel Piyasa Durumu (07 Ekim 2025)

- TDROP güncel fiyatı: 0,0012177 $

- ADA güncel fiyatı: 0,8714 $

- 24 saatlik işlem hacmi: TDROP 40.803,63 $; ADA 6.941.321,11 $

- Piyasa Duyarlılık Endeksi (Korku & Açgözlülük Endeksi): 70 (Açgözlülük)

Canlı fiyatları görüntülemek için tıklayınız:

- TDROP güncel fiyatı için Piyasa Fiyatı

- ADA güncel fiyatı için Piyasa Fiyatı

II. Teknik Analiz

TDROP Teknik Göstergeleri

- Hareketli Ortalamalar:

- RSI (Göreli Güç Endeksi):

- MACD (Hareketli Ortalama Yakınsama Iraksama):

ADA Teknik Göstergeleri

- Hareketli Ortalamalar:

- RSI (Göreli Güç Endeksi):

- MACD (Hareketli Ortalama Yakınsama Iraksama):

Önemli Destek ve Direnç Seviyeleri

TDROP:

- Destek seviyeleri:

- Direnç seviyeleri:

ADA:

- Destek seviyeleri:

- Direnç seviyeleri:

III. Temel Analiz

TDROP Proje Özeti

- Proje odağı: Theta blokzincirinde NFT pazar yeri ve likidite madenciliği

- Son gelişmeler:

- Yaklaşan kilometre taşları:

ADA Proje Özeti

- Proje odağı: Üçüncü nesil paya dayalı (Proof-of-Stake) blokzincir platformu

- Son gelişmeler:

- Yaklaşan kilometre taşları:

Karşılaştırmalı Güçlü ve Zayıf Yönler

TDROP:

- Avantajlar: NFT ekosistemine odaklanma, özgün likidite madenciliği yaklaşımı

- Dezavantajlar: Büyük platformlara göre sınırlı benimsenme

ADA:

- Avantajlar: Bilimsel yaklaşım, ölçeklenebilirlik, sürdürülebilirlik

- Dezavantajlar: Bazı rakiplerine göre daha yavaş geliştirme süreci

IV. Piyasa Dinamikleri ve Gelecek Beklentileri

Fiyat Hareketlerini Etkileyen Unsurlar

- Makroekonomik eğilimler:

- Düzenleyici gelişmeler:

- Teknolojik ilerlemeler:

Kısa Vadeli Tahminler (3-6 ay)

TDROP:

- Olası fiyat aralığı:

- Dikkat edilmesi gereken ana faktörler:

ADA:

- Olası fiyat aralığı:

- Dikkat edilmesi gereken ana faktörler:

Uzun Vadeli Beklentiler (1-3 yıl)

TDROP:

- Büyüme potansiyeli:

- Karşılaşılabilecek zorluklar:

ADA:

- Büyüme potansiyeli:

- Karşılaşılabilecek zorluklar:

V. Yatırımda Dikkat Edilmesi Gerekenler

- Risk değerlendirmesi: TDROP ve ADA, kripto piyasasına özgü yüksek volatiliteye sahiptir

- Çeşitlendirme: Daha geniş bir kripto portföyü stratejisi kapsamında değerlendirilmelidir

- Özenli izleme: Proje gelişmeleri ve piyasa trendleri sürekli takip edilmelidir

Yasal Uyarı: Bu rapor yalnızca bilgilendirme amaçlıdır; finansal tavsiye niteliği taşımaz. Kripto para yatırımları yüksek risk içerir, geçmiş performans gelecekteki sonucu garanti etmez.

II. TDROP ve ADA Yatırımında Temel Belirleyiciler

Arz Mekanizması Karşılaştırması (Tokenomik)

- ADA: 45 milyar token ile sınırlı arz ve Proof-of-Stake (PoS) konsensüs mekanizması

- TDROP: Sağlanan bilgilerde belirtilmemiştir

- 📌 Tarihsel Özellik: ADA’nın kontrollü arzı, piyasa değeri açısından ilk 10 kripto arasında kalmasını sağlamıştır

Kurumsal Benimsenme ve Piyasa Kullanımları

- Kurumsal Varlıklar: ADA, blokzincir topluluğunda yaygın şekilde kabul görmüş; yatırımcı ilgisini çekerek 5 yıl içinde küresel ilk 10’da yer almıştır

- Kurumsal Kullanım: ADA, Cardano ekosisteminin, zincir üstü uygulamaların ve staking işlevlerinin yerel varlığıdır

- Düzenleyici Yaklaşımlar: Her iki token için sağlanan bilgilerde ayrıntı verilmemiştir

Teknik Gelişim ve Ekosistem Oluşturma

- ADA Teknik Güncellemeleri: Byron (Altyapı), Shelley (Merkeziyetsizlik), Goguen (Akıllı Kontratlar), Basho (Ölçeklenebilirlik) ve Voltaire (Yönetişim) olmak üzere beş aşamalı geliştirme yol haritası

- ADA Teknik Özellikler: PoS tabanlı konsensüs ile saniyede yaklaşık 250 işlem; birinci ve ikinci nesil kripto paralara kıyasla daha verimli zincir üstü işlemler

- Ekosistem Kıyaslaması: Cardano, Bitcoin ve Ethereum’un iki ana sorununu çözmeyi hedefler: Yoğun işlem dönemlerinde ağ tıkanıklığı ve ağlar arası iletişim eksikliği

Makroekonomik ve Piyasa Döngüleri

- Enflasyon ortamındaki performans: Sağlanan bilgilerde yok

- Makroekonomik para politikası: Sağlanan bilgilerde yok

- Jeopolitik unsurlar: Sağlanan bilgilerde yok

III. 2025-2030 Fiyat Tahmini: TDROP - ADA

Kısa Vadeli Tahmin (2025)

- TDROP: Temkinli 0,001132926 - 0,0012182 $ | İyimser 0,0012182 - 0,001754208 $

- ADA: Temkinli 0,52464 - 0,8744 $ | İyimser 0,8744 - 1,058024 $

Orta Vadeli Tahmin (2027)

- TDROP büyüme dönemine geçebilir; tahmini aralık: 0,0013268829312 - 0,0021930426224 $

- ADA konsolidasyon dönemine geçebilir; tahmini aralık: 1,0288225376 - 1,2158811808 $

- Başlıca etkenler: Kurumsal sermaye girişi, ETF’ler, ekosistem gelişimi

Uzun Vadeli Tahmin (2030)

- TDROP: Temel senaryo 0,002785602738972 - 0,003064163012869 $ | İyimser senaryo 0,003064163012869 - 0,003169823806416 $

- ADA: Temel senaryo 1,56557211574764 - 1,894342260054644 $ | İyimser senaryo 1,894342260054644 - 1,83728297881128 $

Yasal Uyarı: Bu analiz yalnızca bilgilendirme amaçlıdır; finansal tavsiye değildir. Kripto para piyasası aşırı volatil ve öngörülemezdir. Yatırım öncesinde kendi araştırmanızı mutlaka yapınız.

TDROP:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Getiri Oranı |

|---|---|---|---|---|

| 2025 | 0,001754208 | 0,0012182 | 0,001132926 | 0 |

| 2026 | 0,00219958192 | 0,001486204 | 0,00107006688 | 22 |

| 2027 | 0,0021930426224 | 0,00184289296 | 0,0013268829312 | 51 |

| 2028 | 0,002784795551856 | 0,0020179677912 | 0,001029163573512 | 65 |

| 2029 | 0,003169823806416 | 0,002401381671528 | 0,001344773736055 | 97 |

| 2030 | 0,003064163012869 | 0,002785602738972 | 0,001754929725552 | 128 |

ADA:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Getiri Oranı |

|---|---|---|---|---|

| 2025 | 1,058024 | 0,8744 | 0,52464 | 0 |

| 2026 | 1,37202104 | 0,966212 | 0,7729696 | 10 |

| 2027 | 1,2158811808 | 1,16911652 | 1,0288225376 | 34 |

| 2028 | 1,395223654968 | 1,1924988504 | 0,870524160792 | 36 |

| 2029 | 1,83728297881128 | 1,293861252684 | 0,85394842677144 | 48 |

| 2030 | 1,894342260054644 | 1,56557211574764 | 1,268113413755588 | 79 |

IV. Yatırım Stratejisi Karşılaştırması: TDROP - ADA

Uzun Vadeli ve Kısa Vadeli Yatırım Stratejileri

- TDROP: NFT ekosistemi potansiyeli ve niş pazar fırsatlarına odaklananlar için uygundur

- ADA: Uzun vadeli büyüme ve köklü blokzincir platformu arayanlar için uygundur

Risk Yönetimi ve Varlık Dağılımı

- Temkinli yatırımcılar: TDROP %10, ADA %90

- Agresif yatırımcılar: TDROP %30, ADA %70

- Koruma araçları: Stablecoin portföyü, opsiyonlar, çapraz para sepeti

V. Potansiyel Risk Karşılaştırması

Piyasa Riskleri

- TDROP: Düşük piyasa değeri ve işlem hacmi nedeniyle yüksek volatilite

- ADA: Genel kripto piyasası trendlerinden ve rakip akıllı kontrat platformlarından etkilenir

Teknik Riskler

- TDROP: Ölçeklenebilirlik, ağ kararlılığı

- ADA: Geliştirme gecikmeleri, benimsenme zorlukları

Düzenleyici Riskler

- Küresel düzenleyici politikalar iki varlığı farklı şekilde etkileyebilir; ADA, daha yüksek profil nedeniyle daha fazla denetime tabi olabilir

VI. Sonuç: Hangisi Daha Avantajlı?

📌 Yatırım Özeti:

- TDROP avantajları: NFT ekosistemine odaklanma ve düşük tabandan yüksek büyüme potansiyeli

- ADA avantajları: Yerleşik platform, bilimsel yaklaşım, büyük topluluk ve geniş ekosistem

✅ Yatırım Tavsiyesi:

- Yeni yatırımcılar: Çeşitlendirilmiş portföy kapsamında ADA’ya küçük bir pay ayırmayı düşünebilir

- Deneyimli yatırımcılar: Risk toleransına göre ADA ve TDROP’u dengeli şekilde portföylerine ekleyebilir

- Kurumsal yatırımcılar: Likidite ve köklü piyasa konumu nedeniyle ADA’yı tercih edebilir

⚠️ Risk Uyarısı: Kripto para piyasası aşırı volatil olup, bu makale yatırım tavsiyesi değildir. None

Sıkça Sorulan Sorular

S1: TDROP ve ADA arasındaki temel farklar nelerdir? C: TDROP, Theta blokzincirinde NFT likidite madenciliğine odaklanırken; ADA, üçüncü nesil Proof-of-Stake blokzincir platformudur. ADA, TDROP’a göre daha büyük piyasa değerine, daha yüksek işlem hacmine ve daha gelişmiş bir ekosisteme sahiptir.

S2: Tarihsel olarak hangi kripto para daha iyi fiyat performansı sergilemiştir? C: ADA, 2021’de 3,09 $ ile tarihsel zirvesine ulaşarak daha iyi performans göstermiştir. TDROP ise 2023’te piyasa düşüşünde 0,00113699 $’lık en düşük seviyeye gerilemiştir.

S3: TDROP ve ADA’nın gelecekteki fiyatını etkileyen ana faktörler nelerdir? C: Makroekonomik eğilimler, düzenleyici gelişmeler, teknolojik yenilikler, kurumsal benimsenme ve proje bazlı kilometre taşları ön plana çıkar. ADA’da bilimsel yaklaşım ve ölçeklenebilirlik, TDROP’ta ise NFT ekosistemi büyüme potansiyeli öne çıkar.

S4: TDROP ve ADA’nın arz mekanizmaları nasıl kıyaslanır? C: ADA, 45 milyar token ile sınırlı arza ve Proof-of-Stake konsensüsüne sahiptir. TDROP’un arz mekanizması sağlanan bilgilerde belirtilmemiştir.

S5: TDROP ve ADA yatırımlarında karşılaşılabilecek başlıca riskler nelerdir? C: Her iki kripto para da volatilite riski taşır. TDROP, düşük piyasa değeri ve işlem hacmi nedeniyle daha yüksek volatiliteye sahip olabilir. Teknik riskler; TDROP için ölçeklenebilirlik ve ağ kararlılığı, ADA için geliştirme gecikmeleri şeklindedir. Düzenleyici riskler iki varlığı da etkileyebilir, ADA daha fazla denetime maruz kalabilir.

S6: Farklı yatırımcı tipleri için hangi kripto para önerilir? C: Yeni yatırımcılar, ADA’yı portföylerinde küçük bir oranla değerlendirebilir. Deneyimli yatırımcılar, risk toleranslarına göre ADA ve TDROP’u dengeleyebilir. Kurumsal yatırımcılar ise ADA’nın likiditesi ve köklü piyasa konumu sayesinde onu ön plana çıkarabilir.

S7: TDROP ve ADA için uzun vadeli fiyat tahminleri nedir? C: 2030 yılı için TDROP’un temel senaryo fiyat aralığı 0,002785602738972 - 0,003064163012869 $; ADA’nın ise 1,56557211574764 - 1,894342260054644 $ olarak tahmin edilmektedir. Ancak bu tahminler piyasa oynaklığına bağlıdır ve yatırım tavsiyesi değildir.

Cardano Fiyat Tahmini, $2 $ADA Geliyor mu?

2025 yılında Cardano (ADA) fiyatı nasıl bir dalgalanma gösterecek?

DGMA ve ADA: Makine Öğreniminde İki Yenilikçi Yaklaşımın Kapsamlı Karşılaştırması

CCD ve ADA: Dijital Kamera Sensörlerini Karşılaştırarak En Yüksek Görüntü Kalitesini Elde Etme

LM ve ADA: Doğal Dil İşleme Alanında Dil Modelleri ile Uyarlanabilir Algoritmaların Karşılaştırılması

NEO vs ADA: Akıllı Sözleşme Platformlarının Rekabeti - Blockchain Alanında Hangi Platform Liderliği Ele Alacak?

Do Kwon'un Hapis Cezası, Terra ve LUNA'nın Mirası İçin Yeni Bir Bölümü İşaret Ediyor

Xenea Günlük Quiz Yanıtı 14 Aralık 2025

Kripto Terminolojisini Anlama: Yeni Başlayanlar İçin Rehber

NFT’lerde Yeni Bir Dönem: Soulbound Token’ların Temelini Kavramak

Blockchain Teknolojisinde Tendermint’in Konsensüs Mekanizmasını Anlamak